A core issue in asset pricing is the need to understand the relationship between fundamental macroeconomic conditions and asset market returns (Cochrane 2005, 2017). Nowhere is this more central, and yet consistently difficult to establish, than in the foreign exchange (FX) market, in which currency returns and country-level fundamentals are highly correlated in theory, and yet the empirical relationship is typically found to be weak (Meese and Rogoff 1983, Rossi 2013). A recent literature in macro-finance has documented, however, that the behaviour of exchange rates becomes easier to explain once exchange rates are studied relative to one another in the cross section, rather than in isolation (e.g. Lustig and Verdelhan 2007).

Building on this simple insight, in a recent paper we test whether relative macroeconomic conditions across countries reveal a stronger relationship between currency market returns and macroeconomic fundamentals (Colacito et al. 2019). The focus is on investigating the cross-sectional properties of currency fluctuations to provide novel evidence on the relationship between currency returns and country-level business cycles. The main finding of our study is that business cycles are a key driver and powerful predictor of both currency excess returns and spot exchange rate fluctuations in the cross section of countries, and that this predictability can be understood from a risk-based perspective. Let’s understand where this result comes from, and what it means.

Measuring business cycles across countries

Business cycles are measured using the output gap, defined as the difference between a country's actual and potential level of output, for a broad sample of 27 developed and emerging-market economies. Since the output gap is not directly observable, the literature has developed filters that allow us to extract the output gap from industrial production data. Essentially, these measures define the relative strength of the economy based on its position within the business cycle, i.e. whether it is nearer the trough (weak) or peak (strong) in the cycle.

Sorting countries/currencies on business cycles

Using monthly data from 1983 to 2016, we show that sorting currencies into portfolios on the basis of the differential in output gaps relative to the US generates a monotonic increase in both spot returns and currency excess returns as we move from portfolios of weak to strong economy currencies. This means that spot returns and currency excess returns are higher for strong economies, and that there is a predictive relationship running from the state of the relative business cycles to future movements in currency returns.

Is this not the same as carry trades?

Importantly, the predictability stemming from business cycles is quite different from other sources of cross-sectional predictability observed in the literature. Sorting currencies by output gaps is not equivalent, for example, to the currency carry trade that requires sorting currencies by their differentials in nominal interest rates, and then buying currencies with high yields and selling those with low yields.

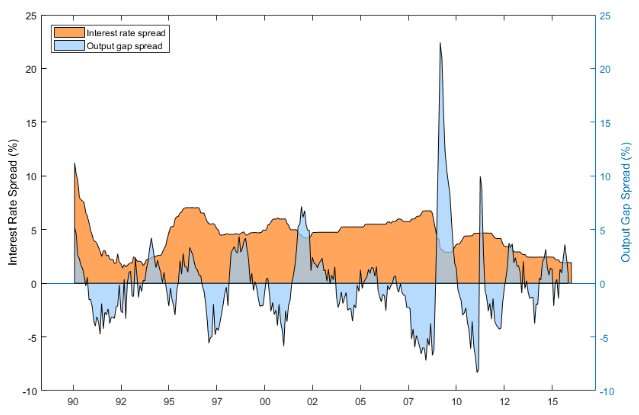

This point can be seen clearly by looking at Figure 1 and examining two common carry trade currencies – the Australian dollar and Japanese yen. The interest rate differential is highly persistent and consistently positive between the two countries in recent decades. A carry trade investor would have thus always been taking long the Australian dollar and short the Japanese yen. In contrast the output gap differential varies substantially over time, and an output-gap investor would have thus taken both long and short positions in the Australian dollar and Japanese yen as their relative business cycles fluctuated. Moreover, the results reveal that the cross-sectional predictability arising from business cycles stems primarily from the spot exchange rate component, rather than from interest rate differentials. That is, currencies of strong economies tend to appreciate and those of weak economies tend to depreciate over the subsequent month. This feature makes the returns from exploiting business cycle information different from the returns delivered by most canonical currency investment strategies, and most notably distinct from the carry trade, which generates a negative exchange rate return.

Figure 1 Disparity between interest rate and output gap spreads

Is this useful to forecasting exchange rates out of sample?

The above discussion is based on results obtained using the full time-series of industrial production data observed in 2016. This exercise allows one to carefully show the relationship between relative macroeconomic conditions and exchange rates by exploiting the longest sample of data to formulate the most precise estimates of the output gap over time. Indeed, in the international economics literature it has been difficult to uncover a predictive link between macro fundamentals and exchange rates even when the econometrician is assumed to have perfect foresight of future macro fundamentals (Meese and Rogoff 1983). However, this raises questions as to whether the relationship is exploitable in real time. In Colacito et al. (2019) we explore this question using a shorter sample of ‘vintage’ data beginning in 1999 and find that the results are qualitatively identical. The vintage data mimics the information set available to investors and thus sorting is conditional only on information available at the time. Between 1999 and 2016, a high-minus-low cross-sectional strategy that sorts on relative output gaps across countries generates a Sharpe ratio of 0.72 before transaction costs, and 0.50 after costs. Similar performance is obtained using a time-series, as opposed to cross-sectional, strategy. In short, business cycles forecast exchange rate fluctuations out of sample.

The GAP risk premium

It seems reasonable to argue that the returns of output gap-sorted portfolios reflect compensation for risk. In our work, we test the pricing power of conventional risk factors using a variety of common linear asset pricing models, with no success. However, we find that business cycles proxy for a priced state variable, as implied by many macro-finance models, giving rise to a ‘GAP risk premium’. The risk factor capturing this premium has pricing power for portfolios sorted on output gaps, carry (interest rate differentials), momentum, and value.

These findings can be understood in the context of the international long-run risk model of Colacito and Croce (2011). Under mild assumptions concerning the correlation of the shocks in the model, it is possible to show that sorting currencies by interest rates is not the same as sorting by output gaps, and that the currency GAP premium arises in equilibrium in this setting.

Concluding remarks

The evidence discussed here makes a compelling case that business cycles, proxied by output gaps, are an important determinant of the cross-section of expected currency returns. The primary implication of this finding is that currencies of strong economies (high output gaps) command higher expected returns, which reflect compensation for business cycle risk. This risk is easily captured by measuring the divergence in business cycles across countries.

References

Cochrane, J H (2005), Asset Pricing, Revised Edition, Princeton University, Princeton NJ.

Cochrane, J H (2017), “Macro-finance”, Review of Finance, 21, 945–985.

Colacito, R, and M Croce (2011), “Risks for the long-run and the real exchange rate”, Journal of Political Economy, 119, 153–181.

Colacito, R, S J Riddiough, and L Sarno (2019), “Business cycles and currency returns”, CEPR Discussion Paper no. 14015, Forthcoming in the Journal of Financial Economics.

Lustig, H, and A Verdelhan (2007), “The cross-section of foreign currency risk premia and consumption growth risk”, American Economic Review, 97, 89–117.

Meese, R A, and K Rogoff (1983), “Empirical exchange rate models of the seventies: Do they fit out of sample?”, Journal of International Economics, 14, 3–24.

Rossi, B (2013), “Exchange rate predictability”, Journal of Economic Literature, 51, 1063–1119.