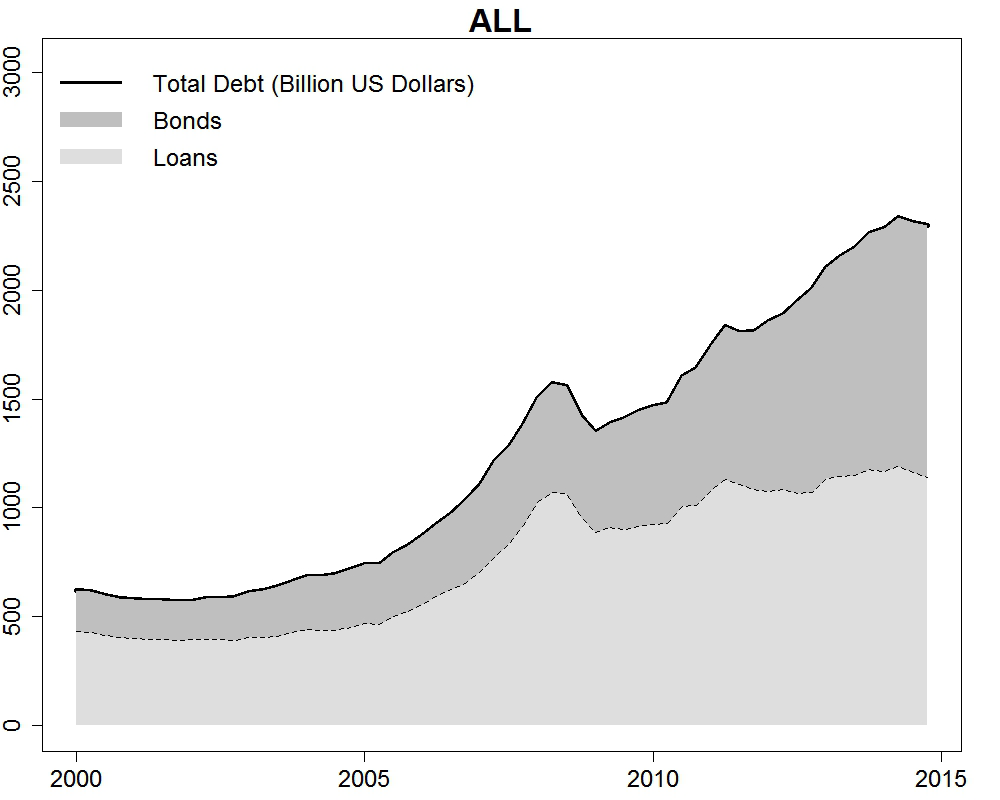

A remarkable trend in emerging market economies (EMEs) since the turn of the 21st century is the considerable increase in the reliance on foreign debt issuance by their corporate sector. Using data from 19 EMEs, Figure 1 documents that the stock of international debt issued by corporations in these economies quadrupled in little over a decade, from an outstanding stock of debt of about $600 billion in the early 2000s to $2.4 trillion by the end of 2014, when it reached its peak. Looking at a larger pool of EMEs, research by the IMF has further documented that such trend has implied a rise of the average corporate debt-to-GDP ratio by 26% during this period (see Chapter 3 in the IMF’s GSFR 2015).

Figure 1. Stock of corporate international debt in 19 emerging economies1

This trend has created an intense debate among policy makers, academics and commentators about its desirability and macro implications. A benign view posits that for EMEs, often portrayed as credit constrained small open economies, access to international capital markets by their corporate sector is essential for sustaining long-run economic growth, as it can provide domestic entrepreneurs with needed funds to finance new investment projects that would otherwise not be available from local sources. Such access is even more welcomed if it is done at record low world interest rates, like the ones we are observing nowadays. Moreover, given that more than half of this access is made via direct bond issuance by non-financial corporates, it could be argued that firms in EMEs are taking direct advantage of a cheaper line of credit (bonds) as opposed to the relatively costlier bank loans that dominated in the past. A theoretical argument along these lines has recently been made by Chang et.al (2016). Empirically, Alfaro et al. (2016) have looked at micro level evidence from the firm’s balance sheets and have concluded that, while leverage ratios and other statistics have deteriorated in some cases, a case of systematic fragility in corporate balance sheets in EMES cannot be made, unlike the case of several Asian corporations in the wake of the Asian crises of the 90s.

A less benign view focuses on certain salient aspects of the recent corporate debt issuance. On one hand, international debt issuance by EMEs’ corporations has been almost entirely in foreign exchange currency. Here Latin America offers a pretty good example. In June 2016, nonfinancial corporations in Latin America and the Caribbean owed $406 billion on bonds issued abroad in USD, including foreign subsidiaries, an almost threefold increase from June 2010, according to data from the Bank of International Settlements. This has exposed the region not only to the risk of higher interest rates but also to that of currency depreciation, as the ones we have observed in recent months. The scant data on currency risk hedging does not show signs of corporations systematically taking advantage of derivative instruments to hedge against such risk (see Caballero et al. 2016). Moreover, a sectoral analysis of the type of debt issuers shows that a non-trivial share of these corporate borrowers belongs to the non-tradable sector, where hedging opportunities are likely less available (Powell 2014).

A second consideration put forth by this less benign view is subtler but equally important, namely that non-financial corporations have been acting like financial intermediaries – borrowing at low interest rates in world markets and lending (at least part of) those funds in domestic markets at a higher rate, a process sometimes referred to as ‘carry trade’. In their firm-level investigation of the determinants of US dollar bond issuance, Bruno and Shin (2015) find that emerging market corporates tend to borrow more in US dollars when they already hold large cash balances, which to them suggest that cash needs for investment or other expenditure may not be the only motivation for bond issuance. Furthermore, Bruno and Shin (2015) also show that international bond issuance by corporations in EMEs is correlated with an ex-ante measure of how profitable carry trade is (also see Caballero et al. 2016, which corroborate this result). This financial risk-taking motive by corporates that issue debt in international markets, as opposed to real risk-taking opportunities, the argument goes, may place emerging economies in a more vulnerable position in the event of changes in external factors.

But how much, in practice, has this increase in corporate debt issuance mattered for macroeconomic performance in emerging economies? And how much macro vulnerability has it entailed? In Caballero et al. (2016b), we sought to find out. Our particular interest was to quantify the extent to which changes in the lending conditions faced by the corporate sector of EMEs in world capital markets have affected economic activity in these economies. For that purpose, we built an external financial indicator for several EMEs, using individual bond-level data on spreads from corporate bonds issued in foreign capital markets and traded in secondary markets. We examined 2,500 corporate bonds that were representative of international securities issued by corporations in seven emerging economies: Brazil, Chile, Korea, Malaysia, Mexico, Peru, and Philippines. We chose these seven countries as they passed a minimum threshold on the number of bonds and their liquidity in secondary markets. We measured the premiums (or spreads) that these bonds paid over the safe interest rate offered for United States Treasury Bonds. And for each country we averaged these premiums to obtain a quarterly indicator that summarised the cost of borrowing by corporates. We then quantified how much information this indicator contains in terms of future fluctuations in economic activity in these economies, and how this activity responds to shocks in the indicator. Our focus is on bond issuance because it is this form of finance that corporates have preferred the most in recent years when increasing their reliance on international sources of funding (see Figure 1).

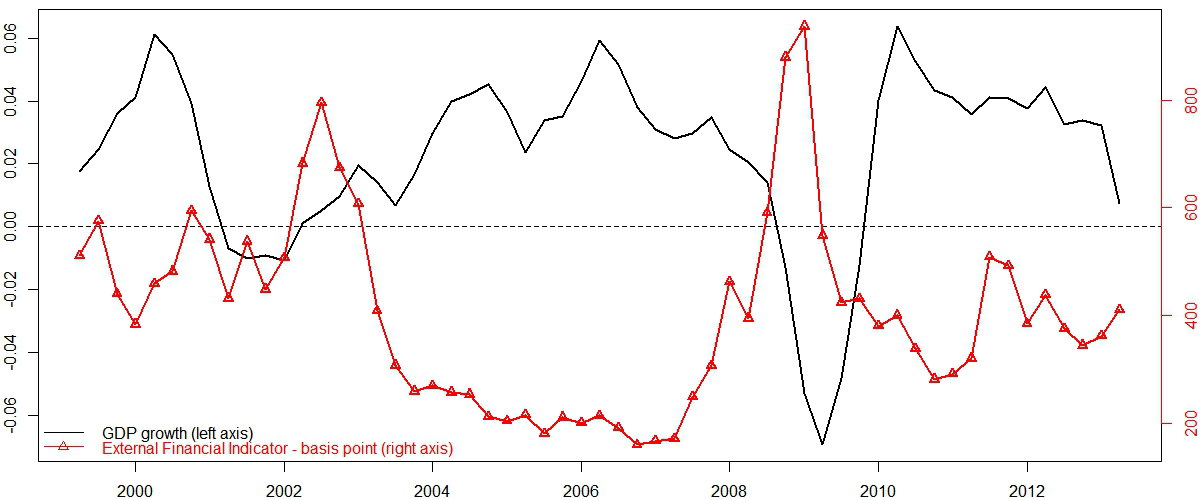

The indicator that we built commoves strongly with macroeconomic activity. Figure 2 illustrates this for the case of Mexico, but the stylised fact documented holds across all the remaining economies studied – periods when the indicator rises (i.e. it is costlier for corporations to issue debt) coincide with a slowdown in economic activity, and vice versa.

Figure 2. External Financial Indicator and Real GDP Growth in Mexico

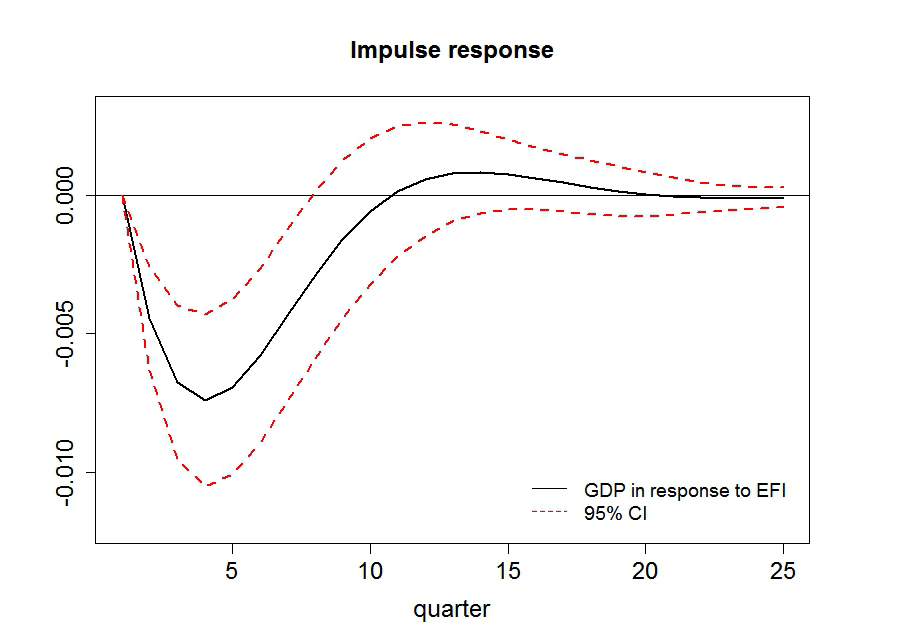

Furthermore, we find strong evidence that the external financial indicator that we construct contains information on future economic activity in EMEs, even after controlling for other domestic and external factors that may also drive aggregate fluctuations in these economies. Results from panel forecasting regressions indicate that, on average, an increase of 100 basis points in the external financial indicator is correlated with a decrease in real output growth of 0.22% in the following quarter, and up to 0.34% three quarters ahead. Furthermore, using a panel structural vector autoregressive (SVAR) model, we find that a positive shock to the external financial indicator, orthogonal to current economic activity, generates a large and protracted fall in economic activity in the following quarters. As shown in Figure 3, a one standard deviation shock in the external financial indicator, equivalent to an increase of 150 basis points, leads to a fall in real output growth of up to 0.75% four quarters ahead, and long-run mean growth is reached again only three years after the shock. Furthermore, 35% of the forecast error variance in real output growth is accounted for by these shocks. This number is between two and three times those obtained in previous studies that quantified the role of risk premiums shocks for emerging economies’ business cycles, but that relied solely on sovereign risk and did not account for the effect of corporate spreads. When looking at other macroeconomic variables, namely aggregate consumption and investment, we find that both react vigorously to shocks to the external financial indicator, but the former appears to be the one that is relatively most affected.

Figure 3. Response of real GDP growth in emerging markets to a shock in the external financial indicator

These findings are robust to several extensions, two of which deserve to be highlighted. First, our benchmark results are virtually unchanged after we control for possible spillovers from sovereign to corporate risk. This is consistent with the fact that, also documented in the paper, in recent times new international lending in EMEs has mainly been channelled to the corporate sector, while governments have substituted foreign sources of finance for domestic ones. Second, we show that, while reduced, the information content that our external financial indicator possesses continues to be significant once we control for the VIX, a measure of uncertainty and risk aversion in global capital markets.

It may be too early to tell if the rise in debt issuance by corporations in emerging markets is a blessing or a curse. However, our results indicate that there is evidence that such a large increase in debt reliance has had a considerable effect in the macroeconomic performance of these economies. Is there a policy lesson to be drawn? Once again, it may be too early to do so as corporate debt on international markets has both advantages and disadvantages - it is both a source of needed financing and the cause of considerable vulnerability for emerging economies. But potential negative impacts on overall health of economies can be reduced in the future if policymakers have access to more and better information. At present, the quality of public information on corporations’ exposure to international debt is patchy at best, in part because current accounting practices do not include reporting on overseas subsidiaries. Moreover, firms may hedge their risk with financial derivatives, and that information is not publicly available either, making the extent of corporation’s real vulnerabilities hard to assess. New regulations mandating better reporting on these two fronts and improved monitoring by financial authorities might go a long way towards resolving these problems. On the more delicate issue of how/when/if to intervene to rescue corporations, there have been voices from central bankers in favour of a more proactive stance. Some high-ranking officials from central banks in emerging economies have called for them to become a ‘market maker of last resort’ position, should corporations see their access to foreign markets vanish. There is, however, a well-known risk associated to such policy advice: moral hazard. To the extent that policy makers send signals in that direction, as in the prelude to any crisis, there might be the temptation to take even more risk by corporates as they know they will be bailed out. Moreover, it may be too early to call for active policy interventions as the sources of the (potential) inefficiencies that the policies would target are little understood. There should be no reason per se for policymakers to be ready to bail out firms that issued debt in international markets unless, on one hand, failure of that particular corporation may have systemic consequences, and on the other, the shutdown of market access is systematically restricted to all firms, those with bad fundamentals as well as those with sound ones.

References:

Alfaro, L, G Asis, A Chari, and U Panizza (2016), “Lessons Unlearned? Corporate Debt in Emerging Markets”, Mimeo.

Bruno, V, and H S Shin (2015), “Global Dollar Credit and Carry Trades: A Firm-Level Analysis”, BIS Working Paper, No. 510.

Caballero, J, U Panizza, and A Powell (2016a), “Foreign currency corporate debt in emerging economies: Where are the risks?” VoxEU.org.

Caballero, J, A Fernández, and J Park (2016b). “On Corporate Borrowing, Credit Spreads and Economic Activity in Emerging Economies: An Empirical Investigation”, IDB Working Paper Series, no. IDB-WP-719.

Chang, R, A Fernandez, and A Gulan (2016), “Bond Finance, Bank Credit, and Aggregate Fluctuations in an Open Economy”, NBER Working Paper no. 22377.

Powell, A (2014), Global Recovery and Monetary Normalization. Escaping a Chronicle Foretold? 2014 Latin American and Caribbean Macroeconomic Report, Inter-American Development Bank, Washington, DC.

Endnotes

[1] The list of 19 economies is: 7 in Latin America: Argentina, Brazil, Chile, Colombia, Ecuador, Mexico and Peru; 5 in East Asia and Pacific: Indonesia, Korea, Malaysia, Philippines, and Thailand; 6 in Eastern Europe and Central Asia: Czech Republic, Hungary, Poland, Russia, and Turkey; 2 from other regions: South Africa and Israel