The boom-bust cycles in cross-border capital flows during and after the Global Financial Crisis have kindled debates on the management of capital flows to emerging markets. While most of the literature has focused on the policy options of recipient countries (e.g., Ostry et al. 2010, 2011, IMF 2011), some recent studies and policy papers call for a more coordinated approach to regulating these flows by acting at both the source and recipient country ends (e.g., Ostry et al. 2012, IMF 2012, Brunnermeier et al. 2012). The idea is not new. In fact, this is the one issue on which the main architects of Bretton Woods – John Maynard Keynes and Harry Dexter White – were in complete agreement when debating the post-war international monetary architecture in 1944.

In a recent paper (Ghosh et al. 2014), we examine whether a cooperative approach to taming potentially destabilising capital flows – by imposing capital account restrictions at both the source and the recipient country ends – may be feasible. To this end, we estimate the impact of capital restrictions in source and recipient countries individually, as well as the impact of measures at both ends. We use annual data on bilateral bank asset flows from the Bank of International Settlement’s Locational Banking Statistics for 31 (reporting) source to 76 major recipient countries (advanced and emerging markets) over 1995–2012, and combine this information with different types of capital account restrictions in these countries – constructed using detailed information from the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions, and the OECD Code of Liberalisation of Capital Movements. Our capital restrictions comprise capital outflow- and inflow-related measures in the source and recipient countries, respectively, and include economy-wide capital controls – overall and disaggregated by asset class (i.e., bond, equity, direct investment, and financial credit flows) – and measures specific to the financial sector (i.e. prudential measures) that may act like capital controls.

Do capital account restrictions matter?

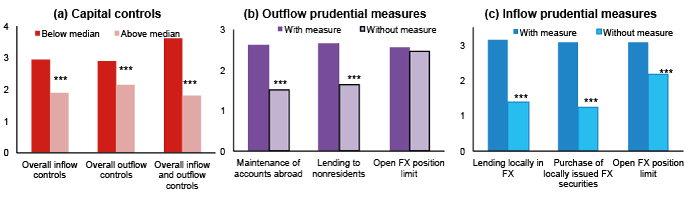

Since a prerequisite for successful coordination is that measures adopted by source and recipient countries actually affect capital flows – the evidence on which is decidedly mixed (Ostry et al. 2010, Magud et al. 2011) – we start by examining whether the capital account restrictions in source and recipient countries individually are associated with a lower volume of cross-border banking flows. An initial snapshot of the data reveals that, on average, bilateral bank flows are significantly lower if restrictions on capital outflows and inflows are in place (above median) in source and recipient countries, respectively (see Figure 1). Similarly, prudential restrictions on maintenance of accounts abroad and on lending to non-residents in source countries are associated with significantly lower bank outflows, while foreign currency (FX)-related measures in recipient countries (such as restrictions on lending domestically in foreign currency and open foreign currency position limits) also seem to discourage inflows.

Figure 1. Cross-border bank flows, capital controls, and prudential measures, 1995–2012

Note: Bank flows measured as log of exchange rate adjusted changes in the total stock (amounts outstanding) of assets (all instruments). In taking logs, the negative asset flow observations are transformed by taking the log of the absolute value and then changing the sign. *** indicates statistically significant different means between the two groups at the 1% level.

These observations are confirmed by more formal empirical analysis, which shows that capital account restrictions at either end are associated with a significantly lower volume of cross-border flows.

- On the source side, moving from the lower to the upper quartile on measures of overall, bond, equity, direct investment or financial credit outflow controls, and restrictions on the financial sector to lend to non-residents, are associated with about 50-100% lower flows.

- On the recipient side, moving from the lower to the upper quartile on overall and bond inflow controls, and the existence of foreign currency-related prudential measures (such as restrictions on lending in foreign currency, and open foreign currency position limits) are associated with some 50-80% lower inflows.

Among other factors, we find a strong effect of global risk aversion and monetary policy (proxied by the interest rate) in source countries on bank flows – highlighting the pro-cyclical nature of such flows – as well as of the domestic interest rate and exchange rate regime of the recipient countries.

Regulating flows at both ends

Controlling simultaneously for both source and recipient country capital restrictions, the estimated effects remain largely unchanged. Individual measures are, however, associated with a larger reduction in flows when the other side is financially more open – though not necessarily fully open. Inasmuch as capital controls are effective, this result makes intuitive sense. When the source country is already restricting outflows, the incremental effect of inflow restrictions on the volume of flows will be smaller than if the source side is completely free. Likewise, the incremental effect of source country restrictions on outflows will be smaller when the recipient is already restricting inflows. The estimated effects of source and recipient country restrictions are thus partially (but not fully) additive, making it possible to operate capital account restrictions at both ends, achieving either a larger reduction in flows, or the same reduction with less intensive (and therefore perhaps less distortive) measures at either end.

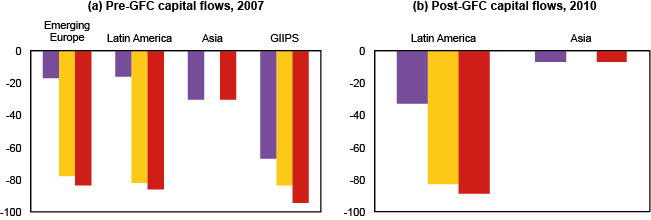

Counterfactual analysis based on our estimates suggests that pre-Crisis flows to emerging Europe and the Eurozone peripheral countries would have been substantially lower in the presence of capital restrictions (including prudential measures) at either, or both, ends. For example, the estimates imply that cross-border bank flows to emerging Europe in 2007 would have been about 20% lower if all source countries (largely other European countries) had financial credit outflow controls in place; about 80% lower if all recipient countries had imposed restrictions on lending locally in foreign currency; and about 85% lower if all source and recipient countries had imposed the financial credit control and foreign currency lending restriction, respectively (see Figure 2). Similar estimates are obtained for the Eurozone peripheral countries (Greece, Ireland, Italy, Portugal, and Spain), where it is estimated that flows might have been almost 95% lower if all source and recipient countries had imposed financial credit outflow controls and foreign currency lending restrictions in 2007, respectively.

Figure 2. Estimated impact of capital account restrictions on cross-border bank flows (in %)

Note: Left- and right-hand panels show the change in predicted flows (in %) if all source countries imposed a financial credit outflow control; if all recipient countries imposed restriction on foreign-currency lending; and if all source and recipient countries imposed these measures together in 2007 and 2010, respectively.

Looking at the effectiveness of measures in controlling the post-Crisis surge in flows to Asian and Latin American emerging markets, we find that action by all source and recipient countries would have lowered inflows to these regions by about 10 and 90%, respectively. Overall, our results are robust to a range of sensitivity tests, including to defining the dependent variable in stock, rather than in flow, terms; and to addressing potential endogeneity concerns through an instrumental variable approach, where we use two novel instruments for the existence of capital restrictions: The (lack of) monetary/central bank freedom and the presence of a democratic left-wing government.

Spillovers

If recipient country restrictions are effective in reducing the volume of cross-border bank inflows – as the results suggest – then they could (inadvertently) divert flows to other more open countries in the region. While such diverted flows may finance productive investments, and could thus be welcome, they may also exacerbate existing distortions in countries already contending with an inflow surge, resulting in costly ‘capital control wars’.

Our results suggest that such diversion of flows is indeed possible; the volume of bank flows received by the recipient country is significantly larger when its neighbours (defined in terms of regional or economic similarity) are financially relatively closed. Given the magnitude and volatility of cross-border bank flows, and the potential spillovers from the capital account restrictions in other recipient countries implied by these results, the possibility of countries imposing beggar-thy-neighbour restrictions cannot be ruled out – which strengthens the case for multilateral coordination among recipient countries as well.

Policy implications

These findings hold important policy implications. First, given the close connection between cross-border bank flows and risks to global financial stability, our analysis suggests that adoption of relevant capital account restrictions in boom times could help to dampen the pro-cyclicality of these flows, thereby lowering the risk of systemic financial crises.

Second, the traction of both source and recipient country capital restrictions in regulating flows implies that coordination could be useful to achieve a given reduction in cross-border flows by adopting relatively lower levels of restrictions at both ends – instead of more intensive controls at one end – which is a globally more efficient outcome when the (administrative, compliance, and distortive) costs associated with capital controls are convex in the tax rate, as seems plausible (Ostry et al. 2012). Such coordination may be especially beneficial when the scope to act at one end is limited—for instance, because of weak institutional or administrative capacity to enact measures, or because international legal obligations constrain the availability of certain restrictions.

Third, considering the role of source country monetary policies in pushing bank flows to recipient countries, our results allude to the importance of coordination on the monetary policy dimension as well. To the extent that countercyclical monetary policy is however required in source countries, its effectiveness on the domestic economy could be enhanced, and adverse cross-border spillovers could be reduced, by the adoption of suitable capital account related policies. Finally, considering the spillover effects of inflow-related capital account restrictions, our results suggest potential gains from coordination amongst recipient countries as well to avoid costly capital control wars.

Disclaimer: The views expressed herein are those of the authors, and should not be attributed to the IMF, its Executive Board, or its management.

References:

Brunnermeier, M, J Gregorio, B Eichengreen, M El-Erian, A Fraga, T Ito, P Lane, J Pisani-Ferry, E Prasad, R Rajan, M Ramos, H Rey, D Rodrik, K Rogoff, H Shin, A Velasco, B Mauro, and Y Yu (2012), Banks and Cross-Border Capital Flows: Policy Challenges and Regulatory Responses (Washington DC: Brookings Institution).

Ghosh, A, M Qureshi, and N Sugawara (2014), “Regulating Capital Flows at Both Ends: Does it Work?” IMF Working Paper 14/188 (Washington DC: IMF).

IMF (2011), Recent Experiences in Managing Capital Inflows—Cross-Cutting Themes and Possible Policy Framework, Washington DC: International Monetary Fund.

IMF (2012), The Liberalization and Management of Capital Flows: An Institutional View, Washington DC: International Monetary Fund.

Magud, N, C Reinhart, and K Rogoff (2011), “Capital Controls: Myth and Reality—A Portfolio Balance Approach,” NBER Working Paper w16805 (Cambridge, MA: NBER).

Ostry, J, A Ghosh, K Habermeier, M Chamon, M Qureshi, D Reinhardt (2010), “Capital Inflows: The Role of Controls,” IMF Staff Position Note SPN/10/04 (Washington DC: IMF).

Ostry, J, A Ghosh, K Habermeier, L Laeven, M Chamon, M Qureshi, A Kokenyne (2011), “Managing Capital Flows: What Tools to Use?,” IMF Staff Discussion Note SDN/11/06 (Washington DC: IMF).

Ostry, J, A Ghosh, and A Korinek (2012), “Multilateral Aspects of Managing the Capital Account,” IMF Staff Discussion Note SDN/12/10 (Washington DC: IMF).