From the shortage of sanitary equipment to the shortage of microchips, global supply chains have been at the heart of economic and policy debates since the beginning of the Covid-19 pandemic. Both the US and EU recovery plans mention the resilience of supply chains as a policy objective.1

We know from previous work that global value chains (GVCs) are a channel of the propagation of supply chain disruptions (Boehm et al. 2015, Carvalho et al. 2021). The propagation of shocks along GVCs has been pervasive in the wake of the Covid crisis (Baldwin and Freeman 2020, Bonadio et al. 2020, Gerschel et al. 2020, Meier and Pinto 2020, Heise 2020). In a recent paper (Lafrogne-Joussier et al. 2021), we go one step further in the analysis and investigate how firms involved in GVCs can mitigate the effect of supply chain disruptions. The goal is to contribute to the debate on the resilience of GVCs through a detailed analysis of the impact of an adverse supply shock, its propagation along value chains, and the types of buffers that help absorb the shock. We most notably focus on two such buffers: the geographic diversification of input sourcing, and firms’ inventory management.

We find evidence that inventory management helped firms weather the supply shock induced by the Chinese lockdown in early 2020 while we find no evidence that geographic diversification helped. To understand how we get to this result, let us first detail the quasi-natural experiment that we exploit.

The early lockdown in China as a case study of an input disruption

At the beginning of the Covid crisis was the lockdown in China. In late January 2020, factories in the province of Hubei were forced to slow down production after the Chinese New Year. Firms around the world relying on intermediate inputs manufactured in this province faced an input disruption while Covid was still largely restricted to China. The early lockdown in China thus provides a natural experiment of an upstream supply chain disruption faced by firms relying on China for their intermediate inputs.

Based on monthly data on firm-level imports, exports, and domestic sales, we compare the performance of French firms exposed to the Chinese lockdown relative to other importing French firms in the first months of 2020. We rely on the trade activity of firms before the pandemic to identify those participating in GVCs. We compare the imports, exports, and domestic sales of GVC firms that rely on Chinese manufacturers for inputs (‘treated firms’) to the activity of comparable firms that purchase their inputs outside of China (‘control firms’), between February and June 2020.

The productivity slowdown in China indeed translated into in a 7% drop in overall imports for exposed firms, in comparison with the control group. The volume of imports of treated firms starts decreasing as early as in February 2020 for firms that rely on air freight, but the bulk of the effect is measured in March and April 2020 when imports by sea freight start decreasing as well.

Propagation of the supply shock

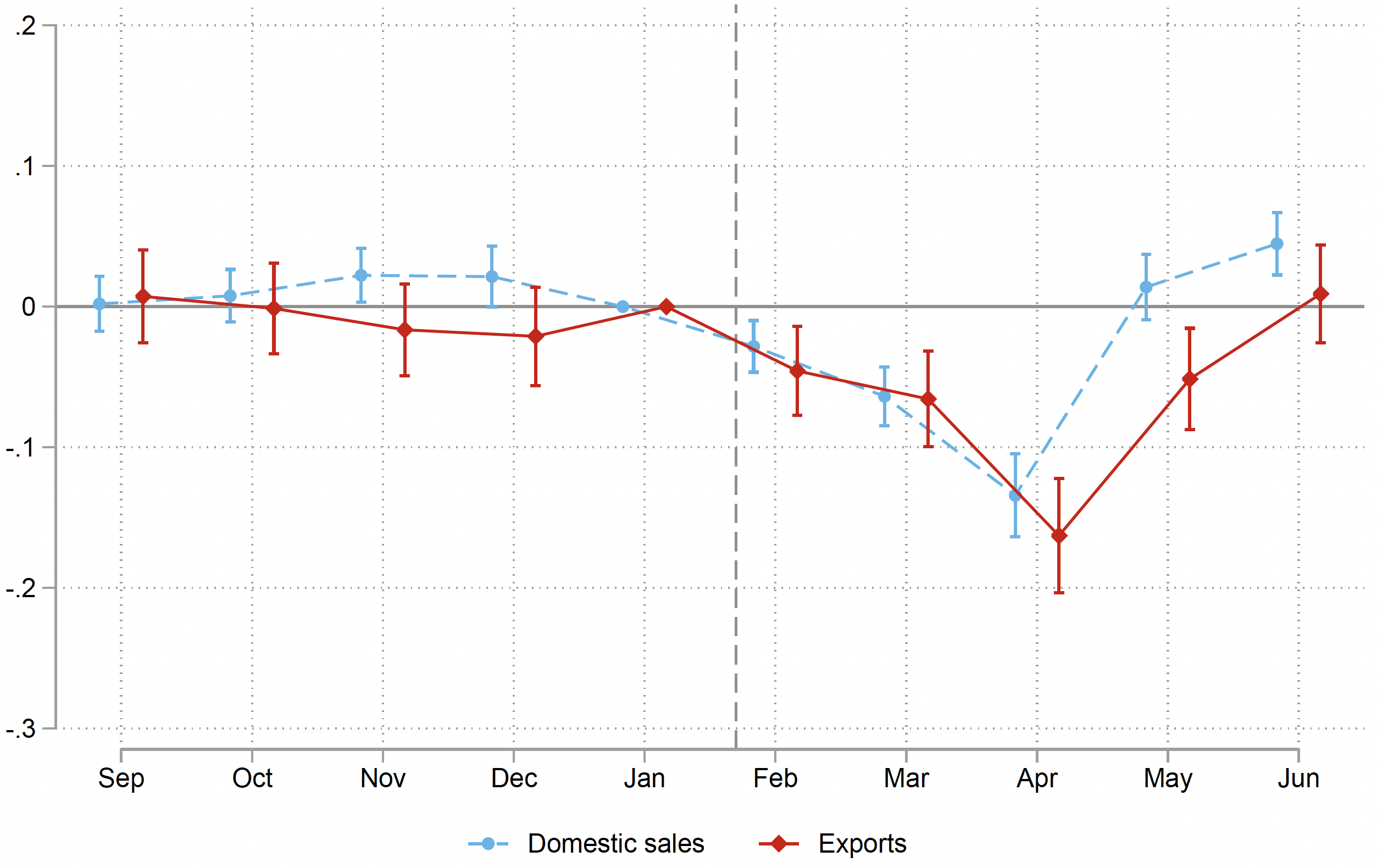

We next turn to the propagation of the shock downstream using the same empirical strategy. Figure 1 displays the time pattern of the drop in domestic and export sales of exposed firms relative to non-exposed firms. The overall size of the decrease is about 5% for both exports and domestic sales, which means that the sales of exposed firms decreased by 5% more than the sales of control firms, between February and June 2020. The shape of the drop is similar on domestic sales and exports, suggesting that the export slowdown is not driven by firms substituting away from foreign markets to keep on serving their domestic partners. Most of the adjustment comes from firms suspending shipments towards some of their partners. These extensive margin adjustments may be indicative of French exporters prioritising some of their customers at a time of capacity constraints.

Figure 1 Log change in the level of domestic and export sales of treated relative to control firms, 2019-2020

Note: The figure shows the dynamics of exports (solid red) and domestic sales (dashed blue) for firms exposed to the Chinese lockdown in comparison with firms not exposed to China. Spikes represent 95% confidence intervals.

We run a variety of exercises to verify that we do not conflate the adverse effect of the Chinese lockdown with other forces such as the seasonality of imports from China, the impact of other shocks, most notably the transmission of the pandemic to France and the rest of the world, or the specific geography or product mix of firms importing from China.

What about inflation? In our paper, we run difference-in-differences specifications at the firm-product level on import and export unit values. Whereas input disruptions appear to be inflationary in some sectors, we do not find evidence of a pass-through of these cost adjustments to downstream partners. The propagation of the input disruption to downstream partners is entirely attributable to volume adjustments.

Heterogeneity of the transmission at the firm level: Benefits from mitigation strategies

Convinced that the Chinese lockdown has acted as a strong supply shock for French firms importing inputs from China, we then investigate the heterogeneity in firms’ ability to absorb the consequences of unanticipated input disruptions.

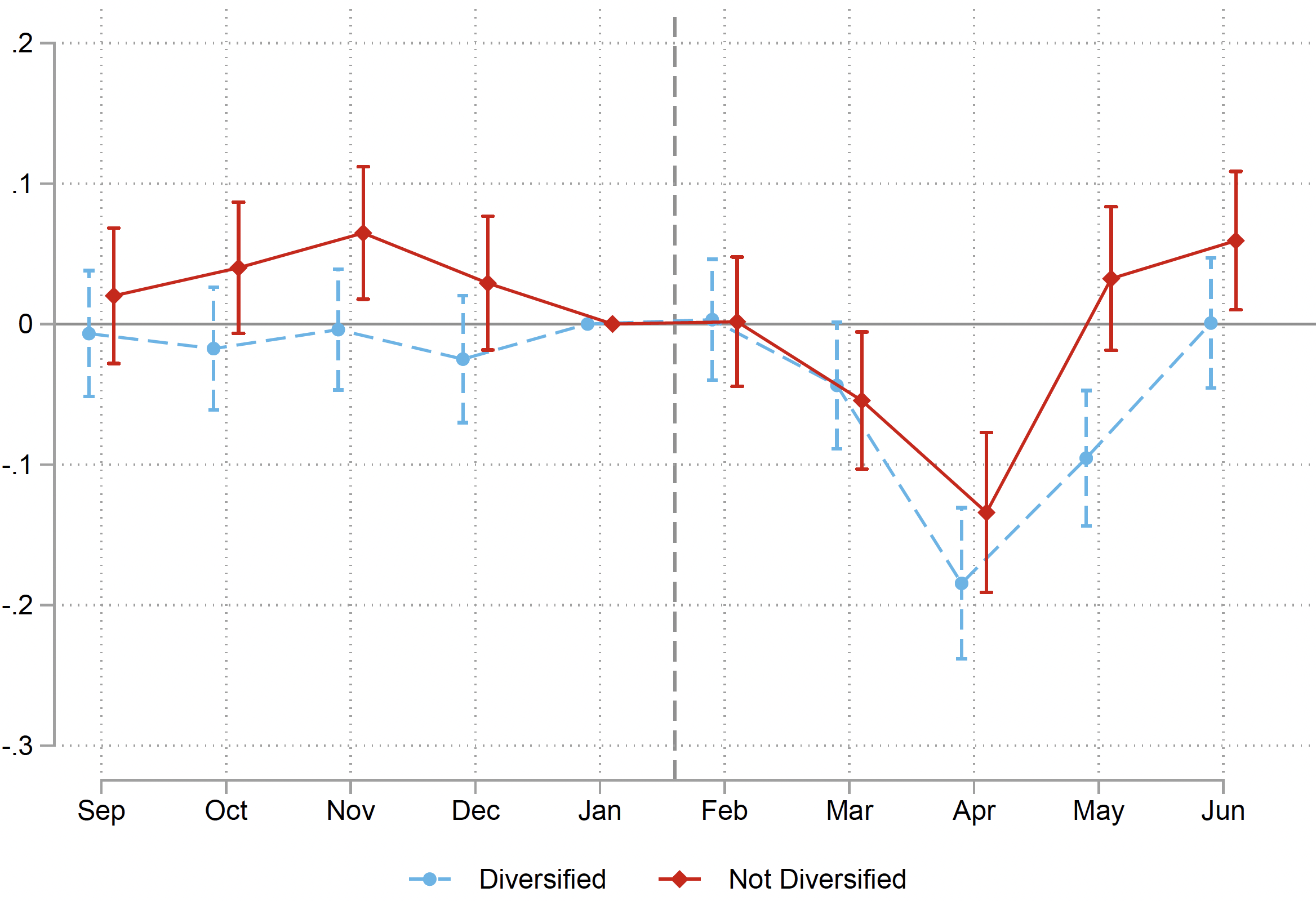

We first assess whether firms holding a high level of inventories managed to absorb part of the shock. We find that precautionary inventory management helped firms mitigate the input disruption. Namely, treated firms that display relatively high level of inventories in 2018 balance-sheet data display export performances in the aftermath of the shock that are indistinguishable from those of control firms. The entirety of the propagation is instead driven by firms with relatively low levels of inventories (Figure 2). This result echoes theoretical work emphasising the role of just-in-time production processes in enhancing short-term fluctuations and strengthening the business cycle (e.g. Ortiz 2021).

Figure 2 Log change in the level of export sales for high vs. low inventory treated firms

Note: The figure shows the dynamics of exports for firms exposed to the Chinese lockdown in comparison with firms not exposed to China. In red are exposed firms holding low inventories. In blue are exposed firms holding high inventories. Spikes represent 95% confidence intervals.

We then explore how diversification in firms’ value chains helped weather the supply shock. If firms had been able to substitute away from China when hit by the negative supply shock, we would observe an increase in treated firms’ imports of inputs from non-Chinese input providers. We would moreover expect such substitution away from China to be easier for firms already involved in diversified supply chain relationships, that imported the same input from more than one country prior to the shock. We do not observe any sizeable substitution away from China in the aftermath of the shock, however, including within the subset of treated firms that were geographically diversified ex ante. Therefore, ex-ante diversified firms did not performed better than non-diversified treated firms when the shock hit (Figure 3).

Figure 3 Log change in the level of exports of diversified and non-diversified treated firms

Note: The figure shows the dynamics of exports for firms exposed to the Chinese lockdown in comparison with firms not exposed to China. In red are exposed firms that were not geographically diversified before the lockdown. In blue are exposed firms that were diversified. Spikes represent 95% confidence intervals.

A potential reason why we do not find a sizeable impact of diversification is that global value chains involve a strong degree of input specificity (Fujiy et al. 2021). Firms that we observe sourcing the same eight-digit product from two origin countries prior to the shock may purchase two versions of the same input that are not necessarily substitutable to each other. If it is the case, then our measure of geographic diversification captures the fact that firms need tailored inputs for different production lines, which would in turn explain that the relative drop in exports is in part driven by the product extensive margin: In the aftermath of the Chinese lockdown, exposed firms are unable to produce certain products that require specific inputs sourced from China. Indeed, we do find evidence of geographic diversification having more of an effect once we focus on homogenous products that are expected to be less prone to relationship-specific investment. Another (complementary) explanation is that firms that are not diversified ex-ante import inputs that can easily be sourced from other countries ex-post. We do observe within the group of treated firms that ex-ante non-diversified firms are more likely to start importing from a new origin country after February 2020 than ex-ante diversified exporters.

Concluding remarks

Our results provide novel evidence on the factors that are likely to improve the resilience of global supply chains to localised shocks. In presence of strongly specific input-output relationships, diversifying supply chains may be costly for individual firms. Holding inventories has instead been an effective buffer for the adverse supply shock, in the context of the early lockdown in China. Such a strategy might be costly in normal times and the development of just-in-time production processes suggests that holding inventories may not be optimal for individual firms. However, the potential losses due to a synchronised disruption of firm-level activities in a country can greatly exceed the sum of individual losses. Governments may thus consider giving incentives to firms to depart from just-in-time organisation of production – especially for firms engaged in the production of critical products.

References

Baldwin, R and R Freeman (2020), “Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion”, VoxEU.org, 1 April.

Boehm, C E, A Flaaen and N P Nayar (2015), “Global supply chains and the transmission of shocks”, VoxEU.org, 9 January.

Bonadio, B, Z Huo, A A Levchenko and N Pandalai-Nayar (2020), “Global supply chains in the pandemic”, NBER Working Paper 27224.

Bonadio, B, Z Huo, A A Levchenko and N Pandalai-Nayar (2021), “The role of global supply chains in the COVID-19 pandemic and beyond”, VoxEU.org, 25 May.

Carvalho, V M, M Nirei, Y U Saito and A Tahbaz-Salehi (2021), “Supply Chain Disruptions: Evidence from the Great East Japan Earthquake”, The Quarterly Journal of Economics 136(2): 1255-1321.

Fujiy, B C, D Ghose and G Khanna (2021), “Production Networks and Firm-level Elasticities of Substitution”, Working Paper.

Gerschel, E, A Martinez and I Mejean (2020), “Propagation des chocs dans les chaînes de valeur internationales : le cas du coronavirus”, Notes IPP 53.

Heise, S (2020), “How Did China’s COVID-19 Shutdown Affect U.S. Supply Chains?”, Federal Reserve Bank of New York, Liberty Street Economics, 12 May.

Lafrogne-Joussier, R, J Martin and I Mejean (2021), “Supply shocks in supply chains: Evidence from the early lockdown in China”, CEPR Discussion Paper 16813.

Meier, M and E Pinto (2020), “Covid-19 supply chain disruptions”, Covid Economics 48: 139-170.

Ortiz, J (2021), “Spread too thin: The impact of lean inventories”, VoxEU.org, 17 December.

Endnotes

1 See the US Executive Order on America’s Supply Chains of 24 February, 2021 or France Relance, the French recovery plan that includes a €600 million budget to “reduce the fragility of global value chains”.