The uncovered interest rate parity (UIP) theory states that currencies with high short-term interest rates should, on average, depreciate against low interest rate currencies. This condition is widely utilised in international finance textbooks and open economy macroeconomic models to explain, for example, why contractionary monetary policy leads to an initial appreciation of the domestic currency. Yet empirically, high interest rate currencies tend to appreciate, giving rise to currency return predictability that can be exploited using carry trades (Fama 1984).

The expectations hypothesis of interest rates states that an upward sloping yield curve is on average followed by higher short-term interest rates. This condition is implicitly assumed when interpreting a forward rate as the market’s expectation over the corresponding future short rate. The condition fails because an upward sloping yield curve is associated with high bond returns rather than higher future short rates (Fama and Bliss 1987, Cochrane and Piazzesi 2005).

The standard explanation for the failure of both conditions is the existence of a ‘risk premium’ – high interest rate currencies are riskier and hence warrant higher returns (Menkhoff et al. 2011, Wachter 2006). Similarly, a steeply upward sloping yield curve reflects a high bond risk premium – investing in long maturity rather than short maturity bonds is now particularly risky. This explanation has two key pitfalls. First, the theories that can rationalise the currency risk premium have counterfactual implications for the bond risk premium (Lustig et al. 2019). Second, there is disagreement on the source of this macroeconomic risk.

In a recent paper (Granziera and Sihvonen 2020), we take a different route. The standard formulations of UIP and expectations hypothesis assume rational expectations. We relax this premise by allowing agents to have sticky expectations concerning short rates. There is broad agreement that aggregate survey expectations concerning variables such as short rates display stickiness, even though the source of this is not fully understood (Coibion and Gorodnichenko 2015).

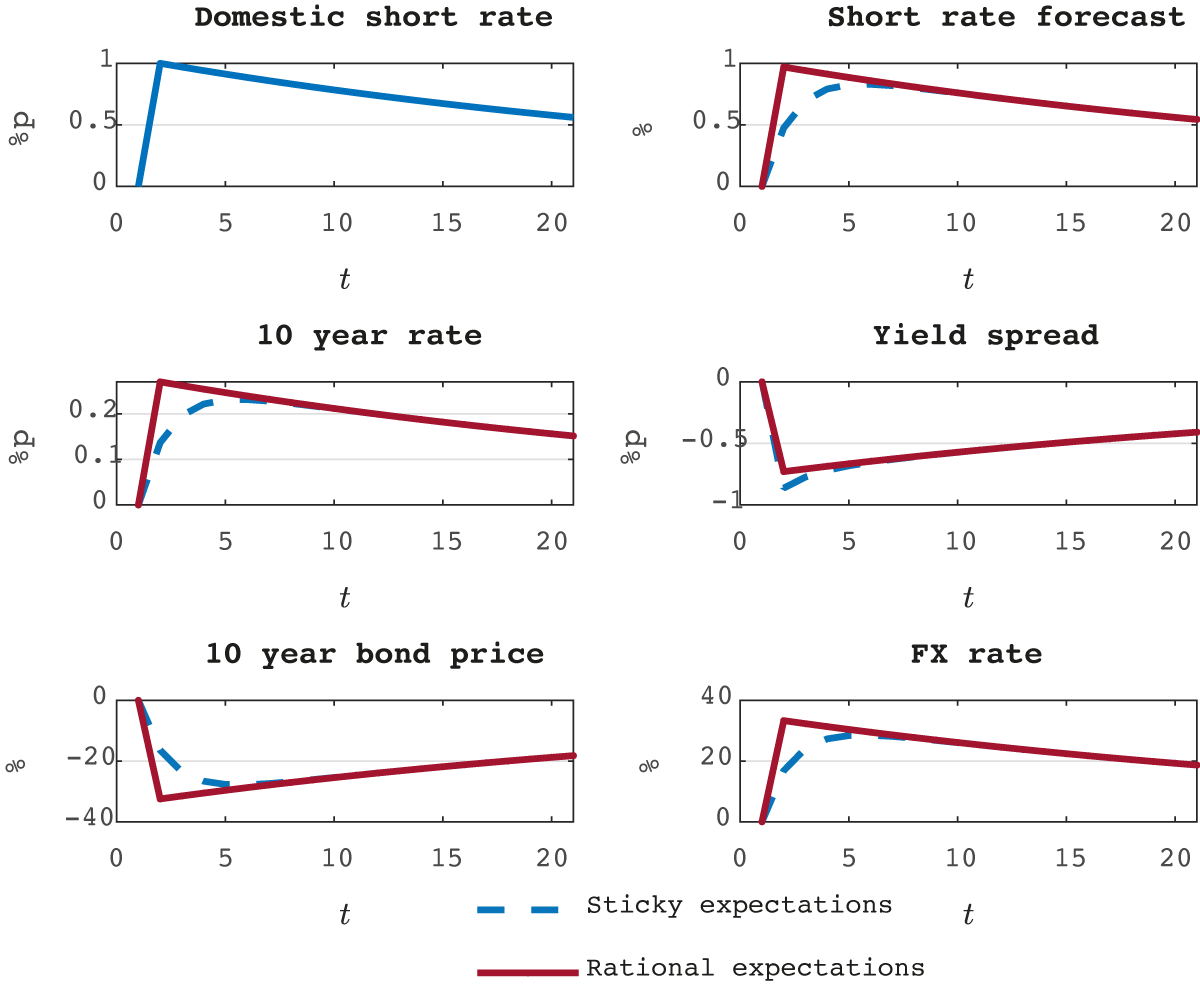

The implications of sticky short rate expectations can be seen in Figure 1, which illustrates how the prices and yields of long-term bonds as well as the exchange rate respond to an increase in the home short rate both under sticky and rational expectations. The rational forecasts for future short rates respond immediately to the shock. However, with sticky expectations this increase in short rate expectations occurs with a lag.

Figure 1 Effects of a home short rate increase under sticky vs rational expectations

The source of the UIP puzzle is that high domestic interest rates relative to foreign interest rates tend to predict home currency appreciation. When domestic interest rates are high, they have on average increased recently. Because of sticky expectations, agents have not fully revised their expectations over future short rates upwards. As the agents gradually update their expectations about short rates, the home currency keeps appreciating. This explains the failure of UIP in the data.

As the agents keep updating their expectations over future short rates up, the price of long-term bonds denominated in the home currency falls and its yield increases. This is because investing in short-term bills is an alternative to buying a long-term bond. However, as the short rates have increased above their historical means, the slope of the yield curve has declined. This is why a flat yield curve predicts low excess returns for long-term bonds and explains the violations of the expectations hypothesis.

Motivated by empirical findings on survey data, sticky expectations offer a simple explanation for the predictability puzzles observed in both bond and currency markets. We provide strong support for the empirical relevance of this explanation. First, we quantify the amount of stickiness in survey expectations using data from Consensus Economics. We find that this empirical amount of stickiness is sufficient for explaining the violations of UIP and the expectations hypothesis. Second, a key prediction of a sticky expectations model is that the same variables that predict bond and currency returns should also predict survey-based expectational errors over exchange rates and long-term interest rates. We confirm this prediction empirically, adding to previous findings by Bacchetta et al. (2009). Third, consistently with a sticky expectations model, we find that currency returns tend to be particularly high and bond returns low after recent shocks that increase short rates.

Our results have important policy implications. First, as Figure 1 suggests, the effects of monetary policy transmit to exchange rates and long-term interest rates with a lag. The initial reaction to a short rate change does not capture the full effect as commonly assumed. Second, forward interest rates can be used to measure market’s expectation over future short rates. However, these expectations are not fully rational, especially after recent short rate changes. Finally, standard term structure models have trouble replicating bond and currency predictability patterns, though they can be modified to allow for sticky short rate expectations.

References

Bacchetta, P, E Mertens and E V Wincoop (2009), “Predictability in financial markets: What do survey expectations tell us?”, Journal of International Money and Finance 28: 406–426.

Cochrane, J and M Piazzesi (2005), “Bond risk premia”, American Economic Review 95(1): 138–160.

Coibion, O and Y Gorodnichenko (2015), “Information rigidity and the expectations formation process: A simple framework and new facts”, American Economic Review 105(8).

Granziera, E and M Sihvonen (2020), “Bonds, Currencies and Expectational Errors”, Bank of Finland Discussion Papers 7.

Fama, E (1984), “Forward and spot exchange rates”, Journal of Monetary Economics 14(4): 319–338.

Fama, E and R Bliss (1987), “The information in long-maturity forward rates”, American Economic Review 77: 680–692.

Lustig, H, A Stathopoulos and A Verdelhan (2019), “The term structure of currency carry trade risk premia”, American Economic Review 109(12).

Menkhoff, L, L Sarno, M Schmeling and A Schrimpf (2011), “The risk in carry trades”, VoxEU.org, 23 March.

Wachter, J (2006), “A consumption-based model of the term structure of interest rates”, Journal of Financial Economics 79: 365–399.