Over the past few years, we have witnessed the advent of online platforms in sectors as different as taxis (Uber), home sharing (Airbnb), car sharing (Drivy), cleaning (Helpling), handyman services (Taskrabbit), babysitting (2Care4Kids), and food delivery (Deliveroo). These platforms were initially well received, as they reduce transactions costs compared with offline markets while also improving variety and flexibility. Governments, however, have become concerned about informal peer-to-peer (P2P) practices among their citizens, which in many ways are at odds with current regulations (European Commission 2016). Facing this, governments basically have four options: enforce regulations, make new regulations, deregulate, or tolerate. Each option may be favoured, depending on the public interest.

Platforms

Citizens use online platforms to share information, goods, and services. This rapidly growing practice has given rise to a new ‘platform economy’, which has been broadly described as an economy in which social and economic interactions are mediated online, often by apps (Kenney and Zysman 2016). While online platforms go back to the late 1990s (e.g. eBay), it was not until the marked success of Airbnb (founded in 2008) and Uber (founded in 2009) that the platform business model was replicated to so many other sectors.

It is useful to distinguish between platforms that allow people to share possessions (such as cars, boats, parking spaces, tools, books, and clothing) from platforms where people offer personal services (such as translation, tutoring, babysitting, cleaning, etc.). The former types of platforms are generally referred to as ‘sharing economy’, and the latter as ‘gig economy’ (Frenken and Schor 2017).

It should be noted these online platforms are not ‘free markets’, because the platform operators police entry and exit, and determine who is allowed to transact in the first place (McKee 2017). In many cases, platform operators also set the price, in some cases even dynamically using a surge price algorithm (as in the case of Uber). The platform thus acts as a ‘private regulator’, excluding participants who do not qualify and orchestrating peer interaction by design and by legal contracts. In some aspects, a platform’s interest may be congruent with a public interest. For example, both platforms and governments have an interest in detecting fraud and promoting trust. In such cases, platforms and government may co-create and co-enforce regulations. In other instances, however, platforms may have interests that diverge from public interests. In such cases, governments face the challenging task of safeguarding public interests without having platform operators on their side.

Public interests

Platforms generate different effects in different sectors. In a recent study, we found, for example, that home sharing creates various negative externalities (feelings of unsafety, nuisance), while car sharing creates several positive externalities (CO2 reduction, more public space) (Frenken et al. 2017). Furthermore, while the UberPop platform uses unlicensed chauffeurs and thus creates unfair competition with licensed taxi drivers, the home cleaning platform Helpling can be viewed as a step towards formalising an otherwise largely informal sector (given that regular cleaning companies are not active in the home cleaning market). Nevertheless, one can identify a number of public interests that are common to most sharing and gig platforms.

- First, many platforms violate the principle of fair competition between P2P suppliers on platforms and professional companies operating in the same market.

P2P suppliers generally do not comply with all regulations (such as licenses or diplomas). This has been the main concern expressed by representative bodies of incumbents in the taxi, hotel, restaurant, and cleaning sectors.

- Second, tax compliance is under threat.

There is a suspicion that income from sharing and gig work is not disclosed to the tax office. The difficulty of levying tax on income derived from sharing and gig practices is caused by the government’s inability to access online transaction data, which are shielded by the platforms in the interests of suppliers’ privacy.

- Consumer protection is a third public interest common to platforms in many sectors.

Peers do not adhere to the quality control mechanisms and regulations that professionals adhere to. Instead, quality is governed ex post by reviews, which platforms use to (threaten to) ban peers from a platform.

- Fourth, labour protection is an important concern for many governments and unions alike.

The key issue resides in whether P2P providers should be seen as freelancers (determining their working times and clients themselves) or as employees of the platform (monitoring the quality of work and sometimes banning a P2P provider from the platform). Current labour law in many countries remains somewhat ambiguous.

- Fifth, all platforms have effects on the privacy of both the P2P provider and the P2P user.

In general, platforms are very reluctant to share data with governments, to protect the privacy of their participants. Yet, many platforms indicate in their privacy policies that the platform will nevertheless use personal data for advertising purposes and data exchange with a ‘third party’. A more fundamental question is whether platforms should be allowed to appropriate the economic value of data generated by users, or whether users should be granted ownership (Kenney and Zysman 2017).

A policy framework

Governments basically have four policy options regarding online platforms (Codagnone et al. 2016):

- Enforcement of current regulations, which often would imply a ban on the activity of P2P providers.

- Designing new regulations, which often comes down to maximising peer activity by limiting the maximum number of hours and amount of money per activity (for example, many cities restrict home owners to renting out their home to tourists for at most 30 or 60 days a year).

- Deregulation, which renders current peer practices legal (for example, removing license or diploma requirements).

- Tolerate, which can be justified if a practice is small or if public interests are mostly positively affected.

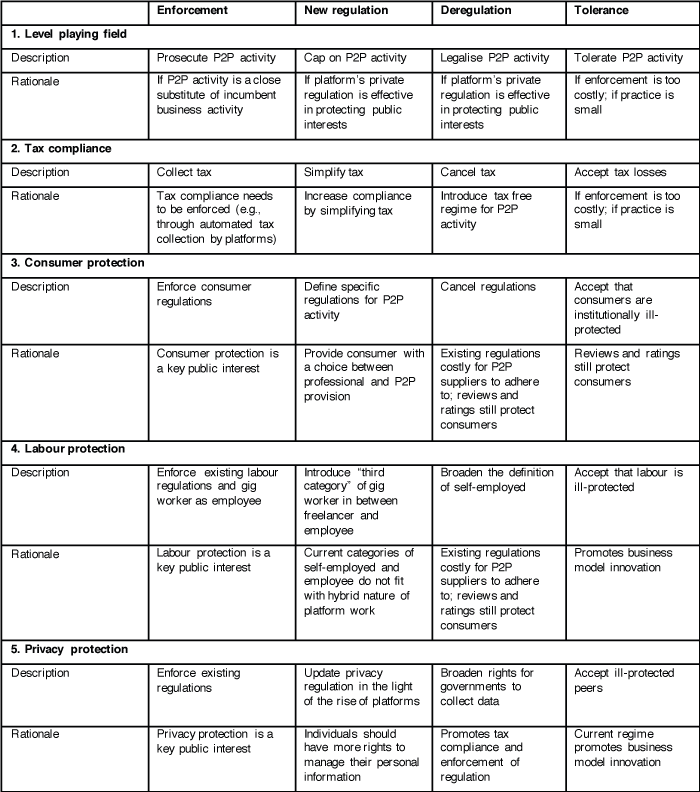

Table 1 summarises the policy option for each of the five public interests listed earlier.

Table 1 Policy options for safeguarding public interests in the sharing and gig economies

Enforcement may be justified in all contexts in which a particular public interest is deemed very important. However, governments should be aware that the enforcement of existing regulations among peers may be very costly, given the sheer size of some P2P markets. In some cases, collaboration with platforms may be needed (e.g. to collect tax, detect fraud, or monitor working hours).

New regulations may be needed in cases where existing regulations are unclear or too hard to enforce. Putting a cap on P2P activity is a way to soften the unfair competition with professional providers and to limit negative externalities (e.g. nuisance among neighbours). As with existing regulations, platforms can be involved in monitoring compliance to the cap algorithmically. However, since limiting peers’ activity is not in the platform’s interest, a trusted third party may be necessary to oversee the platform.

Deregulation has the advantage of creating a level-playing field between peer and professional providers, but public interests will generally be less protected. However, with review systems and the possibility of banning peers from platforms, labourers and consumers are still protected to some extent. Deregulation, then, would reinforce the need for a well-functioning review system, including safeguards for portability and verification.

Finally, governments may also decide to tolerate P2P activity as they have often done in the past. This seems justifiable as long as a practice is small or if enforcement is deemed too costly (compared with the benefits of safeguarding public interests).

This framework is meant as a policy tool to reflect and discuss policy options in particular contexts. Given that the relative weights of public interests differ across sectors, policymakers probably will have to follow a case-by-case strategy. Our scheme provides some generic insights and possible considerations in such complex deliberation processes.

References

Codagnone, C, F Biagi and F Abadie (2016), “The passions and the interests: Unpacking the ‘sharing economy’”, JRC Science for policy report. Institute for Prospective Technological Studies (EUR 27914 EN, doi:10.2791/474555).

Frenken, K and J Schor (2017), “Putting the sharing economy into perspective”, Environmental Innovation and Societal Transitions 23: 3–10.

Frenken, K, A van Waes, M Smink and R van Est (2017), “A fair share: Safeguarding public interests in the sharing and gig economy”, Ratheau Instituut, The Hague.

Kenney, M and J Zysman (2016), “The rise of the platform economy”, Issues in Science and Technology 32(3): 61–69.

Kenney, M and J Zysman (2017), “Intelligent tools and digital platforms: Implications for work and employment”, Intereconomics 52(6): 329–335.

McKee, D (2017), “Neoliberalism and the legality of peer platform markets”, Environmental Innovation and Societal Transitions 23: 105–113.