The long-run decline in the income share of labour in GDP is one of the most debated macroeconomic trends in recent years. The trend is widely shared across industries and countries (Dao et al. 2017). At the same time, ‘factorless income’ is on the rise. This is the residual that remains after subtracting measured payments to labour and imputed cost of capital from GDP (Karabarbounis and Neiman 2018). Some interpret this trend as an increase in economic profits (Barkai 2017). Others stress that it reflects the increased importance of intangible capital that is currently unmeasured in national accounts statistics (Corrado et al. 2005, Haskel and Westlake 2017).

The need for a global value chain perspective

So far, the discussion on factor incomes is around shares in GDP of single countries. In a recent paper (Chen et al. 2018) we argue for the need for a multi-country approach. In today’s world, goods are typically produced and distributed in intricate networks with multiple stages of production, referred to as global value chain (GVC) production. So-called factory-free goods producers like Apple provide an iconic example. They sell and organise the production of manufacturing goods without being engaged in the actual fabrication process (Bernard and Fort 2015, Fontagné and Harrison 2017). They provide software and designs, market knowledge, intellectual property, systems integration and cost management, as well as a strong brand name. Yet, we have no way to infer the income that accrues to these ‘intangibles’ in national accounts statistics as their use cannot be uniquely attributed to a geographically location. In contrast, tangible assets (such as machinery) and labour have a physical presence and their use is recorded in the national account statistics of the countries where they are located.1 There is thus a need to complement factor income studies at the country level by study of factor incomes in global value chains that cross borders.

How to measure intangible income in global value chains

To fix ideas, consider a firm in country 1 selling shoes. This requires two activities, fabrication and marketing. Both activities require firm-specific knowledge B (e.g. market intelligence on consumers’ preferences for particular types of shoes). The fabrication stage is offshored to country 2. In this case the (vertically integrated) production function is Y=F(K1, L1, K2, L2, B). To infer payments to intangible assets B in this GVC we sum payments to all labour L and tangible capital K used in country 1 and country 2, and subtract this from the sales value of the shoes.This is a multi-country extension of the method to calculate ‘factorless income’ in national GDP as outlined in Karabarbounis and Neiman (2018).

The main measurement challenge is the fact that GVCs are not directly observable in the data and need to be inferred from information on the linkages between the various stages of production. We will build upon the approach introduced by Los et al. (2015). They showed how one can derive the value-added contributions of country-industries in a given GVC using global input-output tables. Information from World Input-Output Database (2016 release, see Timmer et al. 2016) is combined with information on wages and tangible capital stocks in each country-industry. Crucially, we use an ex ante rate of return to impute the income to tangible capital such that a residual remains.

Increasing share of intangible income in GVCs

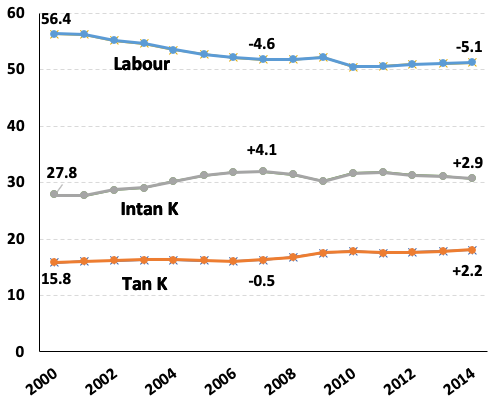

We study factor income distribution in the global production of manufacturing goods.2 We find a large decline in the income share of labour, in particular in the period 2000-07 (see Figure 1). The share of tangible capital remains more or less constant such that the income share of intangibles (measured as a residual) increased rapidly (by 4 percentage points). These trends did not continue after the global financial crisis (2008-2014), but also did not reverse, suggestive of a one-off shift in the factor income distribution in the early 2000s (see Figure 1). In our paper, we discuss robustness of these results to issues like missing information on land and inventories, as well as choice for (ex-ante) rate of return to tangible assets. We argue that the level of intangible income might be overestimated, but the trend over time is likely to be underestimated, if anything. We conclude, along the lines of Corrado et al. (2005), that the current system of national accounts is likely to still miss out on a large range of intangible assets.3

Figure 1 Increasing intangible income share in global value chains

Notes: Income share of labour, tangible and intangible capital in worldwide output of final manufacturing products (in percentages). Based on Table 1 in Chen et al. (2018).

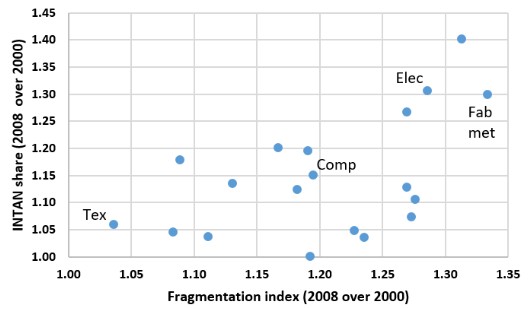

We repeated the analysis for detailed manufacturing product groups and found sizeable variation in intangible income shares. This invited further investigation into possible drivers. In previous work we documented that the process of international fragmentation was fast in the production of electronics (including computers), electrical machinery and metal products in the 2000s. But production of textiles and furniture was already quite fragmented before 2000 (Timmer et al., 2016). We correlate our estimates of changes in intangible income shares with the changes in international fragmentation across 19 manufacturing product groups for the period 2000-08. Figure 2 shows that there is a clear positive correlation (0.52).

Figure 2 Correlation between change in intangible income shares in GVCs and international production fragmentation

Notes: Fragmentation index from Timmer et al. (2016) based on all imports made in the GVC (2008 as ratio of 2000 level). Observations for nineteen manufacturing product groups, highlighting textiles (tex), electrical machinery (elec) electronics and computers (comp) and fabricated metal products (fab met).

Implications

Taken together, our results suggest that the 2000s should be seen as an exceptional period in the global economy: multinational firms benefitted from reduced labour costs through offshoring, while capitalising on existing firm-specific intangibles, such as brand names, at little marginal cost. More generally, we conclude that a global value chain perspective is helpful for better understanding the role of intangibles in today’s economy.

References

Barkai, S (2017), "Declining Labor and Capital Shares", job market paper, University of Chicago.

Bernard, A B and T C Fort (2015), "Factoryless Goods Producing Firms", American Economic Review 105(5): 518-23.

Chen, W, B Los and M P Timmer (2018), “Factor Incomes in Global Value Chains: The Role of Intangibles”, NBER Working paper 25242, forthcoming in C Corrado, J Miranda, J Haskel, and D Sichel (eds), Measuring and Accounting for Innovation in the 21st Century, NBER

Corrado, C, C Hulten and D Sichel (2005), “Measuring capital and technology: An expanded framework”, in C Corrado, J Haltiwanger and D Sichel (eds), Measuring Capital in the New Economy, NBER, pp. 114 – 46.

Corrado, C, J Haskel, C Jona-Lasinio and M Iommi (2013), "Innovation and intangible investment in Europe, Japan, and the United States," Oxford Review of Economic Policy 29(2): 261-286.

Dao, M C, M Das, Z Koczan and W Lian (2017), “Why is labor receiving a smaller share of global income? Theory and empirical evidence”, IMF Working paper WP/17/169.

Fontagné, L and A Harrison (eds) (2017), The Factory-Free Economy. Outsourcing, Servitization, and the Future of Industry, Oxford University Press

Guvenen, F, R J Mataloni, Jr, D G Rassier and K J Ruhl (2017). "Offshore Profit Shifting and Domestic Productivity Measurement," NBER Working Paper 23324.

Haskel, J and S Westlake (2017), Capitalism without capital: the rise of the intangible economy, Princeton University Press.

Karabarbounis, L and B Neiman (2018), “Accounting for Factorless Income”, NBER Macroeconomics Annual 33.

Los, B, M P Timmer and G J de Vries (2015), “How global are global value chains? A new approach to measure international fragmentation”, Journal of Regional Science 55: 66-92.

Timmer, M P, A A Erumban, B Los, R Stehrer and G J de Vries (2014), “Slicing up global value chains”, Journal of Economic Perspectives 28: 99–118.

Timmer, M P, B Los, R Stehrer and G J de Vries (2016). “An Anatomy of the Global Trade Slowdown based on the WIOD 2016 Release”, GGDC research memorandum number 162, University of Groningen.

Endnotes

[1] More generally, increased cross-border sharing of intangibles is undermining the very notion of country-level factor incomes and GDP. Guvenen et al. (2017) find that US multinationals have increasingly shifted income from intellectual property rights to foreign jurisdictions with lower taxes, suggesting an understatement of the labour share decline in US GDP.

[2] This updates and extends the results presented in Timmer et al. (2014).

[3] We remain agnostic about the type of intangibles. Corrado et al. (2005, 2013) showed how stock estimates for certain types of intangibles that are currently not treated as investment in the national accounts (such as market research, advertising, training and organisational capital) could be derived.