The rise of global value chains is posing new challenges to analyses of international trade and countries’ competitiveness. Traditional measures are based on the assumption that all activities in the production of a good take place in the domestic economy, using domestic input only. However, with the increasing fragmentation of production across borders and the increasing use of foreign inputs, this assumption can no longer be maintained.

There is an increasing need for alternatives. Johnson and Noguera (2012) and Koopman et al. (2013) proposed a new measure of the domestic value added content of exports. Bems and Johnson (2012) argued that the conventional real effective exchange rate calculations should be replaced by an analysis based on value added. Drawing on our recent paper (Timmer et al. 2013), this column goes one step further and take the concept of global value chains as a starting point for analysing issues of competitiveness.

What is global value chain income?

Take a particular product, say an iPod. The iPod is the end result of an intricate production network ending with assembly in China. In an already classic study, Dedrick et al. (2010) documented that the production of the iPod-generated incomes in many countries. But the export statistics from China contain the value of all stages of production and grossly overstate the income generated in China itself (this pattern was confirmed by many other product case studies, see e.g. Yuqing Xing 2011). How representative are these case studies of high-end electronics? To answer this, we take a macro-perspective, and analyse the value added along the production chain for a wide set of manufacturing product groups. The novelty of our approach is that we trace the value added by all labour and capital that is directly and indirectly used for the production of final goods. We call this global value chain income.

How do we measure global value chain income?

A global value chain is identified by the industry-country where the last stage of production takes place before delivery to the final user (e.g. Chinese electronics manufacturing). We model the world economy as an input-output model in the tradition of Leontief (1936). Basically, one derives the gross output value of all products that are needed in the production process of one final unit of a particular product. By the logic of Leontief’s insight, the sum over value added by all factors in all countries that are directly and indirectly involved in the production of this good will equal the output value of that product. We also introduce the related concept of global value chain jobs. This is the number of jobs directly and indirectly needed in the production of final goods. To measure global value chain incomes and jobs, we use the global input-output tables and supplementary labour accounts from the World Input-Output Database (available at www.wiod.org and described in Timmer 2012). This prototype database initiative is now being taken up in the international statistical community, see Escaith and Timmer (2012).

New findings based on the global value chain approach

The following findings are based on an analysis of final manufacturing goods (‘manufactures’). A ‘final product’ is a product that is consumed, and is distinct from intermediates that are used in the process of production.

- Exports are not domestic incomes.

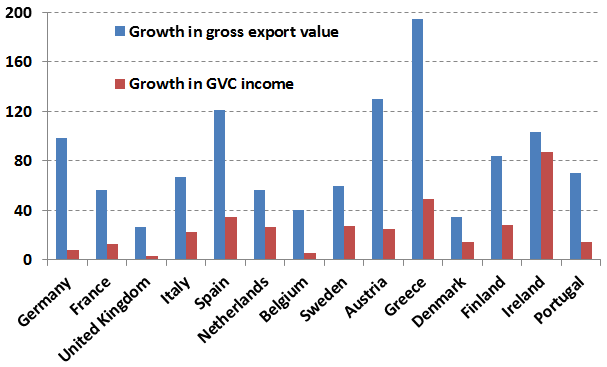

Figure 1 provides a comparison of real growth rates of manufactures global value chain income and manufacturing exports between 1995 and 2008. Exports growth overestimates the related income growth of countries that rely heavily on imported intermediates, in particular for Germany and small open economies. For example, real gross exports of manufacturing products from Germany increased by 98%, whereas manufactures global value chain income increased only by 7%. Why? First, the domestic value added content of Germany’s durable goods production dropped quickly due to offshoring and increasing imported intermediates (Marin 2010). At the same time, an increasing share of domestic demand for non-durables was served by imports from emerging countries. Being ‘super competitive’ in terms of exports does not necessarily generate high domestic incomes.

Figure 1. Growth in real manufacturing exports and manufactures GVC income between 1995 and 2008 (%)

- European comparative advantage is shifting.

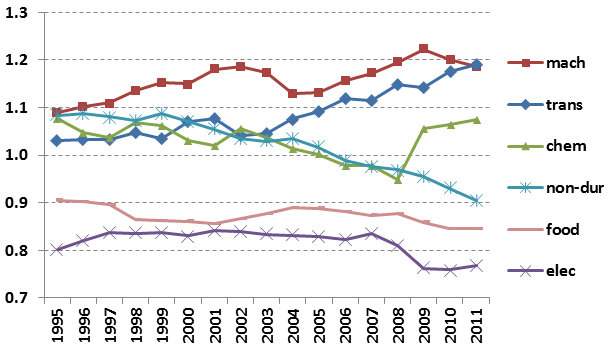

Traditional analyses of revealed comparative advantage based on gross exports suggested that the EU was stuck in low- and medium-tech industries (di Mauro and Forster 2008). In contrast, we find strong changes based on global value chain incomes. Revealed comparative advantage is calculated as the EU27 share in world global value chain income for a product group divided by the EU27 share in world global value chain income for all manufactures. The EU’s comparative advantage is increasingly in activities carried out in global production networks of non-electrical machinery and transport equipment, while declining in the production of non-durables (see Figure 2).

Figure 2. Revealed comparative advantage of EU27, by group of final manufactures (%)

Note: Final food manufacturing products, Other non-durable products; Chemical products; Machinery & metal products; Electrical machinery products and Transport equipment.

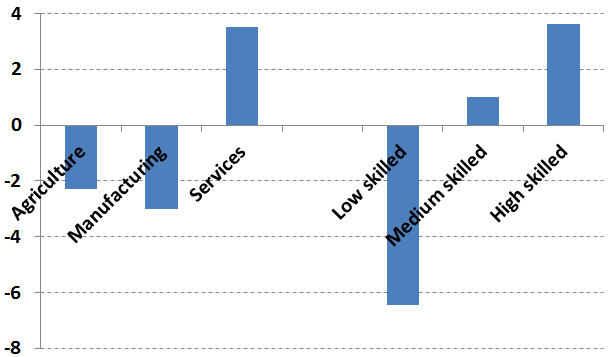

- Enhanced European specialisation in skilled global value chain jobs.

Many policy concerns surrounding globalisation issues are ultimately about ‘good’ jobs. For the EU as a whole, the number of workers involved in the production of manufactures declined by 1.8 million during 1995-2008. Based on additional information on the educational attainment level of workers, we find that there is enhanced specialisation in Europe towards higher skilled jobs. The number of high-skilled jobs increased by almost four million, while more than six million low-skilled jobs were lost (see Figure 3). This pattern was found in all old EU countries (except for Denmark) and perhaps surprisingly, also for the new EU12 member states. From the perspective of competitiveness, this increase of high-skilled global value chain jobs is a clear indication of Europe’s ability to realise employment growth in activities that are productive and relatively well paid in a highly competitive international environment. But it also indicates the uneven distributional consequences of fragmentation.

- European specialisation towards jobs in services and higher-skilled jobs.

The disappearance of manufacturing jobs in advanced nations is occasionally linked to increased fragmentation and offshoring. We find that only about half of the jobs involved in the production of manufactures are actually jobs in the manufacturing sector itself, and this is declining in almost all EU countries over the period 1995-2008. For the EU as a whole, the increase in services jobs related to manufactures global value chains is even bigger than the decline in manufacturing jobs (Figure 3). This might sound paradoxical but is simply a reflection of the fact that global value chains of manufactures include many activities in other sectors such as agriculture, utilities and business services that provide inputs at any stage of the production process.

Figure 3. Change in number of workers in the EU27 involved in manufactures GVCs between 1995 and 2008 (in millions)

Policy conclusions

We argued that international production fragmentation greatly reduces the usefulness of traditional comparative advantage analysis based on exports as a policy guide. Moreover, sectors are becoming the wrong operational unit when framing policies and evaluating performance. The emphasis in trade and industrial policies should therefore not be sector-specific but rather focus on the type of activities carried out along international production chains. More generally, to ensure a broad distribution of the benefits of globalisation, there is a need for policy measures that lubricate the reallocation of resources across activities. At the same time they should counteract the uneven distributional consequences of the fragmentation process both within countries and across the EU.

References

Bems, R and R Johson (2012), “Value-added exchange rates”, VoxEU.org, 6 December.

Dedrick, J, KL Kraemer and G Linden (2010), "Who Profits From Innovation in Global Value Chains? A Study of the iPod And Notebook PCs", Industrial and Corporate Change 19(1), 81-116.

Escaith, Hubert and Marcel Timmer (2012), “The new World Input-Output Database”, VoxEU.org, 13 May.

Johnson, R C and G Noguera (2012), “Accounting for Intermediates: Production Sharing and Trade in Value Added”, Journal of International Economics 86(2), 224-236.

Koopman, Robert, Zhi Wang, and Shang-Jin Wei. (2013, forthcoming). "Tracing Value-added and Double Counting in Gross Exports", The American Economic Review.

Marin, Dalia (2010), “Germany’s super competitiveness: A helping hand from Eastern Europe”, VoxEU.org, 20 June.

Timmer, Marcel P (2012), “The World Input-Output Database (WIOD): Contents, Sources and Methods”, WIOD working paper 10.

Timmer, Marcel P, Bart Los, Robert Stehrer and Gaaitzen J de Vries (2013, forthcoming), “Fragmentation, Incomes and Jobs. An analysis of European competitiveness”, Economic Policy, also GGDC Research Memorandum GD-130.

Yuqing Xing (2011), “How the iPhone widens the US trade deficit with China”, VoxEU.org, 10 April.