While the effects of the 'three arrows' of the Japanese Abenomics policy mix – bold monetary easing, flexible fiscal policy, and the growth strategy –have attracted worldwide attention, reduced policy uncertainty is also expected to contribute to the country’s economic growth by stimulating long-term investments in the private sector.

Political stability and economic growth

When the two chambers of the parliament are controlled by different parties, or when the opposition controls the legislature under the presidential system, decision making on important policies is bound to be stalled or postponed. The recent 'fiscal cliff' in the US is a well-known example. In Europe, the government changes in the Eurozone countries increased uncertainty over the fiscal policy, resulting in the instability of the euro. In Japan, political power was transferred from the Liberal Democratic Party (LDP) to the Democratic Party of Japan (DPJ) four years ago, but the LDP regained control through the general election in December 2012. However, the Diet had been in a flux until this summer. During these government changes, certain economic policies, such as those related to tax, social security, and the labour market, have fluctuated.

A series of empirical studies have shown that political instability and frequent changes in governments have a negative impact on the national economy (Aisen and Veiga 2013). According to these studies, the economic impact of political stability is quantitatively massive, far exceeding those of major growth policies, such as trade liberalisation and corporate income tax cuts. Thus, there is a good possibility that the outcome of the House of Councilors election this past summer, where the ruling coalition parties won the majority of seats, will serve as a significant driver of Japan’s economic growth.

Many hurdles remain, however, and the Japanese government is faced with difficult policy decisions on a range of issues in which there are conflicts of interest among the Japanese people. In particular, it must:

- Lay out a clear path toward fiscal sustainability;

- Reform the social security system; and

- Negotiate the Trans-Pacific Partnership (TPP) and other economic partnership agreements (EPAs).

Whether or not the end to the divided Diet dispels the uncertainty over the future course of economic policies is a key determinant of the success or failure of the government’s efforts to motivate companies to take positive actions.

Negative influence of policy uncertainty

Various research attempts have been made to examine the economic impact of uncertainty (Bloom 2009, Carrière-Swallow and Céspedes 2013). In particular, it has been found that policy uncertainty has a substantial negative impact on the real economy, such as the GDP, equipment investment, and employment (Baker et al. 2013).

Uncertainty about future economic policies and regulations has a significant influence on corporate management decisions with respect to medium- to long-term investment in equipment, research and development, business expansion overseas, human capital, and so forth. For instance, a country’s corporate taxation rate affects the cost of capital – a key element in determining the profitability of investment. Labour market regulations – such as those for employment protection, temporary agency workers, and workers hired on fixed-term contracts – affect the cost of employment. The social security system, which involves costs to companies in the form of employers’ contributions, has a similar impact. Meanwhile, the government’s policy for the TPP and other trade issues results in changes in the costs of international trade and direct investment, thereby affecting corporate decisions regarding business expansion in the global market. Since such investment is irreversible in nature and involves substantial adjustment costs, a wait-and-see strategy could be a rational choice for companies if the future course of policy is uncertain. Therefore, greater uncertainty about the future has a detrimental effect on investment and employment.

Which specific policies have created uncertainty?

However, most studies conducted to date have primarily analysed the impact of macroeconomic uncertainty, and research delving into individual government policies and regulations has been scarce. In response to this gap in the research, we conducted an original survey of publicly listed Japanese companies to find out which specific policies have created uncertainty, the impacts of such uncertainty on management decisions, the types of management decisions that are strongly affected by uncertainty, and so forth. In what follows, I would like to outline the key points of our findings (see Morikawa 2013 for details).

- First, we asked respondents to indicate the degree of uncertainty they feel over the future course of various types of government policies and regulations, such as tax policy, social security system, labor market regulations, corporate law and regulations, and international trade policy.

The results show that international trade policy poses the greatest uncertainty to Japanese companies, followed sequentially by the social security system, environmental regulations, tax policy, and labour market regulations (see column (1) of Table 1).

- Second, we asked to what extent their management decisions are affected by such uncertainty.

We found that uncertainty about tax policy has the greatest impact on corporate management decisions with nearly half of the respondents indicating that their management decisions are “significantly affected” by them. International trade policy and environmental regulations followed with the ratio of those “significantly affected” by their uncertainty at around 30%, and, subsequently, labour market regulations, corporate law and regulations, and social security system at around 20% (see column (2) of Table 1).

Table 1. Economic policy and regulatory uncertainty and impact on business management (%)

Source: The “Survey on the Outlook of the Japanese Economy and Economic Policy” by the Research Institute of Economy, Trade and Industry (RIETI). The survey was conducted from February 2013 to March 2013.

Mechanisms behind the negative influence of policy uncertainty

Uncertainty could affect corporate behavior in a broad range of activities, including:

- Equipment investment

- Innovation

- Mergers and acquisitions

- The hiring of new employees

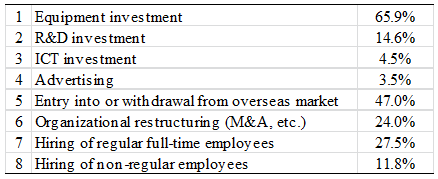

Thus, we asked what type of management decisions are significantly affected by policy uncertainty. Cited by roughly two-thirds of the respondents, equipment investment is found to be most affected by uncertainty, followed by decisions regarding entry into, or withdrawal from, overseas markets; cited by nearly half of the respondents; and then decisions on the hiring of permanent full-time employees and on organisational restructuring (see Table 2).

Table 2. Management decisions significantly affected by policy uncertainty (%)

Source: The “Survey on the Outlook of the Japanese Economy and Economic Policy” (RIETI).

We then conducted a regression analysis to explain the relationship between policy uncertainty and the expected sales growth rate of companies. The dependent variable is the expected medium-term sales growth rate, and the main explanatory variable is the measure of policy uncertainty taken from the survey. After controlling for the industry characteristics and the trend growth rates of the individual companies, we found that policy uncertainty over tax policy, labour-market regulations, and environmental regulations has statistically and economically significant negative effects on the expected sales growth.

Concluding remarks

These findings suggest that the predictability of government economic policies and regulations is a critical factor in making long-term investment decisions. Improving the predictability of policies and regulations would significantly help revitalise the economy. Greater political stability will lead to the improved performance of the Japanese economy, putting an end to the prolonged stagnation.

References

Aisen, Ari, and Francisco José Veiga (2013), “How Does Political Instability Affect Economic Growth?” European Journal of Political Economy, Vol. 29, March, pp. 151-167.

Baker, Scott R, Nicholas Bloom, and Steven J Davis (2013), “Measuring Economic Policy Uncertainty,” unpublished manuscript.

Bloom, Nicholas (2009), “The Impact of Uncertainty Shocks,” Econometrica, Vol. 77, No. 3, pp. 623-685.

Carrière-Swallow, Yan and Luis Felipe Céspedes (2013), "The Impact of Uncertainty Shocks in Emerging Economies," Journal of International Economics, Vol. 90, No. 2, pp. 316-325.

Morikawa, Masayuki (2013), “What Type of Policy Uncertainty Matters for Business”, RIETI Discussion Paper, 13-E-076. ()