Banks that internationalise can access additional profit opportunities and realise diversification benefits as national business cycles are not perfectly synchronised. Garcia-Herrero and Vazquez (2013) document higher risk-adjusted returns for international banks located in eight high-income countries during 1995-2004. Using pre-crisis data for 56 countries, Gulamhussen et al. (2017) similarly find that international diversification created excess shareholder value, especially for banks that expanded towards less developed countries.

In a recent paper, we examine whether bank internationalisation creates shareholder value using an international sample of banks in 113 countries during the 2000-2015 period including the Global Crisis (Bertay et al. 2017). For the overall period, we find that international banks headquartered in high-income countries were discounted in the stock market relative to domestic banks. Following the Global Crisis, however, the relative valuation of international banks from high-income countries rose, as these banks experienced lower increases in loan losses, adjusted their international asset allocations, and were revealed to receive generous ‘too-big-to-fail’ subsidies. International banks headquartered in developing countries, in contrast, were not discounted in the stock market before the crisis, and they did not experience a revaluation following the crisis.

The stock market valuation of international banks

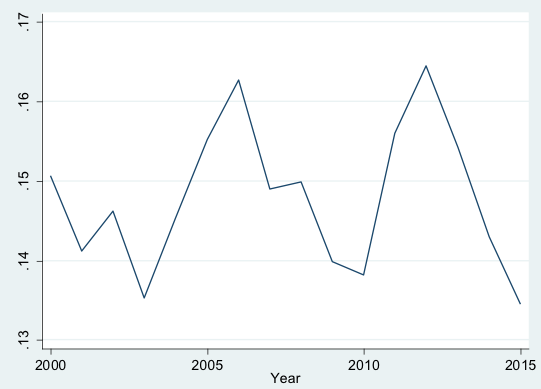

To measure internationalisation, we construct an international bank’s foreign liabilities share as the portion of its overall liabilities that are contracted by its foreign subsidiaries. As seen in Figure 1, the average foreign liabilities share of international banks (which are banks with at least one foreign subsidiary) has varied considerably over the 2000-2015 period, showing a decline during the crisis period of 2007-2010, followed by an increase during 2011-2012, and another subsequent decline.

Figure 1 Foreign liabilities share of international banks

Note: This figure displays yearly means of the foreign liabilities share for international banks.

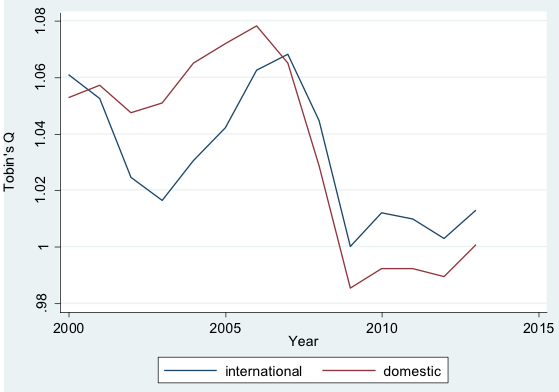

As a measure of bank valuation, we use Tobin’s Q constructed as the market value of the bank’s equity plus the book value of liabilities divided by the book value of assets. Figure 2 shows that international banks were valued less highly than purely domestic banks as reflected in a lower Tobin’s Q before 2007, while on average they were valued more highly subsequently. Figure 2 thus suggests that international banks were revalued relative to domestic banks following the crisis. Consistent with this, we estimate that the average international bank from a high-income country (with a foreign liabilities share of 14.5%) had a Tobin’s Q that was discounted 1.86% before the crisis, but discounted only 1.25% subsequently as evidence of a revaluation of international banks.

Figure 2 Tobin’s Q for international and domestic banks

Note: This figure displays yearly means of Tobin’s Q for international banks and domestic banks by blue and red lines, respectively.

The better performance of international banks following the crisis in part reflects that international banks suffered relatively small increases in their non-performing loan rates. The average international bank is estimated to have experienced an increase in non-performing loan rate that is 0.15% smaller than for domestic banks.1 Furthermore, international banks were in a position to re-optimise their credit allocation internationally, in the process withdrawing from unprofitable foreign markets. Also, they reduced their reliance on net interest income as a share of total operating income. Finally, international banks may have experienced a revaluation on account of the crisis, as they received ample public assistance during the crisis, which increased the valuation of their too-big-to-fail subsidies.

The valuation of international banks from developing countries

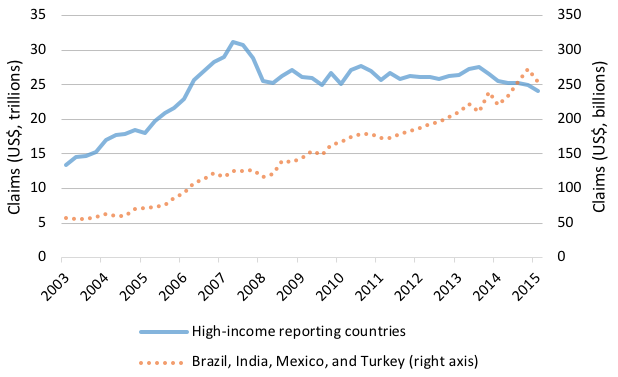

Recent years have seen an increase of international banks headquartered in developing countries relative to those headquartered in high-income countries. This is illustrated by Figure 3, which shows that foreign claims of international banks headquartered in high-income countries decreased since 2007, while claims of international banks in developing countries continued to rise during the last decade. Similarly, Claessens and van Horen (2015, Figure 4) report that the number of foreign banks owned by international banks headquartered in OECD countries went down after 2007, while the opposite is true for international banks headquartered in non-OECD countries.

Figure 3 Foreign claims by banks of BIS-reporting developing and developed countries

Source: World Bank (2018: 34, Figure 1.6.a)

International banks from developing countries tend to invest more in countries in their own region, which implies they are more familiar with the culture and legal setting of the host country, and therefore can more easily lend to informationally opaque small and medium-sized enterprises (SMEs) and households.2 Perhaps on account of these advantages, we find that international banks from developing counties were valued more highly before the crisis relative to domestic banks, unlike international banks that are headquartered in high-income countries.3 At the same time, international banks from developing countries did not experience a revaluation following the crisis.

While international banks generally have the advantage that they can reallocate credit internationally among the countries where they operate, banks from high-income and developing countries appear to adjust their credit provision differently to business cycle shocks. Credit provision in a foreign developing country, in particular, is found to be less procyclical with respect to borrower-country GDP growth if the international bank is also headquartered in a developing country, perhaps because international banks from developing countries have invested more in credit relationships. At the same time, an international bank’s overall global credit provision varies less with its home-country GDP if the international bank is based in a developing country.

This relative inflexibility of credit provision to business cycle shocks in the case of international banks from developing countries may be an advantage to the host counties where the international bank operates. Also, it could be one of the factors behind the different stock market pricing effects for the two categories of international banks found during the crisis and its aftermath.

Authors' note: This column's findings, interpretations, and conclusions are entirely those of the authors and do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

References

Alfaro, L, T Beck, and C W Calomiris (2015), “Foreign bank entry and entrepreneurship”, Working Paper, Columbia University, New York.

Berger, A N, S E Ghoul, O Guedhami, and R A Roman (2016), “Internationalization and bank risk”, Management Science 63: 2283-2301.

Bertay, A C, A Demirgüç-Kunt, and H Huizinga (2017), “Are international banks different? Evidence on bank performance and strategy”, CEPR Discussion Paper No. 12505.

Claessens, S and N van Horen (2015), “The impact of the global financial crisis on banking globalization”, IMF Economic Review 63: 868-918.

Garcia-Herrero, A and F Vazquez (2013), “International diversification gains and home bias in banking”, Journal of Banking and Finance 37: 2560-2571.

Gulamhussen, M, C M Pinheiro and A F Pozzolo (2014), “International diversification and risk of multinational banks: Evidence from the pre-crisis period”, Journal of Financial Stability 13: 30-43.

Gulamhussen, M, C M Pinheiro and A F Pozzolo (2017), “Do multinational banks create or destroy shareholder value? A cross-country analysis”, Financial Markets, Institutions and Instruments 26: 295-313.

World Bank (2018), Global Financial Development Report 2017/2018: Bankers without Borders, Washington, DC.

Endnotes

[1] The average non-performing loan rate of international banks was higher than for domestic banks in each year during 2000-2015. Using US data, Berger et al. (2016) find that international banks tend to be riskier, confirming earlier findings by Gulamhussen et al. (2014) for an international sample of banks in the period preceding the crisis.

[2] Alfaro et al. (2015) show that foreign bank presence is more strongly linked to higher rates of business formation when the foreign banks are headquartered in a developing country.

[3] In particular, international banks from developing countries had a higher market-to-book value of equity.