Entrepreneurship has increasingly been recognised as one of the key drivers for economic growth, employment generation, and technological upgrading (Schumpeter 1934). Governments around the world have implemented a variety of policies designed to reduce constraints to entrepreneurial activity. Among these policies, reducing corporate taxes has enjoyed a resurgent interest. Lower corporate taxes can lead to an increase in investment and entrepreneurial activity (Djankov et al. 2010), by decreasing the opportunity costs of entrepreneurship, reducing barriers to entry , and by increasing the funding available to start a new venture. On the other hand, lower corporate taxes may not generate meaningful changes in entrepreneurial activity. Furthermore, a reduction in corporate taxes may only increase entrepreneurial activity below a certain tax level threshold (Da Rin et al. 2011), as entrepreneurs may seek to avoid or evade taxes (Blau 1987). As a result, it is difficult to draw a clear conclusion as to whether corporate taxes have a meaningful effect on entrepreneurial activity (Carroll et al. 2000).

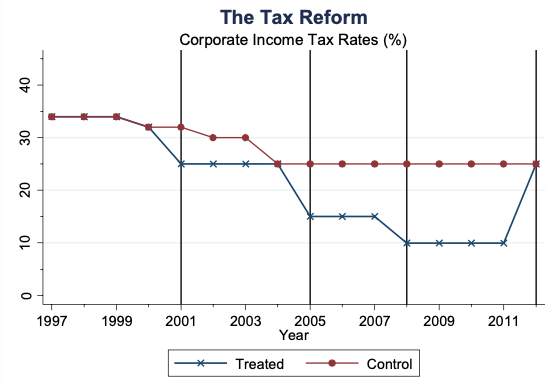

In a new study, we investigate the impact of corporate taxes on entrepreneurial activity using a quasi-natural experiment in Portugal (Venâncio et al. 2020). Before 2001, the corporate tax rate levied on start-ups in Portugal was 34%. Subsequently, Portugal implemented the “Portuguese Tax Benefits for Inland Regions” (Benefícios Fiscais à Interioridade), and corporate taxes were reduced to 25% for all start-ups located in inland regions (within the treated group). After 2004, the tax rate was reduced to 15%, and after 2007 it was further reduced to 10%. In 2012, the tax benefits were abolished altogether, and the level returned to 25%. Figure 1 compares the corporate tax rates faced by start-ups located in mainland Portugal before, and after, the tax reform.

Figure 1 Corporate income tax rates

The policy targeted municipalities with a lower purchasing power and population density. To ensure the comparability between inland and coastal municipalities, we restrict our analysis to municipalities situated on the borderline only. To circumvent the possibility that the tax system may be endogenous to firm entry, we take advantage of a quasi-natural experiment and adopt a difference-in-difference estimation using an instrumental variable approach. The instrument for tax reform adoption takes into consideration whether the political affiliation of the mayor is the same as the party that proposed the tax benefits bill.

To test the relationship between corporate taxes and entrepreneurial activity, we combine rich municipality-level data with individual- and firm-level data for the period spanning 1997 to 2011. We use a detailed mandatory survey which covers virtually all the firms and employees in the Portuguese private sector. The data also allow us to break new ground in the literature by measuring the characteristics of the start-ups and founders who entered the market due to the reduction in corporate taxes.

Our results suggest an economically and statistically significant increase in the number of monthly start-ups and the number of new jobs in inland municipalities. Our regression coefficients imply that full nationwide implementation would generate approximately 29,150 firms and 223,500 jobs over three years. After the abolition of the tax benefits, we find a negative (and statistically significant) decrease in the number of start-ups in inland municipalities, which confirms that a reduction in corporate taxes increases firm entry in inland municipalities. Additionally, we find that the firms for whom entry is plausibly induced by the tax reform tend to be relatively large, more productive, and owned by older (and more educated) entrepreneurs. These firms are also more likely to survive during the first three years after entry, when compared to the preceding cohort(s) of entrants. The estimated positive impact of the tax reform is more noticeable in the construction and trade sectors and is more pronounced during the first years after the reduction of corporate taxes.

These results suggest that the positive and significant impact of corporate tax on entrepreneurship is driven by those individuals who are endowed with a greater level of ability and required knowledge to take advantage of the opportunity created by the tax reform.

It is wise to remain cautious when extrapolating our conclusions beyond the Portuguese context from which they were drawn. Nevertheless, it is important to acknowledge that some benefits are to be gained from corporate tax benefits, and that the extent to which corporate taxes influence entrepreneurial activity (as well as type of entrepreneurship) requires further research in order to improve policies. As governments depend on the collection of taxes to provide public goods, they need to be careful to avoid the risk of deterring firm entry, particularly in the case of high-quality entrepreneurs (Lee and Gordon 2005). A small set of high-growth firms accounts for the majority of job creation and economic growth (Shane 2009), which makes a thorough consideration of the effect of taxes on the type of entrepreneurship even more relevant. In addition, the ability to understand the factors involved in business location decision-making is a key issue for regional policy.

References

Blau, D (1987), “A time-series analysis of self-employment in the United States”, Journal of Political Economy 95(3): 445-467.

Carroll, R, D Holtz-Eakin, M Rider and H S Rosen (2000), “Income taxes and entrepreneurs' use of labor”, Journal of Labor Economics 18(2): 324-351.

Djankov, S, T Ganser, C McLiesh, R Ramalho, and A Shleifer (2011), “The effect of corporate taxes on investment and entrepreneurship,” American Economic Journal: Macroeconomics 2(3): 31–64.

Da Rin, M, M Di Giacomo and A Sembenelli (2011), “Entrepreneurship, firm entry, and the taxation of corporate income: Evidence from Europe”, Journal of Public Economics 95(9-10): 1048-1066.

Schumpeter, J (1934), The theory of economic development: An inquiry into profits, capital, credit, interest and the business cycle. Cambridge: Harvard University Press.

Venâncio, A, V Barros and C Raposo (2020), “Corporate taxes and high-quality entrepreneurship: Evidence from a tax reform,” Available at SSRN.