In Europe, population ageing has been putting pressure on pension spending, threatening the sustainability of pension systems. Countries have responded, and responded with vigour. Over the past three decades, systemic pension reforms have been gradually introduced in many countries, including Italy (1995), Sweden (1998), Austria (2005), and Finland (2005). Still, it was the Global Crisis that triggered an avalanche of reforms. While at the onset of the Global Crisis pension spending in Europe was already projected to increase by about 4% of GDP over the long term, the Global Crisis and the European debt crisis made the imbalances in pension systems more evident and pressing (Börsch-Supan 2013), leading to tripling in the number of measures taken compared to the previous two decades (Carone et al. 2016). Sustainability concerns were at the fore of reforms that also improved the structure of pension systems and eliminated distortions, aiming towards greater actuarial fairness, counterbalanced by enhanced protection of low-income retirees.1 Importantly, the reforms did not treat generations equitably, often reducing pension entitlements for younger generations while sparing those in or close to retirement.

When the effects of the Global Crisis and the European debt crisis dissipated, reforms lost steam. Political pressures built up not to ‘walk the previous talk’, leading to policy reversals in many countries, partly undoing earlier gains (OECD 2019). Such reversals can be facilitated by long transition periods characteristic of most reforms that can stifle implementation (Kohli and Arza 2011). Reversal of reform momentum comes across also from projections in the the 2021 Ageing Report (European Commission 2021), where in several countries’ policy-related changes contribute towards an increase in spending profiles.

The COVID-19 pandemic has increased sustainability risks of pension systems and further widened generational imbalances by disproportionately affecting the youth and working-age populations compared to retirees – a pattern that repeats the experience of earlier crisis periods (Chen et al. 2018). Such changing socioeconomic environment requires clear diagnosis of the sustainability and equity of pensions under current policies and places higher demands on rethinking the design and mix of pension and welfare systems.

In a recent study (Fouejieu et al. 2021), we propose a framework that allows the assessment of pension reforms with a focus on sustainability, fairness, and intergenerational equity. The centre piece is the proportionality measure (PM), motivated by Knell (2005), that allows to compare the ratio of the present value of pension benefits to the present value of pension contributions over time for each cohort. By setting the discount rate equal to GDP growth, the PM can be expressed as the (undiscounted) ratio of the sum of benefits to the sum of contributions, both as a percentage of GDP.2

Defined in this way, the PM is a gauge of actuarial fairness, comparing contributions made during working life and payments received at retirement. For a cohort, an actuarially fair pension system would yield a PM equal to one , i.e. benefits are fully compensated by contributions, while a PM above one would reflect a system that provides more in benefits than what it receives in contributions. A system would be sustainable if the present discounted value of contributions at least equals the present discounted value of benefits across all cohorts, which holds when the PM is below or equal to one.3 The PM also links the sustainability of the pension system to equity across generations. A constant PM across cohorts signals a pension system in which all cohorts are treated equally, thus ensuring intergenerational equity.

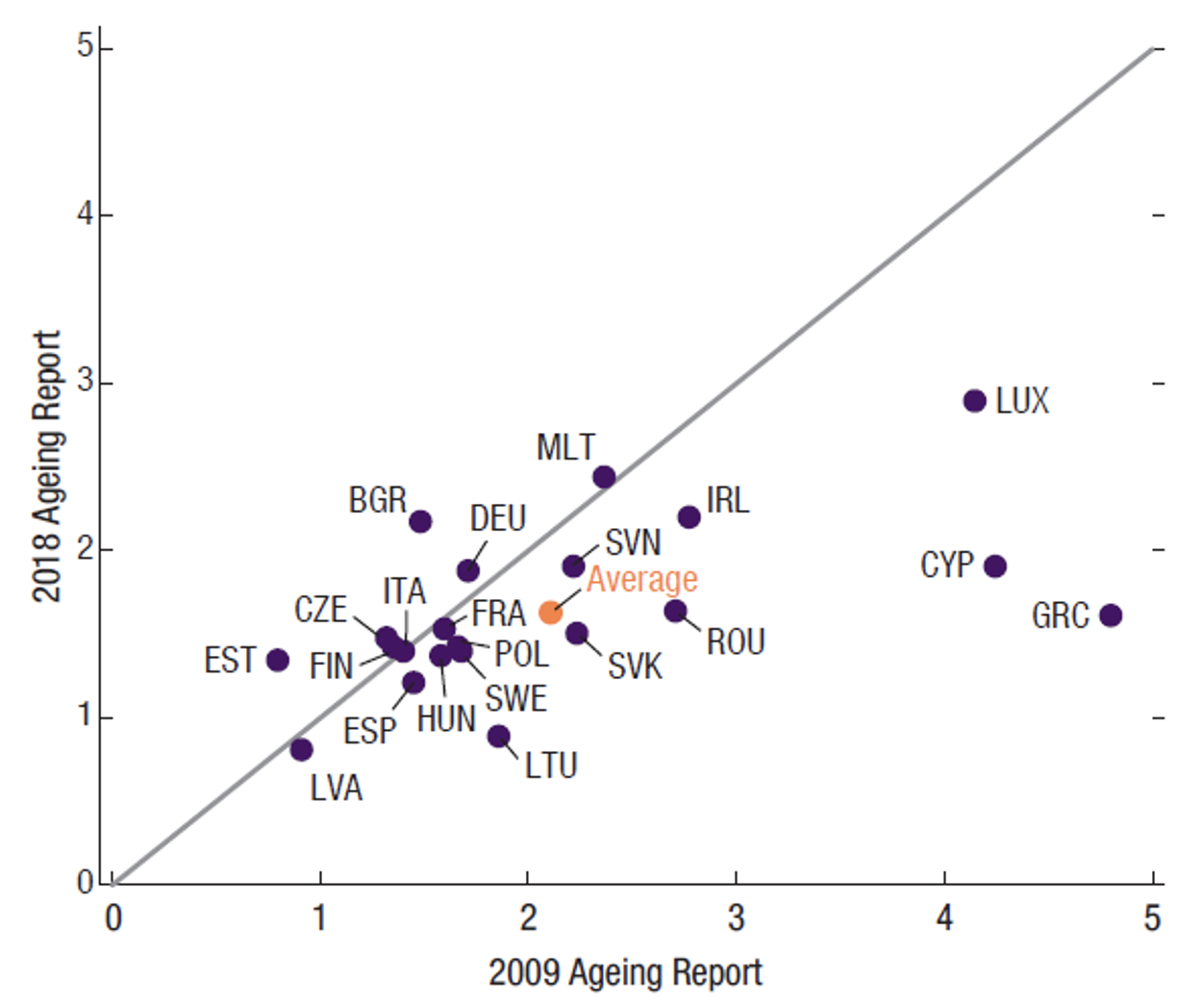

We apply this framework to three vintages of the Aging Report projections: the 2009 vintage, which excludes extensive reforms implemented after the Global Crisis; the 2018 vintage, which largely captures the impact of these reforms; and the 2021 vintage, which allows us to discuss reform reversals in the most recent years. Before the Global Crisis (based on the 2009 Ageing Report), pension systems in Europe were neither actuarially fair nor sustainable: an average PM in the order of two for both current and future retirees signals that pensioners received benefits equivalent to about twice their contributions in present value terms. The average PM estimated using the 2018 Ageing Report projections falls to nearly 1.5 in the long term while remaining largely unaffected for the current retirees, a testament to the impact of reforms adopted after the Global Crisis, which brought pensions about halfway toward achieving the long-term sustainability (Figure 1). Last, the average long-term PM based on projections from the 2021 Ageing Report is 1.7, pointing to the impact of reversals along with other factors that deteriorated sustainability compared to 2018, including rollbacks of earlier increases in retirement ages, suspensions of sustainability factors, and the increasing role of public pension systems in emerging Europe.

Figure 1 Proportionality measure for cohort born in 1990

Sources: 2009 and 2019 Ageing Reports; Eurostat; IMF staff calculations.

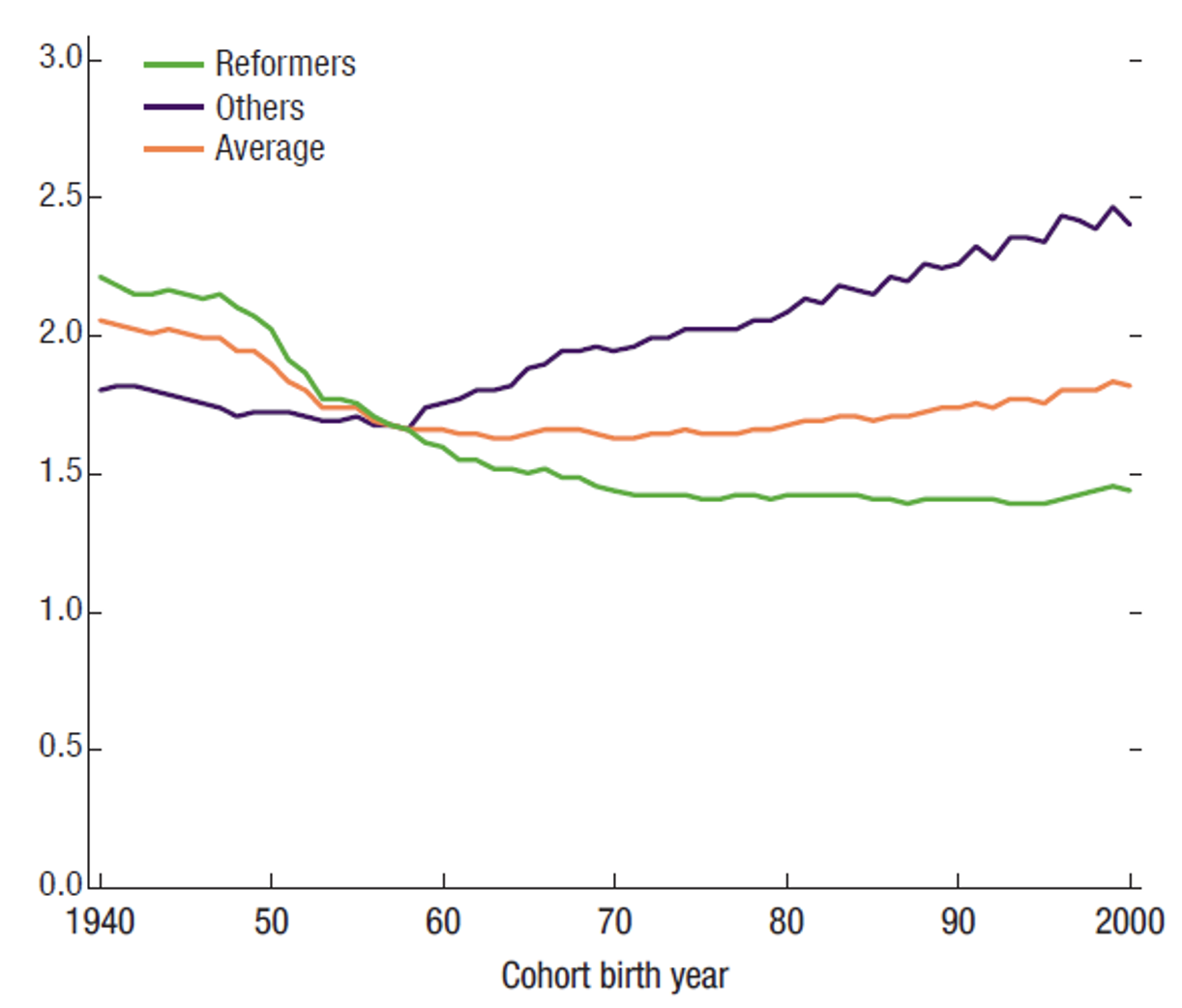

While before the Global Crisis the PM is broadly similar across cohorts on average, subsequent reforms did not treat generations equitably. The pattern of PMs over cohorts for countries that have introduced deeper systemic reforms – declining from high initial levels for older cohorts – illustrates that in most cases younger generations bear the cost of pension reforms (Figure 2). In other countries, current policies and population ageing favour younger cohorts.

Figure 2 Proportionality measure by cohorts for 2021 Ageing Report

Note: Calculations are based on a smaller sample of countries for which lifetime benefits and contributions can be constructed for all cohorts.

Sources: 2021 Ageing Report; Eurostat; IMF staff calculations.

The way forward

These results suggest that pension systems, as they currently stand in Europe, are neither sustainable nor equitable. As such, many systems require substantial state transfers. The average pension system deficit in Europe stands around 2.5% of GDP today and is projected to increase to 4% of GDP in the next three decades. Financing sustained high levels of pension spending in some countries might be difficult without triggering some stress in light of already high public debt levels or eroding potential growth. While population aging has been associated with lower productivity growth (Batog et al. 2019), higher pension spending may also require higher contribution rates, or crowd out other productive spending, which can weigh on employment and GDP (Barr and Diamond 2008, Börsch-Supan 2013).

Going forward, reforms should aim for more progress towards sustainability and do so not only at the expense of younger generations. Appealing to shared principles of fairness and equity across generations, spreading the adjustment more equally across all generations is critical to foster greater political acceptability (Kohli and Arza 2011). Reforms should watch for long phase-in periods which, while giving individuals and households time to adapt, deepen intergenerational divides, posing risks to their future implementation. Strengthening the links between contributions and benefits, for example by setting benefit or contribution adjustments at actuarially neutral levels, would also minimise work distortions as labour markets continue to recover. Where social, basic, minimum or other targeted pensions are in place to provide poverty alleviation, care should be taken in how these interlink with earnings-related pensions or other support to elderly.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Barr, N and P Diamond (2008), Reforming Pensions: Principles and Policy Choices, Oxford: Oxford University Press.

Batog, C, E Crivelli, A Ilyina, Z Jakab, J Lee, A Musayev, I Petrova, A Scott, A Shabunina, A Tudyka, X C Xu and R Zhang, (2019), “Demographic Headwinds in Central and Eastern Europe”, IMF Departmental Paper 19/12, International Monetary Fund, Washington, DC.

Börsch-Supan, A (2013), “Entitlement Reforms in Europe: Policy Mixes in the Current Pension Reform Process”, in A Alesina and F Giavazzi (eds), Fiscal Policy after the Financial Crisis, National Bureau of Economic Research.

Carone, G, P Eckefeldt, L Giamboni, V Laine and S Pamies Sumner, (2016), “Pension Reforms in the EU since the Early 2000’s: Achievements and Challenges Ahead”, European Economy Discussion Paper 42, European Commission.

Chen, T, J-J Hallaert, A Pitt, H Qu, M Queyranne, A Rhee, A Shabunina, J Vandenbussche and I Yackovlev (2018), “Inequality and Poverty across Generations in the European Union”, IMF Staff Discussion Note 18/01.

European Commission (2021), “The 2021 Ageing Report: Economic and Budgetary Projections for the EU Member States (2019-2070)”, European Economy Institutional Paper 148, European Commission.

Fouejieu, A, A Kangur, S Romero Martinez and M Soto (2021), “Pension Reforms in Europe: How Far Have We Come and Gone?” IMF Departmental Paper 21/16.

Knell, M (2005), “On the Design of Sustainable and Fair PAYG Pension Systems When Cohort Sizes Change”, ONB Working Paper 95, Oesterreichische Nationalbank.

Kohli, M and C Arza (2011), “The Political Economy of Pension Reform in Europe”, in R H Binstock and L K George (eds), Handbook of Aging and the Social Sciences, 7th ed., Academic Press.

OECD (2019), Pensions at a Glance 2019: OECD and G20 Indicators, OECD Publishing.

Endnotes

1 Reforms increased retirement ages, lengthened contribution periods, and often incorporated automatic mechanisms (sustainability factors) to put systems in a more sustainable path. Reforms also aimed to improve fairness by fixing several design issues that provided high benefits to workers who contributed little and led many to claim benefits early. At the same time most reforms protected pensions for those with lower incomes at the cost of weakening the link between contributions and benefits.

2 By expressing contributions and benefits in percent of GDP, the sustainability of pension systems is directly linked to the macroeconomic dynamic efficiency condition or the interest rate and GDP growth differential (r-g). This allows us to take a macro-level perspective and assesses the sustainability of pension systems as part of general government budget constraint.

3 The Europe-wide PM benchmark around one derives from the assumption that the discount rate equals GDP growth, or r=g, consistent with the convergence of r-g toward zero in advanced economies over the past two decades. This assumption is also a close approximation of a pure pay as you go pension system, for which the fiscally sustainable discount rate is equal to the growth rate of the tax base (Aaron-Samuelson condition) that in steady state equals the growth rate of GDP. It is also a convenient assumption, allowing to arrive at a simple and practical metric—a ratio of undiscounted flows, expressed in percent of GDP. However, r-g can deviate from one over time and in country-specific circumstances, in which case also country-specific PM benchmarks are different from one (Fouejieu et al. 2021).