In today’s world, numerous websites provide information on product prices, availability, and quality measures. These websites have had a tremendous impact on consumers and firms. As is often the case, however, the public sector has been quite slow to adapt to these technological changes, and government agencies have only recently begun to embrace measures that take advantage of the Internet as a means to disclose information. For instance, public entities have now begun to publish online information about employees’ wages. Mas (2017) examined the impact of a California mandate that required municipal salaries to be posted online and found that among top managers, salary disclosure led to an approximately 7% decline in average compensation.

Another type of a regulatory intervention imposes a mandate on firms to disclose real-time prices. To illustrate, in Argentina, Uruguay, and Mexico, retailers are required by law to post online the prices of many of the products they sell. In other countries, such as Germany, Italy, Australia, South Korea, and Chile, gasoline prices are now available online. While the motivation behind these transparency regulations is to foster competition and incentivise retailers to lower prices, the availability of price information can also be detrimental to competition, as firms can use this information to coordinate prices. Clearly, if the pro-competitive impact of price transparency is stronger than its anti-competitive impact, then it is worthwhile for policymakers to advance policies that mandate price disclosure. On the other hand, if such initiatives actually help firms to tacitly collude, then such policies should be abandoned. In fact, papers that examined the effects of such mandatory transparency regulations in gasoline markets in Chile (Luco 2017) and Australia (Byrne and De Roos 2017) have shown that prices have increased.

Price transparency in the Israeli supermarket industry

In a recent paper, we study the impact of a mandatory price disclosure regulation in the Israeli supermarket industry (Ater and Rigbi 2017). The food retail industry is an important domain to study the impact of transparency, given that Israeli consumers spend about one-sixth of their disposable income on food. Furthermore, fluctuations in food prices have the potential to drive profound societal effects. Indeed, food prices worldwide underwent a steep increase between 2005 and 2011, and this increase was associated with social unrest and even violence in both developed and developing countries. For example, Spain, Greece, and Israel have witnessed social unrest that is often linked to the rise in food prices. In Israel, social protests in 2011 ultimately culminated in the legislation of the Food Act in March 2014. An important component of the Food Act was a clause requiring supermarket chains in Israel to post their prices online and to update their prices continuously. This requirement came into effect in May 2015, and since then Israeli supermarkets have been posting and continuously updating the prices of each and every item sold in their stores. Soon after May 2015, independent websites began to offer price comparison services that are freely available to consumers. We take advantage of this change, and also overcome several empirical challenges, to evaluate the effects of transparency on the prices that retailers set, and then examine how these effects vary across stores and products.

Overcoming the empirical challenges

The first empirical challenge is the need to access price data corresponding to the periods before and after the change in transparency, when such data may not be readily available. To address this challenge, we exploited the fact that the Food Act went into effect more than a year after it was passed in parliament. Over the course of that year, we collected data on prices from a sizable basket from many bricks-and-mortar stores located throughout the country. After the regulation came into effect, we obtained data from one of the price comparison platforms.

Another main challenge is the need to take into account – aside from transparency – other factors (such as local competition, costs and seasonality) that might also affect pricing decisions. Because these factors may change over time, it is inherently difficult to attribute changes in prices to a change in transparency. Our research design addresses these concerns by comparing changes in prices among a group of ‘treatment’ items, i.e. comparing items whose prices became transparent after the regulation against price changes in four distinct control groups. The first control group consists of the same products included in the treatment group, but sold through the online channels of the various supermarket chains considered. These items constitute a useful control group because their prices were transparent before the regulation became effective and remained transparent thereafter. The second control group consists of products, which do not overlap with the products in the treatment group, whose prices in specific stores have been collected by the Israeli Consumer Council (ICC). The prices of these products were publicly available and were often cited in the media and referred to in advertising campaigns as a reliable source of price data. Thus, the products in the ICC basket effectively constitute another set of items whose prices were transparent even before the transparency regulation came into effect. The third control group consists of products that also appear in the treatment group, but are sold in drugstores which were exempt from the Food Act. The final control group consists of products in the treatment group, but sold in mom-and-pop grocery stores, which were also exempt from the transparency regulation. We then use the treatment group and the four control groups to compare the change in prices of items in the treatment group against the respective change in prices of items in the control groups.

Our findings: Transparency reduced both the dispersion and level of prices

In our first analysis, we examine how price dispersion changed after the transparency regulation came into effect. We find that shortly after prices became transparent, the average number of distinct prices that a given item was sold for in brick-and-mortar supermarket stores decreased significantly. Before prices became transparent, there were 16 distinct prices per item, on average, across the 61 stores. After prices became transparent, the average number of distinct prices across these stores fell to about five, resulting in lower price dispersion overall, and nearly uniform pricing across stores affiliated with the same chain. These findings can be observed in Figure 1, which presents a time series of the average number of distinct prices per item in the treatment group and for the first and second control groups, i.e. items that were sold through chains' online channels and items in the ICC basket.

Figure 1 Price dispersion before and after the transparency regulation

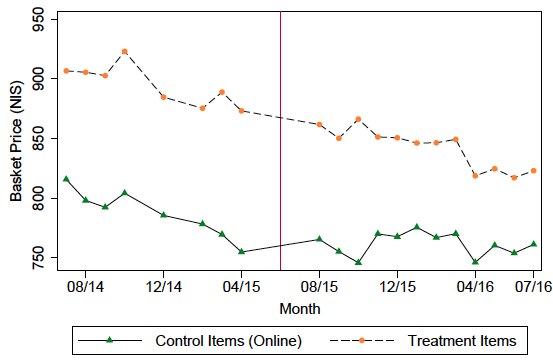

As far as price levels are concerned, we find that that after the regulation took effect, prices of items in the treatment group decreased 4-5% more than did the prices of items in the various control groups (the treatment group prices fell by 2% whereas the prices of items in the various control group largely increased by a similar magnitude). To illustrate this change, Figure 2 shows a time series of the average basket price in the treatment group and in the online channel.

Figure 2 Average basket price in treatment vs. online channel

In additional analyses, we find that prices primarily decreased among chains that are considered more expensive, whereas the impact of the regulation on heavy-discount chains was largely insignificant. Furthermore, prices declined less in supermarkets that faced fiercer local competition. Arguably, consumers who purchase at heavy-discount chains or at stores that face fiercer competition searched for better deals already before prices became transparent. Therefore, price transparency is likely to have less of an impact in these stores. Furthermore, we show that the reduction in prices is negatively associated with the extent to which customers used websites that offer price comparison services. In particular, there was an increase in usage of the three websites at the beginning of 2016, a period when prices significantly declined. The findings also highlight the role of the media in disciplining retailers' pricing decisions, since media outlets can act as intermediaries in disseminating available price information to the market.

Overall, the findings in the study offer solid evidence that support the adoption of similar regulations. On average, Israeli consumers saved about $27 per month after the transparency regulation. However, a word of caution is necessary owing to the fact that the analysis focuses only on the first year after the regulation became effective, and that the results regarding the change in prices could alter in the long run.

References

Ater, I, and O Rigbi (2017), “The effects of mandatory disclosure of supermarket prices”, CEPR Discussion Paper no. 12381.

Byrne, D P, and N de Roos (2016), “Learning to coordinate: A study in retail gasoline”, working paper.

Luco, F (2017), “Who benefits from information disclosure? The case of retail gasoline”, working paper.

Mas, A (2017), “Does transparency lead to pay compression?”, Journal of Political Economy 5(125): 1683–1721.