After witnessing the damaging effects of financial crises, policymakers generally agree that financial regulation needs a macroprudential dimension. With such policies, they seek to strengthen the financial system and lessen the negative externalities on the real sector (e.g. Caruana 2010, Drehmann et al. 2010). Importantly, macroprudential policies are intended to work hand in hand with monetary policy, which cannot by itself simultaneously ensure both monetary and financial stability.

Macroprudential policies can single out specific sectors (e.g. real estate) or agents (e.g. systemically important financial institutions), thus targeting potential threats to the soundness of the financial system.1

Even when focused, however, the effects of a macroprudential policy may extend beyond the targeted sectors or actors. Other parts of the economy may be affected via the impact on the cost of credit. Yet, despite the potential importance of such spillover effects, neither the academic nor the policy literature has so far examined them in detail.

In a recent paper (Auer and Ongena 2019), we examine the compositional effects of Switzerland’s countercyclical capital buffer (CCyB), a targeted macroprudential policy that was adopted into legislation in June 2012. When activated, it requires banks to set aside capital according to a time-varying percentage of their stock of risk-weighted residential mortgages.

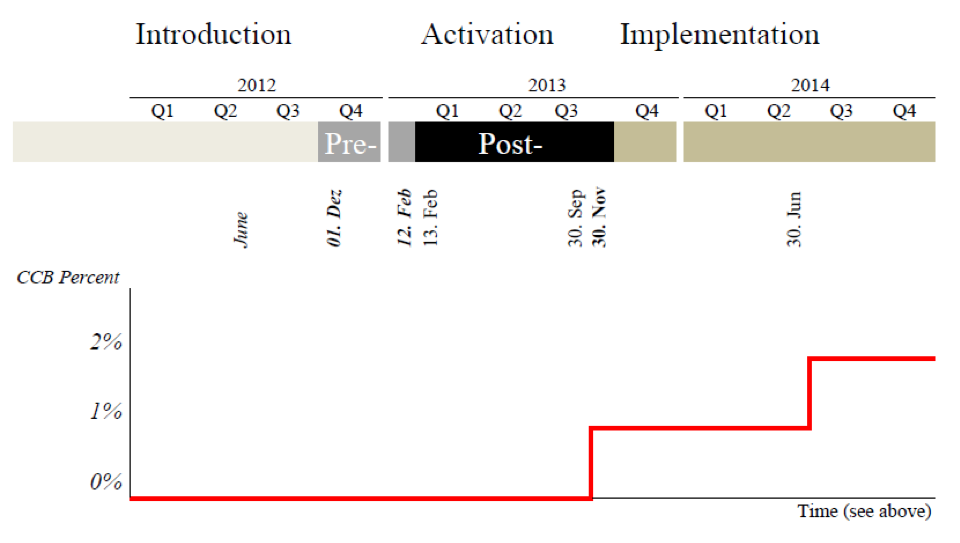

On 13 February 2013, Switzerland’s Federal Council decided to activate the CCyB, requiring banks to hold an additional 1% equity on loans secured against domestic residential properties. The rate of 1% was applied from 30 September 2013 onwards and increased to 2% on 30 June 2014, where it remains at the time of writing (see also Figure 1).

Figure 1 Timeline of the introduction, activation and implementation of Switzerland’s countercyclical capital buffer

Note: Switzerland’s countercyclical capital buffer (CCyB), a targeted macroprudential policy, was adopted in June 2012. On 13 February 2013, Switzerland’s Federal Council decided to activate the CCyB, requiring banks to hold an additional 1% equity on loans secured against domestic residential properties. The rate of 1% was applicable from 30 September 2013 onwards and was increased to 2% on 30 June 2014, where it currently remains. In benchmark estimations the pre-period runs from 1 December 2012 to 12 February 2013 and the post-period from 13 February 2013 to 30 September 2013.

Examining spillovers in loan-level data set

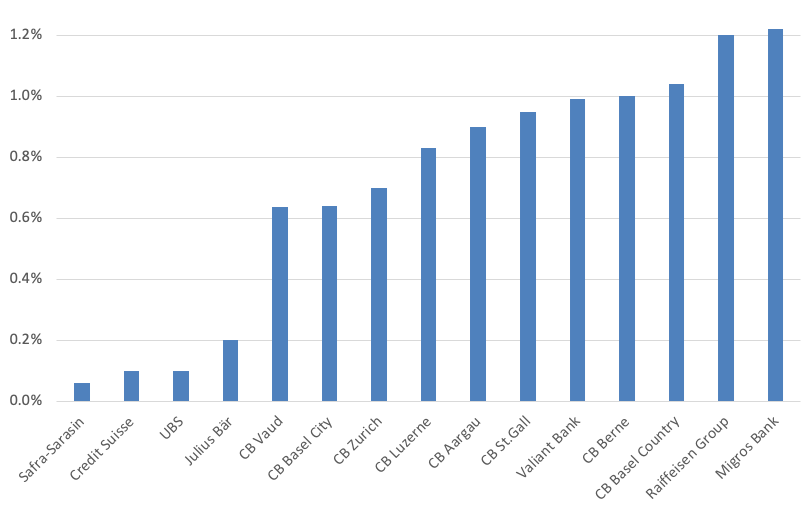

Our empirical strategy exploits the timing of the CCyB’s activation and the resulting capital requirements, which varied across banks. Upon activation, a common formula and a common rate were applied to all banks, but banks differed widely in the relative importance of their residential mortgage lending (as a share of their total business). This is exemplified in Figure 2, which shows the size of the CCyB size as a percentage of total risk-weighted assets (RWAs) at the end of 2014 for 15 large Swiss-domiciled banks. At the high end of the spectrum, the CCyB accounts for 1.22% of RWAs for Migros Bank, representing around a seventh of the bank’s total regulatory core equity (CET1) requirement. At the low end of the spectrum, the CCyB is almost negligible.

Figure 2 The countercyclical capital buffer as a percentage of total risk-weighted assets of 15 large Swiss-domiciled banks (end-2014)

Notes: The countercyclical capital buffer as percentage of total risk-weighted assets is measured as of end-2014 and is collected from banks’ annual reports or the additional public Basel Pillar III Disclosure Reports. “CB” stands for Cantonal Bank.

If the activation of the CCyB resulted in a shift from private to commercial lending, this shift was felt most by the banks with a higher proportion of private lending. Indeed, we first document in a bank-level analysis that heterogeneous exposure to the CCyB is associated with a strong decline in the share of residential lending, but not with a decline in overall lending.

We next investigate whether the patterns present in the bank-level data are truly driven by the CCyB. In particular, it might have been the case that banks with higher exposures to residential mortgages are simply located in booming real estate markets, where demand for credit was consequently higher. Credit registry data from the SNB let us account for credit demand through saturation with business-type fixed effects. In this way, we aim to identify if, and how, the CCyB’s activation altered the supply of bank credit to the commercial loans market (which was not directly affected by the capital surcharge).

Our three main findings, which are statistically significant, economically relevant and robust to many model alterations throughout, are as follows.

- First, we find that the CCyB’s activation, which was intended to curb mortgage lending to private households, also affected lending to corporates. In particular, banks with a higher share of residential RWAs relative to total assets lent more to corporations than banks with a lower share.

- Second, banks increased both the interest rate and their one-time commissions on newly granted corporate loans.

- Third, after this announcement, banks shifted lending to firms assessed to be riskier and to smaller firms.

However, we find no evidence that commercial loan growth was spurred in regions with booming housing markets. While we do find that commercial loan growth picked up following the CCyB’s application to private residential mortgages, we also observe that lending rates increased substantially, as did other costs of obtaining credit.

We document our main empirical findings for a variety of horizons and subsamples, controlling for a large set of alternative mechanisms. Given these robust estimates, the empirical contribution of our paper consists in providing the first evidence of the compositional effects of a prominent macroprudential policy action. In this respect our paper is markedly different from Basten and Koch (2015) and Basten (2019), who study the direct impact of the CCyB on the cost of residential lending.

Spillovers and the optimality of sectorally targeted macroprudential policy.

These findings raise the question of whether and to what extent the highlighted spillovers have shaped the overall impact of targeted microprudential policy on financial stability. We thus develop a microfoundation that can explain these observed spillover patterns and examine whether sectoral differentiation of capital requirements is generally desirable and, further, whether such differentiation should be countercyclical.

In the model, private and commercial lending arise within the same bank-client relationship, due to the structure of access to collateral. That is, only private loans give access to private collateral, while commercial loans have preferential access to commercial collateral. This model is shown to explain the empirically uncovered spillover patterns. Higher equity requirements for private lending increase the equilibrium rate and volume of commercial lending. This effect is more pronounced for banks with initially more private lending.

Our most surprising finding is that, in terms of optimal policy design, such spillovers not only do not undermine the motive for sectorally differentiated equity requirements, but actually provide a rationale for such regulatory differentiation. The key insight is that a regulator who differentiates bank equity requirements for private and commercial loans gains a new tool to increase the overall resilience of banks without distorting the efficient allocation of capital. Higher equity requirements for private loans are desirable precisely because spillovers imply that a higher volume of commercial lending compensates for a lower level of private lending.

The regulator can thus capitalise the banking system via higher equity requirements for private lending, and set commercial loan capital requirements low in order not to distort the total level of invested capital. We show that, due to this effect, it is generally optimal to set higher equity requirements for private lending and also, that the optimal policy is countercyclical.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily represent those of the Bank for International Settlements.

References

Auer, R and S Ongena (2019) “The Countercyclical Capital Buffer and the Composition of Bank Lending”, CEPR Discussion Paper No. 13942.

Basten, C (2019), “Higher Bank Capital Requirements and Mortgage Pricing: Evidence from the Countercyclical Capital Buffer”, Review of Finance, forthcoming.

Basten, C and C Koch (2015), “Higher Bank Capital Requirements and Mortgage Pricing: Evidence from the Countercyclical Capital Buffer”, BIS Working Paper 511.

Brunnermeier, M K, A Crocket, C Goodhart, A D Persaud and H Shin (2009), The Fundamental Principles of Financial Regulation, ICMB and CEPR.

Caruana, J (2010), “Macroprudential Policy: What We Have Learned and Where We Are Going”, keynote speech at the Second Financial Stability Conference of the International Journal of Central Banking, Bank of Spain, 17 June.

Drehmann, M, C Borio, L Gambacorta, G Jimenez and C Trucharte (2010), “Countercyclical Capital Buffers: Exploring Options”, BIS Working Paper 317.

Galati, G and R Moessner (2013), “Macroprudential Policy - A Literature Review”, Journal of Economic Surveys 27: 846-878.

Hanson, S, A K Kashyap and J C Stein (2011), “A Macroprudential Approach to Financial Regulation”, Journal of Economic Perspectives 25: 3-28.

Endnotes

[1] A voluminous literature discusses macroprudential policies (e.g. Brunnermeier et al. 2009, Hanson et al. 2011, Galati and Moessner 2013). Empirical work on the links between macroprudential policies and financial stability includes (1) cross-country studies that consider the link between macroprudential policies and credit growth and other financial indicators; and (2) micro-level studies on the use of only one or a few macroprudential policies within one country. However, none of these studies has analysed the compositional effects of targeted macroprudential policies.

[2] For details, see the Swiss National Bank’s (SNB’s) press releases on 13 February 2013 entitled “Countercyclical capital buffer: proposal of the Swiss National Bank and decision of the Federal Council” and on 23 January 2014 entitled “Swiss National Bank’s proposal to increase the countercyclical capital buffer.” The former proposal came into effect on 30 September 2013 and the latter on 30 June 2014.