The debate on the real economic merits of bank-based versus market-based financial structures has been going on for quite some time. After the Global Crisis, this debate has intensified. While there was no particular favourite prior to the crisis, the literature published since seems to prefer market-based systems (Gambacorta et al. 2014, Langfield and Pagano 2016, Bats and Houben 2020). Generally, it is argued that bank-based structure generates systemic risk and countries can increase their resilience by increasing the share of market-based financing.

At the same time, the Global Crisis spurred research on ‘shadow banking’, a specific form of market-based financing. Shadow banking is generally believed to be less resilient than traditional banking due to dense interconnectedness, liquidity and maturity mismatches, credit enhancement, significant leverage, a highly runnable funding base, and missing access to public backstops (Claessens et al. 2012, Pozsar et al. 2013). Shadow banking has been extensively studied in the US and China, but European evidence is still very scarce. In two recent papers, I offer some empirical evidence on the development of the European shadow banking (Hodula 2018, 2019).

A first look at the European shadow banking data

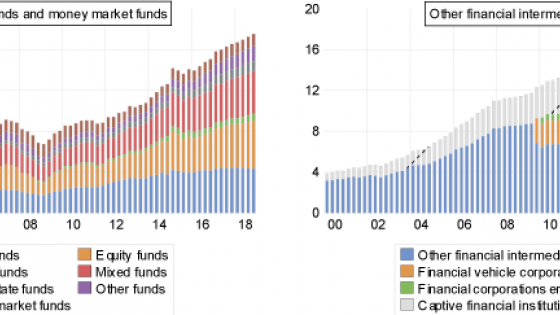

In the European context, investment funds, money market funds, and other financial intermediaries, such as corporations engaged in leasing, factoring, or hire purchase, constitute shadow banking (Figure 1).1 This is a very simplified broad definition of shadow banking. A classification and an overview of the definitions can be found in Hodula (2018).2

In 2018, shadow banking assets in the euro area amounted to almost €34.5 trillion, accounting for more than 40% of the assets of the financial sector. Total shadow banking assets more than doubled between 2000 and 2008, and a similar boom was observed in the between 2009 and 2018 (Figure 1).

Figure 1 The decomposition of the shadow banking assets in euro area, 2000–2018 (€ trillions)

Notes: Given recent advances in data coverage, the data on other financial intermediaries can be cleansed net of assets of captive institutions that are dependent on a significantly different set of factors than the rest of the shadow banking system (i.e. taxation, corporate governance, real sector regulation, etc.). For an assessment of the remaining data gaps in Europe, see Grillet-Aubert et al. (2016).

Source: ECB/Eurosystem data. The data on captive institutions was drawn from Eurostat and national central bank databases (Central Bank of Ireland, De Nederlandsche Bank, Nationale Bank van België/Banque Nationale de Belgique, Banque Centrale du Luxembourg).

In my papers, I analyse the main factors that have contributed to the growth in shadow banking in European countries (Hodula 2018) and the relationship between the ECB’s monetary policy and shadow banking in euro area countries (Hodula 2019).

What drives European shadow banking?

In my earlier paper (Hodula 2018), I collect EU-wide data on shadow banking and analyse the main determinants of its growth. I show the following:

1. EU shadow banking is highly procyclical, owing to the positive relationship with real GDP growth.

Shadow banking, like traditional banking, tends to be procyclical – booming in good times and falling steeply in bad times. This is a challenge for regulatory and supervisory institutions safeguarding financial stability. The procyclical effect of shadow banking is manifested mainly in the provision of short-term liquidity to financial markets at times of market optimism. Nevertheless, this may halt in periods of increasing uncertainty, fostering a sharp rise in market vulnerabilities.

2. The growth in assets of insurance corporations and pension funds are a prominent driver of EU shadow banking.3

This suggests that shadow banking entities, insurance corporations and pension funds are highly interconnected. For example, besides providing traditional insurance services, some insurance corporations may also enter into derivative transactions or underwrite collateralised debt obligations to invest their cash. Some pension funds invest in securities issued in securitisation processes, such as asset-backed securities and collateralised debt obligations.

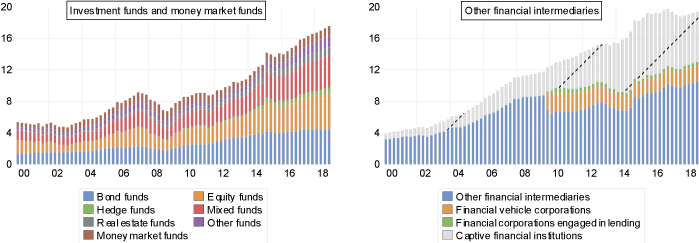

3. There are differences in shadow banking determinants between the original and new EU member states.

Figure 2 shows that in the old member states, there is a strong regulatory arbitrage incentive, which is a result of strict regulation of traditional banking (see ‘Strictness of banking regulation’ in Figure 2).

Figure 2 Estimated factors for shadow banking growth in EU countries

Notes: The mean (black line with dot) represents the estimated coefficients for the individual variables. The box with vertical lines represents the 95% confidence interval. ICPFs = Insurance corporations and pension funds.

4. Shadow banking entities can act as both complements and substitutes to traditional banking.

Some shadow banking entities may serve as substitutes for traditional banking products (e.g. entities providing financial leasing and hire purchase services and products of investment funds), while others serve as complements (entities engaged in securitisation).

What matters – search for yield or funding costs?

In my later paper (Hodula 2019), I present empirical evidence for two main motives that explain the growth of shadow banking: a funding-cost motive and a search-for-yield motive. I answer the question of why shadow banking grew faster than traditional banking in the euro area between 2000 and 2018.

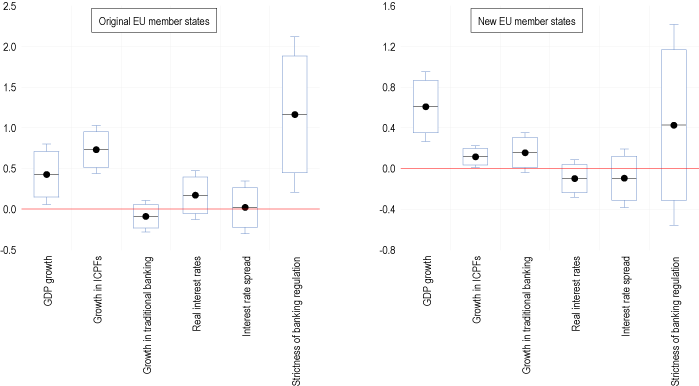

The evidence suggests that the funding-cost motive played a significant role in the run-up to the Global Crisis (pre-2008), and the substantial growth in shadow banking assets was thus fostered, among other things, by monetary policy tightening (see the left-hand panel of Figure 3). While increases in the ECB’s interest rate slowed growth in traditional banking, it boosted growth in shadow banking due to general efforts to circumvent the high funding costs. The funding-cost motive thus suggests a positive empirical relationship between monetary policy actions and growth in shadow banking.

On the other hand, the search-for-yield motive started to play a greater role after the Global Crisis (post-2008), as central banks’ monetary policies pushed interest rates and yields to all-time lows. The empirical link between monetary policy and traditional banking weakened considerably, while the relationship with shadow banking turned negative (see the right-hand panel of Figure 3). The post-crisis monetary policy easing caused massive inflows into investment funds as a result of search for yield induced by persistently low interest rates. The search-for-yield motive thus introduces a negative relationship between monetary policy actions and growth in shadow banking.

Figure 3 Estimated relationship between the ECB’s monetary policy conditions index and individual components of the financial system

Notes: TB = traditional banking; SB = shadow banking; OFIs = other financial intermediaries; IFs = investment funds. The mean (black line with dot) represents the estimated coefficients for the individual variables. The box with vertical lines represents the 95% confidence interval.

Concluding remarks

My findings have broader implications for the current policy debate and for financial stability. The documented procyclicality and complementarity of shadow banking open up new issues for macroprudential policy. The Basel III reforms attempted to reduce the procyclicality in bank lending, but the rise in the prevalence of shadow banking may turn out to undermine the effectiveness of both capital-based regulation and borrower-based limits. The strong link between shadow banking and insurance corporations and pension funds points to a need to create a framework for testing the interconnectedness of financial institutions at the EU level.

These results advance the understanding of the empirical link between monetary policy and financial intermediaries and have non-trivial implications for policy practitioners. The empirical evidence casts doubt on the ability of monetary policy to effectively ‘lean against the wind’. In this respect, the findings support the literature that recommends maintaining close cooperation between monetary policy and macroprudential and supervisory authorities.

References

Bats, J, and A Houben (2020), “Bank-based versus market-based financing: Implications for systemic risk”, Journal of Banking and Finance, forthcoming.

Claessens, S, Z Pozsar, L Ratnovski and M Singh (2012), “Shadow banking: Economics and policy”, IMF Staff Discussion Note 12/12.

Gambacorta, L, J Yang and K Tsatsaronis (2014), “Financial structure and growth”, BIS Quarterly Review, Bank for International Settlements, March.

Grillet-Aubert, L, J-B Haquin, C Jackson, N Killeen and C Weistroffer (2016), “Assessing shadow banking – non-bank financial intermediation in Europe”, European Systemic Risk Board Occasional Paper No. 10.

Hodula, M (2018), “Off the radar: Exploring the rise of shadow banking in the EU”, Czech National Bank Working Paper No. 16/2018.

Hodula, M (2019), “Monetary policy and shadow banking: Trapped between a rock and a hard place”, Czech National Bank Working Paper No. 5/2019.

Langfield, S, and M Pagano (2016), “Bank bias in Europe: Effects on systemic risk and growth”, Economic Policy 31(85): 51–106.

Pozsar, Z, T Adrian, A Ashcraft and H Boesky (2013), “Shadow banking”, Economic Policy Review 19(2): 1–16.

Endnotes

[1] In October 2018 the Financial Stability Board (FSB) announced that it would replace the term ‘shadow banking’ with the term ‘non-bank financial intermediation’. Consistent with this, the ESRB has renamed its annual ‘EU Shadow Banking Monitor’ the ‘EU Non-Bank Financial Intermediation Risk Monitor’ (see FSB 2018 and ESRB 2019).

[2] The definitions of shadow banking can be split into two groups: broad and narrow. The broad definitions define shadow banks as a set of non-bank financial intermediaries that are involved in financial intermediation, maturity transformation, and liquidity transformation. The narrow definitions focus solely on the entities that engage in financial intermediation.

[3] Assets of insurance corporations and pension funds are generally not considered to be part of shadow banking, as these entities are regulated and supervised to a greater extent.