Demand response programmes have been used to reduce electricity consumption during peak periods. During these periods, utilities would either charge customers a higher price, or pay a rebate if they reduced their consumption below a baseline level. Utilities that use a demand response programme wisely reduce their annual peak demand.

Meeting a peak demand of 1,000 megawatts (MW) requires at least 1,000 MW of installed capacity. But if a demand response programme reduces the annual peak by 100 MW, then the installed capacity in the system can also be reduced by 100 MW. The utility can build and operate 100 MW less capacity to meet demand on an annual basis. It can then pass on these cost savings in the form of lower annual average prices.

Borenstein et al. (2002) provided a detailed analysis of the economic theory, practical implications, and empirical effectiveness of this approach to demand response. Faruqui and Sergici (2010) surveyed the results of 15 field experiments quantifying the price responsiveness of electricity demand.

Intermittent resources

Intermittent renewable sources such as wind and solar energy do not produce power on demand, but when weather conditions allow. Increased reliance on these intermittent renewable sources has changed the approach to managing peak demand.

With significant intermittent renewable generation capacity, peak demand is very unlikely to exceed the total installed generation capacity in a system. Instead, the demand response challenge is to match electricity demand to periods when intermittent renewable energy is being produced. This implies that utilities providing price signals for consumers to increase demand during these periods, shifting it away from periods when solar and wind are producing little or no electricity.

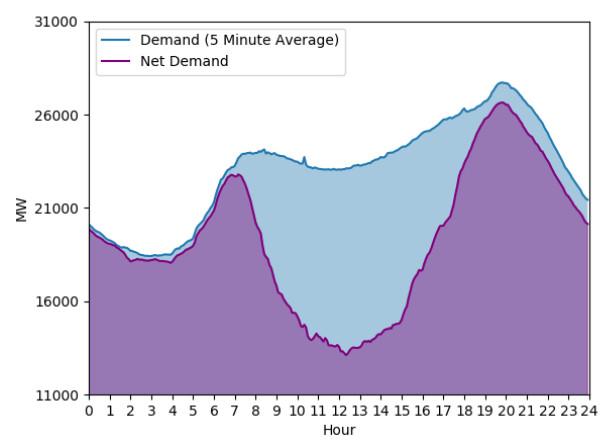

Figure 1 illustrates this point. The light blue line is the average demand in California during each five-minute interval on 1 April 2019. The red line is difference between this five-minute demand and five-minute wind and solar energy production – often referred to as net demand.

Figure 1 Average five-minute demand and net demand in California on 1 April 2019 (MW)

Source: Andersen et al. (2019).

High solar generation capacity in California means that net demand is lowest in the middle of the day. Net demand must be met by dispatchable generation units that can increase and decrease production in response to short-term price signals. In California, these are primarily natural gas-fired generation units.

As net demand drops in the middle of the day, many of these units must be turned on when at night to meet the rapid increase in net demand, and turned off in the morning when solar energy production increases. If consumers were given price signals to increase consumption in the middle of the day, causing demand to fall early and late in the day, net demand during the middle of the day would be higher, and net demand during the rest of the day would be lower.

For the same reason that a car that rapidly starts and stops burns more fuel per mile than one going at constant speed, a natural gas-fired generation unit that rapidly increases and decreases output consumes more natural gas to produce a megawatt-hour (MWh) of energy than the same unit operating at a constant level. A flatter net demand during the day also reduces the dispatchable natural gas-fired generation capacity that would be required. So flatter net demand would reduce the economic and environmental cost of operating a system when there is significant intermittent wind and solar capacity.

Experimenting with dynamic pricing

We recently analysed the effectiveness of a dynamic pricing policy using a field experiment with Danish consumers (Andersen et al. 2019). Customers were randomly assigned to receive different rebate levels on their electricity bill based on how much consumption they could shift between periods of the day. Requests to shift consumption were assigned randomly throughout the day, across days, and across customers. The requests were sent to the customer’s mobile phone using a text message, with two to five hours' notice of the three-hour period they were asked to shift their consumption into, or away from.

Our experiment produced three main results.

- Asymmetric effects. For the same per unit rebate, a request to shift consumption into a three-hour period had a two- to three-times larger electricity consumption change than the decrease associated with a request to shift consumption away from that period. For example, if an 'into' request led to a 1.5 kilowatt-hour (KWh) increase in consumption, then an 'away' request for the same rebate typically led to only a 0.5 KWh drop in consumption.

- Reductions outside an 'in' period. Customers asked to shift their consumption into a three-hour period reduced their consumption for the time between text message and the start of that period, and again for the same length of time after the 'into' period finished.

- Increases outside an 'away' period. Customers asked to shift their consumption away from a three-hour period increased consumption for time between text message and the start of the period, and again for the same length of time after the 'away' period finished. The absolute value of the magnitude, and statistical precision, of these demand shifts were much smaller than for the 'into' shifts.

A counterfactual analysis

We determined how much the Danish utility serving these customers could save in wholesale purchase costs by declaring 'into' and 'away' events as in the experiment, assuming all of the utility’s residential customers are subject to this pricing plan. To do this, we used the aggregate demand bid curve and aggregate supply offer curve for the electricity market in Denmark, and shifted the aggregate demand bid curve each hour by the estimated change that resulted from the events.

We found daily average wholesale energy cost savings of more than €100,000 were possible. This suggests that there are substantial economic benefits that can be shared between consumers and producers associated with declaring both 'into' and 'away' events.

Because 'into' consumption changes are larger, and the pattern of demand reduction before and after an 'into' period greater, we think that declaring an 'into' event for the peak solar production period in California would produce a flatter pattern of net demand throughout the day, that would be less costly economically and environmentally.

Asking paying customers to consume more during peak renewables production would help finance much-needed investments in short-term storage technologies, such as batteries. A signal to consumers to shift consumption into a period would also tell the battery owner to discharge any remaining energy between the time the text message is sent and the start of the 'into' period. The battery owner would charge during the 'into' period, and discharge afterwards.

A world that produces intermittent renewable energy at close to a zero marginal cost, and that shifts consumption using 'into' events, is likely to increase annual electricity demand. But because 'into' events flatten net demand, the system is likely to maintain a reliable supply with less installed generation capacity: flatter net demand means that remaining capacity is used more intensively.

References

Andersen, L M, L G Hansen, C Lynge Jensen, and F A Wolak (2019), "Can Incentives to Increase Electricity Use Reduce the Cost of Integrating Renewable Resources?", NBER working paper 25615.

Borenstein, S, M Jaske, and A Rosenfeld (2002), "Dynamic pricing, advanced metering, and demand response in electricity markets", Center for the Study of Energy Markets working paper 105.

Faruqui, A, and S Sergici (2010), "Household response to dynamic pricing of electricity: A survey of 15 experiments", Journal of Regulatory Economics 38(2): 193-225.