South Africa stands at the cusp of a crucial political transition, the contours of which are slowly becoming clearer. This is taking place in a domestic context of high unemployment and social agitation driven by high crime levels, whilst economic growth stalls in the midst of global recessionary conditions. Hence economic policy is again the subject of intense debate. Of greatest concern is maintaining macroeconomic stability – rightly seen as a prerequisite for sustaining economic growth.

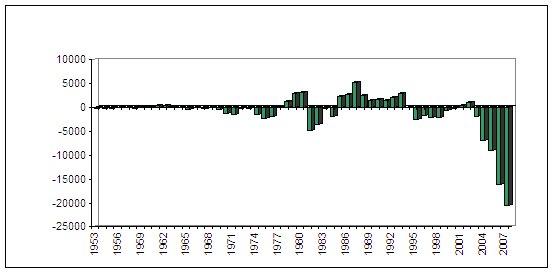

The current account deficit is one potential threat. It has grown to large proportions in recent years, as Figure 1 shows.

Figure 1 South African current account 1953-2007 (million US dollars)

Source: IMF, International Financial Statistics.

A key component of the current account deficit is the growing trade deficit. This attracts strong emotions, generally driven by a mercantilist bias. Trade surpluses are seen as beneficial and reflecting export prowess, and trade deficits are seen as bad and determined by foreign countries’ “unfair” trade practices. From this perspective, a standard policy stance is to demand trade policy actions and state intervention to support particular sectors of the economy. The latter may explain the wish of trade union leader Zwelinzima Vavi to “discipline” the financial sector in order to favour manufacturing. The former treats trade as a zero sum game – countries are like companies that compete with each other, so what is sold by China cannot also be sold by South Africa.

This view may hold for competing firms on a shrinking market, but it is completely misplaced for the analysis of international trade where the potential for division of labour is not yet fully exploited. It is unclear whether a trade deficit is indeed a problem and an alarming sign for the future or whether it is a symbol of a country’s strength (Griswold 2001).

Furthermore, this “competitiveness approach” assigns an important role to the exchange rate. South Africa should devalue its currency in order to achieve the desired trade balance. This outlook finds supplementary expression in the Congress of South African Trade Unions’ desire to eschew inflation targeting in favour of a more “growth friendly” exchange rate. Assuming the Reserve Bank were actually able to implement it, the inflation such an approach would generate would prove self-defeating – whilst reducing economic growth and hurting the poorest in the country. In our view, it would cause major damage to the economy.

Current account deficits and capital account surpluses

A more sensible framework for understanding the current account deficit “problem” is to consider it in relation to its indispensable companion – the capital account. One has to analyse both accounts simultaneously to get a full picture. Higher investment in general – be it foreign direct investment or portfolio – is inevitably positively correlated with increasing international capital inflows. If capital account imbalances (a surplus in this case) occur, the whole balance of payments will be subject to change leading to higher imbalances of the current account and/or a change in international reserves. The exchange rate facilitates the transfer. Seen from this perspective, it is unclear whether a trade deficit is indeed a problem or whether it reflects economic strength (the ability to attract capital inflows).

It is also necessary to analyse the structure of imports. If imports consist mainly of consumption goods, the degree of sustainability would be low. If, however, imports mainly consist of capital and intermediate products, one could expect a boost in productivity. Whilst these distinctions are difficult to measure, it seems clear that South Africa’s growing import bill has not been squandered on consumption goods, as a look at the data shows. Indeed, what is remarkable is the relative consistency of its broad import structure: over twenty years, more than half of South Africa’s imports have been capital and intermediate goods, regardless of the trade balance.

So our analysis, in line with much of the macroeconomic work done recently both domestically and abroad, shows that the sustainability of the South African current account deficit is not immediately endangered. Indeed, as elsewhere, it could safely endure for many years. Our main thesis is that South Africa can benefit from net capital inflows – if maintained, they can be invested further, creating new jobs, lift the living standard of the poorest, and increase savings in the country. Higher savings would automatically reduce the net capital inflows in the future. Therefore, the country should not attempt to artificially reduce net capital inflows via policy means, particularly exchange rate manipulation and trade barriers. This advice seems all the more important against the background of the current financial turmoil in the United States. The crisis does not imply that capital inflows are history. Rather, it indicates that in the future savers and investors will be even more careful when assessing investment opportunities.

Policy reform

Thus, a business-as-usual strategy is not appropriate either. In South Africa’s relatively small and open economy, microeconomic flexibility is essential to enable smooth “structural adjustment” in the event of external shocks. Structural change is a permanent companion of economic development in South Africa, as elsewhere. It is costly, as jobs are at stake, while new jobs are created. It is very difficult to forecast the new opportunities, while it is easy to identify the losers. Temptations are high to protect certain industries from structural change. The government should refrain from doing so – it should rather be interested in removing existing obstacles to structural change. The fewer barriers, the easier structural change can be mastered.

Yet many local and foreign economists have pointed to the South African economy’s structural constraints. In this light, a core policy package currently finding favour in government is the National Industrial Policy Framework (NIPF). One of its central objectives is to promote economic diversification particularly through building manufacturing industry and growing associated exports. Most economists would agree with these objectives.

But questions remain over the forms the NIPF should take. We strongly support the view that the government should address South Africa’s low productivity problem by fostering technological change and basic technologies, and enhancing education policy at all levels. Next, the government should accelerate efforts to tackle the bottlenecks in infrastructure, i.e. electricity, transport and communication. Low productivity in these key network industries, and the high (transport, communication) and rising (electricity) costs of using network infrastructure are not mainly capacity determined, but rather due to organisational and competition problems. Hence government should continue to liberalise and de-monopolise these – and other – sectors.

This programme – which lies at the centre of ASGISA - should improve the competitiveness of South African firms in the long run, reducing the current account deficit. In the short run, this may encourage further capital inflows, leading to an increase in the current account deficit. The alternative, using the NIPF mainly as traditional industrial policy instrument (e.g. subsidies to established firms), may work in the opposite direction, reducing the current account deficit in the short run, but causing lower international competitiveness of South African firms in the long run. That would be a circumstance we can ill afford.

References

Draper, Peter and Andreas Freytag (2008). “South Africa’s Current Account Deficit: Are Proposed Cures Worse than the Disease?” Trade Policy Report No. 25, South African Institute of International Affairs.

Griswold, Daniel T. (2001), ‘America’s Record Trade Deficit. A Symbol of Economic Strength’, Trade Policy Analysis No.12, Cato Institute.