At the onset of the COVID-19 pandemic last spring, leading economists called for swift policy action to mitigate the economic damage (Baldwin and Weder di Mauro 2020). Major central banks promptly took forceful and unprecedented actions to avoid a financial crisis and sustain the supply of credit. Consequently, while the initial collapse in economic activity was enormous, advanced economies generally exhibited rapid rebounds during the summer and early fall.

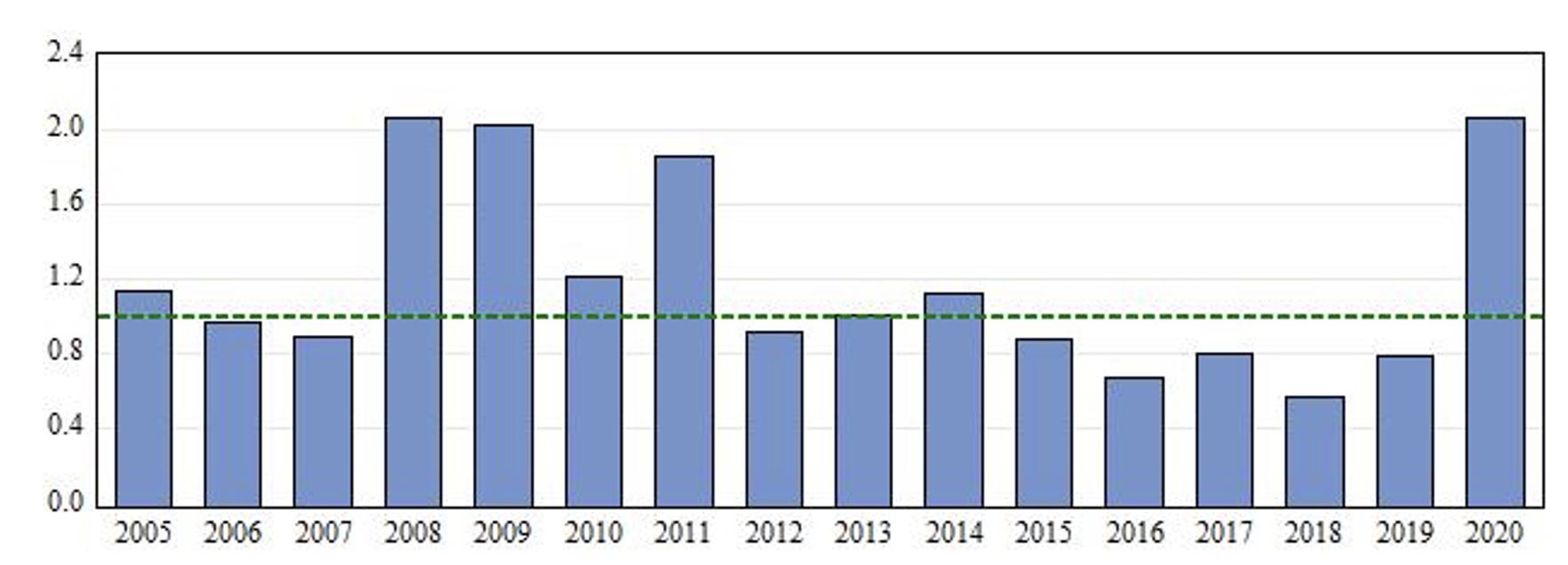

Nonetheless, the degree of economic uncertainty is still extraordinarily high, reflecting a combination of upside and downside risks to the economic outlook. For example, as shown in Figure 1, dispersion among professional forecasters regarding the near-term US economic outlook is now similar to the peak levels that prevailed during the global financial crisis (Levin and Sinha 2020).

Figure 1 Dispersion among professional forecasters about the US economic outlook

Note: This figure shows the interquartile range of 4-quarter-ahead forecasts of U.S. real GDP taken from the Survey of Professional Forecasters conducted by the Federal Reserve Bank of Philadelphia in the final quarter of each calendar year; this measure is normalized using the average level of dispersion during 2005-2007.

These developments have underscored the rationale for central banks to incorporate scenario analysis into their policy deliberations and communications (Bordo et al. 2020). Major central banks generally explain their policy strategy in terms of a single benchmark forecast, with uncertainty conveyed by fan charts based on the distribution of historical forecast errors. But such an approach is not satisfactory for framing the central bank’s policy strategy, especially in a context of heightened uncertainties and risks.

Scenario analysis is particularly advantageous when uncertainty is elevated due to factors that are not well captured by conventional econometric or statistical methods. Such an approach aims at identifying specific risks to the economic outlook and facilitates the development and communication of contingency plans for addressing those risks. This approach is similar to the regular stress test exercises that are used to ensure that large financial institutions are prepared to cope with adverse scenarios, and hence we refer to our recommended approach as ‘stress testing for monetary policy.’

Some central bank officials might worry that publishing risk assessments and contingency plans could undermine public confidence. However, such communications are now standard practice in many other fields, including health care, national defense, and preparedness for natural disasters. Another potential concern is that publishing alternative scenarios could unduly constrain the central bank’s policy flexibility. In practice, however, it will be readily apparent that such scenarios are intended to be illustrative, not binding commitments. Moreover, the contours of each scenario can be updated regularly in light of incoming information, and policymakers can easily highlight or downplay any particular scenario as its relative likelihood changes over time.

To demonstrate the practicalities of this approach, last spring we formulated a set of three illustrative scenarios that were intended to span the range of plausible outcomes for the US economy at that time: (1) a baseline scenario in which US real GDP would return to its pre-pandemic level by the end of 2022, (2) a benign scenario in which the economy would fully recover by the middle of 2021, and (3) a severe adverse scenario involving a stalled recovery over the next several years. For each scenario, we formulated a consistent set of projections for US real GDP, unemployment, and inflation, along with an assessment of the appropriate path of monetary policy. Moreover, we specifically considered those scenarios in light of lessons from key historical episodes, including the influenza pandemic of 1918-20, the Great Depression, WWII, the Great Inflation, and the Global Crisis.

As shown in Figure 2, the US economic recovery over the past six months has proceeded a bit more quickly than in our baseline scenario but not quite as rapidly as in our benign scenario. US real GDP growth has been solid, the unemployment rate has declined rapidly, and core inflation has been edging upwards. Nonetheless, US employment remains far below pre-pandemic levels, while US core inflation is currently running at around 1.5%, similar to its average level over the past decade and significantly below the Federal Reserve’s 2% inflation target.

Figure 2 Alternative scenarios for US real GDP in the wake of the COVID-19 pandemic

Note: The data on US real GDP during 2019 and the first half of 2020 are published by the US Bureau of Economic Analysis. The three alternative scenarios were formulated by Bordo et al. (2020) in late spring following the first wave of the COVID-19 pandemic. The median projection of the US Federal Open Market Committee (FOMC) was published on 16 December 2020.

Moreover, as noted above, uncertainty about the economic outlook remains extremely high. Vaccines are now being introduced, but the pace of availability or public acceptance is not yet clear. Will consumer spending patterns quickly revert to pre-pandemic norms, especially with respect to travel and brick-and-mortar retail sales? Will new small businesses spring up to replace the ones that have permanently closed? At what pace can workers who lost their jobs transition to employment in different sectors or occupations? Will inflation remain persistently low or start surging upwards once the pandemic has ended?

Indeed, the Federal Reserve’s latest communications underscore the degree of uncertainty without providing any further clarity about monetary policy strategy or contingency plans. Nearly all participants on the Federal Reserve’s monetary policy committee agree that uncertainty remains elevated relative to the experience of the past two decades. But the dispersion in their individual economic projections is far narrower than the plausible range of trajectories for US economic activity and inflation over the next several years.

Those deficiencies in communication are particularly acute given that the Federal Reserve‘s monetary policy is now framed in terms of broad overarching goals for maximum employment and average inflation without providing any specific information about its strategy for attaining those goals. Thus, looking forward, scenario analysis would be particularly beneficial in facilitating the effectiveness of the Federal Reserve’s policy framework. More generally, central banks around the globe should incorporate scenario analysis into their policy deliberations and communications.

References

Baldwin, R and B Weder di Mauro (2020), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, CEPR Press.

Bordo, M, A Levin, and M Levy (2020), “Incorporating Scenario Analysis into the Federal Reserve’s Policy Strategy & Communications”, NBER Working Paper 27369, June.

Levin, A and A Sinha (2020), “Limitations on the Effectiveness of Monetary Policy Forward Guidance in the Context of the COVID-19 Pandemic”, NBER Working Paper 27748, August.

US Federal Reserve Board (2020), Summary of Economic Projections, 16 December.