Services have become increasingly important in global value chains, accounting for about one fifth of cross-border trade (WTO 2019) and a larger share of trade in value added (Miroudot and Cadestin 2017). Recent research has estimated the impact of service input liberalisation on the domestic performance of firms operating in downstream manufacturing sectors (e.g. Arnold et al. 2010, 2011) and highlighted how cross-border flows of services and goods at the firm level are strongly related and sometimes complementary (e.g. Breinlich and Criscuolo 2010, Ariu et al. 2019, 2020).

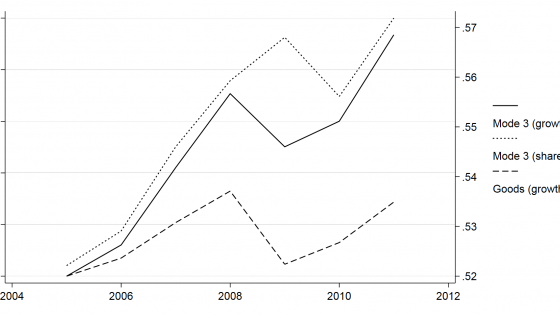

Still, by focusing on cross-border trade in services (Mode 1 of trade in services, according to the WTO classification), most of these studies miss an important share of the contribution of services to global value chains. Since most services are intangible and non-storable, their provision often happens in the location where the buyer is located, either via local commercial presence (Mode 3) or through workers’ movement (Mode 4). For example, Figure 1 shows that trade in professional and business services through Mode 3 for France from 2005 to 2011 accounted for more than half of all trade in services (right axis). Moreover, the value of services exported via commercial presence abroad doubled in the reference period, significantly surpassing the growth in merchandise exports and other modes of cross-border supply of professional and business services (left axis).

Figure 1 French professional and business services supplied via commercial presence abroad (Mode 3 of GATS)

Note: The figure plots, for France, the growth of the export value of professional and business services supplied through Mode 3 of GATS, or commercial presence abroad (left axis), as well as its share of the total service trade (right axis). For comparison, the figure also plots the growth in the value of merchandise (goods) exports (left axis). The professional and business services considered are: transport, telecommunications, computer, information and audiovisual services, charges for the use of intellectual property, and other business services.

Source: WTO TiSMoS.

A new data source that accounts for the commercial presence of firms in the destination market allows for a precise measure of service offshoring at the firm level. The French survey of firm participation in global value chains activities (Enquête sur les Châınes d’Activité Mondiales, or CAM) asks firms about their sourcing decisions in 2011, distinguishing between activities that are sourced locally or in a foreign market, as well as between offshored activities that take place outside or within the boundaries of the business group. Offshoring is defined as the sourcing of goods or services from abroad that were previously produced domestically. This stands in contrast to the vast majority of previous firm-level analyses, which define service offshoring on the basis of imports of services at the firm or industry level. The data reveal that 37% of goods exporters offshore services and 29% do so via commercial presence.

Offshoring of services increases with export experience at destination

Relying on the CAM survey and on French customs data, in a recent paper we explore how service inputs contribute to explain the process of internationalisation of firms (Berlingieri et al. 2021). When firms export goods, they also incur costs related to service activities: contacting retailers, advertising and distributing their products, etc. We argue that firms’ experience in the goods export market increases their propensity to source these inputs from the export destination market, rather than domestically. A simple look at the data supports this hypothesis (Figure 2): the average probability with which a French firm offshores service inputs from the export market is virtually zero for non-exporting firms, but it increases sharply to 7% in the following two years of exporting to the same destination, and keeps growing (albeit at a slower pace) for longer export tenures.

Figure 2 Probability of offshoring services to a destination, by export experience

Note: Experience is the number of years during which a firm has exported to a foreign destination.

Source: French CAM and Customs datasets.

A detailed econometric test of the same relationship reveals that a five-year increase in experience exporting goods to a destination market raises the probability to offshore service inputs there by about 50% of the average probability of offshoring in the sample. The analysis controls for several potential confounding effects. These include firm, activity and destination characteristics, as well as a large set of other determinants of offshoring, including the exported volume and number of products exported. The empirical relationship is robust to changes in the definition of experience, to different cuts of the sample, and to the inclusion of extra controls.

The result can be understood in light of a theoretical framework in the spirit of Albornoz et al. (2012) and Conconi et al. (2016). Sourcing export-related services in the destination market entails lower marginal costs than doing so domestically, where the service still needs to be ‘exported’ to the foreign destination. However, finding a reliable and adequate provider abroad is more costly than doing so domestically. Thus, the benefit from lower marginal costs needs to be weighed against the higher initial setup costs. The upshot is that firms choose to offshore services only if they expect to sell large volumes in the foreign destination. However, firms are initially uncertain about their profitability in new export markets, so they tend to enter small and commit greater resources only once the uncertainty is resolved. Learning their profitability in a foreign market happens with experience exporting there. If the market proves to be highly profitable, a firm that initially sourced services domestically switches to offshoring directly in the destination country. Otherwise, the firm keeps sourcing services domestically or exits. The first and key implication of the model is therefore that longer experience exporting goods to a foreign market translates into a higher probability to source export-related services directly from there.

The model also generates other predictions, for which we also find strong empirical backing. In particular, we find that:

- A firm’s propensity to offshore service inputs to a foreign market is higher and responds more to experience if the market is larger, has better enforcement of the rule of law, and shares a common currency or a regional trade agreement with the firm’s country of origin.

- Greater export experience increases the probability that firms source service inputs from abroad through affiliates or other firms of their business group, rather than at arm’s length.

- Firms offshoring to a destination export greater volumes of goods there in the subsequent years.

- Offshoring firms are more likely to keep exported volumes stable and are less likely to exit the export market than firms that source inputs domestically.

Conclusions

Supported by the access to a new database of global value chain participation of French firms, our analysis expands our understanding of the role service inputs in the process of exporting goods. Experience in the goods export market increases the firm’s propensity to source export-related service inputs from the destination market rather than domestically, and to do so within the boundaries of the business group rather than at arm’s length. In turn, firms offshoring service inputs display higher and less volatile future export volumes and are less likely to exit the export market.

This new set of findings broadens our knowledge of the interdependencies between goods and service production in global value chains. The links between firms’ export experience and their decisions to offshore services there appear unequivocal and strengthen the case for a fresh approach to trade policy, one that can better account for these synergies and could help in a future redesign of the provisions in GATT and GATS (Staiger and Sykes 2021).

References

Albornoz, F, H F Calvo Pardo, G Corcos and E Ornelas (2012), “Sequential exporting”, Journal of International Economics 88(1): 17–31.

Ariu, A, H Breinlich, G Corcos and G Mion (2019), “The interconnections between services and goods trade at the firm-level”, Journal of International Economics 116: 173–188.

Ariu, A, F Mayneris and M Parenti (2020), “How services boost the demand for goods”, VoxEU.org, 6 February.

Arnold, J M, B Javorcik, M Lipscomb and A Mattoo (2010), “Regulatory reform in services sectors: The missing explanation for the revival of Indian manufacturing?”, VoxEU.org, 12 October.

Arnold, J M, B S Javorcik and A Mattoo (2011), “Does services liberalization benefit manufacturing firms? Evidence from the Czech Republic”, VoxEU.org, 1 October.

Berlingieri, G, L Marcolin and E Ornelas (2021), “Service Offshoring and Export Experience”, CEPR Discussion Paper 16215.

Breinlich, H and C Criscuolo (2010), “International trade in services: A portrait of importers and exporters”, VoxEU.org, 2 July.

Conconi, P, A Sapir and M Zanardi (2016), “The internationalization process of firms: From exports to FDI”, Journal of International Economics 99: 16–30.

Miroudot, S and C Cadestin (2017), “Services in Global Value Chains: From inputs to value-creating activities”, OECD Trade Policy Papers 197.

Staiger, R W and A O Sykes (2021), “The Economic Structure of International Trade-in-Services Agreements”, Journal of Political Economy 129(4): 1287–131.

WTO (2019), World Trade Report 2019: The future of services trade.