We live in an era of increasing doubts about the benefits of trade openness among the general public and policymakers, as evidenced by the spread of anti-globalisation political platforms in Western countries. Economic research on the ‘China syndrome’ also has propagated the idea that the costs of globalisation might have been underestimated (Autor et al. 2016). In Europe, Brexit is the most visible element of what looks like a revival of Euro-pessimism.1 In this context, the question of how valuable market integration in Europe is has been particularly debated and questioned.

In a recent paper, we evaluate the welfare consequences of the EU, the most ambitious regional integration process to date (Mayer et al. 2018). Sixty years after the Treaty of Rome came into force, and a quarter of a century after the implementation of the Single Market programme, we think it is a good time for a renewed assessment of the gains members of the EU have reaped from trade integration since 1958 and what the costs would be of going backwards. On the academic front, it is a happy coincidence that the techniques available to estimate those gains and costs have come to maturity, enabling a relatively easy quantification of different scenarios which might characterise the near future of the continent.

Gravity estimates of the EU effects on trade

Assessing the cost of non-EU – i.e. the trade-related gains from the Single Market or, alternatively, the long-run cost of its break-up – implies an evaluation of what proportion of actual trade is caused by the institutional arrangements currently in place. The gravity equation is the natural tool for this assessment. In its modern version, gravity explains bilateral trade values with a large set of fixed effects that account for all factors affecting (1) the total export propensity of a country in a given year; (2) its overall import propensity; and (3) fixed bilateral factors, such as historical linkages or physical distance. The first two sets of this myriad of fixed effects are referred to as ‘multilateral resistance’ terms, and make the estimation consistent with underlying foundations of the gravity. The third set allows us to concentrate on what really matters: the influence of bilateral trade costs factors estimated purely through their change over time. Among these, regional agreements – and in particular the European ones – are of central interest for our purposes. Our estimation strategy compares bilateral trade between two member countries before and after the implementation of the EU to the evolution of trade between any two similar pairs of non-member countries over the same period.

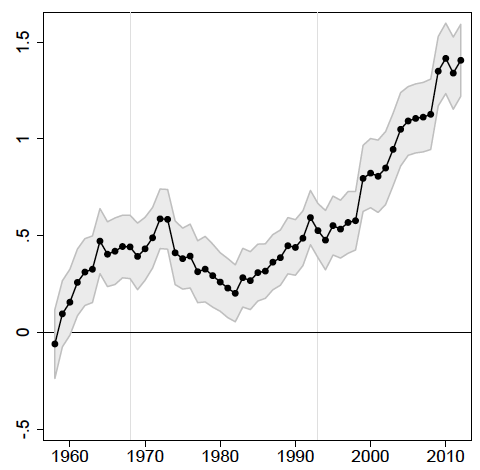

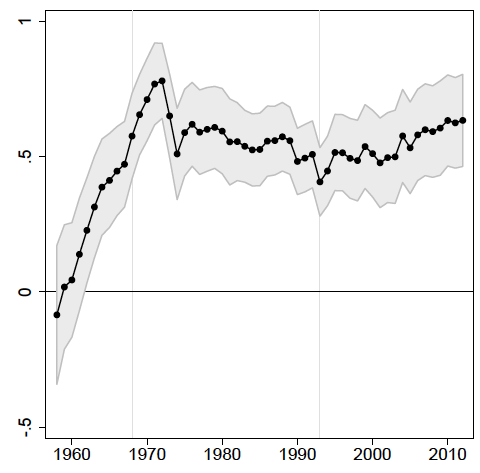

Figure 1 is a visualisation of our main result on this front. It plots the evolution of the EU trade-promoting effect (for goods) over time under the two main estimation methods used in the literature: the traditional linear in logs OLS, and the Poisson-Pseudo-Maximum-Likelihood (as recommended by Santos Silva and Tenreyro 2006). We also highlight two important dates:

- 1968, which marks the end of the phasing-in period of the European Economic Community (after this, tariffs are uniformly zero among members, quantitative restrictions are abolished and the common external tariff vis-à-vis third countries is implemented); and

- 1993, which is the date of entry into force of the Single Market.

The overall trend is quite clear in both cases: the effect of the EU is large and getting larger over time.2

Our results also show that the EU is a vector of deep trade integration, going well beyond tariffs cuts – the trade impact of the Single Market is more than three times larger than the effect of a ‘regular’ regional agreement.

Figure 1 The effect of European integration on trade over time

(a) OLS

(b) PPML

Why is the estimated trade impact of the EU so large? First, because provisions regarding barriers to trade in goods are much deeper in the EU than usual RTA tariff removal. The handling of norms is particularly telling – the mutual recognition principle goes far beyond regular product standard harmonisation in reducing the cost of meeting norms requirements on destination markets. Moreover, the umbrella of the European Court of Justice is likely to reduce trade policy uncertainty.

But other dimensions of the Single Market, not directly related to trade in goods, are likely to favour further trade integration between EU members. The four freedoms guaranteed by the Single Market allow for the free movement of goods, services, capital and labour, which are likely to complement each other in complex ways. For instance, the liberalisation of trade in service is likely to increase trade in goods since selling complementary services increases the profitability of manufacturing exporters. In turn, the free movement of labour facilitates the provision of services abroad through mobility of employees or commercial presence through subsidiaries, potentially boosting exports of goods or services. Our ex-post gravity approach is able to capture this multidimensional nature of the European integration process. Despite weaker data, we also find that the EU increases trade in services beyond what regular RTAs provide, albeit with an effect half as strong as that on trade in goods.

The welfare effects of EU membership

Gravity estimates provide ‘partial trade impacts’ of the EU, neutralising general equilibrium effects that happen through changes in multilateral resistance terms and changes in GDPs. A proper evaluation of the benefits of the EU should account for the reorientation of expenditure by consumers following the price changes implied by the policy experiment. As an illustration, when French exporters get enhanced access to German markets, German consumers will likely consume more French goods but less US goods, so that preferential trade policies generate both trade creation and trade diversion effects. This implies solving for the trade flows and GDPs that the model predicts would occur without the EU.3 Comparing those predictions to actual trade and incomes, one can compute the welfare effects of EU membership. The counterfactual scenarios that we run are comparing the current state to i) a situation without the Single Market (i.e. a return to a standard regional trade agreement); and ii) a total collapse of the EU, with all bilateral European trade flows being governed by WTO rules.

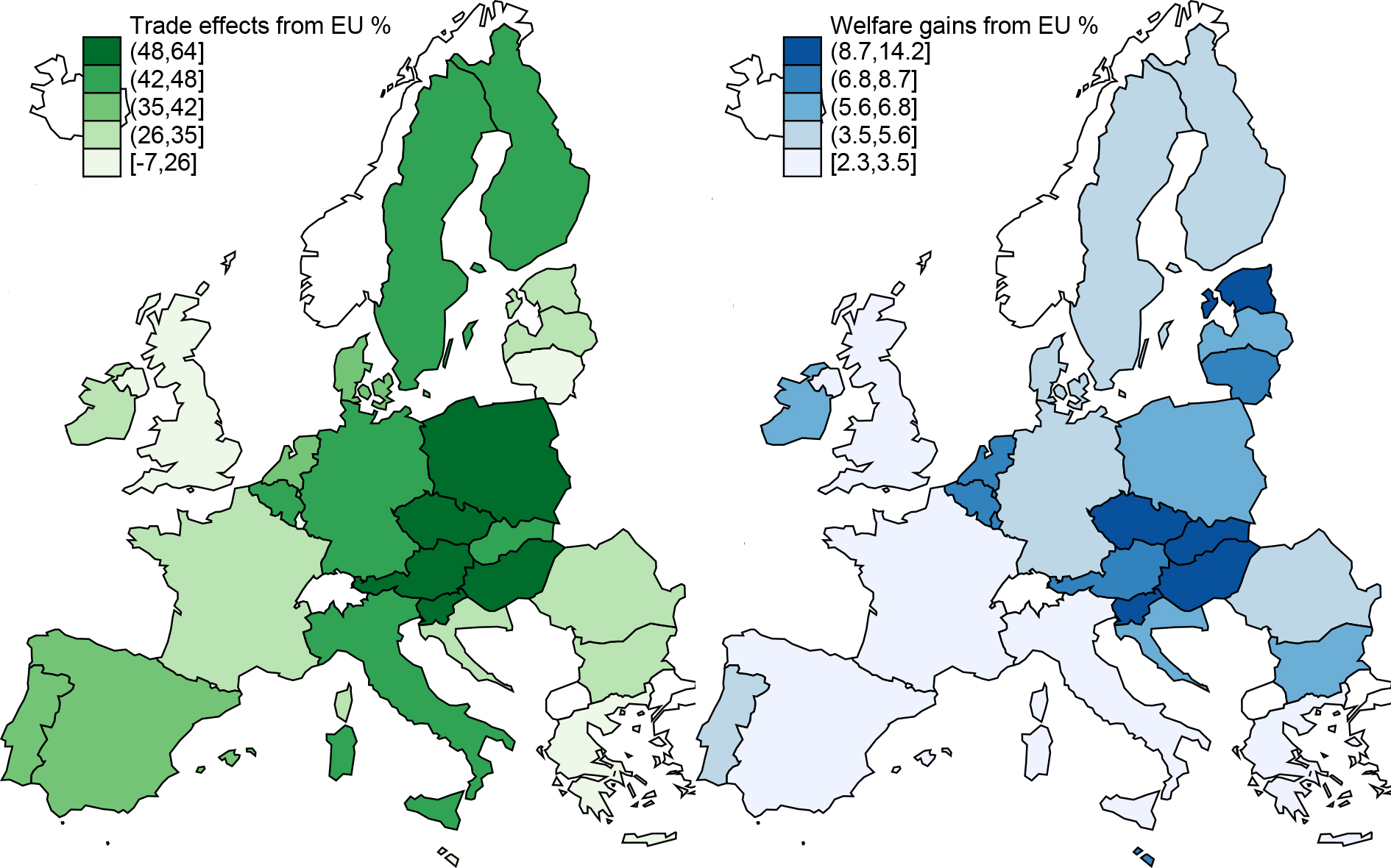

In our preferred simulation, the Single Market is found to have increased trade between EU members by 109% on average for goods and 58% for tradable services. The associated welfare gains from EU trade integration are estimated to reach 4.4% for the average European country (weighted by the size of the economy). Not all countries have benefited to the same extent, however. In order to graphically illustrate the distribution of those gains, Figure 2 shows two maps. The map on the left shows trade increases and the one on the right shows welfare changes for each of the EU28 countries. Welfare gains from EU integration are significantly larger for small open economies than for large EU members. It is also very striking that Eastern European countries have been major benefiters of the integration process. Hungary, for instance, would lose 4.7% of real GDP under the most optimistic scenario, and 17.7% under the worst scenario. The most important losses are in the case where intermediate inputs are taken into account, which suggests that the deep input-output linkages that Eastern Europe has constructed with ‘Old Europe’ would be quite costly to undo.

Figure 2 The effect of European integration on trade in goods and welfare

The domino effect of Brexit

While it is still not completely clear what the precise translation of the Brexit vote will be, it is important to account for this effect when evaluating welfare effects for the remaining members. This is particularly relevant when estimating the potential for a ‘domino effect’, whereby the exit of an influential member could lower the incentives for others to remain members of the club (Baldwin, 1993 Baldwin and Jaimovich 2012). We therefore simulate the case of a return to standard regional agreement with and without the UK having exited the Single Market. It appears clearly that Brexit reduces the gains from EU integration for the remaining members. The average reduction in the welfare gains from EU stands at 0.5%, which represents a small part of the overall estimated gains from trade integration today (estimated between 2% and 8%). While on average the foregone gains are small, they can be substantial for specific countries that have special linkages with the British economy. For Ireland, which is particularly exposed to the exit of its main economic partner, the reduction of the gains from EU integration is close to 40%. Malta and Cyprus also experience a substantial reduction in the gains they derive from the EU after Brexit.

We believe that such an exercise, based on standard tools in the trade literature, provides relevant orders of magnitude of trade-related gains from European integration, and important inputs in the current policy debate. However, the scope of our analysis is limited. We focus on trade integration, and are therefore silent about other dimensions of European integration such as the free mobility of capital and labour, the monetary union, or non-economic gains. In addition, our framework does not feature dynamic gains, which are theoretically and empirically ambiguous.4 Member countries may benefit from a more efficient provision of public goods at the supranational level (e.g. external trade policy, competition policy, monetary policy, etc.) as well as incur costs related to the heterogeneity of preferences between members.

References

Aghion, P, C Harris and J Vickers (1997), “Competition and growth with step-by-step innovation: An example", European Economic Review 41(3-5).

Autor, D, D Dorn, G H Hanson, G Pisano and P Shu (2016), “Foreign Competition and Domestic Innovation: Evidence from U.S. Patents", NBER Working Paper 22879.

Baldwin, R (1993), “A Domino Theory of Regionalism ", CEPR Discussion Paper 857.

Baldwin, R and D Jaimovich (2012), “Are Free Trade Agreements contagious?", Journal of International Economics 88(1).

Bloom, N, M Draca and J Van Reenen (2016), “Trade Induced Technical Change? The Impact of Chinese Imports on Innovation, IT and Productivity ", Review of Economic Studies 83(1).

Costinot, A and A Rodriguez-Clare (2014), “Trade Theory with Numbers: Quantifying the Consequences of Globalization ", in E Helpman (ed.), Handbook of International Economics, vol. 4, Elsevier.

Dekle, R, J Eaton and S Kortum (2007), “Unbalanced Trade ", American Economic Review 97(2).

Dhingra, S, H Huang, G Ottaviano, J P Pessoa, T Sampson and J Van Reenen (2016), “The Costs and Benefits of Leaving the EU: Trade Effects ", CEP discussion paper.

Head, K and T Mayer (2014), “Gravity Equations: Workhorse, Toolkit, and Cookbook", in G Gopinath, E Helpman and K Rogoff (eds), Handbook of international economics, vol. 4, Elsevier.

Mayer, T, V Vicard and S Zignago (2018), "The Cost of Non-Europe, Revisited", CEPR Discussion Paper 12844.

Santos Silva, J and S Tenreyro (2006), “The log of gravity ", The Review of Economics and Statistics 88(4).

Endnotes

[1] Rigorous quantifications of the likely welfare costs of the UK exiting the EU were produced in the hotly debated period before the vote (see Dhingra et al. 2016).

[2 ]In those regressions, we control for the composition effect due to successive enlargements, which tends to create a drop in the enlargement years since new members tend to have relatively low initial trade volumes with incumbents in the first years of their membership.

[3] Using methods developed by Dekle et al. (2007)and extensively covered by Costinot and Rodriguez-Clare (2014); see also Head and Mayer (2014).

[4] From an empirical point of view, Bloom et al. (2016) find a positive impact of trade liberalisation on innovation activities for a panel of European firms in the case of increased Chinese competition in the 2000s (but not from other countries). Autor et al. (2016) find a contrasting negative impact on US firms. See Aghion et al. (1997) for a theoretical argument.