The international community acted swiftly to respond to the outbreak of the COVID-19 pandemic, which has led to a widespread loss of lives and a profound economic crisis. In April 2020, G20 Finance Ministers and Central Bank Governors (FMCBGs) endorsed the ‘G20 Action Plan Supporting the Global Economy Through the COVID-19 Pandemic’, setting out the key principles guiding the global response to the crisis and commitments to specific actions for driving forward international economic cooperation. The G20 agenda in 2021 – under the Italian Presidency – will be closely linked to the Action Plan, the implementation of which will be monitored through the policy trackers. This column develops a few principles to support the G20’s work in 2021 (G20 2020a, 2020b).1

The economic policies adopted by G20 members have cushioned the effects of the pandemic so far. In terms of fiscal policy, at the end of September 2020 measures by G20 economies were at 6.6% of GDP on average (up to 9.1% in G20 advanced countries and 4.2% in G20 emerging market economies).2Liquidity measures of the combined G20 economies in addition stood at about 6.9% of GDP (14.5% in G20 advanced countries and 3.6% in G20 emerging market economies), for a total support from fiscal policy (i.e. budgetary and liquidity measures) corresponding to more than US$11.5 trillion out of the more than $12 trillion of total fiscal support estimated by the IMF at global level (IMF 2020a). The fiscal support was combined with equally substantial actions from central banks, which cut their interest rates to pre-emptively ease financial conditions and stepped up or introduced a number of other monetary policy easing measures, increasing their balance sheets. Some central banks even introduced large-scale asset purchase programmes to ensure a proper functioning of a number of financial market segments and a good transmission of monetary policy stance to the real economy (Cavallino and De Fiore 2020).

The EU responded immediately to the economic impact of the pandemic, introducing a safety net of €540 billion for member states via the European Stability Mechanism (ESM), for companies through the European Investment Bank (EIB), and for workers via the European Commission’s new Support to mitigate Unemployment Risks in an Emergency (SURE). To ensure the recovery is sustainable, even, inclusive and fair for all Member States, the European Commission also proposed to create a new recovery instrument – Next Generation EU, worth €750 billion (almost 5% of EU GDP) – embedded within a powerful, modern and revamped long-term EU budget (European Commission 2020a). The centrepiece and biggest programme of Next Generation EU is the Recovery and Resilience Facility (RRF), composed of both grants (€312.5 billion) and loans (€360 billion), which will run from 2021 to 2024 and will be funded through the Commission’s own borrowing on capital markets. This mechanism will provide financial support for investment and reforms, helping to promote a sustainable recovery focused on a green and digital transitions, as well as the economic and social resilience of the EU economy.3

The EU response to the pandemic aims to turn the pandemic challenge into an opportunity, by both providing a policy direction and creating tools for letting the EU economy getting back on its feet while building for the future. The same spirit should drive the international response. Indeed, even if the immediate and decisive policy reaction to the outbreak of the pandemic compares favourably to the 2008 Great Financial Crisis, the road towards a full recovery might still be a bumpy one. At the international level, to secure the path towards recovery, it is necessary to have a clear and shared recovery strategy, balancing short-term and long-term objectives, based on measures that could provide a stable framework for supporting a durable recovery. Policy actions should not focus only on the short term, but rather be used as occasion for shaping the medium- to long-term future of the economy.

Looking ahead to the G20 Finance Ministers and Central Bank Governors discussions on their Action Plan follow-up and possible updates in 2021 under the Italian Presidency, the following key principles should guide the G20 action towards a strong, sustainable, balanced and inclusive global economic recovery:

1. Avoiding premature withdrawal of fiscal stimulus and reducing uncertainty

The lessons of the 2010 Toronto G20 Summit, which agreed on fiscal consolidation too early, should be internalised (Buti 2020a, 2020b). The necessary sizable measures taken in 2020 to cushion the effect of the pandemic weigh on the G20 fiscal position, which is set to improve by 3.8 percentage points on average in 2021 (Figure 1) (IMF 2020b).4 Fiscal policies should indeed continue to provide targeted and temporary support in 2021 for addressing effectively the pandemic and sustain the economy. G20 members should avoid withdrawing fiscal support abruptly, by shifting gradually from a protective emergency response to measures facilitating resources reallocation and supporting the recovery. Anchoring fiscal policy expectations would also help reduce the level of uncertainty, enhancing the effectiveness of policy actions. Particularly in the case of highly indebted countries, when economic conditions allow, credible fiscal strategies should aim at achieving prudent medium-term fiscal positions, while enhancing investment. As for central banks, the overarching challenge will be to re-establish the basis for sustainable growth in a context of financial market stability (BIS 2020). Lingering uncertainty could hold back consumption and investments for a longer than expected period, skewing inflation expectations to the downside. In turn, monetary policy would also need to remain accommodative and banks’ support to the recovery would remain anchored to their ability to use their capital buffers, without exhausting them.

2. Lifting and sustaining higher economic growth, while ensuring the sustainability of the increased amount of public debt

Structural reforms should help address new and pre-existing challenges, including low productivity growth and low growth potential. Particular attention should be paid to structural reforms enabling the green and digital transformation of the economy. At the same time, the composition of public finances should be made more growth friendly. Spending from less productive items could be redirected towards investments in health, education, and infrastructure, while shifting the tax burden away from distortionary taxes. This would contribute to ensure the inclusivity and sustainability of the recovery, supporting the most vulnerable hit by the crisis and establishing fair tax regimes.

Figure 1 General government deficit and gross debt expected in 2020 and 2021 (% of GDP)

Source: European Commission Autumn 2020 Economic Forecast, IMF World Economic Outlook database, and authors’ calculations.

Notes: The general government deficit-to-GDP ratio is measured on the left axis, while the general government gross debt-to-GDP is measured on the right axis (RHS). *The EU aggregate is formed by the aggregation of the country data in euro, with consolidation where appropriate.

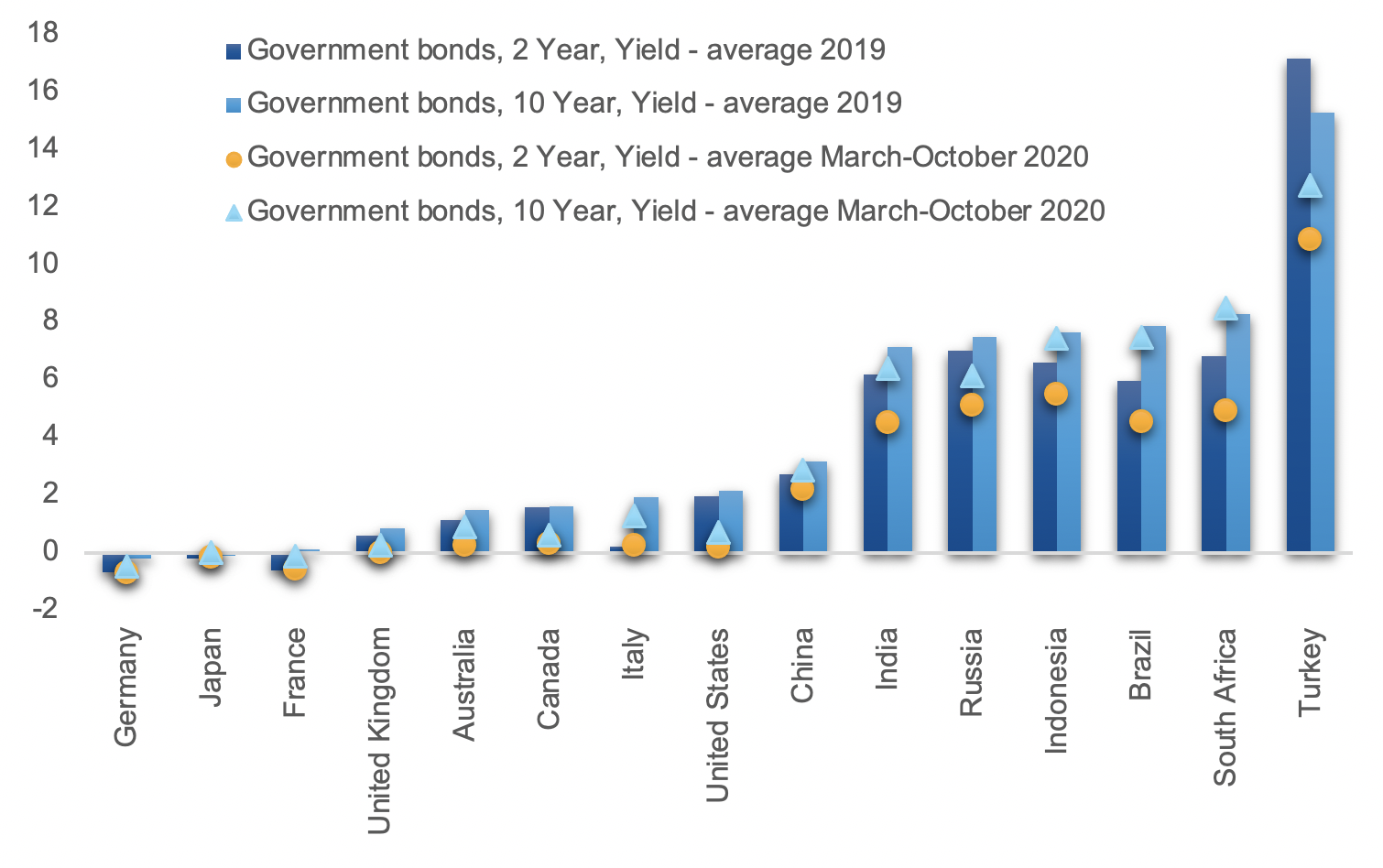

In a similar vein, it is of key importance that supportive fiscal measures are well designed, taking advantage of the current low interest rates to boost growth while remaining sustainable and targeting a reduction in public debt over the long-term. Governments could so far count on smooth financial conditions on financial markets, instilled also thanks to the action of central banks. The interaction of monetary and fiscal policies used in most G20 members has avoided an increase in the yield of government bonds (Figure 2), even in the event of the adoption of large fiscal packages and the accumulation of larger stocks of public debt. In some G20 emerging market economies, however, there has been a steeping of the government bond yield curve which could lead these countries to issue more short-term debt titles and make them more vulnerable. In addition, in highly indebted, advanced economies, even when they currently benefit from a low interest rate environment and a negative interest-growth differential, public debt may not be expected to fall automatically or rapidly after the crisis. Therefore, it seems important that G20 members strive both to restore growth and safeguard debt sustainability on the basis of recovery packages that include longer-term considerations.

3. Shifting the accent of economic policy action from managing current economic risks to preparedness against broader and new types of risks, and higher resilience of societies and economies

In the immediate term, the nature and evolution of the pandemic crisis shows that health and economic policies remain intrinsically intertwined going forward. Until a vaccine is found and distributed, the COVID-19 pandemic may cause continual and uncertain risks to the economic recovery. This was first demonstrated by the fact that despite unprecedented stimulus measures, the US recovery began at the end of spring but immediately slowed down over the summer due to a significant increase in cases in several key states. Similar dynamics are now being seen across the EU, where economic growth has slowed down everywhere due to the increased number of cases and the return of (partial) lock down measures, notwithstanding that stimulus measures have been so far successful in limiting the economic damage (European Commission 2020d). It is therefore necessary to enhance the resilience of G20 economies, including through contingency planning to manage risks and increase their preparedness against downside risks caused by economic and other (e.g. climate, digital, further health) macro-relevant factors.

Figure 2 Variations in the 2-year and 10-year government bonds’ yield

Source: Macrobond and authors’ calculations.\

Notes: Data for Argentina, Mexico, South Korea, Saudi Arabia, and the European Union are not available.

4. Reaping the fruits of multilateralism and international coordination

First, international coordination at the multilateral level should continue and intensify, evolving into joint international action, on those matters that cannot be solved at national level as the following examples suggest. Coordinated measures for public health and pandemic preparedness are necessary to achieve sustainable growth at the global level. G20 action remains essential to provide financial assistance to those countries that do not have the fiscal space to fight the virus, in particular to increase their access to COVID-19 diagnostics, therapeutics, and vaccines. Global cooperation has also played a key role in the emergency phase of the pandemic to avoid unnecessary barriers to trade and investment as well as disruptions to global supply chains. Stepping up that cooperation will be crucial for the economic recovery.

Additional G20 efforts are equally necessary in order to make recovery efforts more inclusive and address inequalities. The development of a global digital tax system remains a key step ahead towards a framework ensuring that it will not be possible to exploit gaps and mismatches between different countries’ tax systems (OECD 2020). It is with the utmost urgency that the G20/OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS) should reach a global and consensus-based solution by mid-2021 at the latest.

Moreover, G20 actions have been undertaken to provide debt relief to low-income countries to both help them manage the severe impact of the COVID-19 pandemic and to avoid its transformation into a public debt crisis (through the so-called G20-Paris Club Debt Service Suspension Initiative and a commonly agreed framework for those countries that need debt restructuring). Further G20 guidance remains highly warranted for the follow-up of these measures, notably in a post crisis scenario of high debt and low growth where some degree of burden sharing is needed for all debtor and creditor countries, in order to avoid beggar-thy-neighbour behaviours.

Second, the coordination at international level of national actions is increasingly needed given that economies are highly interconnected, and that coordinated or synchronised support is better perceived by markets than individual country reactions. This may hold particularly true for fiscal policy, where international coordination may become more relevant over time, when the presence of spillovers increases when countries exit from the lockdown (Blanchard 2020, Thornton 2020). As internal consumption and investment may take time to recover in an uncertain environment, most of the burden of the recovery may be left on the shoulders of public policy alone. In a context of weak global demand, positive spillovers stemming from synchronised support policies might help constrained countries to reach the desired policy stance. Clearly planned and communicated recovery strategies appear in turn essential to avoid a premature withdrawal of fiscal support justified by the impression of ‘wasting public money’, given that the increased spending of one country may not produce immediately tangible results and fall in part on other countries.

Third, through international forums like the G20, countries can exchange information about the link between the pandemic and the economy as well as their policy experiences, and therefore update their respective toolboxes. The G20 response to the COVID crisis needs to be used as occasion to revamp multilateralism and overcome protectionism and de-globalisation trends.

Authors’ note: The authors thank Heinz Scherrer for insightful comments and Matteo Brunelli for excellent research assistance.

References

BIS (2020), Annual Economic Report 2020, 20 June.

Blanchard, O (2020), “Designing the fiscal response to the COVID-19 pandemic”, Real Time Economic Issues Watch, Peterson Institute for International Economics.

Buti, M (2020a), “Economic policy in the rough: A European journey", CEPR Policy Insight No .98.

Buti, M. (2020b), “Riding through the storm: Lessons and policy implications for policymaking in EMU”, VoxEU.org, 12 January.

Cavallino, P and F De Fiore (2020), “Central banks’ response to Covid-19 in advanced economies”, BIS Bulletin 21, 5 June.

European Commission (2020a), “Europe's Moment: Repair and Prepare for the Next Generation”, Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, COM/2020/456 final.

European Commission (2020b), “The 2020 Stability and Convergence Programmes: an Overview, with an Assessment of the Euro Area Fiscal Stance”, Institutional Paper 131, July.

European Commission (2020c), “The Annual Sustainable Growth Strategy 2021”, Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank, COM(2020)575 final.

European Commission (2020d), Autumn 2020 Economic Forecast.

G20 (2020a), G20 Finance Ministers and Central Bank Governors Communique, Meeting of 15 April 2020, including the “G20 Action Plan Supporting the Global Economy Through the COVID-19 Pandemic”.

G20 (2020b), G20 Finance Ministers and Central Bank Governors Communique, Meeting of 14 October 2020.

IMF (2020a), “Policy Responses to COVID-19”, Policy Tracker.

IMF (2020b), A Long and Difficult Ascent, World Economic Outlook, October 2020.

IMF (2020b), Policies for the Recovery, Fiscal Monitor, October 2020.

OECD (2020), “Policy Responses to Coronavirus (COVID-19)”.

Thornton, P (2020), “United G20 must pave the way for robust post-COVID-19 recovery”, Atlantic Council.

Endnotes

1 For the policy trackers developed by the IMF and OECD in line with the commitments of the G20 Action Plan, see IMF (2020a) and OECD (2020).

2 Figures refer to September 2020, using the latest data available and as compiled by the IMF in its Database of Country Fiscal Measures in Response to the COVID-19. The most recent measures announced by G20 members after September 2020 may not be captured in these figures.

3 The European Commission and the Council of the EU have also activated the general escape clause included in the EU fiscal rules of the Stability and Growth Pact. That clause put temporarily aside the annual adjustment requirements normally required for Member States, provided that this does not endanger fiscal sustainability in the medium term. That clause will remain active also in 2021. In addition, the Commission and the Member States put on hold decisions on the opening of Excessive Deficit Procedures due to the uncertainty surrounding the economic outlook and thus the possible adjustment path; see European Commission (2020b, 2020c).

4 The aggregate government deficit of the EU is forecast to increase from 0.5% of GDP in 2019 to around 8.4% in 2020, before decreasing to 6.1% in 2021 and 4.5% in 2022, reflecting the expected phasing out of emergency support measures in the course of 2021 as the economic situation improves. Mirroring the spike in deficits, the aggregate EU debt-to-GDP ratio is set to increase from 79.2% of GDP in 2019 to 93.9% in 2020, 94.6% in 2021 and 94.9% in 2022. For further information see European Commission (2020b).