From the early 1500s to the early 1800s, Spain received large amounts of monetary silver from its colonies in America. Spain’s money supply was thus exposed to the vagaries of the sea: cross-Atlantic voyages came with the risk of hurricanes, pirate attacks, and other threats. The horror of such disasters inspired contemporary art and culture. In Shakespeare’s The Tempest, a strong storm at sea led a sinking ship’s passenger to exclaim: “Hell is empty and all the devils are here!”

While maritime disasters were a grim reality in early modern economies, they constitute repeated natural experiments that allow us to examine how changes in the money supply affect the economy.

In a new paper (Brzezinski et al. 2019), we collect detailed data on 31 Spanish maritime disasters that led to the loss of monetary silver in the years 1531 to 1810. Figure 1 displays the money losses associated with each maritime disaster as a fraction of the Spanish money stock. These money shocks were sizable, amounting to 5% of the Spanish money stock on average.

Three-quarters of maritime disasters were caused by bad weather, navigational errors, or a combination of the two. The remaining quarter was due to naval combat and piracy. The most notable of such events occurred in 1628 when the Spanish fleet, carrying 80 tonnes of silver, was captured by Dutch privateer Piet Heyn.1

Figure 1 Monetary shock measure

The real effects of money shocks and monetary transmission channels

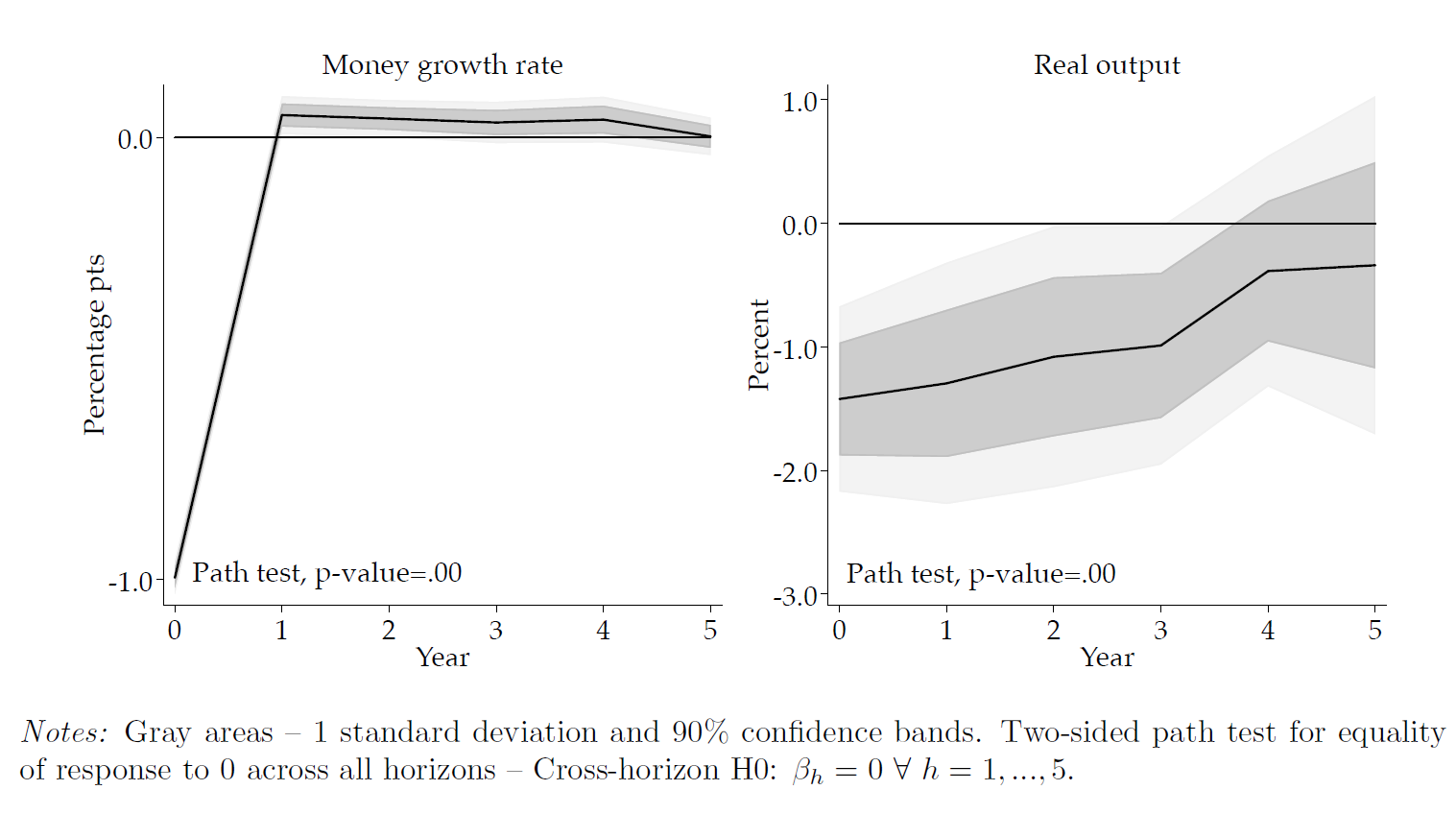

What was the effect of money losses on economic activity?2 Figure 2 shows the answer provided by our impulse response function estimates.3 The left panel of the figure describes the monetary shock that hits the economy: a one-percentage-point reduction in the money growth rate. In response to this money-supply shock, output drops by 1.3% on impact. This drop in output persists for several years.

Figure 2 Real response to a negative 1 ppt money growth shock

To find out through which monetary transmission channels money affected real output, we take a look at the data for indications of whether a channel was active or not. Our transmission channel analysis aims for comprehensiveness and is grounded in a careful reading of the historical literature on early modern Spain and its monetary system. Here, we discuss only those two channels which the data indicate were important: price rigidities and credit frictions.

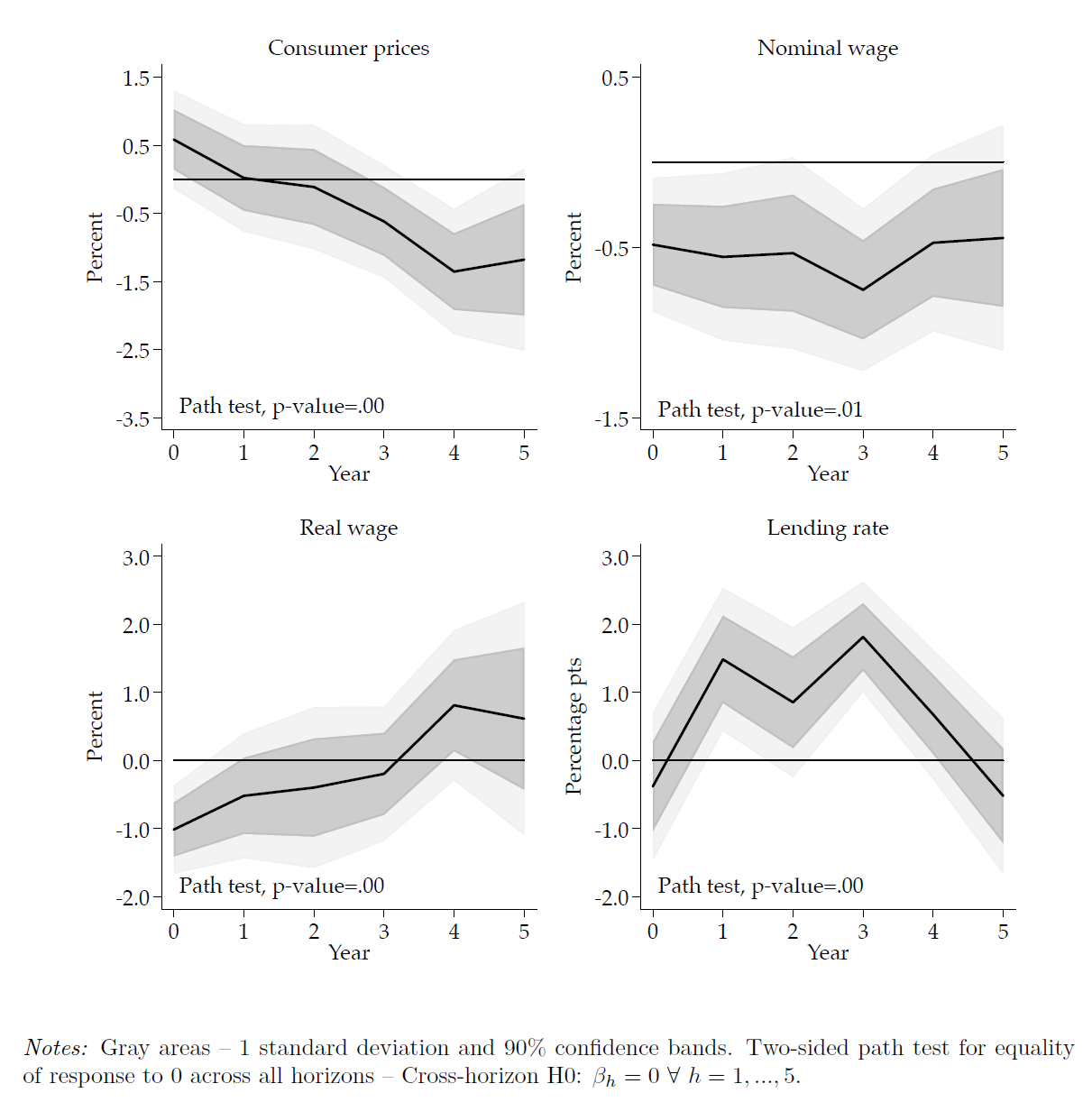

When prices do not immediately adjust to a monetary contraction, households and firms experience a shortage of real money holdings and consequentially buy fewer goods. Figure 3 shows that after a one-percentage-point reduction in the money growth rate, consumer prices fall only slowly over the course of four years. Inflexible goods prices thus emerge as a prime suspect in our search for the monetary transmission channels behind the non-neutrality result. By contrast, wages adjust quickly.

Next, when a monetary contraction negatively affects an economy’s profitability, producers and merchants may find it more difficult to obtain external financing. They thus cut back their expenditures. Indeed, we find that credit markets tighten in the aftermath of a money shock: lending rates increase by up to 1.5 percentage points.4

These findings suggest that credit frictions and price rigidities are important transmission mechanisms through which money shocks affect the real economy. We show that other channels of monetary transmission, such as the Crown’s finances and changes in the silver content of the unit of account, show few signs of activity (Drelichman and Voth 2010, Karaman et al. 2018).

Figure 3 Monetary transmission channels: Responses to a negative 1 ppt money growth shock

Transmission channel strength and decomposition

How much of the real output drop can plausibly be explained by price rigidities and credit frictions? To answer this question, we build a model of the early modern Spanish economy. The model features price rigidities, credit frictions, and a regular stream of money inflows that resemble the arrival of silver shipments. To parameterise the model, we use data from the early modern Spanish economy and a minimum distance estimator that matches the model impulse response functions for prices, wages, and interest rates to their empirical counterparts.

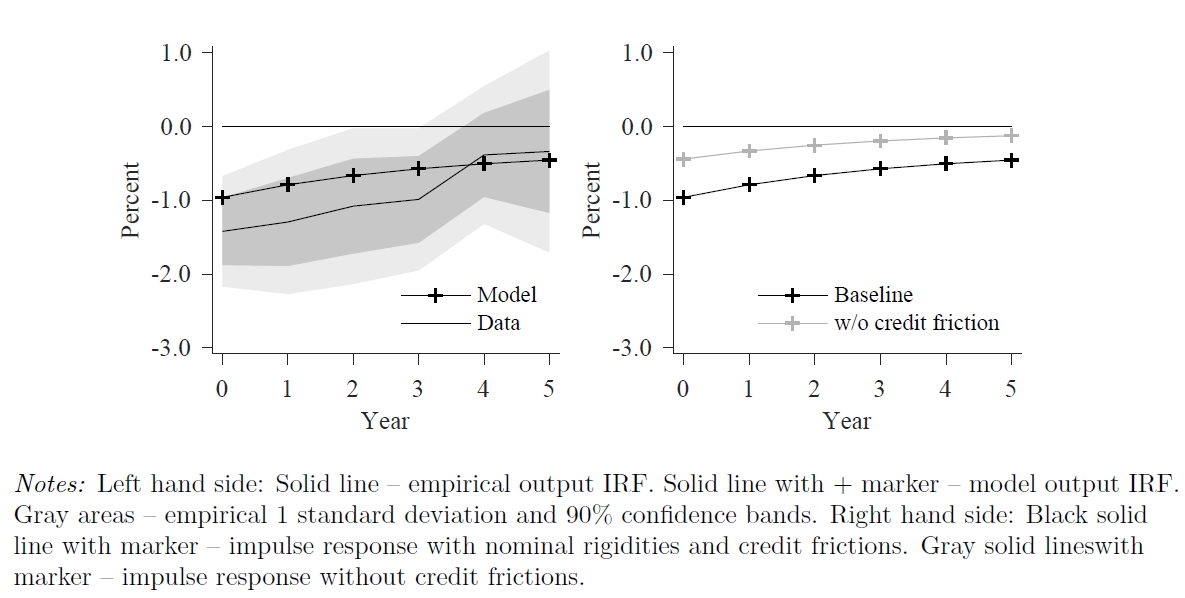

The left-hand side of Figure 4 compares the model output response to the empirical response and shows that the parameterised model can explain most of the non-neutrality result. This confirms that price rigidities and credit frictions were powerful enough to account for much of the drop in real output, leaving little room for other monetary transmission channels. This finding is robust to plausible changes to the model calibration and model structure.

Figure 4 Decomposition of the real output response (negative 1 ppt money growth shock)

The parameterised model also allows us to assess the relative contributions of price rigidities and credit frictions to the real output response. For this purpose, we calculate counterfactual model impulse responses for real output, using model calibrations that sequentially shut down the two channels.

In the right-hand side of Figure 4, the contribution of the credit friction is indicated by the area between the black line and the grey line, and the contribution of price rigidities is indicated by the area between the grey line and the zero line. On impact, each of the two channels accounts for about half of the output response, but much of the response’s persistence comes from the credit channel.

Conclusion

For three centuries after the Columbian voyage of 1492, hurricanes, navigational errors, naval combat, and pirate attacks gave rise to random contractions in Spain’s money growth rate. A careful analysis of these events contributes to a better understanding of how money affects the economy.

Our findings document that contractionary money shocks have sizable effects on real economic activity. Money shocks were primarily transmitted to the real economy through nominal rigidities and credit frictions. That these two channels — so familiar to economists today — were already present in the early modern period underscores their importance.

References

Álvarez-Nogal, C, and L Prados de la Escosura (2013), “The rise and fall of Spain (1270-1850)”, The Economic History Review 66(1): 1–37.

Brzezinski, A, Y Chen, N Palma, and F Ward (2019), “The vagaries of the sea: Evidence on the real effects of money from maritime disasters in the Spanish Empire”, CEPR Discussion Paper 14089.

de Malynes, G (1601), A Treatise on the Canker of England's Commonwealth, London: Printed by Richard Field for William Iohnes printer.

de Roover, R (1967), “The scholastics, usury, and foreign exchange”, Business History Review 41(3): 257–71.

Denzel, M A (2010), Handbook of world exchange rates, 1590-1914, London: Routledge.

Drelichman, M, and H-J Voth (2010), “The sustainable debts of Philip II: A reconstruction of Castile’s fiscal position, 1566–1596”, The Journal of Economic History 70(4): 813–42.

Flandreau, M, C Galimard, C Jobst and P Nogues-Marco (2009), “The bell jar: Commercial interest rates between two revolutions, 1688-1789”, in Atack, J, and L Neal (eds.), The Origins and Development of Financial Markets and Institutions: From the Seventeenth Century to the Present, Cambridge: Cambridge University Press, 161–208.

Jordà, Ò (2005), “Estimation and inference of impulse responses by local projections”, The American Economic Review 95(1): 161–82.

Karaman, K K, S Pamuk and S Yıldırım (2018), “Money and monetary stability in Europe, 1300-1914”, CEPR Discussion Paper DP12583.

Pike, R (1966), Enterprise and adventure, Ithaca: Cornell University Press.

Schneider, J, O Schwarzer and M A Denzel (1994), Währungen der Welt III: Europäische Wechselkurse im 17. Jahrhundert, Stuttgart: Franz Steiner Verlag.

Schneider, J, O Schwarzer, F Zellfelder and M A Denzel (1992), Währungen der Welt VI: Geld und Währungen in Europa im 18. Jahrhundert, Stuttgart: Franz Steiner Verlag.

Shakespeare, W (1611), The Tempest.

Endnotes

[1] While bad weather and navigational errors were very likely exogenous to the state of the Spanish economy, naval combat and capture was rooted in interstate conflicts. Conditional on that, however, the destruction and capture of silver ships were driven by random tactical opportunities, not the evolution of economic variables in Spain. Moreover, our results are robust to excluding conflict-based events.

[2] We draw on annual data from Álvarez-Nogal and Prados de la Escosura (2013) on Spanish real output, wages, and consumer prices. We complement this with our estimates of fluctuations in Spanish annual lending rates, which we calculate based on bills of exchange quotations from Schneider et al. (1992, 1994) and Denzel (2010). Note that the exchange rate embodied in a bill of exchange differs from the spot exchange rate in that it describes the amount of currency to be delivered at one place today in exchange for another currency at another place at a later date. This time delay means that bills of exchange combined a spot exchange transaction with a lending transaction. In fact, against the background of the prohibition of many types of lending through usury laws, bills of exchange became Europe’s dominant lending instrument. They allowed lending rates to be hidden within what on the surface was a foreign exchange contract (de Malynes 1601, de Roover 1967, Flandreau et al. 2009).

[3] The impulse response function estimates are obtained through local projections (Jordà 2005).

[4] The lending-rate response exhibits a lagged reaction, with lending rates peaking one year after the shock. One likely explanation for this is that the lending rate series is constructed on the basis of bill of exchange prices that were quoted in financial centres across Europe (e.g. Amsterdam and London). The spatial distance between these financial centres and Spain opens the door for information lags. Thus, although lending rates in Spain may well have reacted on impact, this may not be reflected in our data due to the time it took for news to travel through Europe. This interpretation finds support in the historical literature on the Atlantic economy, which suggests that even delays in the arrival of silver shipments caused the Sevillian money market to tighten up immediately (Pike 1966: 87).