How is conventional monetary policy transmitted to the real economy? Textbook economics (e.g. Mishkin 1986) argues that a tightening of monetary policy leads to a fall in aggregate demand, as it increases firms’ cost of borrowing for investment – especially if they are financially constrained. By the same token, aggregate supply and marginal costs of production can be affected by changes in monetary policy, as financially constrained suppliers need to borrow to purchase their inputs (Christiano et al. 1997, Barth and Ramey 2000).

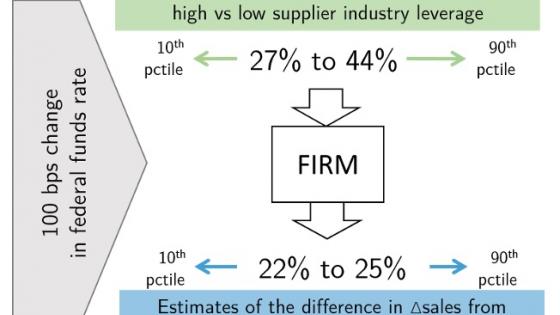

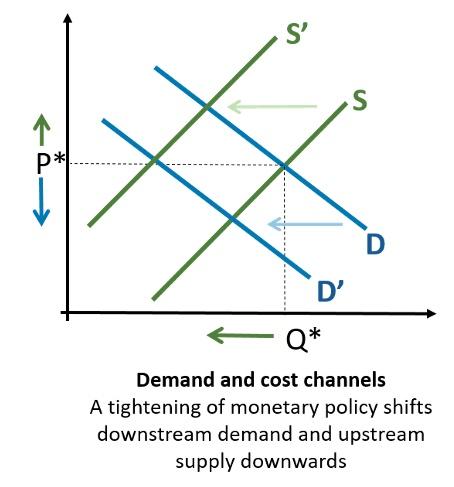

Changes in the monetary reference rate have similar effects on aggregate output through both of these channels of monetary policy transmission (respectively the ‘demand’ and the ‘cost’ channel). For example, a tightening of monetary policy shifts the demand curve to the left through the demand channel, and it shifts the supply curve to the left through the cost channel; either way, aggregate output falls (see Figure 1). However, prices may move upwards or downwards depending on which of the two channels is stronger. For this reason, it is important to policymakers to understand if both channels of transmission operate in the economy and which, if any, dominates. While there has been a substantial amount of research done on the transmission of monetary policy through these two channels, none of these studies have accounted for both of them simultaneously.

Figure 1

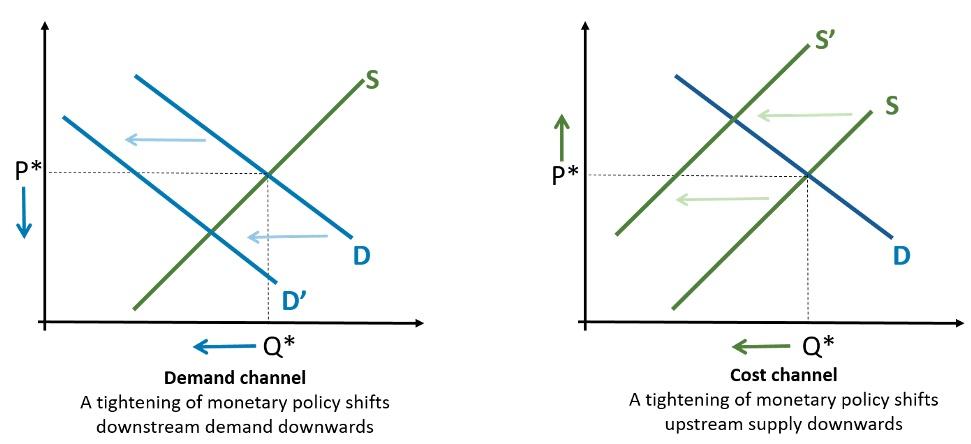

In a recent paper we analyse how monetary policy transmits through the demand and cost channels by focusing on firms producing intermediate goods (Boissay et al. 2021). These firms are simultaneously affected by these two channels, as they purchase inputs from different and specific upstream firms and sell customised goods to downstream firms (Figure 2). We base our analysis on input-output production linkages and actual supply chain relationships in the US, and identify these channels by estimating the effect of changes in the monetary policy reference rate on the economic activity of intermediate firms buying from and selling to financially constrained business partners.

Figure 2

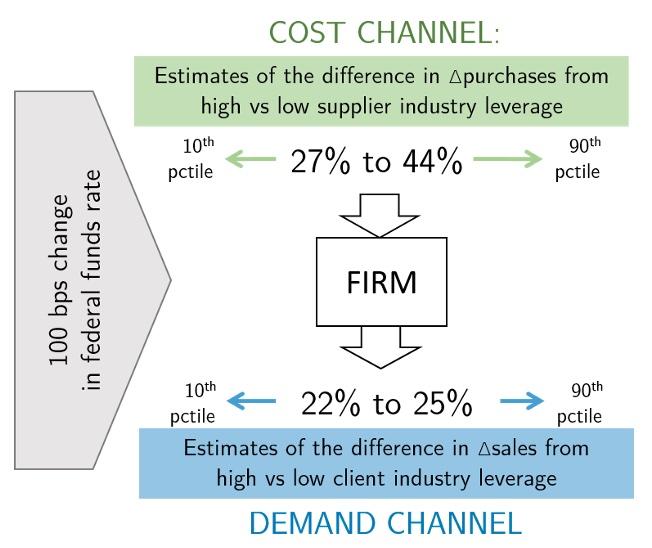

Our evidence shows a tightening of the monetary policy reference rate leads to a significant reduction in the activity of firms that are dealing with financially constrained business partners, and that both the demand and the cost channels matter – with a slightly larger impact of the latter. We quantify the impact of the demand channel of transmission by comparing the effect of a 100 basis-point increase in the monetary policy reference rate on sales to financially healthy versus financially constrained clients. Our most conservative estimates suggest that firms with clients’ coverage ratio in the 10th percentile have a 22% higher sales growth than firms with clients’ coverage ratio in the 90th percentile. For the cost channel of transmission, we focus on firm purchases and the financial health of suppliers. A similar increase in the reference rate leads to differences in the growth of input purchases of firms with suppliers with coverage ratios on the 90th percentile, relative to those in the 10th percentile, of 27% (conservative estimate) to 44% (Figure 3). Our results suggest that firms cannot substitute their financially constrained business partners easily in the face of an adverse monetary policy shock, leading to drops in supply and demand and hence to bottlenecks which induce firms to cut back on their activity (‘ripple effects’).

Figure 3

In extensions to our analysis, we find that these ripple effects are not undone within the supply chain itself, for example through the provision of trade credit; if anything, they are amplified through trade credit. Indeed, firms provide lower amounts of trade credit to financially weak clients following a monetary tightening. This result is akin to the ‘flight-to-quality’ effect observed in the lending decisions of banks to firms, where banks are reluctant to lend to firms with weak balance sheets. In addition, estimations of impulse response functions using local projections suggest that the demand channel of transmission persists for as long as two years, while the cost channel of transmission might lead to more protracted reductions in downstream firms’ economic activities.

Our analysis focuses on quantities because we do not directly observe prices. However, we do observe firm margins and markups, which we use as an admittedly noisy proxy of prices. Consistent with the theoretical predictions, we find that the demand and the cost channels of monetary policy shift firms’ margins in opposite directions. Studying the effects of the cost and the demand channels of transmission of monetary policy on pricing behaviour is an interesting area for future research.

Overall, our results suggest that bottlenecks in the supply chains, which prevent firms from swiftly switching to less constrained business partners in the face of adverse monetary shocks, may magnify the effects of a monetary tightening on aggregate output. These results are particularly relevant as the world emerges from the Covid-19 shock with higher levels of corporate leverage and significant supply disruptions.

In this sense, our results are related to recent studies showing how the transmission of monetary policy can be affected by the structure of the corporate sector (e.g. Greenwald et al. 2021, Döttling and Ratnovski 2021), and how supply chains can facilitate the propagation of shocks in the economy (Inoue and Todo 2020, Barrot and Sauvagnat 2015).

References

Barrot, J N and J Sauvagnat (2015), “Input specificity and the propagation of idiosyncratic shocks in production networks”, 26 February.

Barth III, M J and V A Ramey (2001), “The cost channel of monetary transmission”, NBER Macroeconomics Annual 16: 199-240.

Boissay, F, E Garcia-Appendini and S Ongena (2021), “Ripple effects of monetary policy”, CEPR Discussion Paper 16465.

Christiano, L J, M Eichenbaum C L and Evans (1997), “Sticky price and limited participation models of money: A comparison”, European Economic Review 41(6): 1201-1249.

Döttling, R and L. Ratnovski (2021), “Technological progress reduces the effectiveness of monetary policy”, VoxEU.org, 19 March.

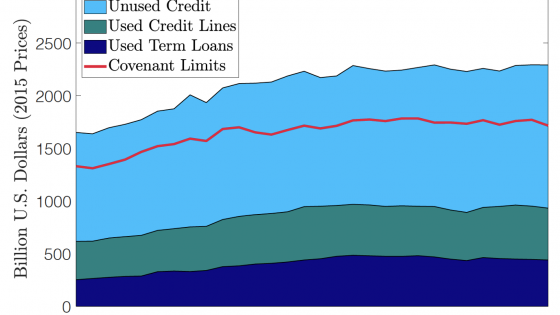

Greenwald, D, J Krainer and P Paul (2021), “The Credit Line Channel”, VoxEU.org, 29 July.

Inoue, H and Y Todo (2020), "Propagation of the economic impact of lockdowns through supply chains", VoxEU.org, 16 April.

Mishkin, F (1996), "The channels of monetary transmission: Lessons for monetary policy", NBER Working Paper 5464, February.