Virtual currency not only represents the emergence of a new form of currency but also a new payment technology for purchasing goods and services (Böhme et al. 2015, Dwyer 2015). The key innovation is cryptographic identification in a distributed ledger – the blockchain – that allows payment tracking. The currency can therefore be used in a decentralised system while preventing 'double spending' (Huberman et al. 2017, Brunnermeier and Abadi 2018). Transactions in virtual currency occur outside the scope of financial institutions, and make possible direct payments between merchants and consumers across large distances.

Exchange rate volatility

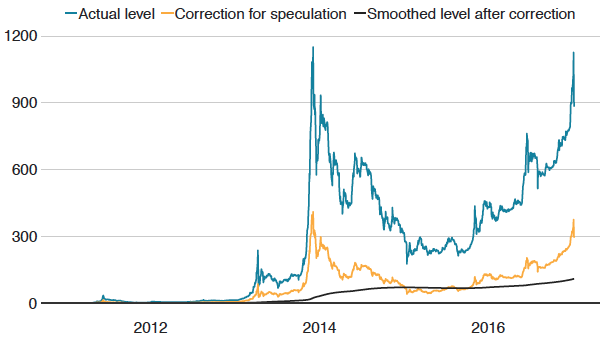

Bitcoin, the best-known virtual currency, continues to attract attention from the financial press, economists, central banks and governments. This was fuelled by the explosion and volatility of the bitcoin exchange rate by the end of 2013. Bitcoins had begun trading for less than $0.10 in 2010 but, by November 2013, the exchange rate was higher than $1,000 per bitcoin. During 2014 the exchange rate fell, settling at around $250 in March 2015, after which it surged to almost $20,000 by the end of December 2017. Since early 2019 it has been hovering between $4,000 and $5,000. Volatility is shown in Figure 1. The blue line shows daily data on the actual exchange rate. The 'bubble-like' behaviour may be a concern for the feasibility of bitcoin as a currency (Yermack 2015, Cheah and Fry 2015).

Figure 1 Bitcoin exchange rate and speculation (price per bitcoin in US$)

Source: www.coinmetrics.io, www.blockchain.info, authors' calculations.

Economists have shown considerable interest in what causes the turbulent exchange rates of virtual currencies (Gandal et al. 2017, Garratt and Wallace 2018, Biais et al. 2018).

Back to Irving Fisher

It is widely believed that speculation is an important factor, because supply of a virtual currency is not controlled by central banks. The role of speculation in determining the value of money is an old idea. Fisher (1911) argued that, in certain situations, speculators may effectively regulate the money supply, as they withdraw money from circulation by betting on its future value. In the context of the run-up to the promised redemption of greenbacks by the US government in 1879, he wrote: "Some of them were withdrawn from circulation to be held for the rise … Thus speculation acted as a regulator of the quantity of money." (p. 261).

We formally adopt Fisher’s idea that speculators may effectively regulate the money supply into the quantity equation (Bolt and Van Oordt 2019). This allows us to analyse how speculation drives the exchange rate of virtual currency in an environment in which merchants rely on the latest available exchange rate to determine virtual currency prices, while prices in fiat money are determined in the rest of the world. Our model combines an investor's portfolio model with a payment network model to determine the drivers of speculation.

Main determinants

Our analysis shows that three components are important for the exchange rate:

- The current use of virtual currency to make actual payments

- The decision of forward-looking investors to buy virtual currency, thereby effectively regulating its supply)

- The elements that jointly drive potential consumer adoption and merchant acceptance of virtual currency in the future.

On the consumer side of the market, private benefits may be large for those who frequently execute cross-border payments such as remittances. Consumers who value privacy and anonymity more, and those who are technologically more adept, are likely to gain from using virtual currencies.

On the other side of the market, large merchants may experience considerable private benefits from avoiding high fees charged by traditional payment providers. Internet stores may gain as well, since they face relatively low implementation costs when accepting virtual currencies.

The model predicts a steep increase in the exchange rate due to speculation when a potentially successful virtual currency is introduced. In anticipation of future transactional usage, investors rationally choose to hoard these currencies. This drives up the exchange rate even before widespread transactional usage emerges.

The black line in Figure 1 gives a first impression of what the exchange rate of bitcoin might have looked like in the absence of speculation.

The orange line is based on our model, and shows a downward correction of the actual exchange rate to account for virtual currency held by speculators.

Here the size of the speculative position is roughly proxied by the number of bitcoins that will remain dormant for an extended period (six months in our analysis). Economic theory, such as buffer stock models, suggests that consumers and merchants do not instantly adjust their positions to their liquidity needs in response to fluctuations. This suggests that a strongly smoothed version of the orange line, such as the black line, may provide an even better indication of the equilibrium exchange rate in the absence of speculation.

Present and future

The volatility of the exchange rate of bitcoin has decreased over time, but it remains high. As the transactional demand for virtual currency increases, our model predicts that the exchange rate will become less sensitive to the impact of shocks to speculators' beliefs and their decisions to participate in the virtual currency market. If correct, the excessive exchange rate volatility of virtual currencies such as bitcoin will not remain prohibitively high in the long run. In this case, widespread transactional usage and lower price volatility would go hand-in-hand.

This is because speculators experience a more elastic supply of virtual currency when the transactional usage of virtual currency is higher. Intuitively, the adjustment to a new equilibrium after an increase in speculative demand will occur partially in the price, and partially in the quantity, domain.

Higher speculative demand puts upward pressure on the exchange rate. This reduces the number of virtual currency units necessary to facilitate any given dollar amount of real transactions. This frees up virtual currency units that can now be held by speculators, which implies a partial adjustment in the quantity domain instead of an adjustment in prices.

The larger the initial dollar amount of real transactions using virtual currency, the larger the amount of virtual currency that will be freed up for any given increase in the exchange rate, and, hence, the larger the adjustment in the quantity domain. This means that adjustments in the price of virtual currency due to shocks in speculative demand will be lower when transactional demand is higher.

Authors’ note: Views expressed are those of the authors and do not necessarily reflect those of the European System of Central Banks, De Nederlandsche Bank, or the Bank of Canada.

References

Biais, B, C Bisiere, M Bouvard, C Casamatta, and A J Menkveld (2018), “Equilibrium bitcoin pricing”, mimeo.

Böhme, R, N Christin, B Edelman, and T Moore (2015), “Bitcoin: Economics, Technology, and Governance”, Journal of Economic Perspectives 29(2): 213-238.

Bolt, W and M van Oordt (2019), "On the Value of Virtual Currencies", Journal of Money, Credit and Banking (forthcoming).

Brunnermeier, M K, and J Abadi (2018), “The Economics of Blockchains", VoxEU.org, 17 July.

Cheah, E T, and J Fry (2015), “Speculative Bubbles in Bitcoin Markets? An Empirical Investigation into the Fundamental Value of Bitcoin”, Economics Letters 130: 32-36.

Dwyer, G (2015), “The Economics of Bitcoin and Similar Private Digital Currencies”, Journal of Financial Stability 17: 81-91.

Fisher, I (1911), The purchasing power of money: Its determination and relation to credit, interest and crises, Macmillan.

Garratt, R, and N Wallace. (2018), “Bitcoin 1, Bitcoin 2, …: An Experiment on Privately Issued Outside Monies”, Economic Inquiry 56: 1887-1897.

Gandal, N, J T Hamrick, T Moore, T Obermann (2017), “Price Manipulation in the Bitcoin Ecosystem”, VoxEU.org, 22 June.

Huberman, G, J Leshno, and C C Moalemmi (2017), “The Economics of the Bitcoin Payment System”, VoxEU.org, 16 December.

Yermack, D (2015), “Is Bitcoin a Real Currency? An Economic Appraisal”, in D Chuen (ed.), Handbook of Digital Currency, Elsevier: 31-43.