Entrepreneurship is one of the main drivers of economic activity, providing far-reaching benefits for innovation, employment, and capital formation. As such, entrepreneurial activity is one of the central points of focus for policymakers and academics. Existing literature documents the importance of financial resources available to entrepreneurs for firm formation (Hombert et al. 2020) and identifies some possible causes of entrepreneurs’ inability to raise finance: weak national and/or local institutions (Acemoglu and Robinson 2012), corresponding wealth inequality (Braggion et al. 2020), poor legislation, and/or adverse culture.

Recent studies also show that supranational and national fiscal transfers, supplementing local governments’ budgets, significantly improve economic growth, investments, and labour market conditions (Becker et al. 2013, Corbi et al. 2019). However, this positive effect is also likely to depend on the quality of national and/or local institutions (Acemoglu and Robinson 2012).

In new research (Danisewicz and Ongena 2020), we examine the role of local government funding as a possible mechanism to alleviate entrepreneurial financial and resource constraints, and how local political institutions and historical legacies shape its success.

We study a fiscal transfer programme in Poland where municipalities with lower tax revenues receive direct monetary grants (Subsidy) from the national budget. Municipalities’ eligibility to receive Subsidy and its level varies at multiple pre-determined and non-manipulable thresholds based on the ratio of a municipality’s per capita revenue to the per-capita revenue of all (more than 2,400) municipalities in the country. On average, funds distributed under this programme constitute 10% of municipalities’ overall revenue and in some regions reaching as high as 30% of the overall revenue. Local governments enjoy complete autonomy in terms of allocating these funds.

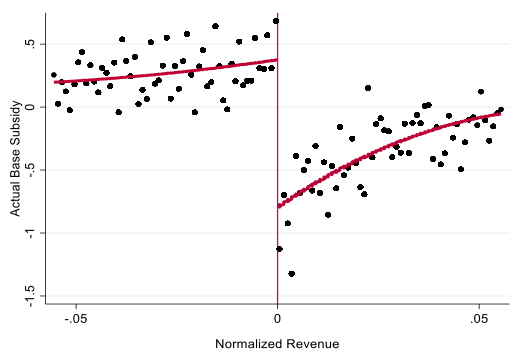

We document significant differences in the level of Subsidy transfers around thresholds during the period 2012-2018 (Figure 1). We do not find changes in other sources of municipal revenue, including tax revenues, EU funds, other fiscal transfers and direct grants, and the level of municipal public debt. Our estimates also suggest that local governments receiving higher Subsidy funding allocate significantly fewer funds to finance public administration and increase all other expenses.

Figure 1 Actual regional transfers around Subsidy thresholds

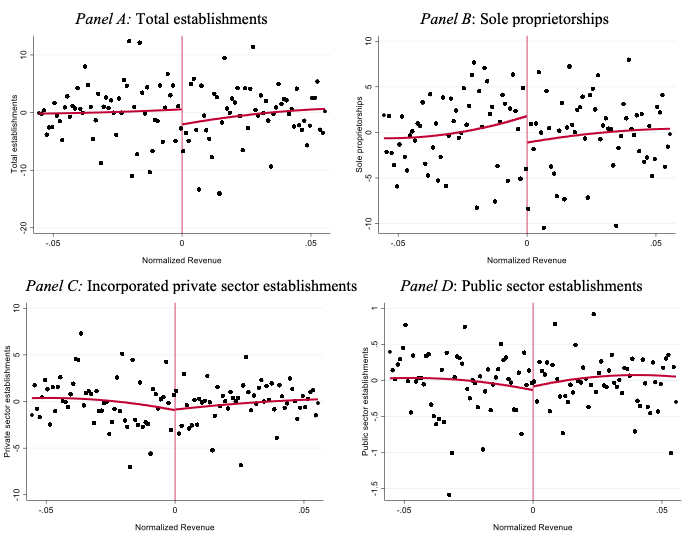

The central part of our analysis finds a significant increase in the number of firms operating in municipalities (Figure 2). We find a 3.2-5.1% increase in the total number of establishments in response to 1% increase in Subsidy funding. This effect is mainly driven by the rise in sole proprietorships. The number of incorporated private sector and public sector firms does not respond to varying levels of fiscal transfers.

Figure 2 Number of per capita establishments around Subsidy thresholds

Additional analysis shows that only small firms with up to nine employees and in easy-to-build sectors (including construction, manufacturing, and retail industries) significantly differ at Subsidy thresholds.

Overall, our baseline results highlight the beneficial role of government funding as a mechanism to alleviate entrepreneurial constraints and spur firm formation. However, this mechanism may suffer from limitations such as weak local institutions and/or an adverse local culture, providing only partial relief. Ultimately, the extent to which fiscal transfers spur entrepreneurial activity largely depends on how efficiently local governments allocate funds. We uncover significant heterogeneity in our main results, stemming from municipal council accountability and council members’ attitude towards entrepreneurship.

First, we document that Subsidy funding provides stronger stimulus to entrepreneurs in municipalities where the number of opposition parties’ councilmembers and the number of parties represented on the municipal council is higher. This is consistent with the notion that a higher degree of political competition, where the opposition is more involved in the legislative process, results in improved political accountability. In turn, the ability to hold politicians accountable was found to significantly enhance governments’ responsiveness to social needs (Besley and Burgess 2002, Strömberg 2004), and economic growth (Besley et al. 2010).

Next, we also find significant heterogeneity in our baseline results between regions in which historical legacies shaped different attitudes towards supporting entrepreneurial activity. Here, we consider the partition of Poland, one of the most significant events in the history of the country. In 1795, the territory of the Kingdom of Poland was divided into partitions, governed by the Kingdom of Prussia, the Russian Empire, and the Austrian Empire (Figure 3). Until 1918, when Poland regained its independence, there existed significant differences in governance of each partition, affecting, among other factors, Polish residents' involvement in the legislative process or the rate of economic development (Davies 2001, Wolf 2007). Grosfeld and Zhuravskaya (2015) document significant cultural differences observed in different regions of present-day Poland resulting from these historical events. Conversely, differences in economic development between regions faded away with time.

Figure 3 Partition of Poland

We find that fiscal transfers result in significantly higher entrepreneurial activity in municipalities that belonged to the partition governed by the Kingdom of Prussia. These results are consistent with the hypothesis suggesting that a much higher rate of industrialisation in this partition resulted in a more positive attitude towards entrepreneurship among its residents, an attitude which has persisted until present years.

Our results inform a recent political debate in Europe, where significant changes to legislatures of several countries are being proposed. These proposed reforms include reducing the size of governments and the representation of political parties in the government. Our findings suggest that any such efforts to reform national as well as local governments, should avoid measures which may negatively affect political accountability. In addition, our results also suggest that in regions where the support for entrepreneurs is insufficient – either because of a low level of political accountability or due to attitudes shaped by historical legacies – perhaps direct grants for specific investment projects could provide a much better stimulus for entrepreneurship compared to fiscal transfers which allow local governments to freely decide how to allocate additional funds.

References

Acemoglu, D and J A Robinson (2012), Why Nations Fail: The Origins of Power, Prosperity, and Poverty, Crown.

Becker, S O, P H Egger and M Von Ehrlich (2013), “Absorptive Capacity and the Growth and Investment Effects of Regional Transfers: A Regression Discontinuity Design with Heterogeneous Treatment Effects”, American Economic Journal: Economic Policy 5: 29-77.

Besley, T and R Burgess (2002), “The Political Economy of Government Responsiveness: Theory and Evidence from India”, The Quarterly Journal of Economics 117: 1415-1451.

Besley, T, T Persson and D M Sturm (2010), “Political Competition, Policy and Growth: Theory and Evidence from the US”, The Review of Economic Studies 77: 1329-1352.

Braggion, F, M Dwarkasing and S Ongena (2020), “Household Inequality, Entrepreneurial Dynamism, and Corporate Financing”, The Review of Financial Studies.

Corbi, R, E Papaioannou and P Surico (2019), “Regional Transfer Multipliers”, The Review of Economic Studies 86: 1901-1934.

Danisewicz, P and S Ongena (2020), “Fiscal Transfers, Local Government, and Entrepreneurship”, CEPR Discussion Paper 15384.

Davies, N (2001), Heart of Europe : the past in Poland's present, Oxford: Oxford University Press.

Grosfeld, I and E Zhuravskaya (2015), “Cultural vs. economic legacies of empires: Evidence from the partition of Poland”, Journal of Comparative Economics 43: 55-75.

Hombert, J, A Schoar, D Sraer and D Thesmar (2020), “Can Unemployment Insurance Spur Entrepreneurial Activity? Evidence from France”, The Journal of Finance 75: 1247-1285.

Kerr, W R and R Nanda (2009), “Democratizing entry: Banking deregulations, financing constraints, and entrepreneurship”, Journal of Financial Economics 94: 124-149.

Strömberg, D (2004), “Radio's Impact on Public Spending”, The Quarterly Journal of Economics 119: 189-221.

Wolf, N (2007), “Endowments vs. market potential: What explains the relocation of industry after the Polish reunification in 1918?”, Explorations in Economic History 44: 22-42.

Endnotes

1 Such debates are currently taking place in France, Greece, and the UK. The results of a recent referendum in Italy show that 70% of the voters support the reduction of the government members by a third.