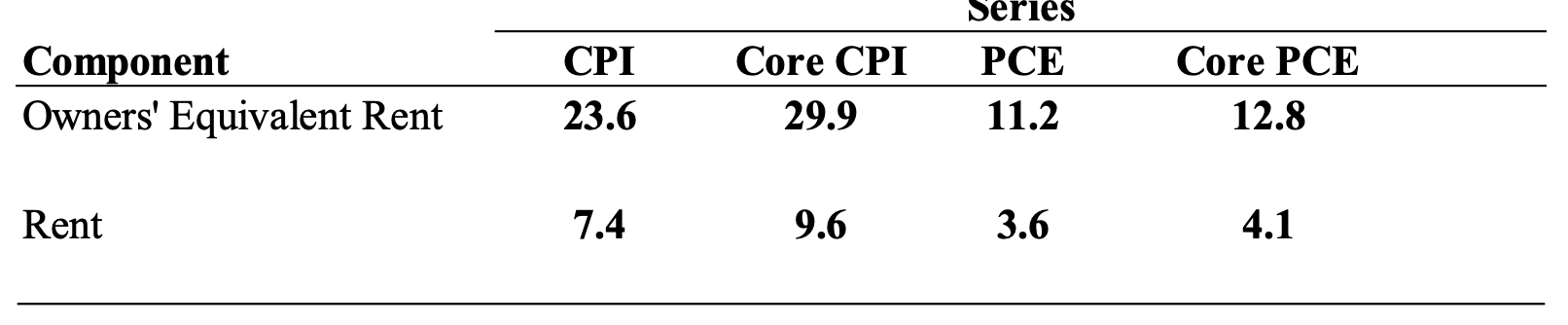

A few basic statistics suggest the importance of residential services to the overall inflation process. The two largest components of residential services – owners’ equivalent rent of residence (OER) and rent of primary residence – combine to range from about 15% of the Personal Consumption Expenditure Price (PCE) Index to almost 40% of the Consumer Price Index (CPI) core measure, which strips away volatile energy and food prices (Table 1).1 This represents roughly half of the services component of the CPI.

Table 1 Differences in weight shares in housing PCE vs CPI (%)

Sources: Bureau of Labor Statistics, Bureau of Economic Analysis, authors’ calculations

Notes: PCE weights will change with new releases and revisions.

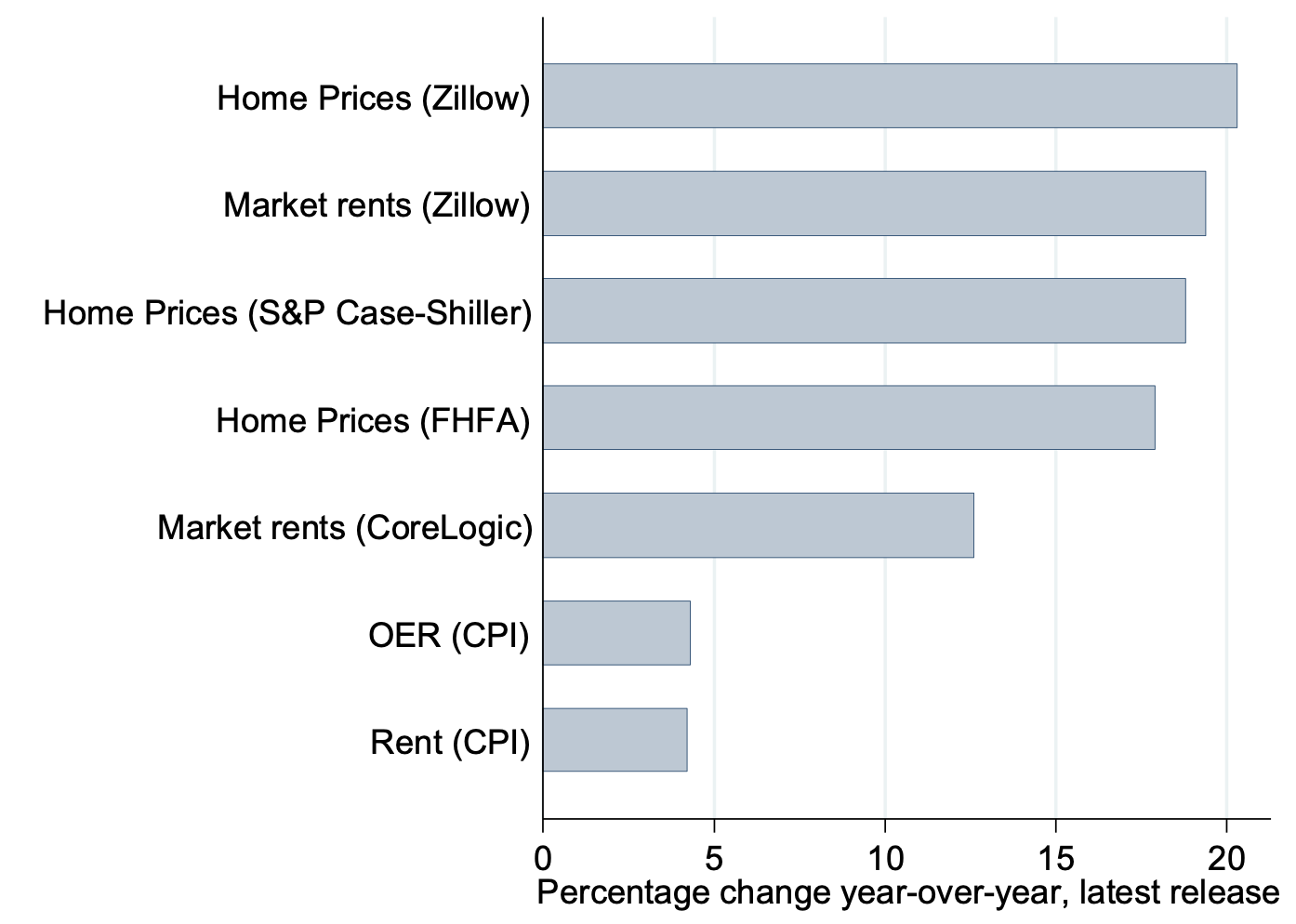

Measured residential services inflation was only 4.3% in the twelve months ending in February 2022 for OER, and 4.2% for the less significant rental housing component over the same period. These figures represent a recent increase, but still seem almost incommensurate with private sector estimates of the current change in the cost of living for homeowners and renters. Over the same period, home prices have jumped by 20.3% according to Zillow. The Zillow Observed Rent Index has increased 19.4%, and the CoreLogic Single-Family Rent Index, likely to be a particularly good leading indicator for OER, had risen by 12.6% in the twelve months ending January 2022 (Figure 1).2

Figure 1 Growth in measures of housing costs, latest releases

Sources: Zillow Home Value Index, S&P CoreLogic Case-Shiller Home Price Index, FHFA House Price Index, CoreLogic Single-Family Rent Index, Zillow Observed Rent Index, CPI Owner’s Equivalent Rent of Residences, CPI Rent of Primary Residence.

Notes: Figure plots latest data release of series, expressed in percentage change relative to 12 months earlier. This figure reflects updated numbers since the publication of Bolhuis et al. (2022). S&P Case-Shiller, shorthand for S&P CoreLogic Case-Shiller, is from December 2021, FHFA from Q4 2021, CoreLogic from January 2022. Other series from February 2022.

The reason for this apparent disconnect is that most homeowners and renters did not move in 2021. They thus did not have to pay the spot price for shelter as it rose rapidly. Instead, many had to pay the rate that they signed for earlier in the year or the rate they signed for years earlier that had been modified slightly by their landlord or bank. These prices should tend to converge to the market price, but the lag time may be significant and the convergence incomplete.

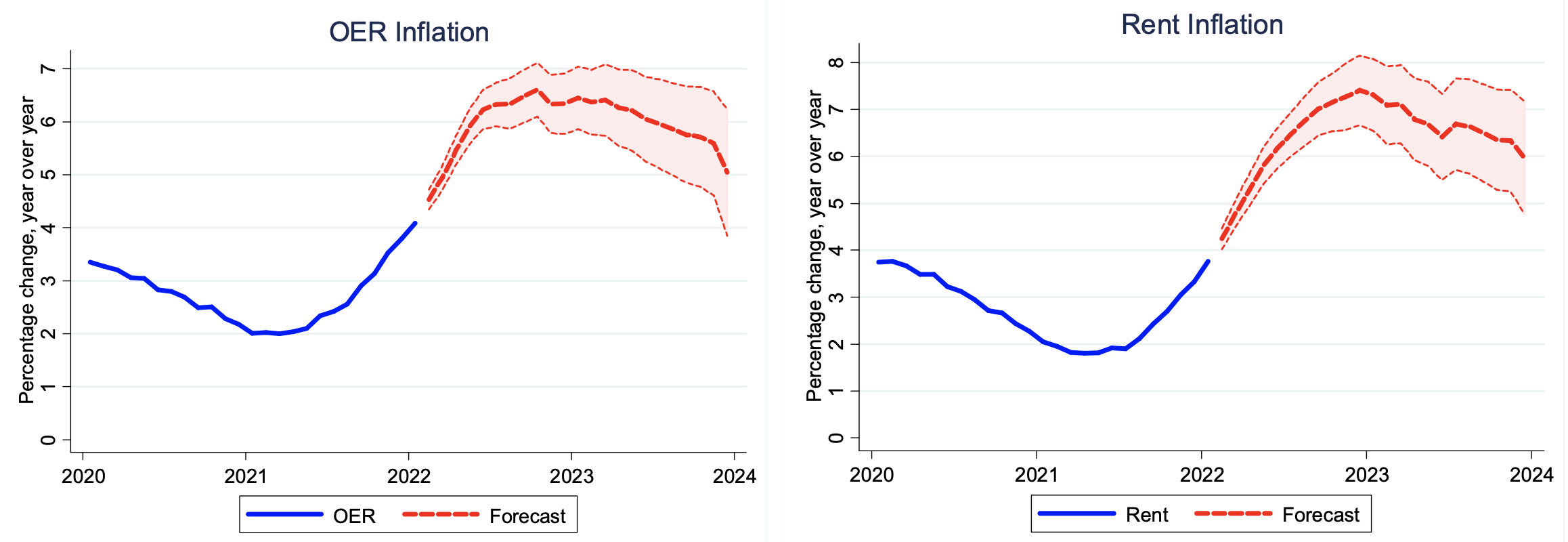

Whereas before we might not have been able to forecast the trajectory of measured governmental rental inflation accurately, the advent of real-time big data on rental asking prices from firms like Zillow and machine learning techniques allow us to predict changes more accurately. In a recent paper (Bolhuis et al. 2022), we provide rough estimates for the housing component of inflation in the near term.3

Forecasting housing inflation

Extrapolating from past relationships using a machine-learning forecasting method, we estimate that housing inflation is likely to move to between 6.5% and 7% towards the end of 2022 (Figure 2). This would mean housing will make a significant contribution to overall inflation in 2022, ranging from about one percentage point for the PCE to 2.6 percentage points for core CPI, depending on the weight housing is given. Our estimates imply housing’s contribution to overall inflation would be between 0.4 and 1.1 percentage points higher in 2022 compared to 2021, depending on the choice of index. We believe that our estimates are relatively robust due to their stability irrespective of data series choices or forecasting techniques.

Figure 2 Projected OER and rent

Sources: Bureau of Labor Statistics. Private sector rent data from CoreLogic Single-Family Rent Index. Home prices from Zillow Home Value Index. Authors’ calculations.

Notes: Forecast model is an elastic net using 24 months of lags in the year-over-year growth rates of the dependent variable and 24 months of lags in the year-over-year growth rate of the Zillow Home Value Index and the CoreLogic Single-Family Rent Index. Dotted lines are 95% confidence intervals based on in-sample forecast errors.

In our paper, we assess the overall impact on core and headline inflation under two scenarios. We show that even if the rest of the CPI basket returns to the target of 2%, we project that housing will push up core CPI to close to 4% in December 2022. We also estimate that even if the price of used cars relative to the overall CPI returns to pre-pandemic levels, this would not offset the additional residential services inflation that we project in 2022.

Including leading indicators of housing supply, the model projects 8% for the weighted inflation rate of OER and rent in the CPI in December 2022. This increase in our forecasts reflects the muted supply response relative to what would have been predicted given historical relationships and the rapid run-up in housing prices since the start of the pandemic. Our models suggest that the growth in new supply will moderate in 2022, keeping the supply of new homes for sale below the peak of the previous cycle.

Conclusion

In the era of Covid, extrapolating from historical relationships comes with substantial uncertainty. This is especially true for residential services, as working from home, changes in household formation, and supply bottlenecks have affected both sides of the housing and rental markets. We take this opportunity to list a few other caveats that could serve to bias our forecasts.

Especially for continuing tenants, there are varying state and local laws that cap rent increases.4 While these restrictions do not always bind in all jurisdictions, they could attenuate our results as landlords may not be able to adjust to the spot price as quickly as they have in the past. Newly proposed and existing laws on rent control and eviction moratoria would also make our estimates for 2022 too high. Additionally, while we do not think that bottlenecks were the sole reason for cost increases, their easing could lead to a strong supply response. If there are nonlinearities in the response of construction to prices – as prices have risen at record rates – then prices may decline faster than the data on which our forecasting models are trained. On the other hand, if bottlenecks continue well into 2022, our estimates might be biased downwards as the lack of new supply could exacerbate strong rental price growth. In the same direction, strong housing pricing growth could price potential new homebuyers out of the housing market and keep them in the rental market. This could serve to strengthen the rental market beyond our estimates and lead to higher measured residential services inflation than we project. Taking a step back, our model itself is calibrated on past readings for private sector home and rental increases that are not as large as they are currently. Continuing unprecedented price rises could also make our extrapolation more error prone in either direction.

Despite these caveats, using a variety of techniques and datasets, we estimate housing’s contribution to 2022 services inflation and overall inflation as being significant. The way that housing inflation is measured – as the average price growth across all housing occupants, not as the average price increase one looking for housing today would pay relative to an earlier period – ensures that past developments in the housing market will result in an increase in recorded housing inflation in 2022. Our findings suggest that if past relationships hold into 2022, housing inflation is likely to move to between 6.5% and 7% and make a significant contribution to overall inflation in 2022, ranging from one to nearly three percentage points. Although our projections suggest that residential inflation will peak in late 2022, we expect it to remain elevated in 2023.

Authors’ note: The views expressed herein are those of the authors and do not necessarily reflect the views of the, IMF, its Executive Board, or IMF management.

References

Bernstein, J, E Tedeschi, and S Robinson (2021), "Housing prices and inflation", Council of Economic Advisers blog post.

Boesel, M, S Chen, and F E Nothaft (2021), "Housing preferences during the pandemic: effect on home price, rent, and inflation measurement", Business Economics.

Bolhuis, M A, J N L Cramer, and L H Summers (2022), “The Coming Rise in Residential Inflation”, NBER Working Paper 29795.

Brescia, E (2021), “Housing poised to be strong driver of inflation”, Fannie Mae Housing Insights.

Dolmas, J, and X Zhou (2021), "Surging House Prices Expected to Propel Rent Increases, Push Up Inflation”, Federal Reserve Bank of Dallas blog post.

Glaeser, E L and J Gyourko (2009), “Arbitrage in Housing Markets”, in E L Glaeser and J M Quigley (eds), Housing markets and the economy: risk, regulation, and policy: essays in honor of Karl E. Case.

Endnotes

1 For more information on how the indices differ and a recent discussion of similar issues, see work by the Council of Economic Advisers (Bernstein et al. 2021).

2 Glaeser and Gyourko (2009) show that the rental stock and owner-occupied stock of housing differ significantly, with single-family homes more prevalent amongst owner-occupied units. Boesel et al. (2021) show the utility of the CoreLogic Single-Family Rent Index and how it better captured housing dynamics early in the pandemic.

3 Brescia (2021) and Dolmas and Zhou (2021) forecast rent and OER inflation using historical data on home prices. Our analysis shows that, while home prices tend to lead official shelter inflation, private sector rent data are a more robust predictor of shelter inflation in the near term.

4 See Been et al. (2019) for a recent discussion of the past, present, and possible futures of rent regulations.