Resettled refugees in the US historically exhibit remarkable success. On average, refugees fare better than economic migrants in terms of earnings, hours worked and acquisition of language due to higher rates of human capital accumulation (Cortes 2004). Refugees are also more entrepreneurial than immigrants, who in turn are more entrepreneurial than natives (New American Economy 2017). Refugees excel in myriad fields, famous examples include Madeleine Albright in the public sphere, Sergey Brin in the technology sector and Wyclef Jean in music.

In this column, we show that refugees can also foster development to their origin countries. We summarise the findings of our new paper (Mayda et al. 2019), which provides causal evidence in favour of a new channel through which refugees influence the development of their origins, namely through outward foreign direct investment (FDI).

We focus on FDI since it is an essential ingredient for economic development and long-lasting stable relationships between countries (World Investment Report 2008). FDI is also less likely to experience capital reversals in times of adverse economic shocks (Albuquerque 2003), which refugee origin countries will likely be more susceptible to. Since technology diffusion through FDI contributes more to productivity and economic growth than domestic investment (Borensztein et al. 1998, Xu 2000), FDI will likely be particularly important for refugees' origins, which are located far from the technological frontier.

How refugees may facilitate FDI

Refugees may facilitate FDI in at least three ways. First, refugees might be positively selected (Roy 1951, Borjas 1987), thus relatively well endowed with human capital and more likely to possess the gumption required for success. Second, refugees can access ethnic networks or social capital (Bourdieu 1980, Portes 2000). Since refugees often maintain close ties to family and friends in their countries of origin, they often have extensive knowledge of their home markets, languages, customs, and of local business opportunities. Refugees can also help overcome problems of imperfect contract enforcement through maintaining trusting relationships, especially in weak institutional environments (Greif 1993, Rauch 1996, Dunlevy 2006). Leveraging social capital in this context is especially important since FDI flows are highly sensitive to information frictions (Daude and Fratzscher 2008).

A third mechanism, one proffered by Vandor and Franke (2016), conjectures that cross-cultural experiences increase individuals' capabilities to identify promising business ideas. For example, David Tran, who fled Saigon in 1976, combined his knowledge of making hot sauce, specifically a recipe originating from Si Racha in Thailand, to launch Huy Fong foods in California, makers of one of the world's leading brands of hot sauce, Sriracha. Similarly, David Thai, who took refuge in Seattle at age six, witnessed Starbucks' success, which in turn inspired him to establish Highlands Coffee, in 1998, the first Viet Kieu investment in Vietnam. As of 2009, the company operated 80 coffee shops in six cities and provinces across Vietnam and, in 2012, David Thai sold 50% of the shares of Highlands Coffee to Jollibee for $25 million. This mechanism is related to Bahar et al. (2019) who show that returning Yugoslavian refugees from Germany fostered exports in sectors in which the Yugoslavs had previously been exposed.

The channels through which refugees stimulate FDI are similar to those that undergird the trade-migration nexus (Parsons and Winters 2014, Felbermayr et al. 2015). There is also a closely related literature that explores the role of migrant networks in fostering foreign direct investment (Buch et al. 2006, Javorcik et al. 2011, Docquier and Lodigiani 2010, Foley and Kerr 2011, Burchardi et al. 2018).

Cross-country evidence from the US Refugee Resettlement Program

To investigate the effect of refugees on FDI, we merge aggregated individual-level refugee data from the US State Department, by origin country and US resettlement commuting zone, with project-level data on FDI from fDiMarkets.

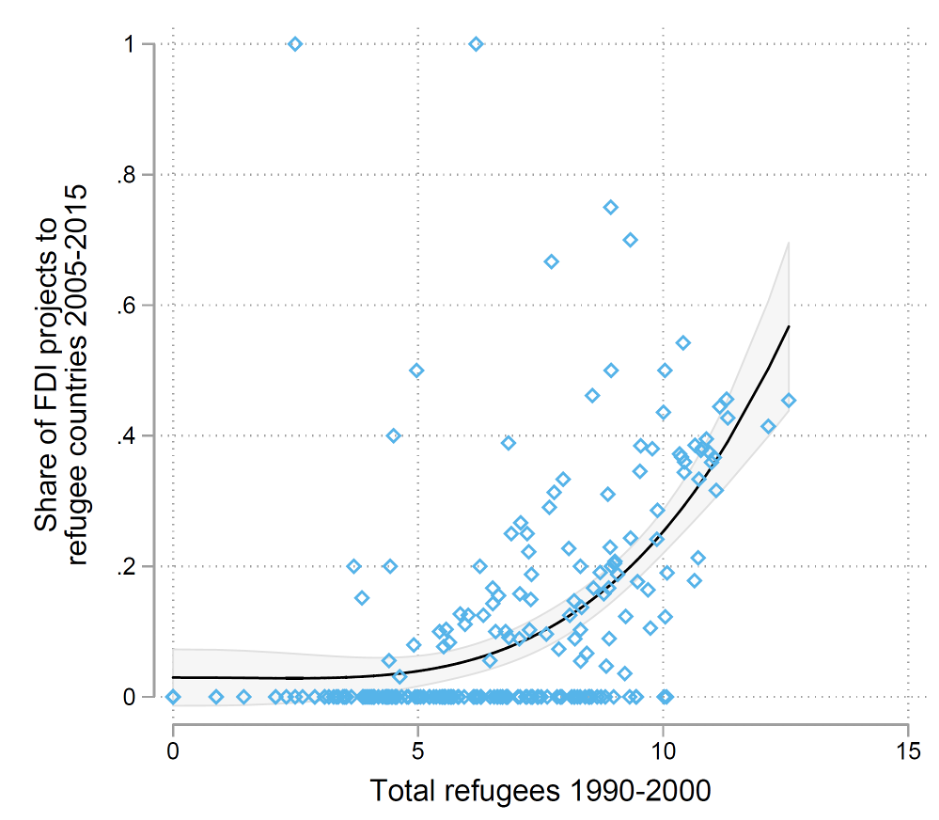

At first glance, the data suggest that those commuting zones that host greater numbers of refugees are concurrently also the largest investors in refugees’ origin countries (Figure 1).

Figure 1 Refugees and FDI across US commuting zones

Yet a key threat to identifying a causal relationship here is the endogenous location decision of refugees, since, for example, refugees could move to locations that offer particular advantages with doing business with their origins. We address this threat to identification issue in two ways.

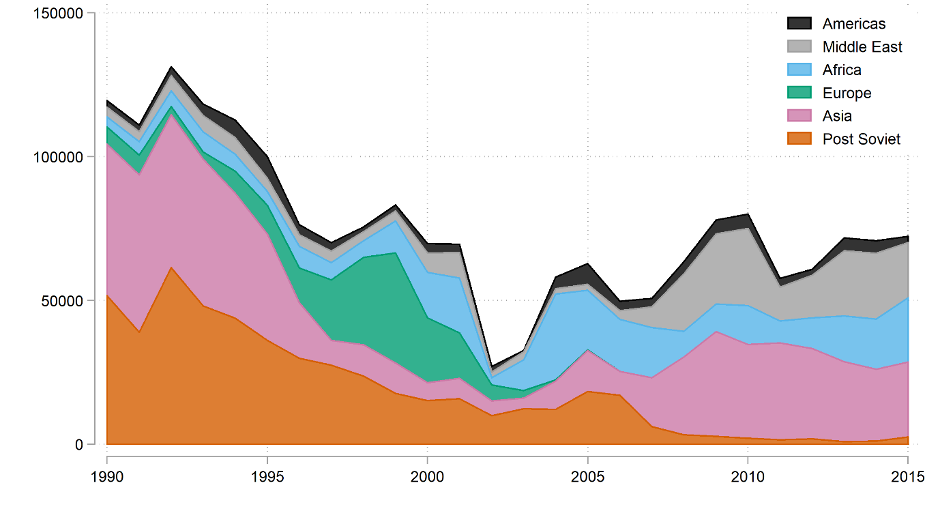

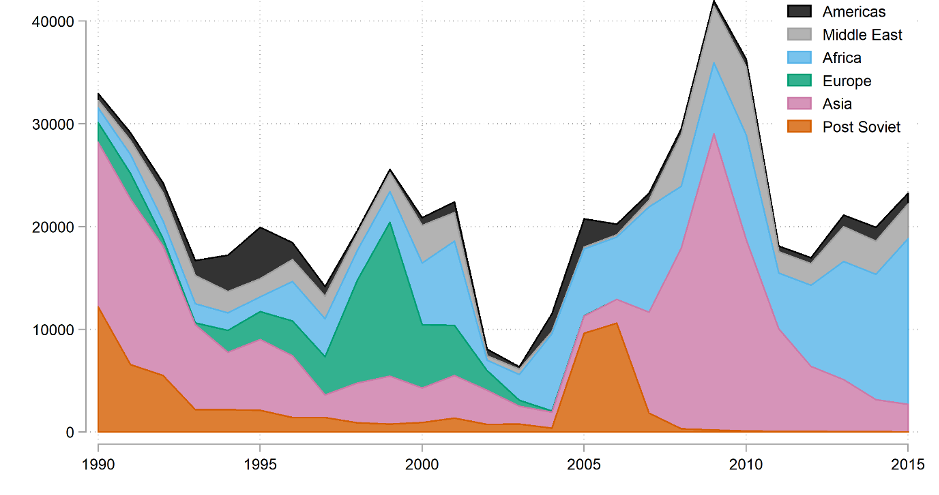

Frist, we exploit the quasi-random allocation of refugees that have no family members or other ties in the US (i.e. refugees without US ties), since the placement of these refugees is determined by refugee resettlement agencies, as opposed to by the refugees themselves. This allays fears of the endogenous location of refugees as a function of their individual-level decisions. Figures 2a and 2b show the inflows of refugees with and without ties into the US from 1990 to 2015.

Figure 2a Arrivals of refugees with ties (millions)

Figure 2b Arrivals of refugees without ties (millions)

Resettlement agencies could nevertheless strategically place refugees, for example by allocating refugees to commuting zones with greater opportunities for FDI flows to refugees' countries of origin. While it is unlikely that agencies base their relocation decisions on the potential for doing business in the refugees' origin countries, rather than on employment and housing considerations, the location of pre-existing communities of co-nationals is an important factor in the location decision of agencies, according to Beaman (2012). So, while we are able to control for the fact that some commuting zones are chosen because they have, say, better employment and housing opportunities – using commuting zones fixed effects – we cannot rule out that pre-existing communities may well be associated with refugee allocations as well as greater FDI flows to their countries of origin. To overcome this issue, we control for the effect of pre-existing co-national communities by including economic migrants, both in 1990 and in 2000, on the right-hand side. This way we can be sure that the FDI effect of refugees is not driven by co-national migrants. We also examine the effect of refugees on FDI in commuting zones where there are no economic migrants of the same nationality whatsoever, both in 1990 or 2000, thereby removing this potential source of endogeneity, and focusing on commuting zones which are unlikely to have been strategically chosen by agencies.

Our specification delivers an estimate of the impact of 1990-2000 refugee inflows on 2005-2015 FDI flows. Using our preferred specification, we show that a 10% increase in refugees in a given commuting zone increases outward FDI flows to their countries of origin by 0.54%, FDI projects by 0.24% and FDI jobs by 0.72%. The positive effect on FDI is highest for refugees from the former Soviet Union, former Yugoslavia and Vietnam.

The Vietnamese boat people as a natural experiment

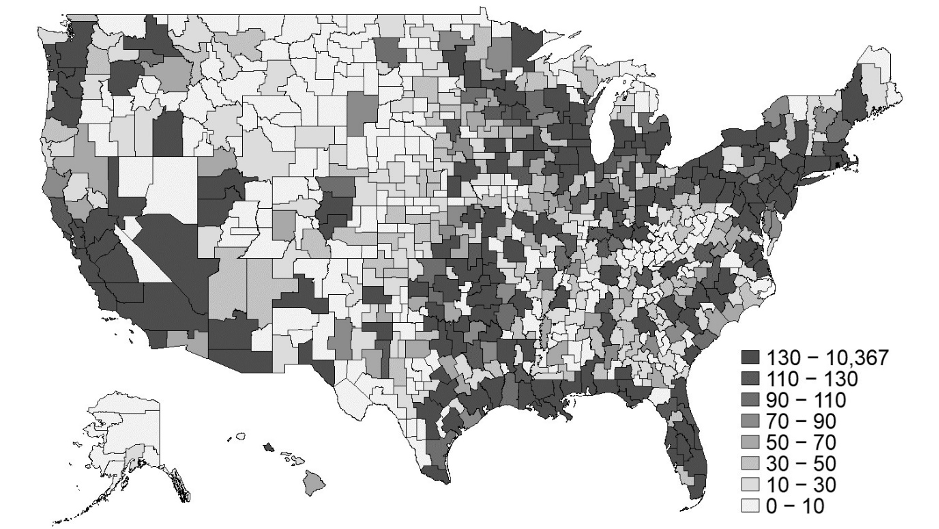

We subsequently focus on the specific case of Vietnamese refugees in the US and exploit the fall of Saigon as a natural experiment. This event triggered a large exodus of Vietnamese, especially to the US. The first wave of some 125,000 Vietnamese refugees admitted to the US in 1975 (Figure 3), under the auspices of the Indochina Migration and Refugee Assistance Act, were quasi-randomly dispersed across the US at a time when a complete trade ban was imposed on Vietnam by the US.

Figure 3 Vietnamese in the US in 1975

Our identification strategy consists of instrumenting the 1976-1995 flow of Vietnamese refugees – i.e. those refugees who arrived to the US before the lifting of US sanctions on Vietnam in 1995 – with the initial quasi-randomly allocated 1975 distribution of refugees, across US commuting zones. We also exploit the fact that almost all Vietnamese refugees are originally from the south of Vietnam. Specifically, we compare the effect of refugees on FDI to the south of Vietnam, where most refugees are from, to FDI the north, where the capital Hanoi is located. This provides a quasi-ideal counterfactual as it is the same country (since 1975), with the same institutions, language, and investment potential. Our results show that those commuting zones that hosted larger concentrations of Vietnamese refugees, before the lifting of the ban, invest more in the south of Vietnam today. Our estimates show that a 10% increase in 1995 Vietnamese refugees increased FDI flows to the south of Vietnam by 0.4%.

What’s more, the government of Vietnam implemented several policies aimed at engaging overseas Vietnamese as part of its overarching growth strategy, which included the 2005 Investment and Enterprise Laws and the 2008 Nationality Law. We further document that those commuting zones hosting larger concentrations of Vietnamese fostered larger volumes of FDI to Vietnam following the enactments of the laws, thereby highlighting the potential of developing country policies aimed at leveraging overseas diasporas for development (Figure 4).

Figure 4 The effect of post-2005 reforms on FDI projects to south and north Vietnam across commuting zones with different numbers of Vietnamese refugees

Notes: The graphs illustrate the effects of post-2005 reforms on FDI projects to Vietnam across commuting zones. A coefficient of 0.05 suggests that FDI projects increased by around 5% from 2003-2005 to 2006-2010. Dashed lines are 95% confidence intervals. The three columns show the reduced-form and 2SLS estimates (IV) respectively.

Conclusion

Taken together, our results provide causal evidence that refugees foster FDI to their countries of origin, a few years after they were forced to flee persecution. Our paper also demonstrates that decisions taken primarily for humanitarian reasons in developed host nations may yield economic benefits for some of the world's poorest nations. Evidence of refugees fostering FDI to their origin countries is all the more surprising given the persecution they once fled, thereby speaking to the strong attachment refugees maintain with their countries of origin.

References

Albuquerque, R (2003), “The composition of international capital flows: Risk sharing through foreign direct investment”, Journal of International Economics 61(2): 353-383.

Bahar, D, C Ozguzel, A Hauptmann, and H Rapoport (2019), “Migration and post-conflict reconstruction: The effect of returning refugees on export performance in the former Yugoslavia”.

Beaman, L A (2012), “Social networks and the dynamics of labour market outcomes: Evidence from refugees resettled in the US”, The Review of Economic Studies 79(1): 128-161.

Borensztein, E, J D Gregorio, and J-W Lee (1998), “How does foreign direct investment affect economic growth?”, Journal of International Economics 45(1): 115-135.

Borjas, G J (1987), “Self-selection and the earnings of immigrants”.

Bourdieu, P (1980), “Le capital social: notes provisoires”, Actes de la recherche en sciences sociales 31(1): 2-3.

Buch, C M, J Kleinert, and F Toubal (2006), “Where enterprises lead, people follow? Links between migration and FDI in Germany”, European Economic Review 50(8): 2017-2036.

Burchardi, K B, T Chaney, and T A Hassan (2018), “Migrants, ancestors, and foreign investments”, The Review of Economic Studies 86(4): 1448-1486.

Cortes, K E (2004), “Are refugees different from economic immigrants? Some empirical evidence on the heterogeneity of immigrant groups in the united states”, Review of Economics and Statistics 86 (2): 465-480.

Daude, C and M Fratzscher (2008), “The pecking order of cross-border investment”, Journal of International Economics 74(1): 94-119.

Docquier, F and E Lodigiani (2010), “Skilled migration and business networks”, Open Economies Review 21(4): 565-588.

Dunlevy, J A (2006), “The influence of corruption and language on the pro-trade effect of immigrants: Evidence from the American states”, Review of Economics and Statistics 88(1): 182-186.

Felbermayr, G, V Grossmann, and W Kohler (2015), “Chapter 18 - migration, international trade, and capital formation: Cause or effect?”, in B R Chiswick and P W Miller (eds), Handbook of the Economics of International Migration, Volume 1, North-Holland.

Foley, C F and W R Kerr (2011), Ethnic innovation and US multinational firm activity, Technical report, National Bureau of Economic Research.

Glennon, B (2018), “How do restrictions on high-skilled immigration affect offshoring? Evidence from the H-1B program”, Technical report, Working paper.

Greif, A (1993, June), “Contract enforceability and economic institutions in early trade: The Maghribi traders' coalition”, American Economic Review 83(3): 525-48.

Javorcik, B S, C Ozden, M Spatareanu, and C Neagu (2011, March), “Migrant networks and foreign direct investment”, Journal of Development Economics 94(2): 231-241.

Mayda, A, C Parsons, H Pham and P-L Vezina (2019), "Refugees and Foreign Direct Investment: Quasi-Experimental Evidence from US Resettlements'“, CEPR Discussion Paper 14242.

New American Economy (2017), “From struggle to resilience: The economic impact of refugees in America”.

Parsons, C R and L A Winters (2014), “International migration, trade and aid: A survey”, in International Handbook on Migration and Economic Development.

Portes, A (2000), “The two meanings of social capital”, Sociological Forum 15: 1-12.

Rauch, J E (1996), Trade and search: Social capital, sogo shosha, and spillovers, Technical report, National Bureau of Economic Research.

Vandor, P and N Franke (2016), “See Paris and. . . found a business? the impact ofcross-cultural experience on opportunity recognition capabilities”, Journal of Business Venturing 31(4): 388-407.

World Investment Report (2008), “Transnational corporations and the infrastructure challenge”,

Roy, A D (1951), “Some thoughts on the distribution of earnings”, Oxford Economic Papers 3(2): 135-146.

Xu, B (2000, August), “Multinational enterprises, technology diffusion, and host country productivity growth”, Journal of Development Economics 62(2): 477-493.