When short-term nominal interest rates were lowered to somewhere close to zero in 2009, it became vitally important to know whether expanding the ECB’s balance sheet could also be effective at increasing inflation and output. To that end, Gambacorta et al. (2014), Boeckx et al. (2018), Burriel and Galesi (2018) and Elbourne et al. (2018) have provided evidence using vector autoregressions (VAR) that link monetary policy changes directly to macroeconomic aggregates. This research seems to suggest that expanding the size of the balance sheet of the Eurosystem has likely been effective in stimulating the euro area economy. However, in recent research (Elbourne and Ji 2019), we revisit these studies and show that the technique employed by all four studies does not provide reliable estimates in this case. As such, their conclusions that ECB balance sheet policy has been effective at stimulating the euro area economy are unwarranted and, consequently, the effectiveness of the ECB’s balance sheet policies is still unproven. We explain how we reached that conclusion.

Identifying assumptions do not pin down monetary policy shocks

As in all empirical economic research, VAR modelling needs some source of exogenous variation to be able to distinguish cause from effect. Consequently, the validity of the existing VAR estimates depends on whether the chosen data and identifying restrictions successfully isolate exogenous monetary policy shocks from all the other shocks that impact the economy. Even perfectly reasonable identifying restrictions can be unsuccessful and may isolate some other type of shock instead of monetary policy shocks. In that case, the resultant impulse responses are responses to those shocks rather than to monetary policy shocks. Logically, estimated responses of the economy to shocks that aren’t monetary policy shocks tell us nothing about how effective monetary policy is.

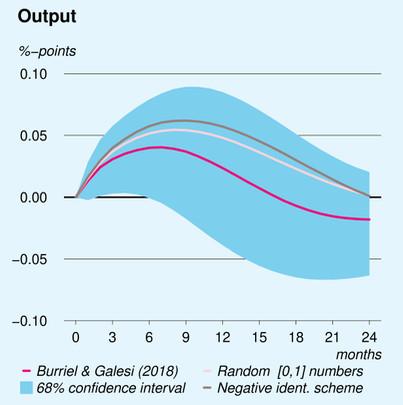

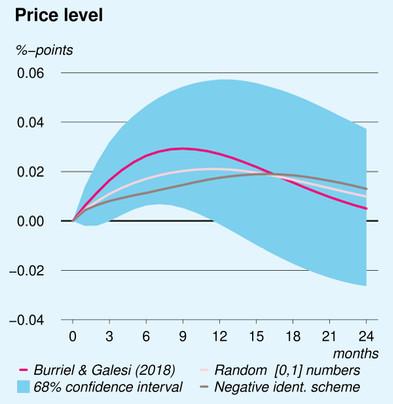

The primary technique we employed to evaluate how successfully previous studies have identified exogenous monetary policy shocks is to replace the key variable summarising the stance of monetary policy, the size of the balance sheet of the Eurosystem, with random numbers. It is, of course, implausible that you can isolate unconventional monetary policy shocks without using any information about the stance of monetary policy. When we replaced the data on the size of the balance sheet of the Eurosystem – the only direct measure of the stance of monetary policy in these models – with random numbers, we got impulse responses and time series of identified shocks that were statistically indistinguishable from those in the published papers. Figure 1 shows this for the Burriel and Galesi (2018) model, while in our paper we show the same for the Gambacorta et al. (2014) model, and a model similar to Boexckx et al. (2017). Since the time series of purported monetary shocks doesn’t change when the information about monetary policy is ignored, it is highly improbable that the original studies have successfully pinned down monetary policy shocks.

Figure 1 Impulse responses to purported balance sheet shocks from Burriel and Galesi (2018) are statistically indistinguishable from those from nonsensical identification schemes

To see why the size of the balance sheet is so crucial for identifying exogenous variation in monetary policy, we need to describe the identification scheme used by Gambacorta et al. (2014), Boeckx et al. (2018) and Burriel and Galesi (2018) in more detail. In these studies, the set of restrictions that are supposed to isolate unconventional monetary policy shocks is that an expansionary unconventional monetary policy shock increases the size of the central bank’s balance sheet, lowers financial system stress and lowers the spread between the Euro overnight index average and the main refinancing operations rate (EONIA-MRO spread), whilst having no contemporaneous effect on output and prices (the VAR models used by Gambacorta et al. 2014 do not contain a spread, but the essence of the identification scheme is the same, since the spread is also a measure of financial system stress). This combination of zero and sign restrictions is meant to distinguish monetary policy shocks from financial system shocks, which would not move the size of the balance sheet in the opposite direction relative to the financial stress indicators. As such, the information contained in the size of the balance sheet is supposedly vital for identifying unconventional monetary policy shocks.

We didn’t stop at random numbers, though. We also found the same results when we switched the sign of the response of the balance sheet in the identification scheme such that an expansionary unconventional monetary policy shock reduces the size of the balance sheet. This is obviously nonsensical but, as Figure 1 shows, still produces similar shocks and statistically indistinguishable impulse response functions. Clearly the reported impulse response functions are independent of the information in the size of the balance sheet, which implies that the identification scheme is not distinguishing monetary policy shocks from other shocks that lower financial system stress.

Identified shocks are unrelated to actual monetary shocks

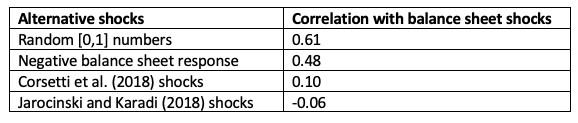

In Elbourne and Ji (2019), we go one step further than showing that this identification scheme returns very similar shocks even if we make nonsensical specification changes. We show that these purported monetary policy shocks have no correlation with other credible measures of monetary policy shocks. The credible alternative measures we used are derived from EONIA swap rates. Because swap rates contain information about what monetary policy is expected to do, any change in swap rates around the time of monetary policy announcements is a measure of how unexpected that announcement was. This feature makes them a credible direct measure of exogenous monetary policy shocks. However, they may also reflect changed beliefs about other economic fundamentals (Nakamura and Steinsson 2018). As Table 1 shows, whilst the identified shocks from the SVAR (structural vector autoregressions) models are highly correlated with each other, they have almost zero correlation with the monetary policy surprises derived from EONIA swap rate data by Corsetti et al. (2018) and Jarociński and Karadi (2018). Given that the similarity between the SVAR shocks makes it highly implausible that they successfully capture the correct shocks, the only reasonable conclusion in light of the very low correlation with the EONIA swap rate surprises is that they are not monetary policy shocks.

Table 1 Correlation between SVAR shocks identified using Eurosystem balance sheet data and other candidate unconventional monetary policy shocks

Note: Each set of zero and sign restrictions returns 5,000 candidate models. Each of these models has a unique time series of purported monetary policy shocks. As is common when using sign restrictions, we summarise the shocks of each model by constructing a time series of the median shock in each time period. The correlations reported in this table are correlations between these median shock time series.

Why are the existing VAR estimates unreliable?

There are some obvious econometric issues with the balance sheet as a measure of the stance of monetary policy. In particular, the balance sheet suffers from the foresight problem. That is, many of those unconventional monetary policy changes were announced some time in advance. For example, when the ECB announced the Public Sector Purchase Programme in January 2015, it announced that €60 billion of assets would be purchased each month until at least September 2016. Therefore, the balance sheet changes in the months following the January announcement were highly predictable in advance to agents in the real economy. Contrary to the assumptions behind the VAR modelling strategy, the forecast errors associated with these balance sheet changes in the VAR forecasts were not unexpected. They are not exogenous monetary policy shocks – they are simply a measure of how misspecified the VAR model is for not taking into account that the balance sheet changes were made in advance. It's not just quantitative easing that suffers from this. The ECB press release of 8 December 2011 announced long-term refinancing operations allotments in both December 2011 and February 2012 so that the February balance sheet movements were therefore predictable in advance. When these movements show up as errors in the VAR models, they are not the needed exogenous source of variation.

No evidence of absence

Our research concludes that the existing VAR estimates do not provide evidence that unconventional monetary policy shocks have meaningful effects on macroeconomic aggregates. Of course, absence of evidence is not evidence of absence. It’s not even the case that there isn’t any evidence – there is a lot of microeconometric evidence that the ECB’s balance sheet policies have had effects on asset prices and even on lending volumes (e.g. Altavilla et al. 2015, Carpinelli and Crosignani, 2017). However, the problem with such evidence on asset price and lending effects is that they do not necessarily translate into meaningful effects on macroeconomic aggregates. It’s possible that asset price or lending changes just represent some substitution between various forms of finance for investment projects – observing increased lending to firms doesn’t translate one-for-one into more investment by those firms.

There is also a growing literature using theoretical models that argue that unconventional monetary policy can be effective (e.g. Andrade et al. 2016). Nonetheless, this evidence also has weaknesses. Specifically, it cannot be evaluated separately from theories used to build the models – if the theory used to build the model says that balance sheet policies are effective, then those models will likely find that it is effective when confronted with the data. What’s required is some evidence that links changes in the balance sheet of the Eurosystem to macroeconomic aggregates that isn’t conditional on some specific economic theory. That’s why the VAR evidence was such an important part of the evidence for the efficacy of the ECB’s balance sheet policies.

It is also worth emphasising that even successful VAR models only provide information about the dynamic effects of random deviations from normal, expected monetary policy. They do not tell us about the effects of systematic monetary policy changes in response to the economy. It is entirely plausible that random, temporary shocks have little economic impact but the promise of the ECB to try to stabilise the economy will have an impact. Nonetheless, the efforts of the ECB to hit its inflation target would be more credible if there was convincing empirical evidence that its balance sheet policies are effective at stimulating output and inflation. Our recent research shows that this macroeconomic evidence is still lacking.

References

Altavilla, C, G Carboni and R Motto (2015), “Asset purchase programmes and financial markets: Evidence from the euro area”, ECB working paper 1864.

Andrade, P, J Breckenfelder, F De Fiore, P Karadi and O Tristani (2016), “The ECB's asset purchase programme: An early assessment”, ECB working paper 1956.

Boeckx, J, M Dossche and G Peersman (2017), “Effectiveness and transmission of the ECB’s balance sheet policies”, International Journal of Central Banking 13(1): 297-333.

Burriel, P and A Galesi (2018), “Uncovering the heterogeneous effects of ECB unconventional monetary policies across euro area countries”, European Economic Review 101: 210-229.

Carpinelli, L and M Crosignani (2017), “The effect of central bank liquidity injections on bank credit supply”, Board of Governors of the Federal Reserve System Finance and Economics discussion series 2017-038.

Corsetti, G, J B Duarte, and S Mann (2018), “One money, many markets: A factor model approach to monetary policy in the Euro area with high-frequency identification”, Center for Macroeconomics discussion paper 2018-05.

Elbourne, A and K Ji (2019), “Do zero and sign restricted SVARs identify unconventional monetary policy shocks in the euro area?”, CPB Netherlands Bureau for Economic Policy Analysis discussion paper 391.

Elbourne, A, K Ji and S Duijndam (2018), “The effects of unconventional monetary policy in the euro area”, CPB Netherlands Bureau for Economic Policy Analysis discussion paper 371.

Gambacorta, L, B Hofmann and G Peersman (2014), “The effectiveness of unconventional monetary policy at the zero lower bound: A cross‐country analysis”, Journal of Money, Credit and Banking 46(4): 615-642.

Jarociński, M and P Karadi (2018), “Deconstructing monetary policy surprises: the role of information shocks”, ECB working paper 2133.

Nakamura, E and J Steinsson (2018), “High-frequency identification of monetary non-neutrality: The information effect”, Quarterly Journal of Economics 133(3): 1283-1330.