In its budget draft, the Italian government has decided to pursue an expansionary fiscal policy, increasing the deficit to 2.4% of GDP in 2019 and maintaining an expansionary posture for the following two years. The bulk of the deficit increase is due to a minimum universal income scheme and a decrease in the retirement age, although some funds are also allocated to infrastructure investment spending.1 Even though tax cuts are also included, the increase in welfare spending is the centrepiece of the fiscal expansion.2 With government debt at 130% of GDP, this budget draft was rejected by the European Commission as it conflicts with the objective of a structural budget surplus and the reduction of the debt-to-GDP ratio.

The fundamental economic bet is that the fiscal expansion will lead to enough economic growth to keep the debt-to-GDP ratio under control and put it on a downward path. Whether this will happen or not depends on the size of the fiscal multipliers (see Ramey (2018) for a review; see also Alesina and Ardagna 2010). Concerns have been raised about the composition of the fiscal expansion, and on the fact that its reliance on welfare spending is unlikely to make it growth enhancing.3 We focus, instead, on the potential negative effects on private investment.4 Specifically, we use recent microeconometric evidence on the 2010–2012 sovereign debt crisis to investigate the crowding outof private investment.5 This is a key issue, as private investment is the most volatile component of GDP, and long-run growth depends on productivity-enhancing capital investment.

Crowding out can occur even if the ECB maintains the a low bench-mark rate, as the fiscal expansion may lead to an increase in the yields of Italian Treasury bonds due to higher perceived probability of default. In turn, higher rates on Treasury bonds are likely to translate into an increase in the cost of funding for Italian banks, resulting in higher lending rates and lower investment by Italian firms.

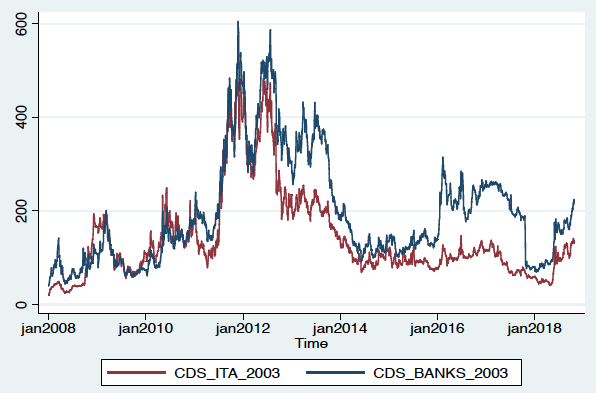

Figure 1 reports the five-year credit default swap (CDS) spread on Italian government bonds, as well as the average CDS spread on bonds issued by the five major Italian banks, for the period beginning 1 January 2008 (using the ISDA 2003 CDS definitions) (Markit Research 2014). CDS spreads incorporate information about default probabilities and expected losses, as well as about risk and risk aversion. Both spreads increase starting in the first quarter of 2011, with the sovereign spread reaching around 460 basis points and the bank spread 600 basis points. They decrease briefly at the end of that year in conjunction with the ECB’s introduction of long-term financing operation, resuming their increase until Mario Draghi’s “Whatever it takes” speech in July 2012, and the announcement shortly thereafter of a programme to buy the bonds of countries under distress (the Open Market Transactions programme). The two CDS spreads reach the lowest point at the end of 2017/beginning of 2018.

Figure 1 Daily CDS spreads on five-year Italian government bonds (CDS_ITA_2003) and five-year bonds for the five largest banks (CDS_BANKS_2003), average value: 2008–2018

Source: Markit; ISDA 2003 CDS definition.

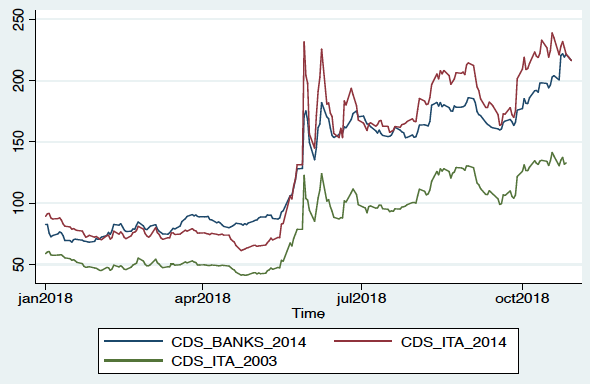

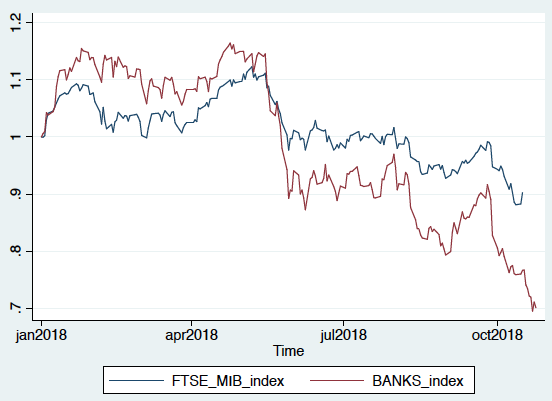

Figure 2 zooms in on the more recent period, starting on 1 January 2018, and reports the spread for government bonds based on both the 2003 and 2014 ISDA CDS definitions, with the latter also insuring against a currency redenomination of the sovereign bond due to a country leaving the euro area. The rules for CDSs for bank bonds also change, but the effect on their spread is small and we report only the figures for the 2014 definitions. CDS spreads on bank bonds and sovereign bonds (inclusive of redenomination risk) move together – they start increasing in May/June, around the time when the new government is being formed, and reach approximately 225 basis points at the end of October, after the submission and subsequent rejection by the European Commission of the draft budgetary plan and a worsening of the credit rating for Italian government bonds. The CDS spread for sovereign bonds – covering only default but not redenomination risk, as defined in 2003 – increases as well, but only to 130 basis points. This implies that the increase in the perceived possibility of Italy leaving the euro is a large fraction of the overall rise in the riskiness of Italian government bonds, a point made recently by Ignazio Visco, Governor of the Bank of Italy (Visco 2018), and in Gros (2018). These increases in the spreads for banks and sovereign CDSs are substantial, although they are not as large as those observed during the sovereign debt crisis. Finally, Figure 3, in which we report the index for the general stock FTSE MIB stock market index and an index for the five largest banks, paints a worrisome picture as well, with the banks’ stocks falling by 33% between January and October, faster than the market as a whole.

Figure 2 Daily CDS spreads on five-year Italian government bonds (CDS_ITA_2014 or CDS_ITA_2003) and five-year bonds for the five largest banks (CDS_BANKS_2014), average value: January–October 2018

Source: Markit; ISDA 2003 CDS or ISDA 2014 CDS definition.

Figure 3 FTSE_MIB stock market index and stock market index for the five largest banks (BANKS_index): January–October 2018

Source: Datastream; BANKS_index is constructed by using the same weights of the FTSE_MIB_index.

The spreads now are still well below the level reached in the 2010–2012 period. The explanation is that the financial and real stress during the sovereign debt crisis had a systemic character, affecting several countries at the same time and raising fundamental questions about the very survival of the euro. This is not the case now, with a widening of the risk premia affecting only Italy. Moreover, the Italian banking sector is better capitalised, has ample liquidity available, and the burden of non-performing loans has started to decrease.6 The valuations of Italian government bonds have also benefitted from the effects of the ECB’s quantitative easing programme started in 2015.

However, the increase in the spread that we have observed recently is substantial (roughly 150 basis points compared to 300 basis points and more during the sovereign debt crisis). Moreover, there are further reasons for concern looking to the future. First, the expiration of the ECB’s bond-buying programme in January 2019 and the need to reimburse ECB loans may renew tensions in the bond markets, adversely affecting bank liquidity and increasing Italian banks’ cost of non-deposit sources of funding.7 In addition, the difficult discussions between the Italian government and the European Commission may generate further stress, depending upon the Italian government’s response to the Commission’s rejection of its budget draft. Finally, the recent downgrades by rating agencies has brought Italian government debt closer to ‘junk’ status. Any further worsening of the ratings carries large risks. In short, one cannot exclude the possibilities that Italy may find itself in dire financial stress in the future.

It is quite useful, therefore, to go back to the microeconometric evidence from the 2011–2012 sovereign debt crisis and see what lessons one can learn from it. Recent research suggests that the financial market volatility experienced around 2011 had significant negative real effects.8 In Balduzzi et al. (2018), we use matched firm-bank level data to assess whether firms whose banks’ financial market valuations (CDS spread, equity price, and equity volatility) were more severely affected by the sovereign debt crisis invested less than firms borrowing from less affected banks.9 Importantly, we control for demand shocks and our instrumenting strategy addresses reverse-causality effects – we instrument bank’s valuations with its pre-crisis exposure to Italian sovereign debt, interacted with the CDS spread for Italian government bonds – and isolates the effects of banks’ financial market valuations that were unrelated to the possible worsening of the quality of the banks’ loan portfolios.10

The essential logic of the argument for why a worsening outlook for Italian government debt negatively affects banks valuations, their lending policies, and firms’ decisions is simple. A loss in value of government bonds has multiple effects on a bank’s balance sheet. A capital loss on sovereign bonds may have an adverse impact on a bank’s book equity. Whether it does or not depends on whether sovereign bonds are marked to market (which depends, in turn, upon whether they are classified as trading securities, available for sale, or held to maturity) and upon the changing accounting treatment of each category.11 In whichever way losses are accounted for, investors are likely to incorporate the information about the worsening quality of a bank’s security portfolio in the bank’s financial market valuations and in the cost of funding for the bank. These, in turn, are likely to affect client firms’ cost and availability of credit, and real decisions such as investment and employment.

Our data set contains information about both large and small firms in manufacturing, and provides us with information on which banks lend to a given firm. We show that an increase in a bank’s CDS spread (or a fall in the equity price or increase in the equity price or CDS volatility) leads, ceteris paribus, to lower investment and employment for younger or smaller firms. Our firm-level results translate into sizable aggregate effects. For instance, the increase in 2011 of banks’ CDS spreads by somewhat more than 300 basis points generates a fall in aggregate investment from 2010 to 2011 of 3.53 percentage points relative to the fixed capital stock. This is a large fall, as the weighted average of the investment to capital ratio in our sample is 0.115. Another way to look at it is that the fall in investment due to the increase in the banks' CDS spread equals 6.11 percentage points relative to gross value added in manufacturing (compared to an average value of the investment to value added ratio of .186) and .98 percentage points relative to total gross value added (GDP).12 There is obviously a standard error around these estimates, but they are indicative of the substantial size of the effect. The worsening of government debt valuations also lead to a worsening in the efficiency with which financial resources are allocated, in the sense that during the crisis the association between investment and the marginal revenue product of capital was smaller than in the pre-crisis period.

While ours is the only study to directly relate banks’ financial market valuations to client firms’ real decisions, a few other studies have explored the real effects of the sovereign debt crisis. Acharya et al. (2018) rely on syndicated loan data for an international sample of large firms and banks differentially exposed to government bonds issued by GIIPS countries, and provide evidence of a larger fall of investment, employment, and sales growth for those firms borrowing from more exposed banks. They focus on the loss in equity due to the capital losses on sovereign bonds and the risk-shifting behaviour (away from corporate loans to the holding of risky sovereign bonds) of weakly capitalised banks, which lead to a reduction in loans to firms with adverse real consequences. De Marco (2018) also uses syndicated loans data to assess the effect of the sovereign debt crisis on loan supply, and emphasises how the capital losses on sovereign bonds affects the cost of funding for the banks. Using matched firm-bank data, he also shows that investment falls more for firms exposed to more affected banks.13

In summary, there is plenty of evidence that the sovereign debt crisis had severe consequences for the real economy. The lesson is that there is a real and worrisome possibility that the planned fiscal expansion by the Italian government will substantially crowd out private investment. As a result, the bet that growth will keep the debt-to-GDP ratio under control and even reduce it is extremely risky, to say the least, and comes with a very serious downside.

Authors’ note: The views expressed in this column are those of the authors and should not be attributed to the institutions with which they are affiliated. We would like to thank, the Editor, Silvia Ardagna, Susanto Basu, Olivier Blanchard, Riccardo De Bonis, Filippo De Marco, Francesco Giavazzi, Lisa Lynch, Francesco Mancini, Giuseppe Marinelli, Jean-Stephane Mesonnier, Raffaele Santioni and Philip Strahan for useful comments.

References

Acharya, V, V Eisert, T Eufinger and C Hirsch (2018), “Real effects of the sovereign debt crisis in Europe: Evidence from syndicated loans,” Review of Financial Studies August: 2855–2896.

Alesina, A and S Ardagna (2010), “Large changes in fiscal policy: Tax versus spending,” in J R Brown (ed), Tax Policy and the Economy 24: 35-68.

Alesina, A and F Giavazzi (2018), “Se Nessuno Pensa Più a Chi Lavora e Produce,” Corriere della Sera, 29 September.

Alesina, A and F Giavazzi (2018a), “L’Illusione di Crescere per Decreto,” Corriere della Sera, 6 October.

Balduzzi, P, E Brancati and F Schiantarelli (2018), “Financial markets, banks' cost of funding, and firms' decisions: Lessons from two crises," Journal of Financial Intermediation 36(October): 1–15.

Baldwin, R and F Giavazzi (2015), “The Eurozone Crisis: A consensus view of the causes and a few possible solutions”, in The Eurozone Crisis: a Consensus View, CEPR Press.

Blanchard, O and J Zettelmeyer (2018), “The Italian budget: A case of contractionary fiscal expansion?” PIIE Real Time Economic Issues Watch Blog, 25 October.

Bofondi, M, L Carpinelli and E Sette (2018), “Credit supply during a sovereign debt crisis,” Journal of the European Economic Association, forthcoming.

Bottero, M, S Lenzu and F Mezzanotti (2015), “Sovereign debt exposure and the bank lending channel: Impact on credit supply and the real economy,” Bank of Italy Working Paper 1032.

Cardillo, A and M Coletta (2018),“Household investments through Italian asset management products,” Journal of Economic Policy (2): 165–194.

Coletta, M and R Santioni (2016), “Bank bonds in Italian households’ portfolios,” Bank of Italy, Questioni di Economia e Finanza, Occasional Paper 359.

De Marco, F (2018), “Bank lending and the European Sovereign Debt Crisis,” Journal of Financial and Quantitative Analysis, forthcoming.

Gros, D. (2018), "Italian risk spread: Fiscal versus redenomination risk", VoxEU.org, 29 August.

Popov, A and N Van Horen (2015), “Exporting sovereign stress: Evidence from syndicated bank lending during the Euro Area Sovereign Debt Crisis,” Review of Finance 19: 1825–1866.

Markit Research (2014), “ISDA 2014 Definitions: A Robust Framework”, 19 September.

Ramey, V (2018), “Ten years after the Financial Crisis: What have we learned from the renaissance of fiscal research?” Journal of Economic Perspectives, forthcoming.

Visco, I (2018), Remarks by the Governor of the Bank of Italy at the Giornata Mondiale del Risparmio, 31 October.

Endnotes

[1] The lowering of the retirement age will undo the Fornero pension reform of 2011 that had put the pension system in Italy on a more sustainable path.

[2] On the revenue side, there are tax cuts for small businesses and self-employed workers, and incentives for the reinvestment of retained earnings. However, these cuts are counteracted by a removal of existing accelerated depreciation provisions and incentives to R&D spending. Moreover, there is an increase in taxation on insurance companies and banks, in the latter case due to the postponement of the deductibility of credit losses. The automatic VAT increases—which had been introduced by the previous government to compensate for the overshooting of the deficit the previous year, relative to the commitments with the European Commission—have also been cancelled. More on Italy’s draft budgetary plan can be found here. The tax amnesty included in the measure has been subjected to continuous renegotiation between the two governing parties.

[3] See the editorials by Alesina and Giavazzi (2018, 2018a) in Corriere della Sera on 29 September and 6 October, respectively, on the composition of the proposed fiscal expansion and why it is unlikely to be growth enhancing. The prevalence of spending increases versus tax cuts and the choice of measures that do not incentivise work are at the centre of their argument. With respect to the universal income scheme, they note that the existing job centres are insufficiently equipped to monitor the (loose) job search requirement contained in the law and that the reintroduction of generous benefits in case of firms’ closing (Cassa Integrazione) will discourage job search.

[4] Blanchard and Zettelmeyer (2018) investigate this issue as well, and its implication for the overall effect on Italian GDP of the planned expansionary fiscal policy, relying on macro data. Note also that the fiscal expansion is likely to have negative wealth effects for households because of its impact on the valuations of Treasury securities (and also bank securities) that constitute a sizable part of Italian households’ portfolio (approximately 11% through direct and indirect holdings), which raises questions about the overall effect on consumption. For a study of the importance of bank bonds in Italian households’ portfolio see Coletta and Santioni (2016) and Cardillo and Coletta (2018). Finally, consumption spending and housing purchases are also likely to be negatively affected by an increase in interest rates.

[5] It has been argued that the euro area crisis should more correctly be thought of as a sudden stop crisis, following the buildup of current account deficits in a set of countries and the associated borrowing from abroad (Baldwin and Giavazzi 2015). Although we recognise the merits of that distinction, we will use ‘sovereign debt crisis’ as a shorthand and in conformity with the wording used in many of the papers we will review.

[6] The recapitalisation exercises following the European Banking Authority stress tests, the liquidity injections in the banking system by the ECB through the long-term financing operation programs, and the efforts by the Bank of Italy and the previous Italian government to address the issue of non-performing loans have contributed, together with a period of positive real growth, to improve bank health relative to the sovereign debt crisis period.

[7] The reimbursement of loans will occur starting in 2020, but already in 2019 the need to refinance bank bonds tranches coming due, and the shortening remaining maturity of ECB loans may create funding and liquidity pressures. The shorter maturity of ECB loans will also affect negatively the net stable funding ratio.

[8] See Balduzzi et al. (2018), Acharya et al. (2018), De Marco (2018), Popov and Van Horen (2015), and Bofondi et al. (2018). The first three papers contain evidence on bank loans and on the real effects of the sovereign debt crisis. The last two papers focus on bank lending.

[9] The Italian experience during the sovereign debt crisis is very relevant because the sovereign debt shock was largely external to Italy, Italian banks had a substantial, yet differentiated exposure to Italian sovereign debt, banks relied heavily on bond issuance, and many Italian firms were (and still are) small and unable to cushion the fall in bank debt with the issuance of market debt.

[10] The essential issue is how to separate the credit supply from the credit demand effects. In addition to instrumenting, we control for a large menu of firm-level variables and a complex set of time effects. Our results show that banks’ financial market valuations dominate balance sheet variables as a determinant of investment and employment decisions.

[11] At the time of the sovereign debt crisis, securities in the ‘held to maturity’ portfolio were not marked to market. Those in the ‘trading’ book were marked to market and a capital loss would immediately impact the profit and loss account (and hence shareholder equity). A fall in value of those held as ‘available for sale’ would impact firms’ equity (but not profit and losses). This change could however be sterilised and would not affect the Tier 1 capital ratio. After January 2018, this sterilisation is no longer allowed for any bank, and losses negatively affect the regulatory capital ratios.

[12] These calculations use the EUKLEMS data, available at http://www.euklems.net/

[13] Further evidence on Italy, using the Credit Register, is contained in a subsequent paper by Bottero et al. (2015, revised 2018). Their difference in difference exercise confirms our result that it is the real outcomes of small firms that are negatively impacted.