It is now seven years since the Greek crisis began. Since 2008, real output has been reduced by one-quarter; unemployment has been above 23% for over five years, and youth unemployment around 50%. Meanwhile, Greek public debt-to-GDP remains above 175% – despite a huge debt write-down. The banking system has long since stopped intermediating savings and investment; the welfare state is in dire straits. Non-performing loans clog the banking system. An exodus of the most talented and vibrant young Greeks has begun, eroding the tax base. Trust in democratic institutions has plummeted. For many Greeks, hope has long since given way to hopelessness.

The Greek crisis reflects chronic deficiencies of its institutions, structural shortcomings, indecisiveness, and unwillingness of its political system to address long-lasting problems, among perhaps deeper societal issues. Yet, the failings in Greece also reflect substantial shortcomings in international institutions. The IMF failed to fulfil the promise of Bretton Woods to provide temporary financial support to facilitate external adjustment “without resorting to measures destructive of national or international prosperity.” EU institutions – those intended to foster peace through cooperation and shared prosperity – have turned upon each other.

It’s time for all sides to move on.

To this end, we outline simple steps the Greek government and creditor community can take to deliver realistic and meaningful debt sustainability within the constraints set by the Eurogroup of 24 May 2016. The promise of further action to ease the burden of debt goes back to November 2012 – but procrastination by the EU and missteps by the Greek government delayed delivery.

To be sure, by no means will debt sustainability alone restore growth. It should be accompanied by significant and far-reaching supply-side reforms – in the judicial system, public administration, product markets and the education system.1 Debt relief should be accompanied by demand-side policies – lowering taxes and boosting public infrastructure spending. Moreover, Greece’s fate depends on much-needed Eurozone-level reforms such as the banking union project, institutional modernisation, and dealing with asymmetric shocks (Baldwin and Giavazzi 2016). But action on debt is a necessary condition for a sustainable recovery – to free Greece from its ‘debt overhang’.

Inside the black box of debt sustainability analysis

Niels Bohr, the Danish quantum physicist, put it eloquently: “Forecasting is very hard, especially about the future.” Debt sustainability analyses are notorious, as one has to make assumption for the evolution of interest rates, real output, and inflation, for decades. Unsurprisingly then, despite methodological convergence amongst the Quadriga (or quartet) of creditors (the IMF, European Commission, ECB, and European Stability Mechanism), meaningful differences around debt sustainability analysis conclusions persist. On the one hand, in its 2016 debt sustainability analysis, the IMF sees debt-to-GDP increasing to 294% of GDP in 2060 and gross financing needs2 touching 67% of GDP. On the other hand, in its 2016 debt sustainability analysis the European Commission sees debt-to-GDP declining to 101% by 2060 and gross financing needs increasing to 23%. While the Commission’s assessment suggests little further action on debt is needed, the IMF’s analysis suggests otherwise.

While the differences between institutions seem insurmountable, they hinge on two key assumptions:

- First, the evolution of Greek GDP, which depends on a confluence of domestic and global factors (many outside the control of the Greek authorities). Domestic uncertainties relate to the permanence of the banking system, the relaxation of capital controls, the timing and strength of much-anticipated recovery, the impact of taxation on investment, recovery of infrastructure spending, and many more. And there are global risks related to political regime shifts in Greece’s key partners, ongoing conflict in the Middle East and North Africa, swings in Greece’s international political alliances, and the evolution of US interest rates.

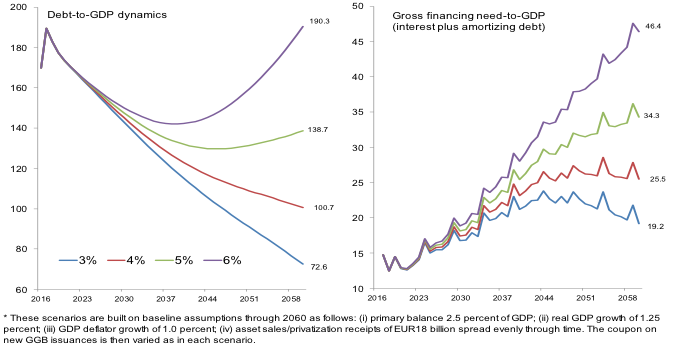

- Second, the interest on future new debt issuance (illustrated in Figure 1). In short, while an interest rate of 4% on new borrowing will deliver a debt-to-GDP of about 100% by 2060, if this interest rate were instead raised to 6%, debt-to-GDP would reach 190% in the same year. Likewise, the gross financing need-to-GDP would nearly double.

Figure 1 Greece: Debt scenarios* (percent of GDP) as the coupon on new debt issuance varies

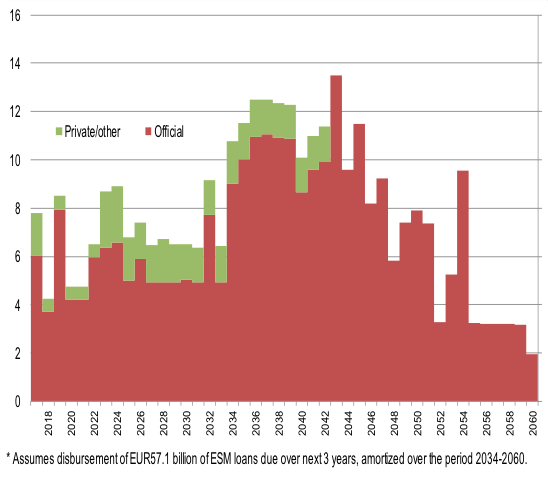

The intuition for the sensitivity of Greek debt to interest rate risk is straightforward. For high debt levels, debt sustainability is extremely sensitive to the interest rate at which this debt is refinanced – an interest rate higher than output growth means the debt stock will snowball. When debt is high – well above 100% of GDP, as is the case for Greece – the interest rate is the key driver of debt dynamics. And while the official sector has helped Greece by delaying the repayment of loans, the amortisation of this debt – and the need to roll into more expensive private funding – will slowly increase towards the middle of the century. Greece faces a substantial refinancing hump in the 2030s, when the EFSF and ESM loans in particular are to be repaid (see Figure 2). Debt sustainability therefore hinges crucially on the interest rate at which Greece will borrow during the next 50 years. And who would venture to guess the global interest rate in 30 years, let alone the rate at which Greece can borrow!

But all is not lost. Despite the uncertainties inherent in assessing sustainability, there are actions that can be taken today to bring down the future interest payments on the current stock of debt. This amounts to reducing: (i) interest rate risk on outstanding official sector loans; and (ii) containing future private funding costs reducing the gross financing need.

Figure 2 Greece: Amoritisation schedule of currently outstanding government debt* (billion euros)

A reasonable path

The Eurogroup of 26 May contains a commitment to medium- and long-term debt relief; the upcoming Eurogroup meeting on 5 December can deliver. Conditional post-2018 action on Greek debt would be consistent with past Eurogroup statements, and would not require parliamentary approvals. And there is no need for additional payments by euro area taxpayers.

Consider, first, some immediate measures to reduce official funding costs before the current 3rd programme is completed:

1. Eliminate official sector interest rate risk. A non-negligible risk remains because a large part of official debt is provided at variable interest rate. To assuage this, market transactions (interest rate swaps) or fiscal guarantees can ensure that official interest rate costs do not increase over time.

2. Asset liability management. If plausible from a financial stability perspective, the €19.6 billion of unused recapitalisation funds held in a segregated ESM account, as well as €1.8 billion of withheld SMP profits, can be used for early repayment of ECB and IMF loans. There may also be funds from the 3rd MoU that Greece may not use by the end of 2017.

However, these actions would only make a small difference for the long-term sustainability. More important is to minimise the risk of future private funding costs. When Greece completes the current programme, we estimate that reliance on private financing will begin again in 2019 – and Greece will likely need to tap €35 billion (cumulative 17½% of GDP) from the private sector alone by 2023 as repayment of official funding begins. If interest rates on these new bonds are above sustainable levels, Greece will be forced back in the hands of the official sector, perpetuating its Sisyphean fate. But the political and social realities in Greece and in the EU are unlikely to stretch to another program.

As such, the official sector should take now further actions and break this vicious loop:

3. QE inclusion. Inclusion in the ECB’s Public Sector Purchase Program (PSPP) – typically known as QE – will immediately bring down the yield on government debt. The current 10-year yield exceeds 7%, hovering around 10%. Greece will have to benefit from the global low-yield environment as a means to sustainability, and funding costs will need to come in at or below 4%. QE inclusion is an important step to this end. Implementation can proceed gradually, following additional banks stress tests. The Greek government should speedily complete the pending review of the 3rd programme so as to give space to the ECB Governing Council to include Greece in the PSPP. Moreover, QE can be a boost for the private sector by lowering the cost of funding across the economy, helping liquidity constrained firms, entrepreneurs, and debt-ridden households.

4. A commitment to replace official loans with ESM-issued, long-dated bonds. The most important step the official sector (other than the ECB) can take to help Greece benefit from the current favourable interest rate environment would be to convert a large share of official debt into low-coupon, long-dated bonds. For example, upon completion of the current programme (or perhaps once Greece has completed the third review), European creditors could begin issuing, through the ESM, long-dated bonds. We believe in the current environment – where there is a shortage of safe assets and hunt for yield – these could be issued with a coupon as low as 2% . The Greeks would, of course, begin paying the coupon on these immediately, increasing the interest cost near-term. But, conditional on sound programme implementation, the EU and ESM could switch the outstanding official debt in 2023 into these long-dated bonds. (That is, the remaining €260 billion EFSF, GLF and ESM loans – this does not include the €33 billion ESM bonds included in the GGB-PSI co-financing agreement in 2012.) Conditionality around this conversion into long-dated bonds would revolve around privatisation progress and targeted structural reforms.

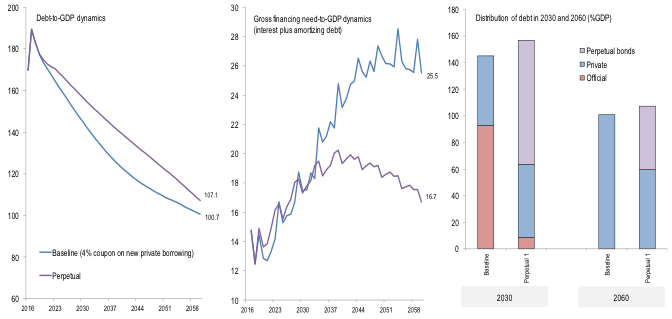

In Figure 3 we simulate this scenario, which compares the above baseline (with assumed 4% coupon on new bonds) with a scenario in which long-dated bonds are issued by ESM on the behalf of Greece and outstanding loans switched in 2023. We assume perpetual bonds are issued at 2% coupon; we discuss implications of using shorter maturities below. While the debt stock is slightly higher in 2030 as a result of this operation – due to additional near-term interest costs – private debt outstanding by end-2060 falls below 60% of GDP. Moreover, gross financing needs are substantially reduced beyond 2030 as official loans need not be amortised. In addition, such an operation might further reduce funding costs below 4% as the risk of lending to Greece is lowered. This, in turn, will further improve debt dynamics, encourage private investment, and spur growth.

Figure 3 Greece: Debt scenarios (% GDP)

The idea that there ought to be a move towards European Safe Bonds has already been in the air for some time (e.g. Brunnermeier et al. 2016), although the political will has not yet been summoned to meet such ambition. And there seems to be a wide consensus on the global safe asset shortage, initially put forward by Bernanke (2006) and Caballero et al. (2008). The issuance of long-dated bonds on behalf of Greece provides a simple complementary alternative. Greece would not be absolved of this debt, of course, but would be committed to repay the coupon on these bonds into the indefinite future – or until such a time as their situation permits replacement by better value sources of funding.

There is one wrinkle: at the moment, the ESM is not permitted to issue debt at a maturity of longer than 45 years. As such, the ESM operating rules would need to be changed if the maturity of the new bonds was to exceed this maturity. Alternatively, within current operating rules, the ESM could issue debt in 2023 at 45 years’ maturity, ensuring sustainability through 2060. This, however, simply creates another financing hump in the 2060s, requiring the problem to be tackled by the next generations of Europeans. Hopefully by that time, technological improvements, structural reforms and the power of conditional convergence would push Greek GDP into much higher levels, ring-fencing debt sustainability.

A realistic debt relief path

Since the outbreak of the Greek debt crisis, a great deal of financial and political capital has been invested in seeking to contain the crisis and prevent it from spilling over to the Eurozone. Successive bailouts and harsh conditionality have bought time for the Eurozone and Greece to repair the institutional failings. During this period, Greece has undertaken extensive adjustment achieving probably the largest fiscal consolidation in history. While Greece has to continue this process, placing an emphasis on massively dysfunctional and inequity-promoting institutions, and invest in education, Greece’s European partners have to provide a helping hand. Now!

It’s time to provide a lasting solution that will allow the Greek economy – and a new generation of Greeks – to move forward. Given the debt overhang, locking in interest rates on the outstanding debt held by the official sector and swapping current liabilities for long-dated bonds can have sizable effects. If this is accompanied by Greece completing the second review of the current 3rd programme allowing inclusion in the ECB’s QE programme, then the foundations for the much-needed recovery will be in place.

We have suggested a simple debt operation for Greece that can deliver debt sustainability with minimal adjustments to the ESM operating procedures.

From the point of view of contributions to debt dynamics, addressing refinancing risk over the projection horizon is quantitatively more important than simply pressing for ever higher primary surpluses (which, given the current high levels of unemployment and underinvestment, are unreasonable). And a credible solution at tackling the problem would allow more meaningful flexibility over fiscal targets in the long term. What is more, the market-based solution we are proposing has no immediate cost for European taxpayers.

It might still be possible that the Greek Crisis will come to be seen not as a symbol of European failure, but as a demonstration of how modern Europe can work together towards lasting solutions through cooperation, mutual concessions, and trust. This would be a good outcome for Greece, Europe, and the world.

Authors' note: Chris Marsh and Dominik Nagly are members of the Investment Team at an investment firm that may at times have financial interests in European and Greek asset markets.

References

Baldwin, R and F Giavazzi (2016), How to Fix the Eurozone: Views of Leading Economists, CEPR Press.

Bernanke, B (2006). “The Global Savings Glut and the US Current Account.”

Brunnermeier, M K, S Langfield, M Pagano, R Reis, S Van Nieuwerburgh and D Vayanos (2016), “ESBies: Safety in the Tranches”, ESRB Working Paper No.21.

Caballero, R J and E Farhi (2014), “The Safety Trap,” NBER Working Paper No. 19927 (summary on Vox here).

Caballero, R, E Farhi and P-O Gourinchas (2008), “An Equilibrium Model of “Global Imbalances” and Low Interest Rates”, American Economic Review 98(1), 358–93.

Eurogroup (2016), “Eurogroup Statement on Greece”.

European Parliament (2016), IPOL EGOV “Greece’s financial assistance programme (September 2016)”, Strasbourg.

European Stability Mechanism (2016), ESM Annual Report 2015, Luxembourg.

Meghir, C, C Pisarides, D Vayanos and N Vetas, (2017), Beyond Austerity: Reforming the Greek Economy, MIT Press.

Schumacher, J and B Weber di Mauro (2015), “Debt Sustainability Puzzles: Implications for Greece”, VoxEU.org, 12 July.

Schumacher, J and B Weber di Mauro (2015), “Greek Debt Sustainability and Official Crisis Lending”, Brookings Papers on Economic Activity, Fall.

Endnotes

[1] A comprehensive set of proposals is included in Meghir et al. (2017).

[2] Overall new borrowing requirement plus debt maturing during the year.