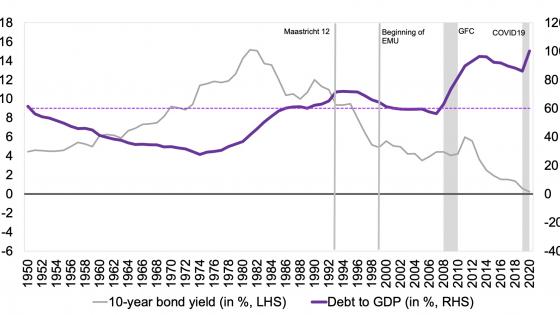

During the past 13 years, the EU has undergone two major ‘existential’ crises: the Great Recession that reached the peak after the bankruptcy of Lehman Brothers in September 2008 and culminated with the sovereign debt crisis of 2011-2012 (Reinhart and Felton 2008a, 2008b, Baldwin and Giavazzi 2015), and the COVID-19 crisis which erupted in spring 2020 (Baldwin and Weder di Mauro 2020a, 2020b). It is now largely acknowledged that the responses of the EU and its member states were radically different between the two crises. During the Great Recession, after an initial monetary and fiscal expansion, the focus quickly turned to government debt sustainability and fiscal prudence to reassure the markets, so that the onus of sustaining the economy fell mainly on the shoulders of the ECB. Instead, during the pandemic a much more forceful monetary and fiscal response was enacted. The ECB adopted the Pandemic Emergency Purchase Programme (PEPP) and strengthened its utilisation of other monetary tools, and national fiscal authorities implemented sizeable fiscal expansions on the back of the suspension of the Stability and Growth Pact (SGP)’s adjustment requirements via the General Escape Clause (GEC) and the temporary state aid framework. Most importantly, the Union agreed on a programme of direct support via the EU multiannual balance, Next Generation EU (NGEU), with at its core the Recovery and Resilience Facility (RRF).

It is important to stress that, in the pandemic crisis, the combination of national and EU budgets coupled with the rapid and determined ECB measures have led to a more expansionary policy stance compared to previous crisis episodes. Moreover, for the first time, the EU rule-based framework has been complemented by direct policy support at the central level. In CEPR Policy Insight 113, we argue that this forceful policy response and, in particular, the move to a more structured ‘vertical’ coordination between national and EU fiscal policies has led to a more balanced policy mix and has, thus, allowed the rapid absorption of the euro area’s dramatic recession and favoured a strong bouncing back of its economy in the current year (Buti and Messori 2021b).

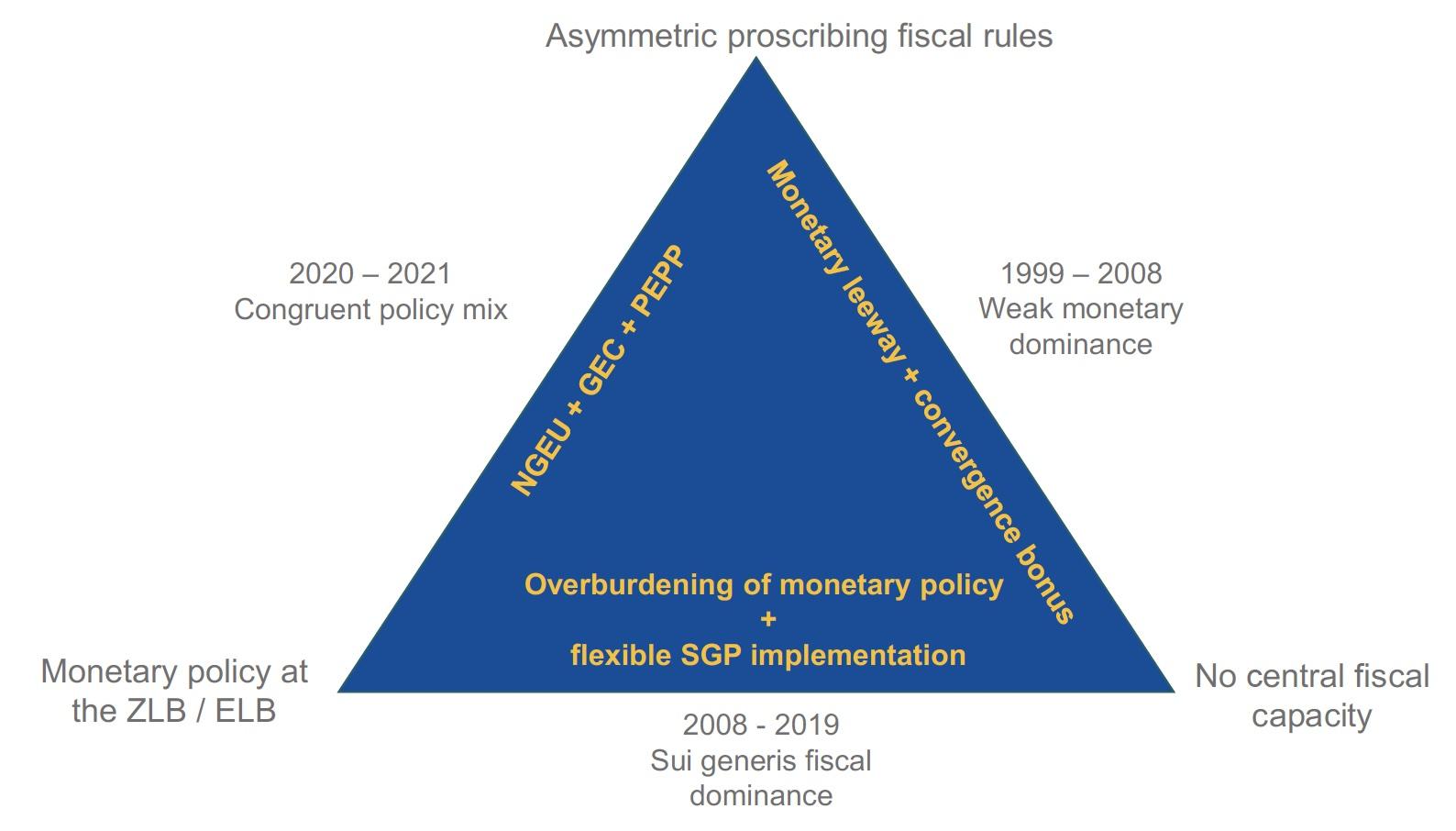

The different policy stance between the two crises can be explained by the different nature of the shocks and the learning from the past failures (Buti 2020, Buti and Papacostantinou 2021). However, these changes in the policy stance also raise fundamental issues. Conceptually, in any currency area, policymakers need to supply an ‘adequate’ amount of cyclical stabilisation, either via the common monetary policy, via fiscal policy at central or decentralised level, or, most likely, via a combination of these different policies. Within the Maastricht framework, policy authorities face what can be dubbed the euro area’s “policy-mix trilemma”: one cannot have, at the same time, (a) asymmetric fiscal rules of the Maastricht type, (b) monetary policy constrained by the effective lower bound (ELB), and (c) no-central fiscal capacity.

The Maastricht Treaty and, a fortiori, the SGP are fundamentally asymmetric in their call to avoid excessive government deficits without any constraint on the corresponding balance surpluses. These rules ‘proscribe’ excessive government deficit even if this entails a pro-cyclical fiscal behaviour, but do not have any ‘prescribing’ power over policies by countries with fiscal space. This asymmetry reflects the ‘Brussels-Frankfurt consensus’ prevailing at the time of the negotiations of Maastricht Treaty and of the SGP. The focus was on the risk of a deficit bias aggravated by the common pool problem (Buti and Sapir 1998, Buti and Gaspar 2021).

The Commission and the EU Council could credibly enforce the Excessive Deficit Procedure in the absence of a central fiscal capacity only if monetary policy had an unconstrained space to respond to shocks. This is not the case in the euro area, because the monetary policy is limited by the ELB on interest rates. Hence, the fiscal stabilisation should be necessarily supplied either by the violation of the Maastricht fiscal requirements or by the setting up of a central fiscal response. A related implication is that the proscribing (as opposed to prescribing) nature of Maastricht fiscal rules makes it exceedingly difficult to achieve the right fiscal stance for the EU solely via ‘horizontal’ coordination of national fiscal policies. The experiences of the last decade before the pandemic shock has shown that either the EU fiscal stance was not adequate, or the achievement of a satisfactory fiscal stance took place, most of the times, via a wrong distribution of national fiscal positions – i.e. too restrictive in countries with fiscal space and too relaxed in countries with high government deficits and debts.

Figure 1 summarises how the policy mix trilemma has been tackled so far. After a period of weak monetary dominance during the euro area’s first decade (1999-2007) and a short episode of coordinated expansion at the outset of the global financial crisis, sui generis fiscal dominance prevailed during and after the sovereign debt crisis (2011-2019). In that period, monetary policy progressively became ‘the only game in town’ (El-Erian 2016). During the pandemic instead, the trilemma was resolved at the two corners characterised, respectively, by the ECB’s attainment of the ELB and by the implementation of a central fiscal capacity. The latter was complemented by the suspension of the SGP adjustment requirements via the triggering of the GEC. The combination between these initiatives, the strengthening of unconventional monetary policies (most notably the PEPP), and the action at EU level which showed strong solidarity among member states (SURE, NGEU), favoured the adoption of expansionary fiscal policies even in euro area countries without fiscal space (Messori 2021).

This exceptional policy response has entailed a more congruent policy mix. However, given the one-off nature of NGEU and the large accumulation of government bonds in the ECB’s balance sheet, even this solution of the trilemma is temporary and does not ensure stable equilibria going forward. Going forward, supplementing national fiscal policies with a permanent central fiscal capacity would allow to attain an adequate fiscal stance and a more balanced policy mix that would overcome the risk of fiscal dominance. In this new policy mix with vertical fiscal coordination, the unconventional monetary policy would not be constrained to support the sustainability of national fiscal policies and, thus, it would not fall again into a distortionary fiscal dominance condition. This would ease the gradual winding down of the government bonds accumulated in ECB’s balance sheet, when required by monetary policy considerations. As a result, the ECB will be able to escape the ELB as well as a distortionary and unsustainable composition of its assets.

Figure 1 How the policy mix trilemma has been solved so far

Source: own elaboration.

The EU’s vertical fiscal coordination in practice

We have argued above that a ‘vertical’ fiscal policy coordination between the national and the EU level will appear the appropriate way forward, if one does not want to continue relying on the monetary arm, with the high risk of pushing the ECB beyond its mandate. This coordination requires building a central fiscal capacity within a coherent ‘European budgetary system’. The EU’s current governance is far from this solution. In response to the dramatic economic fallout of the pandemic, vertical coordination has taken the form of setting up NGEU, with the RRF at its core. Many observers, including the German Finance Minister, Olaf Scholz, hailed the building of NGEU as Europe’s Hamiltonian moment. This led to calls for making the new central fiscal capacity a permanent feature of the EU’s post-pandemic fiscal architecture. However, NGEU and its main programmes were explicitly conceived as a ‘large one-off, whereas an effective central fiscal capacity requires a permanent and stable institutional design.

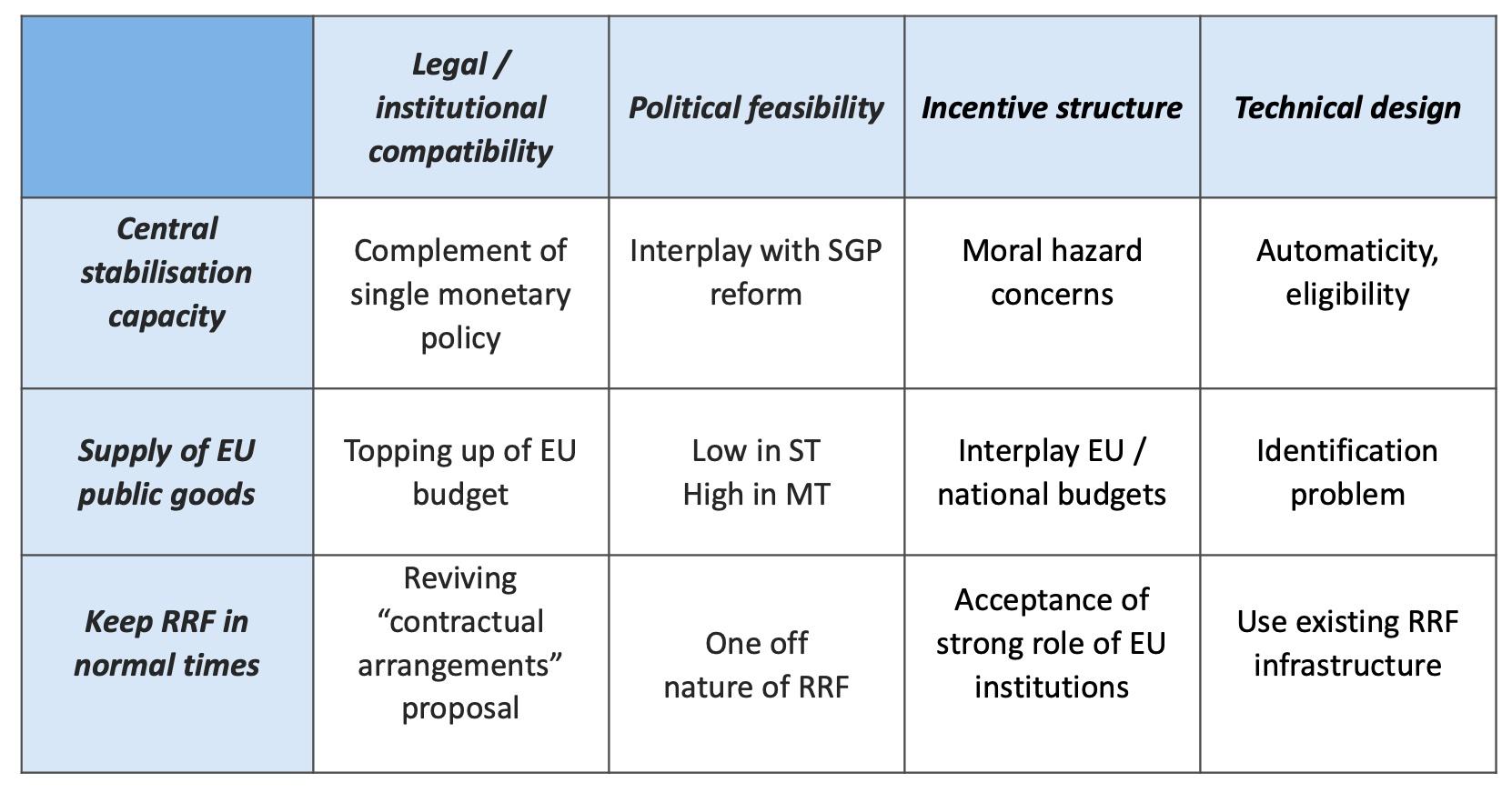

The Commission has called in the past for setting up a central fiscal capacity (European Commission 2017). What form could such capacity take? There are, in principle, three non-mutually exclusive options:

a) creating a central stabilisation function

b) increasing the supply of EU public goods and

c) setting up conditional transfers from the EU budget.

The pros and cons of these three options are assessed in Table 1.

The first option – that is, creating a central stabilisation capacity – would be the most rational one for the completion of the EU economic governance, but probably also the most contentious politically. In 2018, the Commission proposed an embryo of a stabilisation capacity based on loans, the European Investment Stabilisation Function (EISF) (European Commission 2018), which fell on deaf ears. The most cumbersome issue of this option could be the ‘moral hazard’ risks characterising the implicit contract under imperfect information between the European fiscal supervisors and national governments. If the national governments anticipated the support by a central fiscal instrument in case of negative shocks or of negative cyclical phases, they would have a weaker incentive to create national fiscal room for manoeuvre in periods of strong growth. This is what allegedly occurred during the euro area’s ‘good times’.

Table 1 Assessing the three options

Source: own elaboration.

The second option – that is, increasing the supply of EU public goods – would be the response to the criticism towards NGEU for relying excessively on transfers to member states (via the RRF) and, as such, not being sufficiently ‘European’ (Pisani-Ferry 2020). As we pointed out in an earlier paper (Buti and Messori 2021a), the agreement at the European Council in July 2020 increased the share of the RRF and reduced the non-allocated part of NGEU, which provided truly European public goods. This was a signal that, particularly during an emergency and the subsequent recovery, the option under examination is not easy to agree upon. Moreover, it would require a topping up of the EU budget and an increase in own resources of the EU balance. However, even if this option is not likely in the short to medium term, it may turn out to be compelling in the longer term. Whilst not always straightforward from a fiscal federalism standpoint, its incentive structure and technical design appear solvable in the light of the evolving EU priorities in the economic, environmental, and geopolitical spheres.

The final option – that is, setting up conditional transfers to national budgets – would be akin to de facto reviving the proposal of Contractual Arrangements made by Herman van Rompuy in mid-2013, when he was at the helm of the European Council, but rejected by the majority of member states at the end of that same year. This option would have the advantage of building on the institutional infrastructure set up under the RRF. Politically, the recourse to Contractual Arrangements would entail the EU’s ‘core’ countries accepting the principle of conditional grants, and the EU’s high-public-debt countries accepting an intrusive role of European institutions in their national fiscal policies.

Way forward

The interactions between the single monetary policy and the fiscal policies of the member states are central elements of economic policies in the euro area. Politics and institutions – national and supranational – are key for fiscal practices and performance. Thus, a stability-oriented economic policy regime requires not only rules and procedures but also institutions delivering sustainable and resilient fiscal policies, and an adequate policy mix. The monetary-fiscal framework of EU has proved to be resilient in the face of massive emergencies; however, its policy mix has been suboptimal most of the time. ‘Horizontal coordination’ has often failed – it has put a disproportionate burden on monetary policy in bad times, and it has created insufficient fiscal room for manoeuvre in good times. On the other hand, fiscal ‘vertical coordination’ between national and EU levels has occurred only in the extreme circumstances created by the pandemic.

The relaunch of the “Review of the economic governance framework” this Autumn will discuss if and how EU fiscal rules allow reining in burgeoning debt levels, tackling the pro-cyclical bias of fiscal rules, and making the rules consistent with the green and digital transitions. Our previous analysis has pointed to the need of considering the ‘vertical coordination’ between national balances and the EU budget as an essential element to attain an adequate fiscal stance and to contribute to a balanced policy mix.

NGEU has provided an effective central response under duress and allowed to attain a balanced fiscal-monetary policy mix. Our suggested more-lasting innovations require stronger mutual trust between member states. Success in the implementation of the RRPs will be key to creating this trust as a condition to allowing any more lasting option for a central fiscal capacity. As the example of other currency union shows, in the long run there will be no alternative to a central budget supplying EU public goods and supplementing national stabilisation programmes. However, handling the transition will require complex policy choices and difficult trade-offs.

Authors’ note: The authors are writing in their personal capacity and their views should not be attributed to the European Commission or to other institutions.

References

Baldwin, R and F Giavazzi (2015), The Eurozone Crisis: A Consensus View of the Causes and a Few Possible Solutions, a VoxEU.org eBook.

Baldwin, R and B Weder di Mauro (2020a), Economics in the Time of Covid-19, CEPR Press.

Baldwin, R and B Weder di Mauro (2020b), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, CEPR Press.

Buti, M (2020), “Economic Policy in the Rough: A European Journey”, CEPR Policy Insight 98, January.

Buti, M and V Gaspar (2021), “Maastricht Values”, VoxEU.org, 8 July.

Buti, M and M Messori (2021a), “Towards a new international economic governance: the role of Europe”, mimeo.

Buti, M and M Messori (2021b), “Euro Area policy mix: from horizontal to vertical coordination”, CEPR Policy Insight 113, October.

Buti, M and G Papacostantinou (2021), “The Legacy of the Pandemic: How Covid-19 is Reshaping Economic Policy in the EU”, CEPR Policy Insight 109, June.

Buti, M and A Sapir (1998), Economic Policy in EMU: A Study by the European Commission Services, Oxford University Press: Oxford.

El-Erian, M (2016), The Only Game in Town, Random House.

European Commission (2017), “Reflection Paper on Deepening the EMU”, COM/2017/291, 31 May.

European Commission (2018), “Proposal for a Regulation on the Establishment of a European Investment Stabilisation Function”, COM/2018/387, 31 May.

Messori, M (2021), Recovery Pathways. The Difficult Italian Convergence in the Euro Area, Bocconi University Press.

Pisani-Ferry, J (2020) “European Union recovery funds: Strings attached, but not tied up in knots", Policy Contribution, no. 19, October, Bruegel.

Reinhart, C and A Felton (2008a), The First Global Financial Crisis of the 21st Century. Part I: August 2007-May 2008, a VoxEU.org eBook.

Reinhart, C and A Felton (2008b), The First Global Financial Crisis of the 21st Century. Part II: June-December 2008, a VoxEU.org eBook.