All wealthy countries consume large amounts of electricity (Gertler et al. 2016). Electricity demand in poorer countries is projected to increase dramatically over the coming decades as households become richer and purchase electric appliances (Wolfram et al. 2012). However, electricity blackouts remain ubiquitous in the developing world (Gertler, Lee, and Mobarak 2017). Blackouts are costly, reducing firm productivity (Allcott et al. 2016, Cole et al. 2018), increasing production costs (Steinbuks and Foster 2010, Fisher-Vanden et al. 2015), and lowering household income (Burlando 2014).

Several factors contribute to the high frequency of blackouts in developing countries. The complex system of generators and wires that provides electricity to consumers is only as strong as its weakest link – voltage spikes and grid disruptions occur more frequently in places where infrastructure quality is poor (McRae 2015). Low-income countries may also struggle to meet electricity demand due to limited electricity generation capacity, as in Ghana’s Dumsor crisis (Dzansi et al. 2018). However, in India, consumers face frequent power outages despite relatively high-quality infrastructure and an ample supply of power plants. In our new paper (Jha et al. 2022), we identify a novel explanation for India’s power outages: when the cost of purchasing electricity rises, utilities choose to buy less from power plants, thereby restricting the amount of power that reaches consumers.

Indian utilities choose when to provide power

In almost every setting, demand falls as prices rise. Thus, it may sound obvious that utilities would choose to buy less power when the cost of power rises. However, in high-income countries, regulations force electric utilities to buy enough electricity to satisfy the demand of all consumers, regardless of cost. As a result, if someone wants to turn their lights on, the utility is legally obliged to sell them the electricity that lets them turn their lights on. In developing countries like India, such regulations are weak or non-existent. When an Indian utility faces a high cost of purchasing wholesale electricity to meet the demand of retail consumers – say, on a hot day, when inefficient power plants must fire up to produce the electricity to operate air conditioners – the utility can choose to purchase less electricity. This results in blackouts, where Indian households may not be able to use their air conditioners and have no way of communicating to the utility how much they would be willing to pay to use their air conditioners.

In Figure 1, the downward-sloping line in purple is the Indian wholesale demand curve. As prices increase, utilities demand less electricity from the market. The vertical line in light blue is what wholesale electricity demand looks like in the US or most of Europe. Utilities are mandated by regulators to purchase enough electricity from the wholesale sector to satisfy all electricity demand, regardless of the wholesale price. Finally, the supply curve in black documents that the quantity of electricity supplied increases with prices. It is a step function because different power plants can have very different marginal costs of producing an additional unit of electricity. By intersecting supply and demand, we can see the trade-off inherent to mandating that all electricity demand must be satisfied. On the one hand, more electricity is supplied to end-users. On the other hand, wholesale electricity prices are higher under this mandate, likely leading to higher prices faced by end-use consumers as well.

Figure 1 Wholesale electricity demand in India, with versus without regulatory mandate

Note: Prices and quantities are subscripted E under elastic demand, and I under inelastic demand. A regulatory mandate requiring that all demand be satisfied would shift the market from the elastic equilibrium to the inelastic equilibrium, resulting in higher wholesale prices and quantities.

Using detailed administrative data on the Indian power sector, we show that Indian utilities choose to purchase less electricity when their procurement costs rise. We digitised thousands of supply and demand curves from the Indian Energy Exchange (IEX), the largest wholesale power market in India where utilities submit bids to purchase the electricity they resell to consumers. Across all hours of the day, utilities’ demand is downward sloping, with an average elasticity greater than one. This implies that if the wholesale electricity price increases by 1%, utilities will respond by decreasing the quantity of power they provide to consumes by more than 1%. We also investigate what happens to the quantity of electricity supplied to consumers when power plants shut down due to equipment malfunctions, thereby raising the aggregate costs of electricity supply. We estimate that the quantity supplied in a state decreases when more power plants in that state have equipment failures, even when other power plants are available to generate.

Power plant incentives also lead to blackouts

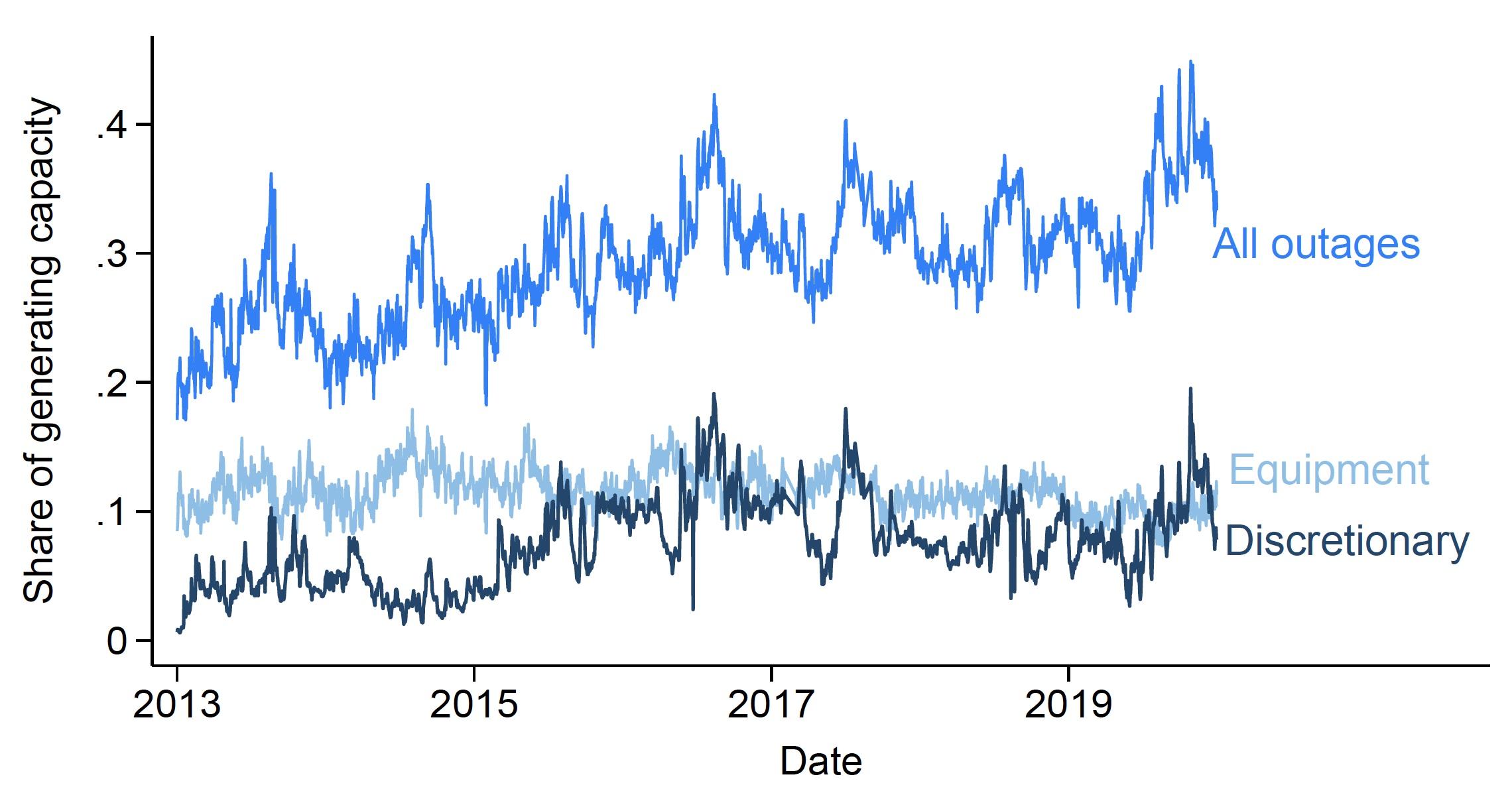

Our results imply that India could reduce blackouts by making its existing fleet of power plants available to generate more often. Doing so would require addressing ongoing inefficiencies in Indian electricity supply: on a typical day, roughly 27% of the country’s non-renewable generating capacity is down for outage (see Figure 2). Many of these outages are due to technical issues, like equipment failures. However, for a substantial share of outages, plants cite economic factors, including rigid contracts that restrict their ability to sell electricity to buyers other than the single utility specified in their contract. Allowing sellers and buyers to trade contracted positions based on current economic conditions would incentivise low-cost plants to avoid ‘discretionary’ outages on days when their electricity is especially valuable. We find that this could increase the quantity of power supplied in the day-ahead market by up to 13%.

Figure 2 Daily share of generating capacity on outage

Note: This figure plots daily outage rates from 2013-2019. The denominator is total generating capacity of fossil fuel and nuclear power plants. The numerators are total capacity that is unavailable to generate for any reason (‘all outages’), for equipment-related reasons (‘equipment’), and for non-technical economic reasons (‘discretionary’).

What if Indian regulators eliminated blackouts?

Imposing a regulatory mandate that utilities must supply power to all consumers may seem like an obvious policy solution. As illustrated in Figure 1, enforcing such a ‘full demand’ mandate will increase both the quantity supplied to end-users and wholesale electricity prices, potentially imposing an extremely high financial burden on utilities to eliminate every blackout. In a perfect world, the economists’ answer is simple: consumers should be stacked from highest to lowest willingness to pay for electricity, and power plants should supply consumers until the marginal cost of producing an additional unit exceeds the next consumer’s willingness to pay, else the utility can fall into a trap where non-payment undermines access. One way to benchmark the average consumer’s willingness to pay is to note that many Indian consumers currently pay roughly 13,000–36,000 Rs/MWh to purchase and run diesel backup generators.1

Our results suggest that if Indian regulators imposed a mandate forcing utilities to prevent all blackouts, the cost to utilities per MWh would be 2–7 times greater than the costs of diesel backup generation. However, the costs would be much more reasonable if Indian regulators also enacted contracting reforms to eliminate ‘discretionary outages’ at power plants, since more low-cost power plants would be available to generate electricity. In a world without discretionary outages, the costs of a regulatory mandate would be comparable to the costs of purchasing and operating a diesel backup generator.

Lessons going forward

Electricity blackouts continue to impose major costs on firms and households around the developing world. There are many causes for these blackouts, including limited electricity generating capacity and failing distribution infrastructure. We provide a new explanation for blackouts: utilities choose to purchase less electricity from the wholesale sector when procurement costs are high, leading to less electricity reaching end-users. Improving the profitability of utilities through reforms in the retail sector is a challenge in many developing countries where electricity theft and bill non-payment remains prevalent (Khanna and Rowe 2021). Our results suggest that reforms to wholesale supply which lower wholesale prices, such as alleviating restrictions on the financial trading of contracted positions (Jha and Wolak 2019), may more cost-effectively reduce blackouts.

Reforms of this nature are becoming increasingly important as developing countries transition towards renewable energy. Wind and solar resources have very low operating costs but produce only intermittently – when the wind is blowing, or the sun is shining. If suppliers’ contracts are not flexible enough to respond to large fluctuations in wind/solar generation (Andersen et al. 2019), reducing the incidence of blackouts will become even more challenging.

Editors' note: This column has been published in collaboration with Ideas for India and VoxDev.

References

Allcott, H, A Collard-Wexler and S D O’Connell (2016), “How do electricity shortages affect industry? Evidence from India”, American Economic Review 106(3): 587–624.

Andersen, L M, L G Hansen, C L Jensen and F Wolak (2019), “Paying consumers to increase their consumption can reduce the cost of integrating wind and solar electricity production into the grid”, VoxEU.org, 26 April.

Burlando, A (2014), “Transitory shocks and birth weights: Evidence from a blackout in Zanzibar,” Journal of Development Economics 108: 154–168.

Cole, M A, R J R Elliott, G Occhiali and E Strobl (2018), “Power outages and firm performance in Sub-Saharan Africa,” Journal of Development Economics 134: 150–159.

Dzansi, J, S L Puller, B Street and B Yebuah-Dwamena (2018), “The vicious circle of blackouts and revenue collection in developing economies: Evidence from Ghana”, Working paper.

Gertler, P J, K Lee and A M Mobarak (2017), “Electricity reliability and economic development in cities: A microeconomic perspective”, Energy and Economic Growth, State-of-Knowledge, paper no. 3.2.

Gertler, P J, O Shelef, C D Wolframand A Fuchs (2016), “The demand for energy-using assets among the world’s rising middle classes”, American Economic Review 106(6): 1366–1401.

Jha, A and F Wolak (2019), “Purely financial market participants improve spot market performance”, VoxEU.org, 14 August.

Jha, A, L Preonas and F Burlig(2022), “Blackouts in the Developing World: The Role of Wholesale Electricity Markets”, NBER Working Paper 29610.

Khanna, S and K Rowe (2021), “Escaping the subsidy-quality trap in India’s retail electricity market”, VoxDev.org, 5 July.

McRae, S (2015), “Infrastructure quality and the subsidy trap”, American Economic Review 105(1): 35–66.

Steinbuks, J and V Foster (2010), “When do firms generate? Evidence on inhouse electricity supply in Africa”, Energy Economics 32: 505–514.

Wolfram, C, O Shelef and P Gertler(2012), “How will energy demand develop in the developing world?”, Journal of Economic Perspectives 26(1): 119–138.

Endnotes

[1] See https://powerline.net.in/2019/01/19/changing-cost-dynamics/