The former Eurogroup president allegedly said, “We all know what to do but we don’t know how to be re-elected once we have done it” (The Economist 2007). In an earlier VoxEU column (Buti et al. 2008), we argued that the presumed electoral risk for a reformist government – based on the statement by Mr Juncker – is largely unfounded, in particular if a number of conditions are met. Based on electoral and structural reform records for 21 OECD countries over the period of 1985-2004, we found that electorates generally do not discriminate between reformist and non-reformist governments, although the electoral approval of reforms is stronger when the financial system works effectively and an efficient social safety net is present. More sophisticated econometric testing broadly confirmed these findings (Buti et al. 2010), which we interpret as follows:

- Well-developed and properly regulated financial markets allow households and firms to seize the opportunities created by structural reforms at an earlier stage, bringing forward benefits that often materialise with lags.

- They also help the reallocation of factors of production towards new activities spurred by structural reforms.

- Moreover, the availability of a wider range of investment opportunities improves risk-sharing and permits consumption-smoothing in the face of policy shocks, making agents more resilient to reform-related temporary income or job losses (notably in the case of labour market reforms).

Of course, the consumption-smoothing and risk-sharing roles are not unique to financial markets. If well-designed, social security and social protection systems may play a similar role, and hence soften the resistance against structural reform.

The record before and after the crisis

Our earlier work was based on pre-crisis data. Do our conclusions still hold when taking crisis period data into account? To examine this, we updated our dataset on 20 OECD countries to include the period 2005-2012, based on the same (but updated) sources, most prominently the World Bank Database on Political Institutions data (to determine when incumbent government chief executives were re-elected), various OECD structural reform indicators in the fields of pension, labour market, and product market (to define the reformist nature of governments), and the Fraser Institute indicator of financial freedom (our gauge of the role of financial markets).

Three stylised findings stand out:

- The popular perception that incumbent governments have been punished for the crisis is not rejected by the data.

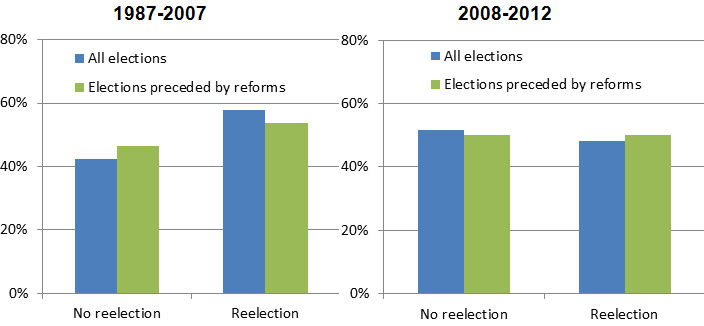

Pre-crisis – that is over the period 1987-2007 – there are 131 elections in our dataset, of which in 76 (58%) the incumbent government was re-elected, and in 55 (42%) it was not re-elected. Post-crisis – that is over the period 2008-2012 – there are 29 elections, of which in 14 (48%) the incumbent government was re-elected and in 15 (52%) it was not re-elected. So the (unconditional) probability of being re-elected appears to have fallen after the crisis, most likely as a consequence of the crisis itself, as supported by the econometric evidence indicating a significant effect of economic growth on the probability of re-election (Buti et al. 2010).

- Another popular perception – that electorates have penalised reformist incumbents particularly hard in the wake of the crisis – is, however, disproved by our data.

Pre-crisis the re-election probability of reformist governments was slightly smaller than the probability of re-election of all governments taken together. Post-crisis it is the other way around – reformist governments were more likely to be re-elected than all governments taken together (see Figure 1). The difference in probability is presumably not statistically significant, not least since post-crisis the number of reformist governments that faced elections is small – six in total, of which three were re-elected (all in the Eurozone). But it surely does not suggest that abstaining from, instead of embarking on, reform is the best route for the incumbent to win the next election. Such a presumption is corroborated by econometric tests: Updating the Buti et al. (2010) probit model with post-crisis data, whether governments were reformist or not remains non-significant in determining the probability of re-election.

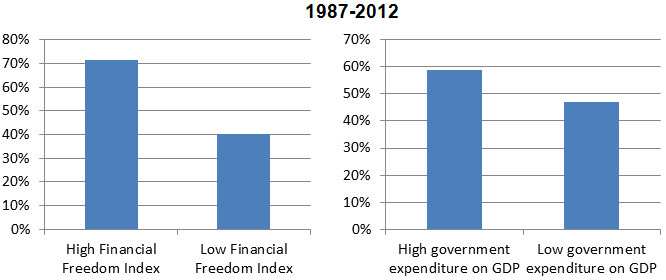

- Our earlier finding – that a reformist government is more likely to be re-elected if financial freedom and/or the social safety net is large – remains intact.

As shown in Figure 2 over the whole sample period high financial freedom and a large government size are both conducive to a comparatively higher-election probability of reformist governments.

Figure 1. Probabilities of re-election and no re-election

Figure 2. Probability of re-election of reformist governments

What lessons can we draw?

The creation of the banking union and the development of financial markets as a complementary channel to banks for financing the real economy are generally welcomed as an important step forward towards easing the fragmentation of the financial system in the Eurozone. This is an important achievement both from the point of view of economic efficiency – i.e. by promoting the effective flow of funds across the monetary union – and financial stability. Our findings add a – perhaps unexpected, but potentially very important – third dimension to the considerations of efficiency and stability.

- They suggest that improvements in the functioning of the banking and financial system promote the electoral reward for structural reform.

The above findings have an important implication. If reform activism indeed does not hinder the re-election of incumbent governments, further synergies within the ‘consistent trinity’ of policies in the Eurozone – genuine banking union, symmetric macroeconomic adjustment, and deep structural reforms (see Buti 2014 and Buti et al. 2014) – may emerge. The banking union and the better functioning of the financial system it will entail over time – by fostering the electoral incentives for incumbent governments to embark on structural reforms – would also support growth and macroeconomic adjustment. Moreover, growth would permit the sustainability of adequate welfare models, which, as our work suggests, would further heighten the electoral rewards for structural reform, thus reinforcing the virtuous circle.

Last but not least, a virtuous circle of this kind, once set in motion, would facilitate the task of the coordination of economic policies at the supranational level – e.g. in the framework of the Macroeconomic Imbalances Procedure and the European Semester. Indeed, the perceived conflict between ‘national’ and ‘European’ policy objectives would fade.

Conclusion

It may be true that governments are reluctant to embark on bold structural reforms for electoral reasons, but we find that those governments that dared to carry out reforms have not suffered worse electoral outcomes than those who did not dare. In fact, electorates tend to reward reformist governments in certain cases, notably if electorates can rely on effective welfare systems to protect them against social hardship, and if well-functioning financial markets help frontload the benefits of structural reform and diminish their short-run cost. This suggests that, looking forward, financial system repair and the preservation of an effective welfare system would contribute to further contain the risk of reform inertia. We can, therefore, add a ‘consistent trinity’ to the list: There are no conflicts between sustainable social welfare systems, well-functioning financial markets, and electoral support for structural reform.

Authors’ note: the views expressed in this column represent those of the authors and not necessarily those of the institutions to which they are affiliated. They thank Aron Kiss for excellent statistical work.

References

Buti, M (2014), “A consistent trinity for the Eurozone”, VoxEU.org, 8 January 2014.

Buti, M, M Demertzis, and J N Martins (2014), “Delivering the Eurozone ‘Consistent Trinity’”, VoxEu.org, 30 March.

Buti, M, A Turrini, and P van den Noord (2008), “Can governments implement structural reforms and yet be re-elected?” VoxEU.org, 17 June.

Buti, M, A Turrini, P van den Noord and P Biroli (2010), “Reforms and Re-elections in OECD Countries”, Economic Policy, Vol. 25, Issue 61, pp. 63-116.

The Economist (2007), “The Quest for Prosperity”, March 15th.