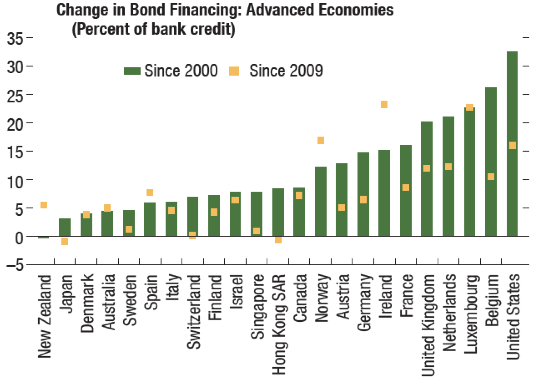

The structure of financial markets has changed considerably over the past decades. Fast-paced financial innovation and weak bank balance sheets following the Global Crisis, changes in business models, and more stringent bank regulation have driven a strong shift from bank lending to bond issuance, enabling a larger role for nonbank financial intermediaries (Figure 1).

Figure 1 The relative importance of nonbank financial intermediaries

Sources: Bank for International Settlements; Dealogic; Financial Stability Board; Organisation for Economic Co-operation and Development; and IMF staff calculations.

Note: The figure shows the change in the ratio of outstanding bonds issued by nonfinancial firms (by parent nationality) to outstanding bank credit to the private nonfinancial sector. The figure may overestimate (underestimate) borrowing in countries that are sources (recipients) of foreign direct investment. Nonbank financial intermediaries (NBFIs) include insurance companies, pension funds, and other financial intermediaries (OFIs).

Some have speculated that the rise in nonbank financing has weakened the transmission mechanism of monetary policy. Traditionally, banks have played a key role in transmitting monetary impulses to the real economy, and other financial intermediaries may potentially react very differently (Nelson et al. 2015).

In theory, nonbanks can either dampen or amplify the effects of monetary policy.1 On the one hand, nonbanks may be able to step in to lend in lieu of banks if their funding cost is less strongly affected by monetary policy, if they are not subject to the same regulatory constraints, or if their risk-taking incentives are different. On the other hand, nonbanks may amplify the transmission of monetary policy if their risk appetite is more sensitive to changes in monetary policy (Figure 2). Although of key policy relevance, so far, the literature on this topic is very scarce. In a recent paper, we examined this issue in detail, using aggregate, flow-of-funds-, and microeconomic data (IMF 2016).

Figure 2 Transmission of monetary policy through the reaction of financial intermediaries

Source: IMF staff.

Note: A darker shade signifies a larger response. Red shades or arrows signify an adverse effect or response. A green arrow means that an adverse response from one sector may trigger a positive response from the other. A dashed red arrow means the effect of monetary policy through this channel is disputed.

If anything, the transmission of monetary policy seems to have strengthened in many countries and appears to be slightly stronger in countries with larger nonbank financial sectors. These are the results of panel regressions for developed and emerging market economies, controlling for the level of financial market development (Figure 3). However, there are important cross-country differences in the composition of financial systems, requiring a more in-depth look.

Figure 3 The transmission of monetary policy and the size of the nonbank financial sector

Sources: IMF, International Financial Statistics database; Organisation for Economic Co-operation and Development; World Bank; and IMF staff estimates.

Note: The figure shows the estimated peak response of GDP to a 1 percentage point increase in the nominal interest rate. The responses are estimated using a vector autoregression of log real GDP, log GDP deflator, the log of the nominal effective exchange rate, and the monetary policy interest rate (shadow policy rate for countries using unconventional monetary policy). The responses are identified using a Cholesky decomposition in which the interest rate is ordered last.

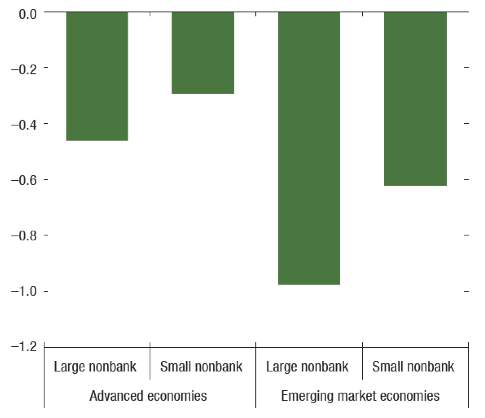

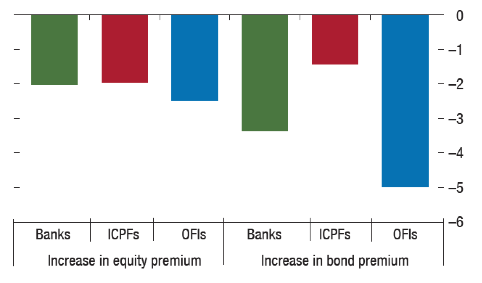

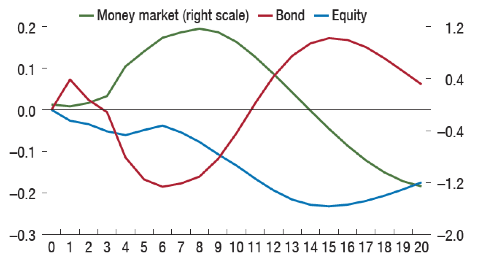

Overall, more detailed evidence suggests that nonbanks tend to respond more strongly to monetary policy than banks. This is particularly true for so-called other financial intermediaries (OFIs), which include investment funds. For the US, a vector autoregression (VAR) analysis shows that a drop in the risk appetite in credit markets – measured by a rise in the bond risk premium2 – is followed by a large decline in total assets owned by OFIs (Figure 4, panel a). In other words, these nonbanks are very responsive to changes in risk appetite, which, in turn, is strongly affected by changes in monetary policy. On the other hand, mutual funds and their investors themselves seem to amplify the effects of monetary policy on risk premia through their risk-taking – after an increase in the monetary policy rate, total assets under management by equity funds consistently decline, whereas those of bond funds first fall and then increase (Figure 4, panel b). In other words, with some delay, investors switch from riskier assets (equity) to safer assets (bonds). Fund managers react in a similar way. Fund-level data on portfolio allocations by equity- and bond mutual funds in the US show that fund managers tilt their allocations toward riskier assets after an expansionary monetary policy change (Figure 5).3 Overall, these findings suggest that, if anything, mutual funds amplify monetary policy shocks.

Figure 4 Risk taking and monetary policy in the US

a. Peak response in financial sector assets

b. Response of mutual fund assets to US monetary policy

Sources: Federal Reserve System; Haver Analytics; Organisation for Economic Co-Operation and Development; and Thomson Reuters Datastream.

Note: Panel a shows the peak response of each variable on the x-axis to orthogonal shocks to the equity and bond premiums. The response in this case is estimated with a VAR which includes real GDP, the GDP deflator, total assets for each financial subsector, the US shadow policy rate from Ichiue and Ueno 2016 to take into account the use of unconventional monetary policy, the Gilchrist and Zakrajšek (2012) excess bond premium, and the equity risk premium from Absolute Strategy Research. Panel b shows the response of total assets net of valuation by type of mutual fund to an orthogonal monetary policy innovation. The response is also estimated with a VAR, which also includes real GDP, the GDP deflator, shadow rate, total assets for the banking, and insurance and pension sectors, and a trend with a break in the postcrisis period.

Figure 5 Risk taking by mutual funds and monetary policy

Sources: Lipper Global Mutual Fund Holdings; and IMF staff estimates.

Note: The figure shows the estimated change in the allocations of bond mutual funds’ portfolios into each asset class, after a 1 percentage point decrease in Wu and Xia’s (2016) shadow policy rate. The shadow policy rate considers the use of unconventional monetary policies. All estimates are significant at least at the 10 percent significance level.

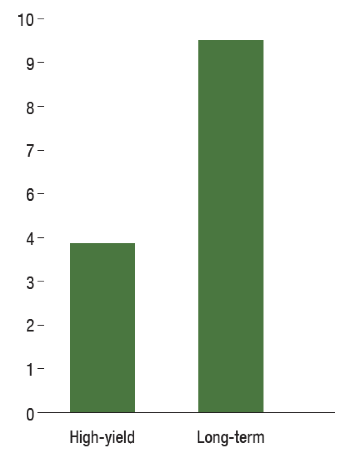

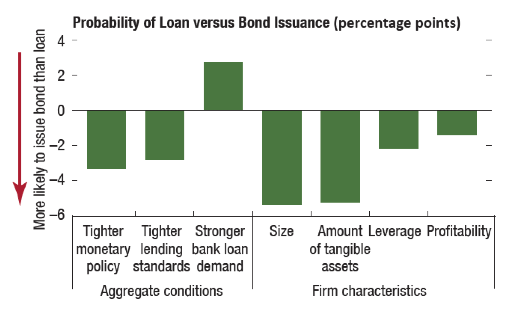

But does the reaction of banks to monetary policy still matter in this new environment? If firms can now easily substitute bonds for bank loans, then any shocks to the supply of bank loans caused by monetary policy changes are much less important for economic activity. However, borrowing companies show a limited ability to substitute between market and bank financing. An analysis using data for nonfinancial firms in Europe, Japan, and the US for 1993-2015 finds that the choice between the issuance of bonds and syndicated loans is only very marginally affected by monetary policy. On average, an increase in the monetary policy rate of roughly two percentage points reduces firms’ probability of bank financing in favour of bond issuance by only 3 percentage points (Figure 6). The evidence of limited substitutability is especially significant given that the sample consists of very large listed companies with access to bond markets.4 This suggests that changes in bank lending induced by monetary policy can still have significant effects on total credit.

Figure 6 Bond financing and monetary policy

Sources: Bank of England; Bank of Japan; Dealogic; European Central Bank; FactSet; Federal Reserve Board; IMF, World Economic Outlook database; Svirydzenka 2016; Thomson Reuters Datastream; and IMF staff calculations.

Note: The figure shows the estimated response of the probability of a firm taking a loan instead of issuing a bond when each explanatory variable increases by one standard deviation (about 2 percentage points for the monetary policy measure). The results in the figure are estimated using data for listed nonfinancial firms in Europe, Japan, and the US during 1993 to 2015. All estimates are significant at least at the 10 percent significance level.

Although monetary policy remains potent in an environment with more nonbank intermediation, it will need to continuously adapt to changes in the transmission mechanism. For example, as the relative importance of the risk-taking channel grows, the effects of monetary policy changes on the real economy may become more rapid and marked.

Moreover, the effects of monetary policy on financial stability are becoming more important because the risk-taking channel seems to be an increasingly important mechanism in driving the responses of financial intermediaries. This suggests the need for greater vigilance by prudential and regulatory authorities. Monetary policy itself needs to take into account the size and composition of balance sheets of key financial intermediaries to better gauge changes in financial institutions’ risk appetite. For instance, the leverage and changes in leverage of broker-dealers and total assets managed by bond funds can be informative for monetary policy. In this context, closing data gaps on nonbanks is essential.

Authors’ note: The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

References

Gilchrist, S and E Zakrajšek (2012), "Credit spreads and business cycle fluctuations", American Economic Review 102(4): 1692-1720.

Hau, H and S Lai (2016), “Asset allocation and monetary policy: Evidence from the Eurozone”, Journal of Financial Economics 120(2): 309-329.

IMF (2016), “Monetary policy and the rise in nonbank finance”, in Global Financial Stability Report (October).

Nelson, B, G Pinter and K Theodoridis (2015), "Do contractionary monetary policy shocks expand shadow banking?", Bank of England, Working Papers 521, London.

Endnotes

[1] The traditional discussion of monetary policy transmission emphasises how changes in interest rates affect investment and consumption decisions. These channels operate through changes in the user cost of capital, intertemporal substitution effects, and wealth effects. Similarly, changes in interest rates can induce exchange-rate changes and therefore influence net exports. Although important, these channels for the transmission of monetary policy do not assign a particular role to financial intermediaries and, to a large extent, do not affect banks and nonbanks differently.

[2] The bond risk premium is captured by Gilchrist and Zakrajsek’s (2012) excess bond premium.

[3] Hau and Lai (2016) report similar findings for European mutual funds.

[4] The lack of substitution between bond and bank financing reflects difficulty in accessing bond markets even for large firms and borrowing conditions in bond markets that closely mirror those for bank loans. That is, the lack of substitution may mean that firms cannot substitute or have no incentive to substitute between loans and bonds. Unfortunately, it is not obvious how to separate the effects. However, because firms do not significantly substitute bonds for loans when banks’ lending standards tighten, it is likely that they cannot easily substitute bank loans.