Large firms play a pivotal role in international trade. A significant share of exports is done by a small number of these large firms, which enjoy substantial market power across destination countries, as documented in Freund and Pierola (2015).1 The fates of these large firms shape, in part, the countries’ trade patterns. For instance, Nokia in Finland or the Intel plant in Costa Rica have profoundly altered the specialization and export intensity of these countries.2 The importance of large firms is also reflected in trade and industrial policies that are often so narrow that they appear to be tailor-made for individual firms rather than industries.3

In our new paper (Gaubert and Itskhoki 2020), we study the role of individual firms in determining the comparative advantage of countries. We aim to disentangle the role of common characteristics of all firms in a given sector — such as the availability of specific human capital, infrastructure, and technology — from the role played by individual firms and their specific know-how and managerial talent in shaping a country’s comparative advantage. We call the former Fundamental Comparative Advantage (FCA) and the latter Granular Comparative Advantage (GCA). Our analysis is based on an international trade model in which a finite number of firms operate in each sector to allow large firms to potentially shape sectoral outcomes. This approach is in stark contrast to much of the literature that assumes a continuum of infinitesimal firms, leaving no room for individual firms to affect sectoral trade.

The concept of granular comparative advantage (GCA) is perhaps best illustrated with a hypothetical example. Suppose, for instance, that a given firm and its technological know-how disappear. How does the export stance of the sector change? If comparative advantage is only shaped by sector-country characteristics, it does not change. This is equivalent to the neoclassical benchmark where other domestic firms in the sector expand to absorb the market share of the exiting firm. However, if comparative advantage is in part driven by the performance of individual firms, then the export stance of the sector will change as the firm disappears with its specific strengths. In this world, the firm’s market share is taken over by other domestic firms that contribute differently to export patterns, or even by foreign firms. Granular versus fundamental forces therefore have different implications for the evolution of comparative advantage over time. When comparative advantage comes in part from granularity, standard firm dynamics — whereby individual firms gain and lose market shares to other domestic firms — result in changing sectoral exports.

Granular export patterns in the data

If granular forces shape, in part, trade patterns, one would expect that the presence of a few unusually large firms in a given sector correlates positively with the aggregate export intensity of the sector.4 We turn to French firm-level data to test for such empirical patterns. Our baseline analysis is done at the level of 4-digit manufacturing sectors: the industrial production is split into approximately 300 sectors with 350 firms on average. Using this dataset, we proxy for sectoral granularity by measuring the concentration of domestic sales among domestic firms. This measure identifies sectors with unusually large domestic firms, and is not directly affected by the international competitiveness of the sector. We then use this measure to predict both the contemporaneous export stance of the sector as well as its evolution over time, controlling for the overall size of the sector.

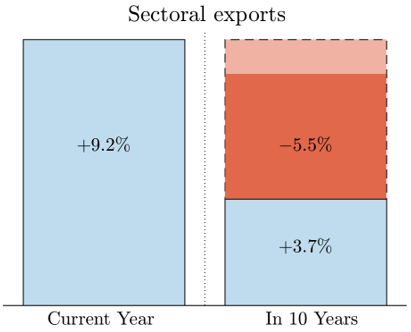

Figure 1 Granularity and sectoral exports in the data

Note: The figure plots the predicted effect on overall sectoral exports in sectors with a 10 percentage points higher top-3 domestic concentration ratio.

Figure 1 summarizes our findings. It illustrates that a sector with a 10 percentage points higher top-3 firm concentration ratio (relative to an average sector with a 35% top-3 concentration ratio) exports on average 9.2% more in the current year. Furthermore, we find that a higher concentration ratio also predicts higher mean reversion in aggregate exports in subsequent years. While granularity in general, and firm concentration in particular, are persistent characteristics of sectors, they nonetheless tend to mean revert over the medium-to-long run, and with them, so do sectoral export outcomes. Specifically, as reflected by the second bar in the figure, the same sector is expected to lose 5.5% of its total exports over the next 10 years, reducing its export advantage from 9.2% to 3.7% relative to an average sector in the economy. This is a much faster reversion in sectoral exports relative to what is expected in non-granular comparative-advantage sectors, as we illustrate with the light portion of the orange area in Figure 1 (1.2% loss in exports versus 5.5% for granular sectors). Overall, we find that proxies of sectoral granularity correlate both with the current export advantage of sectors, as well as with their future decline towards the mean.

Quantifying granular comparative advantage (GCA)

To measure the contribution of granularity to a country’s comparative advantage, we choose a structural approach. We develop a multi-sector granular model of trade. Formally, the model combines Ricardian comparative advantage across sectors, as in Dornbusch et al. (1977), with the Melitz (2003) model of firm heterogeneity within sectors, in which we relax the assumption of a continuum of firms, following Eaton et al. (2012). This allows the model to simultaneously nest fundamental and granular comparative advantage in a unified framework: a large, yet finite number of firms operates in each sector, with the largest firm often claiming a massive share of the sectoral market. Under these circumstances the productivity of individual firms does not average out at the sectoral level. It therefore shapes realized sectoral productivities, and hence comparative advantage.

We estimate the model with the simulated method of moments using data on domestic and export sales of French firms across manufacturing industries. In particular, we target moments that summarize the extent of firm concentration (number of firms, market share of top firms across industries), as well as the correlation of firm concentration with sectoral trade patterns.

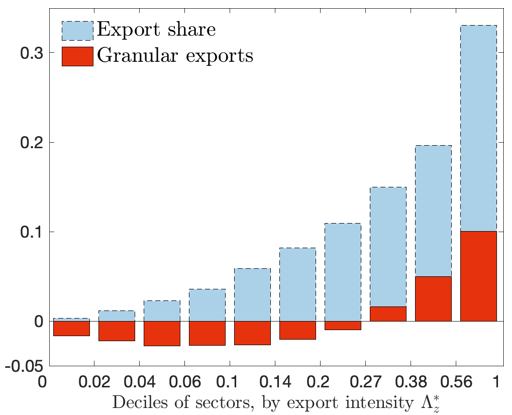

Figure 2 Granular contribution to sectoral exports in the model

Note: The figure splits sectors into 10 equal-sized bins (deciles) by export share Λ∗z , the ratio of exports to foreign absorption, and plots the contribution of sectors to aggregate exports (dashed blue bars, which sum to 1) and the contribution of granularity to sectoral exports (solid red bars, which sum to 0) within each bin.

Using the estimated granular model, we find that a significant part of trade flows is of a granular origin (around 20%), and that the contribution of granularity is particularly pronounced in the most export-intensive sectors — the export champions of the country. This is illustrated in the left panel of Figure 2, where sectors are binned by export intensity. We plot the contribution of each bin to aggregate exports (dashed blue bars), and the portion of this contribution which is of granular origin (solid red bars). Note that the cumulative height of all blue bars is 1 (aggregate exports), while the cumulative height of all red bars is zero, since we construct granular contribution as a residual that is zero on average. In other words, granularity creates additional trade in a few sectors that host unusually large firms, which is compensated by ‘missing’ trade in non-granular sectors without such firms-outliers. We find that the most export-intensive sectors are exactly the sectors where the granular contribution to trade is net positive and accounts for a substantial fraction of trade flows. Overall, these patterns suggest that granularity shapes trade flows, and it does so in a concentrated way among the most export-intensive sectors.

We finally turn to the dynamic implications of granularity for the evolution of comparative advantage over time. This analysis is motivated in particular by Hanson et al. (2018) who document two striking empirical patterns:

(i) hyper-specialization of exports: with about 100 sectors in their data, a single top sector accounts for 21% of a country’s total exports on average across countries, while the three top sectors account for 43%

(ii) high turnover of comparative advantage: a top-5 sector in terms of export intensity has only a 50:50 chance of staying among the top-5 two decades later.

The combination of these two facts is indeed intriguing: countries appear to exhibit extreme specialization, yet their comparative advantage tends to change significantly over the medium run.

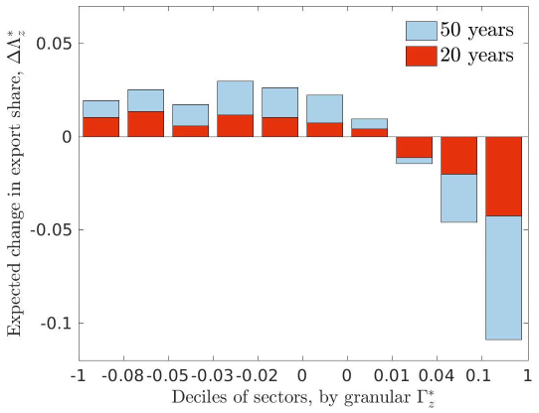

Figure 3 Mean reversion in export shares

Note: The figure splits sectors into 10 equal-sized bins (deciles) by granular export share Γ∗z = Λ∗z −Φ∗z , where Φ∗z = EΛ∗z is the fundamental (non-granular) export share, and plots the expected change in the overall sectoral export share Λ∗z within each bin over the next 20 (50) years.

Figure 3 plots the predicted change in sectoral export intensity over the next 20 and 50 years in the quantified model. Sectors are binned by importance of granularity for exports in the initial period. We see that granularity in the initial period predicts mean reversion in sectoral exports: sectors with strong granular trade are predicted to see a rather fast reversal in their comparative advantage, while non-granular sectors are expected to gradually gain export shares over time. Quantitatively, granular forces account for about a third of the year-to-year changes in sectoral export shares and nearly a half of the mean reversion in comparative advantage of sectors, consistent with our empirical findings illustrated in Figure 1. Our dynamic granular model is consistent with both the hyper- specialization of countries in a few industries at any given point in time and a relatively fast mean reversion in comparative advantage over time, which is especially pronounced in the most granular sectors.5

Overall, we find that large individual firms appear to be a quantitatively important force in driving the comparative advantage of countries and its evolution over time. The granular structure of the world economy arguably offers incentives for governments to adopt trade and industrial policies targeted at individual firms. The implication of granular comparative advantage for policies in an open economy is an important and fascinating question that we are studying next in Gaubert et al. (2020).

References

Blonigen, B A and T J Prusa (2008), “Antidumping”, in E Choi, and J Harrigan (eds) Handbook of International Trade Hoboken: Wiley-Blackwell.

Dornbusch, R, S Fischer and P A Samuelson (1977), “Comparative Advantage, Trade, and Payments in a Ricardian Model with a Continuum of Goods”, American Economic Review 67(5): 823–839.

Eaton, J, S Kortum and S Sotelo (2012), “International Trade: Linking Micro and Macro”, NBER Working Papers No. 17864.

Freund, C and M D Pierola (2015), “Export superstars”, Review of Economics and Statistics 97(5): 1023–1032.

Gaubert, C and O Itskhoki (2020), “Granular Comparative Advantage”, Journal of Political Economy, forthcoming,

Gaubert, C, O Itskhoki and M Vogler (2020), “Government Policies in a Granular Global Economy”, work in progress.

Hanson, G H, N Lind and M-A Muendler (2018), “The Dynamics of Comparative Advantage”, Manuscript, Department of Economics UCSD.

Melitz, M J (2003), “The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity”, Econometrica 71(6): 1695–1725.

Endnotes

1 In their “Export superstars” paper, they find that a single largest exporting firm accounts for 17% of total manufacturing exports, on average across 32 developing and middle-income countries in their dataset. In the French manufacturing dataset used in this paper, the largest firm accounts for 7% of all manufacturing exports, and within 4-digit industries the largest firm accounts on average for 28% of the industry exports.

2 In Costa Rica, Intel decided to close its microchip plant and move it to Asia in 2014. The electronics sector represented a steady 27% of Costa-Rican exports until 2013, yet starting 2015 it fell to just 8%. In Finland, Nokia at its peak in the mid-2000s enjoyed a 25% share of total Finnish exports, a 3.7% share of Finnish GDP, and a 39% share of the global mobile phone market, before collapsing following the smartphone revolution launched by Apple, and being eventually bought-out by Microsoft in 2013.

3 Recent examples of international antitrust regulations are the 2007 case of the European Commission (EC) against Microsoft Corporation and the 2017 fine imposed by the EC on Google. A very recent case of a granular trade war is the 292% tariff imposed by the US on a particular jet produced by the Canadian Bombardier. ‘Granular’ tactics are particularly widespread in antidumping retaliation (see Blonigen and Prusa 2008) and international sanctions (as in the recent case of the US against the Chinese ZTE). The ongoing US-China battle over TikTok is another interesting case of a "granular" international conflict.

4 Conversely, if granular comparative advantage were unimportant, we would expect the opposite correlation pattern, as sectors with fundamental comparative advantage are likely to feature a greater entry of domestic firms, at the expense of foreign firms, reducing the sales concentration at the top among the domestic firms.

5 In addition, in the granular model, the exit of a single firm in a given industry can have a marked impact on the country’s comparative advantage — an effect that is absent in models with a continuum of firms. The largest exporter accounts on average for over a quarter of total sectoral exports, and if such an exporter fails and exits, its market share is redistributed to both home and foreign firms. In strongly granular sectors, much of this reallocation is towards foreign firms, reflecting a loss in comparative advantage. A single large firm leaving the industry can flip the sector from comparative advantage into disadvantage, echoing the anecdotal evidence on Nokia in Finland and the Intel plant in Costa Rica described in footnote 2.