On 7 December 2017, after two years of work, the Basel Committee published its discussion paper on the regulatory treatment of banks’ sovereign debt holdings (Basel Committee on Banking Supervision 2017). The Committee decided to maintain the status quo, acknowledging that there is no consensus among supervisors, experts, and economists on alternative policy options to amend the framework. Interestingly, a very similar debate took place when Basel I was launched in 1976 – the pros and cons were thoroughly explored and eventually the decision taken to allow zero risk weights on domestic sovereign exposures (Goodhart 2011).

As in 1976, the Basel Committee’s latest decision cites several reasons to be cautious about the trade-off between the benefits and costs of introducing stricter regulation of banks’ sovereign exposures. These are summarised in the Basel document, as well as in a recent paper which we co-authored (Lanotte et al. 2016).

Reasons for caution

One such reason has been highlighted by the euro area crisis. In periods of tension on sovereign debt markets, domestic intermediaries, including banks, may play a stabilising role by acting as contrarian investors, counteracting the effects of short-termism and panic selling. This role may actually contribute to financial stability. Clearly, this function would be hampered by stricter regulatory limits (Visco 2015).

This reasoning was recently criticised by Gros (2017), who argues that:

- households could replace banks as major sovereign bond holders; and

- bank profits would be increased by a reduction in banks’ sovereign bond holdings, as their yields are lower than those of banks’ bonds.

These counter arguments are not fully convincing. In particular, they only apply in ‘normal’ times, when yield differentials reflect differences in fiscal and macroeconomic fundamentals.

The recent euro area experience, however, reminds us that sovereign debt markets can be prone to self-fulfilling confidence crises, during which yields are not driven by fundamentals (e.g. Giordano et al. 2013, de Grauwe and Ji 2013). In times of ‘crisis’, households – unlike domestic financial intermediaries – may have neither the resources nor the ability to behave in a contrarian way.

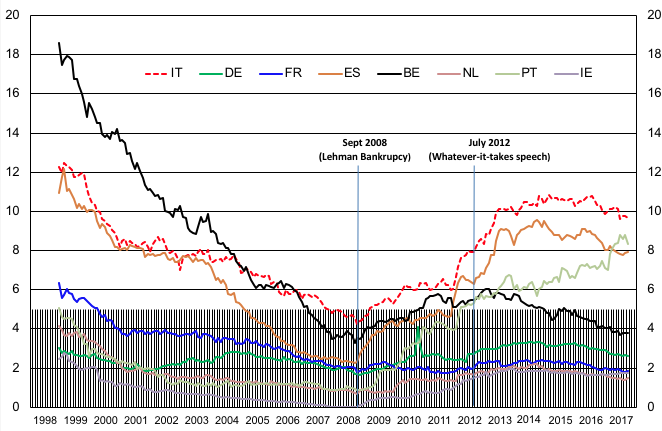

In ‘normal’ periods, banks and other financial intermediaries tend to shed sovereign exposures, because they tend to prefer other assets (e.g. loans) with better risk-return features. Figure 1 shows that this was the case for the euro area in the decade following the adoption of the euro and preceding the financial crisis. During the crisis banks increased domestic sovereign exposures, only to reduce them again when market turbulence receded. In other words, past experience suggests that the behaviour of banks, at least in the euro area, is countercyclical – they sell when bond yields are low and buy when yields are high.

Figure 1 Banks’ holdings of domestic sovereign bonds

Note: Percentage of banks’ assets; based on Eurosystem data.

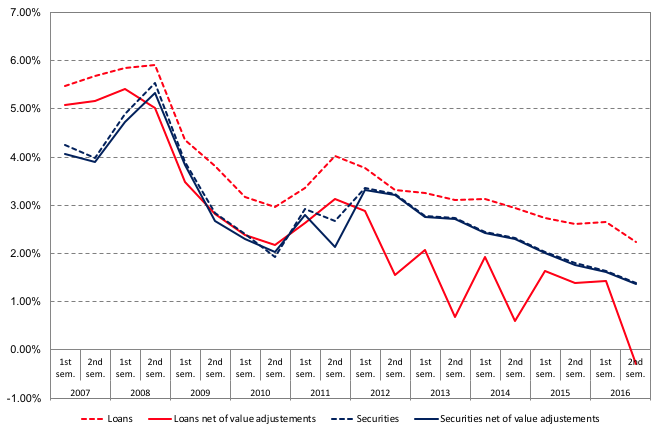

It is noteworthy (see Figure 2 for the case of Italy) that this investment behaviour sustained intermediaries’ profits, helping them to weather the crisis, with ultimately beneficial effects on financial stability.

Figure 2 Rates of return on Italian banks’ assets

Note: Income as a percentage of the respective balance-sheet items; based on supervisory reports.

Further reasons

Having said this, the argument that domestic intermediaries play a stabilising role is not the only one that can be advanced to caution against the introduction of more restrictive rules on sovereign exposures.

- As acknowledged in the Basel Committee discussion paper, sovereign debt plays a special role in the economy. Sovereign bonds are crucial for liquidity management purposes and are the most commonly used form of collateral in many financial transactions (e.g. derivative contracts and repos). They are also crucial for monetary policy implementation, given that in most countries government paper is used as collateral in central bank operations. In addition, sovereign yields are used as reference rates for pricing most domestic assets, as they are widely seen as a good proxy for ‘risk-free rates’. Tighter rules might make it unduly difficult and costly for banks to perform these routine day-to-day activities.

- Recent regulation has gone a long way towards breaking the perverse banks-sovereign loop that underpins proposals for prudential regulation reform. The rules on leverage ratios and – in Europe – the stress test exercises regularly conducted since 2011 have already de facto imposed positive risk weights on domestic sovereign exposures. The risk that banks act, in Gros’ words, as “lenders of last resort to their domestic governments” is already greatly reduced by these rules. Other pieces of regulation have also abated the risk of problems in the banking sector being transmitted to the domestic sovereign – in Europe, the Bank Recovery and Resolution Directive and the State Aid Framework impose losses on private investors before ailing banks can resort to any external financial support.

- A more restrictive prudential approach is often advocated based on the belief that high sovereign exposures increase (the perception of) banks’ fragility in the event that the domestic sovereign falls prey to tensions. This contagion channel is clearly present in principle. However, the fates of banks and of their domestic sovereign are strictly intertwined, independently of banks’ holdings of sovereign bonds (Bocola 2016). Sovereign distress is associated with macroeconomic turmoil to start with; in turn, it depresses the economy and ultimately increases the insolvency rate of domestic households and firms. In the three years after a sovereign default, the median output loss with respect to the potential is over 40% (Laeven and Valencia 2013). An economic disruption of this proportion would inevitably have adverse consequences on the health of the banking system. A change in regulation aimed at insulating a banking system from the default of its domestic sovereign rests on a static and partial equilibrium approach, and would be unlikely to achieve its target (Angelini et al. 2014).

While amending the current regulation would likely bring small benefits and significant costs, it would raise difficult implementation issues.1 The introduction of risk weights, which are a function of each sovereign’s creditworthiness, would require a commonly agreed method to assess sovereign risk. Resorting to credit rating agencies, given their well-known drawbacks (intrinsic pro-cyclicality, potential to generate herd behaviour, backward-looking orientation), is hardly more appealing (Financial Stability Board 2010).

This problem could be attenuated by introducing increasing ‘marginal add-ons’ on sovereign exposures exceeding a given set of thresholds, regardless of the nationality (domestic versus foreign) and the riskiness of the sovereign exposures. This option, presented in the Basel discussion paper, was recently supported, among others, by Véron (2017).

This proposal represents an interesting step forward in the debate, but still raises doubts. First, as it is meant to apply to euro area banks only, it could seriously skew the level playing field for EU banks with an international reach, especially now that the Basel Committee, after careful consideration, has decided to shelve the issue at the international level (notice that banks’ exposures to their domestic sovereign are relatively large for the vast majority of jurisdictions). Second, the calibration suggested by Véron (the first non-zero risk weight would kick in as soon as sovereign exposures exceed 33% of capital) does not take into consideration the interaction of the add-ons with the liquidity requirements – the liquidity ratio (LCR) and the net stable funding ratio (NFSR) – introduced by the Committee in the aftermath of the financial crisis; it would not allow banks to meet the LCR by using sovereign bonds, which are the only ‘very’ liquid financial instrument.

Concluding remarks

Our conclusion, in line with the Basel Committee discussion paper, is that a convincing case for a reform imposing stricter regulatory limits on sovereign exposures – over and above the tightening already implemented in Europe – remains to be made. Both theory and experience suggest that such a reform would have small net benefits in most states of the world,2 while it could instead increase tail risks related to the possibility of non-linear investors’ reactions and of multiple market equilibria. Close ties between sovereigns and banks are arguably an intrinsic feature of the modern macroeconomy. These links might be a source of financial instability, but to tackle this risk the best instrument is not microprudential regulation, but sounder public finances (a first-order priority) and, in Europe, the completion of the banking union.

Similarly, we are not entirely convinced by the argument sometimes made in Europe – the world region where this debate started and the only one where it is still alive – that weaker EU countries, which would pay the highest cost of tighter regulation, should accept it as part of a comprehensive agreement whereby the introduction of a specific prudential treatment of the sovereign is linked to the completion of banking union and, in particular, to the implementation of the European Deposit Insurance Scheme (e.g. Bénassy-Quéré et al. 2018). De-risking is in everybody’s interest. However, for the reasons stated above it is highly doubtful that a sovereign prudential charge would in fact reduce systemic risk in any country; furthermore, in a ‘de-risking’ logic, it is not clear why other sources of potential bank balance sheet fragility (e.g. opaque and illiquid assets like those analysed in Roca et al. 2017) should be overlooked.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily reflect the official position of the Bank of Italy. We thank Paolo Angelini for several comments and Roberto Felici and Raffaele Santioni for helping us with the data behind Figures 1 and 2.

References

Angelini P, G Grande and F Panetta (2014), “The negative feedback loop between banks and sovereigns”, Banca d’Italia, Questioni di Economia e Finanza (Occasional Papers) 213.

Basel Committee on Banking Supervision (2017), “The regulatory treatment of sovereign exposures”, discussion paper, Basel.

Bénassy-Quéré, A, M K Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Véron, B Weder di Mauro and J Zettelmeyer (2018), “How to reconcile risk sharing and market discipline in the euro area”, VoxEU, 17 January.

Bocola, L (2016), “The pass-through of sovereign risk”, Journal of Political Economy 124(4): 879-926.

de Grauwe, P and Y Ji (2013), “Self-fulfilling crises in the Eurozone: an empirical test”, Journal of International Money and Finance 34: 15-36.

Financial Stability Board (2010), Principles for Reducing Reliance on CRA Ratings.

Giordano, R, M Pericoli and P Tommasino (2013), “Pure or wake-up-call contagion? Another look at the EMU sovereign debt crisis”, International Finance 16(2): 131-160.

Goodhart, C (2011), The Basel Committee on Banking Supervision: A History of the Early Years 1974-1997, Cambridge University Press, Cambridge, UK.

Gros, D (2017), “Banks as buyers of last resort for government bonds”, VoxEU, 27 November.

Laeven, L and F Valencia (2013), “Systemic banking crises database”, IMF Economic Review 61(2): 225-270.

Lanotte, M, G Manzelli, A M Rinaldi, M Taboga and P Tommasino (2016), “Easier said than done? Reforming the prudential treatment of banks’ sovereign exposures”, European Economy: Banks, Regulation and the Real Sector 2(1): 73-103.

Manna, M, F M Signoretti and P Tommasino (2016), “Large-country bias and the limits on sovereign concentration risk”, Banca d’Italia, Notes on Financial Stability and Supervision 5.

Reinhart, C M and K S Rogoff (2011), “The forgotten history of domestic debt”, Economic Journal 121(552): 319-350.

Roca R, F Potente, L G Ciavoliello, A Conciarelli, G Diprizio, L Lodi, R Mosca, T Perez, J Raponi, E Sabatini and A Schifino (2017), “Risks and challenges of complex financial instruments: An analysis of SSM banks”, Banca d’Italia, Questioni di Economia e Finanza (Occasional Papers) 417.

Véron, N (2017), “Sovereign concentration charges are the key to completing Europe’s banking union” Breugel, 7 December.

Visco, I (2015), “The future of European government bond markets: Banks’ sovereign exposures and the feedback loop between banks and their sovereigns”, Concluding Remarks, Euro50 Group meeting.

Endnotes

[1] The most sizeable negative effects could stem from the introduction of binding concentration limits. This policy could force banks in many global jurisdictions to sell very sizeable amounts of domestic government bonds. It has been shown that this policy would be particularly and unduly detrimental for large countries (Manna et al. 2016). Not surprisingly, the Basel Committee paper clearly rejects this proposal.

[2] Until the euro area sovereign debt crisis, sovereign defaults were regarded as a problem of emerging economies. According to Reinhart and Rogoff’s (2011) dataset, no OECD country defaulted on its domestic debt between 1950 and 2010.