The economic outlook is gloomy in many countries. Growth is expected to be 2.4% in 2020 – the weakest growth rate since the Global Crisis, despite accommodative financial conditions and signs of easing trade tensions (OECD 2020). Downside risks to the outlook persist, including risks arising from geopolitical tensions, policy uncertainty, and, more recently, from the outbreak of the coronavirus. This outlook raises the question of how policymakers could effectively accommodate a downturn. Monetary policy may not be as effective as in the past. The room for conventional monetary policy is limited or exhausted, as central banks in advanced economies have been operating at or near the effective zero lower bound since the Global Crisis. Unconventional measures may also provide less stimulus as financial conditions have already been very accommodative for an extended period. On the fiscal front, fiscal space differs across countries. A few European economies with relatively low debt have scope to not only let automatic stabilisers operate fully but to also implement discretionary fiscal policy (Boone and Buti 2019). In contrast, for countries with relatively high debt and budget deficits (including France, Japan, Italy, the UK, and the US) the scope for fiscal easing is limited.

Decisions about an optimal fiscal reaction to downturns depend primarily on the size and effectiveness of automatic stabilisers as well as available fiscal space. Automatic stabilisers refer to automatic changes in government spending and revenues that are timely, temporary, and do not require discretionary decisions by authorities. For instance, unemployment benefits rise timely as more workers lose their jobs, are temporary as they diminish with falls in unemployment, and target individuals that are most affected by the downturn. Automatic fiscal stabilisers have traditionally been seen as superior to discretionary fiscal stimulus and are the most effective tool to stabilise the economy after temporary shocks (Blanchard et al. 2010, Sutherland et al. 2010). Further, as no change in legislation is required, automatic stabilisers do not suffer from information, decision, design, and implementation lags contrary to discretionary fiscal measures (Sutherland et al. 2010, Van den Noord 2000).

How effective are automatic stabilisers?

A new OECD analysis (OECD 2019a, Maravalle and Rawdanowicz 2020) assesses the effectiveness of automatic stabilisers in smoothing household disposable income in 23 OECD countries in the context of a specific negative shock to market income. The analysis is based on the national account identity of disposable income and builds on the OECD methodology of measuring cyclically adjusted budget balances (Price et al. 2015). The analysis accounts for automatic fluctuations in selected tax and expenditure categories including personal income taxes, social security contributions, and unemployment, family, and housing benefits.

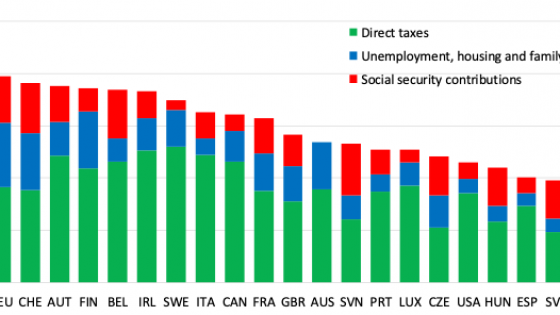

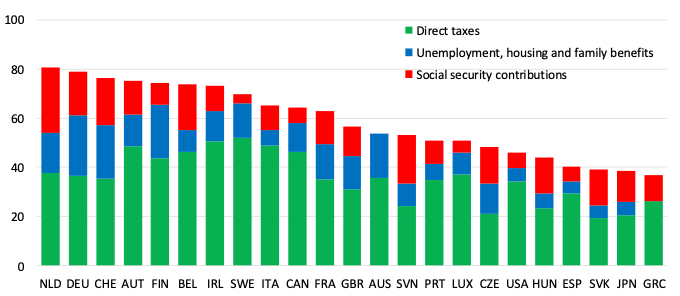

Figure 1 Share of a market income shock offset by specific automatic stabilisers

Note: The figure shows the degree to which a decline in market income is offset by automatic stabilisers one year after the shock. A ratio of 100 implies that automatic stabilisers offset the shock to market income completely, leaving aggregate household disposable income unchanged. A ratio of 0 implies no automatic stabilisation effects at all, with disposable income falling by as much as market income.

Source: Maravalle and Rawdanowicz (2020).

On average, automatic stabilisers absorb around 60% of a specific negative shock to market income across countries (see Figure 1). There are, however, significant differences across economies in the effectiveness of automatic stabilisers, ranging from 80% in some countries like the Netherlands and Germany, to below 40% in other countries like Greece and Japan. Differences across countries mainly reflect non-linear interactions between the size of a specific automatic stabiliser and the set shock scenario analysed, as well as the initial conditions (Maravalle and Rawdanowicz 2020). Figure 1 shows that changes in direct taxes (in green) play the most significant role in stabilising household disposable income in most countries. Rising unemployment, housing, and family benefits (in blue) and falling social security contributions paid by employees (in red) also help buffer the decline in market income, on average in equal proportions across countries.

How can automatic stabilisers become more effective?

If automatic stabilisers play a useful role, a natural question is whether policymakers could increase the degree of automatic stabilisation -- by rising marginal tax rates or the size of the public sector for example -- without introducing distortions to long-term growth. In the following, we illustrate several options, both on the spending and on the tax side, through which automatic stabilisers may be strengthened. If applicable, we further discuss how countries fared after implementing such measures.

On the spending side, automatic stabilisers can be strengthened by building automatic triggers into unemployment insurance schemes which are linked to the business cycle. In such schemes, the generosity of unemployment benefits automatically depends on the extent and the duration of a downturn. In Canada for instance, eligibility conditions are eased and the length and the level of allowances increases automatically if the regional unemployment rate exceeds some fixed thresholds (OECD 2011). Similarly, the US has a joint state-federal programme, called extended benefits, which allows states to extend the duration of unemployment benefits automatically if their unemployment rate crosses a certain threshold (Chodorow-Reich and Coglianese 2019). However, assessing the effectiveness of this programme is challenging as only a few states have ever opted in and extended benefit duration in a downturn.

Another option to strengthen automatic stabilisers that countries have turned to is implementing automatic or quasi-automatic rules which make spending on active labour market policies contingent on the economic cycle (OECD 2019b). Such rules are currently in place in Australia, Denmark, and Switzerland. If effective, spending on active labour market policies reduces unemployment which in turn sustains individual’s incomes while limiting unemployment spending.

Short-time working schemes are a third option to strengthen automatic stabilisers on the spending side. Such schemes make it easier for employers to temporarily reduce hours worked as they compensate workers for the loss of income incurred due to fewer hours. During the 2008-2009 recession, many OECD countries (e.g. Belgium, Turkey, Italy, Germany, and Japan) successfully implemented such short-time working schemes. They are found to not only have reduced job losses but to have further provided income support for affected employees (OECD 2010, Hijzen and Martin 2013).

A last option is making transfers to local governments more contingent on the economic cycle. This might be useful as subnational governments are often bound by balanced budget requirements, which fuel procyclicality, because local expenditure and revenue move together (Boushey et al. 2019, Mohl et al. 2019). Sweden is currently looking into implementing this option in order to mitigate the adverse impact of fiscal decentralisation on macroeconomic stabilisation.

Also the tax side holds several options to strengthen automatic stabilisers. A first option is to link tax collection more closely to the current economic cycle. Governments could collect taxes based on estimates of current income as opposed to actual income from the previous year. The US, UK, and France have all implemented such “pay-as-you-earn” systems. Another option is to link the collection of real estate property taxes more closely to the real estate cycle to lower the tax burden in a recession. However, this requires both frequent and objective assessment of real estate property values. Ideally, real estate property values should be estimated by an independent body or a specialised governmental organisation on an annual basis as it is done in Iceland and the Netherlands (Almy 2014).

A further option is automatic investment tax deductions. Such deductions can help reduce the cost of capital, ease credit constraints and stimulate investment during downturns (Blanchard et al. 2013). Cyclical bonus depreciations allow businesses to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery, rather than making this deduction spread out through the useful life of the asset. Evidence from the US suggests that such bonus depreciation raised investment in eligible capital by 17% between 2008-2010. The effect was largest among small firms which are typically the most liquidity-constrained (Zwick and Mahon 2017). Finally, cyclical loss-carry backward allows an individual or business to deduce current corporate losses in order to receive an immediate refund of previously paid taxes. This has been implemented in some advanced economies such as Canada, France, Germany, the UK, and the US where hard-hit companies are eligible for immediate tax refunds during recessions.

Conclusion

Given that monetary policy may not be able to effectively accommodate the next recession, policymakers will need to rely increasingly on fiscal stimulus. Automatic stabilisers have a comparative advantage over discretionary measures as they are timely, temporary, and targeted. Further, while they are typically effective in stabilising household income in most OECD economies, there are large differences across countries. Hence, it is important to find the best way to strengthen automatic stabilisers without introducing distortions ahead of the next recession, especially for countries with weak automatic stabilisers. Possible options on the spending side include installing automatic triggers into certain government spending categories such as unemployment insurance schemes or spending on active labour market policies,. Other possibilities are fiscal support for short-time working schemes or transfers to local governments that are more contingent on the economic cycle. Options on the tax side include tax collection schemes that are more closely linked to the current economic cycle as well as automatic investment tax deductions.

Authors’ note: The opinions expressed in this column are those of the authors and do not necessarily reflect the views of the OECD.

References

Almy, R (2014), "Valuation and Assessment of Immovable Property", OECD Working Papers on Fiscal Federalism No. 19, OECD Publishing, Paris.

Blanchard, O, G Dell’Ariccia and P Mauro (2010), “Rethinking macroeconomic policy”, Journal of Money, Credit and Banking, 42(1): 199–215.

Blanchard, O, G Dell’Ariccia, and P Mauro (2013), “Rethinking Macro Policy II: Getting Granular”, IMF Staff Discussion Note 13/03.

Boone, L and M Buti (2019), “Right here, right now: The quest for a more balanced policy mix”, VoxEU.org, 18 October.

Boushey, H, R Nunn and J Shambaugh (2019), Recession Ready: Fiscal Policies to Stabilize the American Economy, The Hamilton Project, Washington Center for Equitable Growth.

Chodorow-Reich, G, J Coglianese and L Karabarbounis (2019), “The Macro Effects of Unemployment Benefit Extensions: A Measurement Error Approach”, Quarterly Journal of Economics 134(1): 227-279.

Hijzen, A and S Martin (2013), “The Role of Short-Time Work Schemes during the Global Financial Crisis and Early Recovery: A Cross-Country Analysis”, IZA Discussion Paper Series No. 7291, March.

Maravalle, A and Ł Rawdanowicz (2020), “How Effective Are Automatic Fiscal Stabilisers in the OECD Countries”, OECD Economics Department Working Papers, forthcoming.

Mohl, P, G Mourre and K Stovicek (2019), “Automatic Fiscal Stabilisers in the EU: Size and Effectiveness”, European Commission Economic Brief 45.

OECD (2010), “Supporting Labour Demand”, Position Paper, OECD Publishing, Paris.

OECD (2011), OECD Employment Outlook, OECD Publishing, Paris.

OECD (2019a), OECD Economic Outlook, Volume 2019, Issue 2, OECD Publishing, Paris.

OECD (2019b), OECD Employment Outlook, OECD Publishing, Paris.

OECD (2020), OECD Interim Economic Outlook, OECD Publishing, Paris, March.

Price, R, T Dang and J Botev (2015), “Adjusting Fiscal Balances for The Business Cycle: New Tax and Expenditure Elasticity Estimates for OECD Countries”, OECD Economics Department Working Papers No. 1275.

Sutherland, D, P Hoeller, E Balazs and O Rohn (2010), “Counter-cyclical Economic Policy”, OECD Economics Department Working Papers No. 760.

Van den Noord, P (2000), “The size and role of automatic fiscal stabilisers in the 1990s and beyond”, OECD Economics Department Working Papers No. 230.

Zwick, E and J Mahon (2017), “Tax Policy and Heterogeneous Investment Behavior”, American Economic Review 107(1): 217-248.