Sugar consumption is far in excess of recommended levels in much of the developed world, and is strongly linked with a range of diet-related diseases, including diabetes, cancers and heart disease, and is particularly detrimental to children (WHO 2015). Soda is an important contributor to excess sugar consumption (CDC 2016), particularly among the young (Han and Powell 2013). Soda taxes have been proposed as a way to reduce sugar consumption, particularly for individuals whose consumption generates costs that are borne by others (externalities) or for whom the future costs of excess consumption are large and are partially ignored at the point of consumption (internalities). Internality-correcting taxes have been advocated for unhealthy foods (O’Donoghue and Rabin 2006, Haavio and Kotakrpi 2011), with a growing number of jurisdictions adopting taxes on soda. Whether such measures will succeed in improving public health depends on how individuals’ demand responses correlate with the size of any unanticipated costs that their soda consumption imposes on themselves in future and the costs on others.

In a recent paper, we provide evidence on how well targeted soda taxes are (Dubois et al. 2017). In particular, we ask whether they are effective at lowering the sugar consumption of individuals for whom the consequences of high levels of soda consumption are most severe, and for whom internalities are most likely to be important. We estimate consumer choice in the drinks market and simulate the introduction of a soda tax, accounting for pass-through to prices.

Unlike much of the existing literature, we model consumer preferences as individual-level parameters that we estimate. This enables us to directly relate individual-level predictions of the impact of the tax to individual characteristics in a very flexible way, meaning that we can assess precisely which individuals respond to the tax and on whom the economic burden of the tax falls most heavily.

We study individual purchase decisions made for immediate consumption on-the-go using novel longitudinal data on a representative sample of British individuals (including teenagers and young adults). These data cover an important, understudied segment of the market (around half of soda purchases are made on-the-go) and they allow us to estimate individual, rather than household, preferences.

Descriptive evidence suggests soda taxes may be well targeted

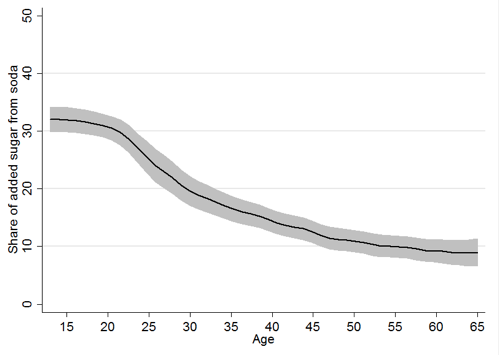

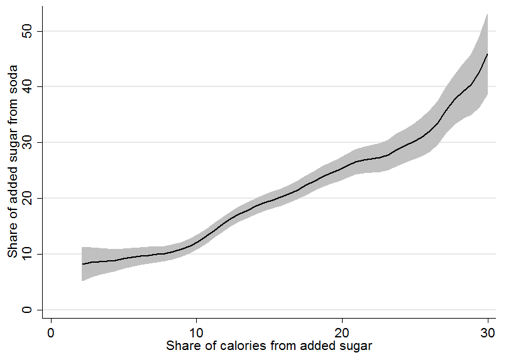

Figure 1 shows that there is a strong gradient in sugar obtained from soda with both age and total dietary sugar – young people and those for whom sugar represents a high share of the total calories that they purchase (high total dietary sugar individuals) tend to get particularly large amounts of sugar from soda. This suggests that soda taxes are potentially well motivated; sugar consumption is well above medical recommendations, soda represents a substantial share of this, and soda intake is especially high for the young and for individuals with high total dietary sugar. However, the effectiveness of a soda tax depends not only on the extent to which individuals consume soda prior to the introduction of the tax, but also on how strongly they switch away from the sugar in soda and what alternatives they switch to.

Figure 1 Sugar from soda

a) by age

b) by total dietary sugar

Notes: Numbers using National Diet and Nutrition Survey 2008-2011 for a representative sample of 3,073 UK adults and children. Shaded areas denote 95% confidence intervals.

Estimates of market demand and supply

Our demand estimates show that preferences vary over consumer attributes in ways that would be difficult to capture by specifying a priori a parametric preference distribution. For instance, individuals below 30 years of age tend to be more price sensitive and have stronger preferences for sugar than older age groups. Among younger consumers preferences over sugar and prices are negatively correlated – those with strong sugar preferences are most price sensitive – but among older consumers the correlation is reversed. These rich patterns of preference heterogeneity are central to determining the impacts of a soda tax.

Using our estimates of consumer demand and a model of price competition between soda manufacturers, we simulate the introduction of a volumetric tax on sugary soda. This tax is similar to those taxes currently in place, or due to come into effect, in the UK, and in Berkeley, San Francisco, Oakland, Albany, California and Boulder, Colorado. The supply-side model allows us to account for the possibility that prices do not move one-for-one with tax. We find, on average, that the tax is over-shifted to consumer prices.

Effects of tax on sugar purchases

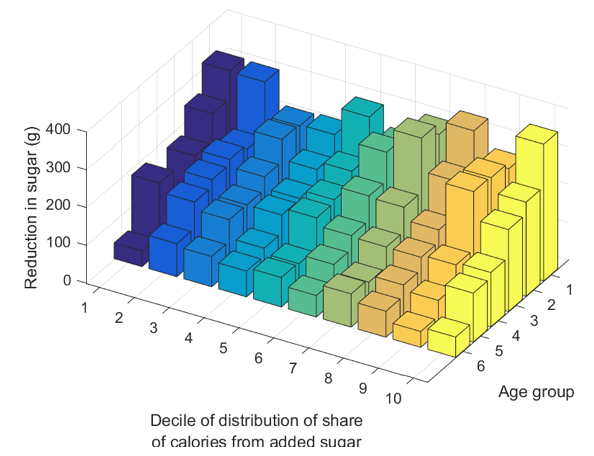

We show that the sugary soda tax is well targeted at young people. In response to the tax, young adults (aged 13-21) reduce the amount of sugar they purchase from on-the-go soda by around 80% more than the average consumer. This is driven both by younger consumers being more likely to consume soda than older individuals and, conditional on being soda drinkers, them responding more strongly than older people to the tax in terms of reducing the amount of sugar they purchase from soda. The tax is less effective at targeting those people with high total dietary sugar; despite getting large amounts of sugar from soda, those individuals with high total dietary sugar do not reduce the amount of sugar that they purchase from soda by any more than those with more moderate amounts of total dietary sugar. This is because individuals with high total dietary sugar have both particularly strong preferences for sugar and are relatively insensitive to price increases. Figure 2 illustrates these patterns; within each decile of the dietary sugar distribution, young consumers reduce their sugar consumption more strongly than older individuals.

Figure 2 Reductions in sugar

Notes: Numbers show how the mean reduction in sugar from soda varies by age and deciles of the distribution of share of calories from added sugar. Age groups are 1=<22, 2=22-30, 3=31-40, 4=41-50, 5=51-60, 6=60+.

Effects of tax on welfare

If consumers fully internalised the future costs of excess sugar consumption, we could measure the full effect on consumer welfare using individuals’ compensating variations (the monetary amount an individual would require to be paid to be indifferent to the imposition of the tax based on their estimated preferences). However, if some people do not fully account for the future costs at the point of consumption, then the tax will have a second effect on welfare through averted future unanticipated costs (internalities). We show that compensating variation is highest among individuals with high total dietary sugar and among young consumers (especially young consumers with high total dietary sugar). While there is experimental evidence that people have behavioural biases with respect to food and drink consumption (e.g. Read and Van Leeuwen 1998, Gilbert et al. 2002), measuring the extent of the internalities is challenging, and not something we attempt to do in this paper. However, we can get an idea of the full effect on consumer welfare by computing how much internality per reduction in sugar that is required to make people indifferent to the introduction of a soda tax. For young consumers, this number is around £0.80 per typical 330ml can of sugary soda; for those in the top decile of the distribution of total dietary sugar, the equivalent number is £1.40.

Is the tax regressive?

A common criticism of excise style taxes is they are regressive (see, for instance, Senator Sander’s op-ed on the Philadelphia soda tax; Sanders 2016); the poor typically spend a higher share of their income on the taxed good, and so bear a disproportional share of the burden of the tax. However, if the tax plays the role of correcting an internality, then the distributional analysis is more complicated. If low-income consumers also save more from averted internalities, this may overturn the regressivity of the traditional economic burden of taxation (Gruber and Koszegi 2004). We show that compensating variation associated with a sugary soda tax is around 40% higher for those in the bottom half of the distribution of total expenditure (based on a wide set of food, drink and non-drink items) compared with those in the top half. However, the reduction in sugar is also larger for these individuals, which leaves open the possibility that they will also benefit more from averted internalities, and so the full effect on consumer welfare is likely to be less negative than the compensating variation suggests.

Conclusions

Corrective taxes have traditionally been applied to alcohol, tobacco, and gambling. Recently, there has been a drive to extend them to cover some types of foods, with soda taxes being at the vanguard of this move. The principal economic rationale for such taxes is that they discourage consumption that generates costs not taken account by individuals at the point of consumption. In the case of sugar, there is clear medical evidence that excess consumption can lead to large future costs, while almost all individuals exceed official recommendations on how much to consume. It is plausible that, at least for some consumers, these health costs are not factored in at the point of consumption. This is most obviously true for children, but is also likely to be the case for some individuals with high total dietary sugar and who therefore are at elevated risk of suffering health problems. The efficacy of a soda tax relies on the extent to which it can encourage these groups to avoid internalities and at what cost to consumers in terms of welfare loss associated with higher prices.

Our results show the tax would succeed in achieving relatively large reductions in sugar among young consumers. However, the young also lose out most in terms of direct consumer surplus loss due to higher prices. The relatively large internalities some young people impose on themselves make it likely that the gain from averted internalities will outweigh this. The performance of the tax in terms of reducing the sugar intake of those with the most sugary diets is less good – those with high total dietary sugar are relatively price inelastic and therefore fail to lower their sugar consumption in response to the tax by more than more moderate sugar consumers. Nevertheless, if internalities are sufficiently convex in total sugar, this group may still benefit from the tax. The redistributive properties of the tax are more attractive than one based purely on traditional economic tax incidence. While the traditional economic burden of the tax falls disproportionately on the poor, the poor also lower their sugar consumption by a relatively large amount and therefore are likely to benefit by more than better off consumers due to averted internalities.

References

CDC (2016), “Cut Back on Sugary Drinks”, September.

Dubois, P, R Griffith and M O’Connell (2017), “How well targeted are soda taxes?”, CEPR Discussion Paper No. 12484.

Gilbert, D T, M J Gill and T D Wilson (2002), “The Future Is Now: Temporal Correction in Affective Forecasting”, Organizational Behavior and Human Decision Processes 88(1): 430-444.

Gruber, J and B Koszegi (2004), “Tax incidence when individuals are time-inconsistent: The case of cigarette excise taxes”, Journal of Public Economics 88(9-10): 1959-1987.

Haavio, M and K Kotakorpi (2011), “The political economy of sin taxes”, European Economic Review 55(4): 575-594.

Han, E and L M Powell (2013), “Consumption patterns of sugar sweetened beverages in the United States”, Journal of the Academy of Nutrition and Dietetics 113(1): 43-53.

O'Donoghue, T and M Rabin (2006), “Optimal sin taxes”, Journal of Public Economics 90(10-11): 1825-1849.

Read, D and B Van Leeuwen (1998), “Predicting hunger: The effects of appetite and delay on choice”, Organizational behavior and human decision processes 76(2): 189-205.

Sanders, B (2016, April), “Op-Ed: A Soda Tax Would Hurt Philly's Poor”.

WHO (2015), “Sugars intake for adults and children”.