The introductory statements of the ECB press conferences are the most important form of formal communication from the Bank. The content of the introductory statements is always highly relevant from the point of view of monetary policy, as the organisation includes carefully drafted announcements and explanations of the Governing Council's decisions, often based on real-time economic and monetary analysis from the ECB/ESCB staff.

After every press conference, key phrases and semantic changes in the introductory statement are intensively analysed by the media and by financial market participants in order to gain information about the central bank’s policy objectives, future policy actions, and its assessment of current (and future) economic conditions (e.g. Altavilla et al. 2019).

In this column, we explain how we are able use this information to directly estimate the ECB’s ‘loss function’, gaining a greater understanding of the ECB’s objectives. In particular, we are interested in what the level of ‘de facto inflation’ the ECB is aiming for, and whether the ECB has been more averse to high inflation or low inflation overall (Paloviita et al. 2020).

We extract the ‘tone’ (or sentiment) from the introductory statements, using Loughran and McDonald's (2011) dictionary, simply by focusing on ‘net negativity’. This is a measure of the share of negative words relative to that of positive words. Then, we regress this general tone on macroeconomic forecasts of the Eurosystem/ECB staff in order to directly estimate the ECB Governing Council’s loss function. In other words, we use the tone as a proxy for the loss and assume that the Governing Council’s preferences regarding its inflation aim (and possibly other economic variables) are reflected in the introductory statements.

A similar approach has been used by Shapiro and Wilson (2019), who study the loss function of the Federal Reserve. In addition to initial analysis, we repeat our estimations using a tone based only on inflation-related paragraphs in the introductory statements. To access this data, we gathered press conference texts from July 1999 to December 2019 from the ECB’s website using automated web scraping.

One of the advantages relative to ‘reaction function’-based estimations1 is that we do not have to make specific assumptions about the form of the reaction function, the structure or stability of economic relationships, or the transmission channels of monetary policy in order to infer the parameters of the loss function. In our estimations, the dependent variable is the tone (sentiment) proxy based on text analysis (instead of the policy instrument itself or policy-sensitive short-term market interest rates). Using the tone as the dependent variable, the estimation period can be extended to periods during which an effective lower bound has been approached, and/or non-standard measures have been employed, without a fear of non-linearity or discontinuity in the reaction function.

Tones extracted from the ECB's introductory statements

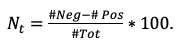

To measure the ECB's tone, we consider lexicon-based sentiment analysis. After employing general pre-processing steps for the textual data, we count the frequencies of positive and negative words in each introductory statement based on a finance-specific dictionary created by Loughran and McDonald (2011).2 We define the tone (net negativity) as the difference between negative and positive words, normalised with the total number of words. Following Shapiro and Wilson (2019), we determine the tone index as:

The general tone is measured from the full data set, but when calculating an alternative inflation-specific measure for net negativity, we consider only the subset of the full data set related to inflation. To identify inflation-related paragraphs, we employ ‘Latent Dirichlet Allocation’ (Blei et al. 2003).

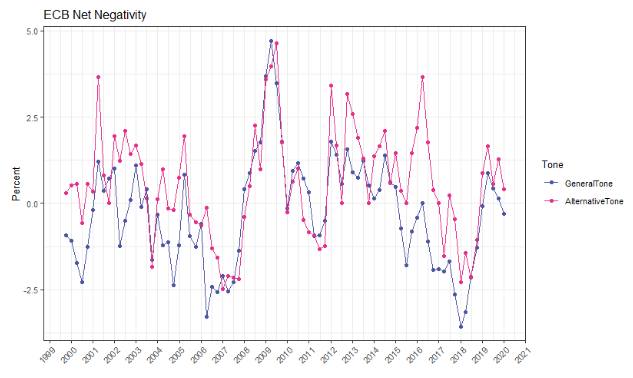

Figure 1 indicates that the net negativity in the ECB's introductory statements gradually decreased in the pre-financial crisis years. However, the financial crisis has contributed to a subsequent increase in the net negativity. In the post-financial crisis years, decreasing net negativity is observed until 2017Q4. At the end of the sample, the general tone indicates minor ‘general optimism’, whereas the alternative tone reveals some pessimism in regard to inflation developments. Overall, movements in the two tones are clearly associated to economic developments in the euro area and the two indices are (relatively) highly correlated.

Figure 1 General (based on all text) and alternative tone (based on inflation-related text only)

Note: The net negativity (vertical axis) is calculated with the formula presented in the main text.

Source: Authors’ calculations based on the introductory statements of the ECB (https://www.ecb.europa.eu/press/pressconf/html/index.en.html).

Estimation of the loss function

In our estimations, we link the tone to real time information on the economic outlook presented to the ECB Governing Council in the monetary policy meetings. As explained above, we treat the tone as a proxy for the loss and assume that the introductory statements reflect the ECB Governing Council’s preferences regarding key economic variables.

We estimate both ‘piecewise linear’ and linear-exponential loss functions, based on the assumption that the ECB has a preference for keeping inflation close to its inflation aim, and that it does so by minimising the inflation gap (i.e. the distance of the real time assessment of actual inflation from the targeted level), subject to some constraints and tradeoffs. In addition to symmetric specifications, we consider specifications which allow for asymmetric preferences with regards to positive and negative deviations of inflation from the inflation aim. As a robustness check, we control for a real time measures of output gap and squared output gap as additional determinants of the loss.

When constructing the dependent variable (i.e. the tone) for estimations, we combine all the text in the introductory statements published during each quarter. As explanatory variables, we use the short run forecasts of Harmonised Index of Consumer Prices (HICP) inflation and output gap of the Eurosystem/ECB staff. We compare estimation results based on an exogenously fixed inflation aim to estimations where the inflation aim is not fixed in advance. This approach is motivated by the two-step quantification of price stability by the Governing Council. In 1998, the council defined price stability as “a year-on-year increase in the HICP for the euro area of below 2%”. In 2003, the Governing Council clarified that “in the pursuit of price stability, it aims to maintain inflation rates below, but close to, 2% over the medium term”. The expression “below, but close to 2%” is ambiguous and has with it a sense of asymmetry, even though the ECB’s communication stresses symmetry within its monetary policymaking.

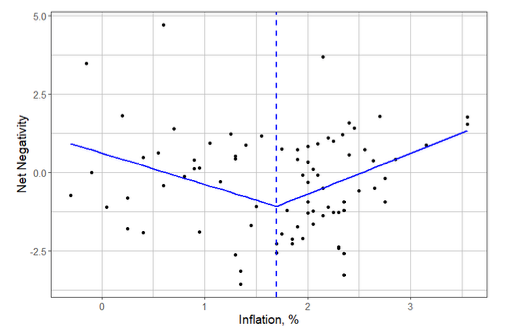

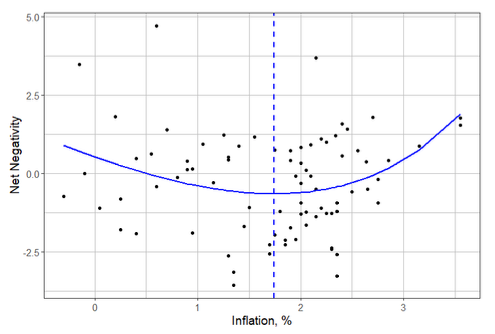

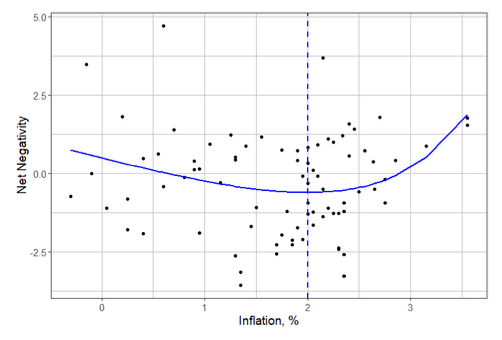

Figures 2a and 2b present estimation results for two specifications in which the inflation aim is not fixed in advance. When estimating the piecewise linear loss function, we observe that the highly significant inflation gap parameter is above one, and that the point estimates for the implicit de facto inflation aim of the ECB is 1.70%.3 According to the corresponding linear-exponential function, the ECB’s de facto inflation target is marginally higher (i.e. 1.74%) (Figure 2b). In neither of the cases can we reject the null hypothesis, according to which the ECB’s preferences are symmetric.

Figure 2a Estimated asymmetric loss function

Figure 2b Estimated Linex loss function

Note: The net negativity (vertical axis) is the general tone calculated with the formula presented in the main text. The inflation rate (horizontal axis) is the average of the nowcast inflation rate and one-quarter-ahead projection of the ECB/ESCB staff. See Paloviita et al. (2020) for details of the estimations.

Sources: ECB and authors' own calculations.

Next, we consider specifications where the inflation aim of the ECB is exogenously fixed to 2.0% (i.e. to the upper bound of the ECB’s price stability definition). The estimated piecewise linear loss function (with separate coefficients for positive and negative inflation gaps) is shown in Figure 3a. The results indicate that when inflation has increased further above 2%, the net negativity in the ECB's tone has increased more strongly (2.5 times faster), compared to the case where inflation has been falling further below 2%. It should also be noted that the null hypothesis of symmetry is rejected at a 10% significance level.4 The corresponding results of a linear-exponential formulation suggest that the ECB has indeed been more averse to high inflation than to low inflation (Figure 3b), as the null hypothesis of ‘quadratic’ (and symmetric) preferences is rejected (Paloviita et al. 2020).5

Figure 3a Estimated asymmetric loss function, fixed π*=2.0

Figure 3b Estimated Linex loss function, fixed π*=2.0

Note: The net negativity (vertical axis) is the general tone calculated with the formula presented in the main text. The inflation rate (horizontal axis) is the average of the nowcast inflation rate and one-quarter-ahead projection of the ECB/ESCB staff. See Paloviita et al. (2020) for details of the estimations.

Sources: ECB and authors' own calculations.

Conclusions

Rapidly developing methods of textual and sentiment analysis provide new and more direct ways to infer the preferences of policymakers. In this column, we have provided one example of such research aimed at understanding the objectives of the ECB's Governing Council. Linking the tone in the ECB’s introductory statements to the most relevant variables on macroeconomic outlook, we have been able to provide further insight into the de facto inflation aim of the ECB and identify possible asymmetry within its preferences for inflation. Our empirical analyses support the earlier findings by Hartmann and Smets (2018), Rostagno et al. (2019), and Paloviita et al. (forthcoming).

When we freely estimate the de facto inflation target of the ECB, our results suggest that the de facto target has been relatively low (1.7%), and we cannot reject the null hypothesis of symmetric preferences with respect to inflation. If, however, we fix the de facto inflation target to the upper bound of the price stability definition (2%), the loss function estimation reveals asymmetric preferences to inflation. These results are robust to the inclusion (or exclusion) of secondary targets (such as output gap or squared output gap) concerning the loss function and are robust to whether we estimate a piecewise linear or a more general linear-exponential loss function.

Both of the interpretations of the loss function are problematic in the current low interest rate environment. Asymmetry and a low inflation aim anchor inflation expectations and actual inflation to low levels, generating a low-inflation bias to the policy. This increases the probability of the euro area economy hitting the effective interest rate lower bound and reduces the monetary policy space in the face of future negative shocks. These features of the estimated loss function reflect (with a high likelihood) the ECB’s current two-handed definition of price stability and raise the question of whether (and how) it should be altered. The ongoing review of the ECB’s monetary policy strategy will scrutinise these issues in further detail.

References

Altavilla, C, L Brugnolini, R Gürkaynak, R Motto, G Ragusa (2019), “Monetary policy in action: Multiple dimensions of ECB policy communication and their financial market effects”, VoxEU.org, 4 October.

Blei, D, A Ng and M Jordan (2003), "Latent Dirichlet Allocation", Journal of Machine Learning Research 3(4/5): 993-1022.

Hartmann, P and F Smets (2018), "The First Twenty Years of the European Central Bank: Monetary Policy", ECB Working Paper No. 2219.

Loughran, T and B McDonald (2011), "When Is a Liability Not a Liability? Textual", The Journal of Finance 66(1): 35-65.

Paloviita, M, M Haavio, P Jalasjoki and J Kilponen (Forthcoming), "What Does 'Below, But Close To, Two Percent' Mean?" International Journal of Central Banking.

Paloviita, M, M Haavio, P Jalasjoki, J Kilponen and I Vänni (2020), "Reading between the lines − Using text analysis to estimate the loss function of the ECB", Bank of Finland Research Discussion Paper 12/2020.

Rostagno, M, C Altavilla, G Carboni, W Lemke, R Motto, A S Guilhem and I Yiangou (2019), "A Tale of Two Decades: The ECB's Monetary Policy at 20", ECB Working Paper No. 2346.

Shapiro, A and D Wilson (2019), "Taking the Fed at its Word: Direct Estimation of Central Bank Objectives using Text Analytics", Federal Reserve Bank of San Francisco Working Paper 2019-02.

Endnotes

1 See, for example, Hartmann and Smets (2018), Paloviita et al. (forthcoming) and Rostagno et al. (2019).

2 We modify dictionary further by adding some central bank specific terms and expressions in order to improve accuracy. Added positive words: ‘ample’, ‘favourable’, ‘restructuring’, ‘robust’, ‘buoyant’, ‘dynamic‘. Added negative words: ‘disequilibria’, ‘deficit’, ‘tensions’. Added expressions: ‘unemployment’ + ‘decline’/’fall’/’decrease’, ‘risk to price stability’ + ‘low’/’high’/’increase’/’decrease’.

3 When also the output gap terms are used as explanatory variables, the point estimate of the implicit de facto target of the ECB stands at 2.3%. In this case, the sum of squared residuals (SSR) criterion we use for selecting the estimate of the de facto target is more or less indifferent between any values over the range of 2.0% to 2.3%.

4 When also the output gap terms are included in the piecewise linear specification, the null hypothesis of symmetry is clearly rejected. In this case, the estimation results indicate that when inflation has increased further above 2%, the net negativity in the ECB's tone has increased 5 times faster than when inflation has been falling further below 2%.

5 In Paloviita et al. (2020), we repeat the estimations using the alternative tone. Broadly speaking the results are unchanged when the analysis is based on the tone reflecting inflation text only.