The outbreak of the Covid-19 pandemic has caused a worldwide disruption in trade flows. According to the WTO, a 9.2% decline in the volume of world merchandise trade for 2020 is expected, with a rebound of 7.2% in 2021. The drop in trade is around two to three times larger than the drop predicted for world GDP (a drop of 3.5% is most recently forecasted by the IMF, in the updates to the World Economic Outlook released in January 2021). The adjustment is very heterogeneous – the WTO calculates 14.7% and 11.7% declines in export volumes in the US and Europe, respectively, and a mere 4.5% drop in Asia. These developments resemble what has been known as the Great Trade Collapse of 2008-09 (Baldwin 2009, 2020) during which the world GDP shrank by 1%, while the value of global trade flows slumped by some 10% in a remarkably synchronised fashion across the world (Alessandria et al. 2010).

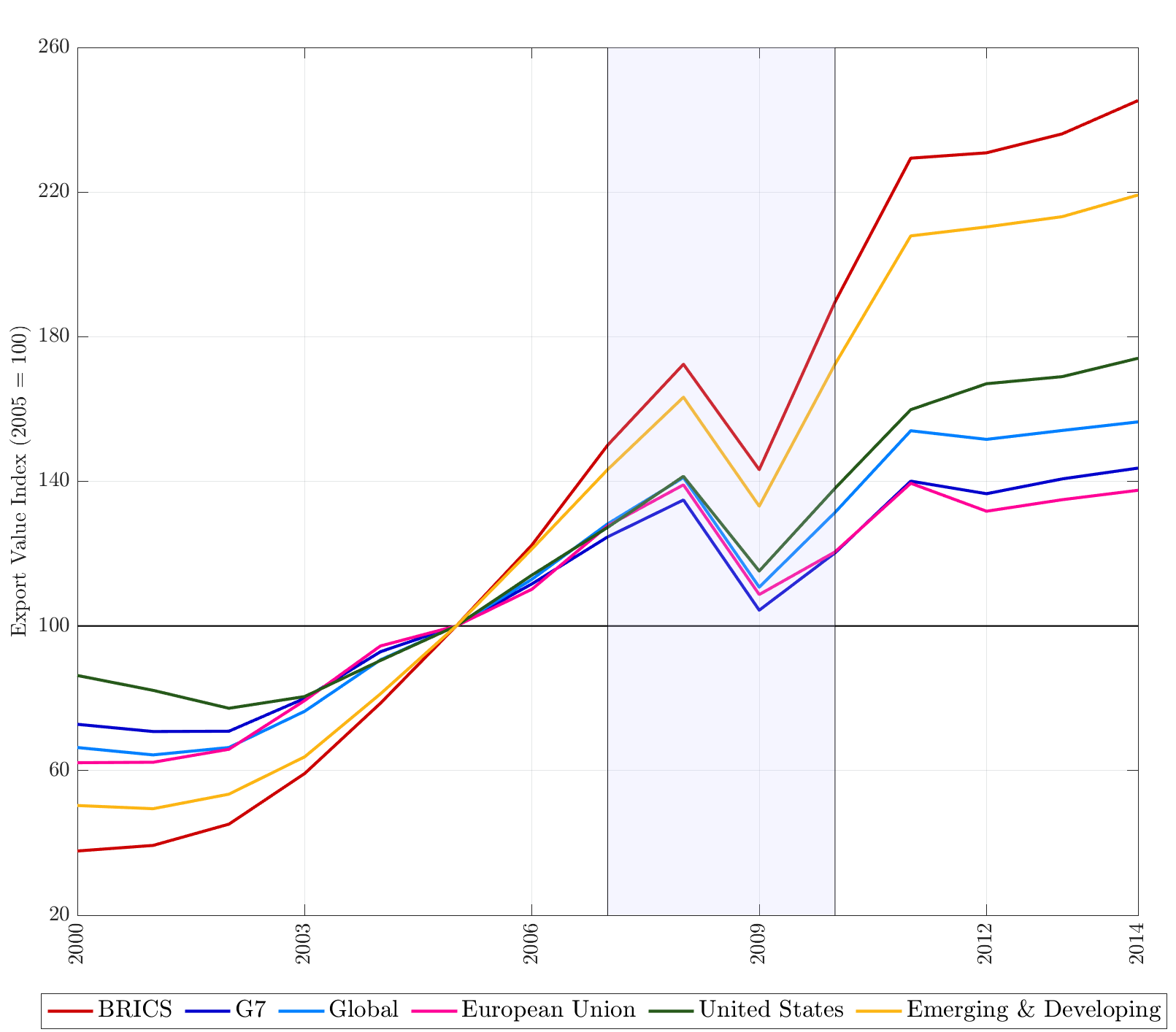

These international trade patterns before, during, and after the Great Recession, can be seen in Figure 1, which encapsulates three empirical facts. First, independently of the country group, there is a sharp and synchronised global decline in the value of international trade in response to the global crisis of 2008-2009. Second, and similarly to the Covid-19 experience, the recovery from the Great Trade Collapse is remarkably heterogeneous. In particular, the BRICS (Brazil, Russia, India, China, South Africa) recovered most rapidly, followed by other emerging and developing countries, leaving the EU and G7 well behind. Third, the value of international trade is substantially more volatile than aggregate income.

These stylised facts suggest a relatively low persistence in the value of international trade, particularly in response to global shocks, thereby illustrating the essence of what we call the ‘excess trade persistence’ puzzle in Comunale et al. (2021). However, we claim that it can be successfully resolved with a theory of habits in supply chains that delivers three new ingredients: trade-pair-specific trade elasticities and loadings on global shocks and aggregate imbalances in the bilateral trade model.

Trade flows dynamics and supply chains

The bulk of modern trade literature relies on the ubiquitous gravity equation to predict the value of trade flows across countries. And it is notoriously successful at predicting both ‘who trades with whom’ as well as ‘how much is traded’ when trade shocks are local or country-specific. But when trade shocks are global, the observed value of trade flows adjusts by more and more rapidly than predicted by the standard gravity equation.

The most well-known empirical extensions of the seminal static gravity model by Anderson and van Wincoop (2003) include the models by Yotov and Olivero (2012) and Anderson et al. (2020). They are based on the standard neo-classical capital accumulation equation, which introduces an infinitely divisible measure of aggregate capital stock, depreciating at a deterministic rate. The aggregate capital stock dynamics are then linked to the bilateral trade flows through a neo-classical production function and standard homothetic preferences across the domestic and foreign varieties from which a dynamic gravity equation is derived.

Figure 1 Trade flows in major country groups

Notes: The figure depicts the export value indices over the period of 2000-2014 for the global economy, the US, the EU, and other selected groups of countries, such as Brazil, Russia, India and China (abbreviated as BRICS), the group of seven (G7), and a cohort of other emerging and developing countries. The reference year is 2005, when the index value is equal to 100. The shaded area represents the Great Trade Collapse.

Predicted trade persistence, based on capital accumulation, is at odds with the empirical evidence, as we showed before. If we take the neo-classical theory at face value, it follows that an empirically plausible lower bound for the annual trade persistence coefficient is very high at around 0.8–0.9. This cannot be reconciled with the empirically observed trade flows volatility. Neither can it shed light on the heterogeneous responses to global shocks.

We instead suggest incorporating habits in the supply chains, thereby nesting the static gravity equation as a special case when all bilateral habits are infinitesimally weak. And when habits are strong for any given country pair, they cause less volatile and more persistent bilateral trade flows that are consistent with Anderson et al. (2020). Consequently, the theory of habits in the supply chains delivers an intermediate degree of trade persistence relative to the static and the neo-classical gravity equations. Consistent with the data, it predicts sharp and heterogeneous international trade flow adjustments in response to global shocks.

Our theory appeals to the notion that countries develop habits in their preferences when they continuously trade with one another. At the aggregate level, habits may develop due to shared history, institutions, values, or colonial ties, as argued by Eichengreen and Irwin (1998). Similarly, at the firm level, international companies may choose to do business with offshore suppliers that are reliable, since assembling, disbanding, or swapping foreign suppliers in response to shocks is costly. In turn, contractual obligation that closely tie companies and suppliers over time create a momentum for international trade flows to persist. But at the same time, differences in habits across countries generate differences in their trade momentum, which lead to either temporary or prolonged country-specific trade imbalances.

Theory meets empirics

When we augment the gravity equation with country-specific habits, the transmission of local and global trade shocks becomes fundamentally different. This is because trade imbalances arising from differences in country-specific habits influence countries’ ‘inward’ and ‘outward’ propensities to trade, which are strongly correlated with foreign demand and foreign supply (see Delpeuch et al. 2021 for another mechanism linking imbalances and trade flows, namely an endogenous rise in protectionism). Global shocks are therefore directly transmitted into bilateral trade flows through the process of multilateral trade rebalancing.

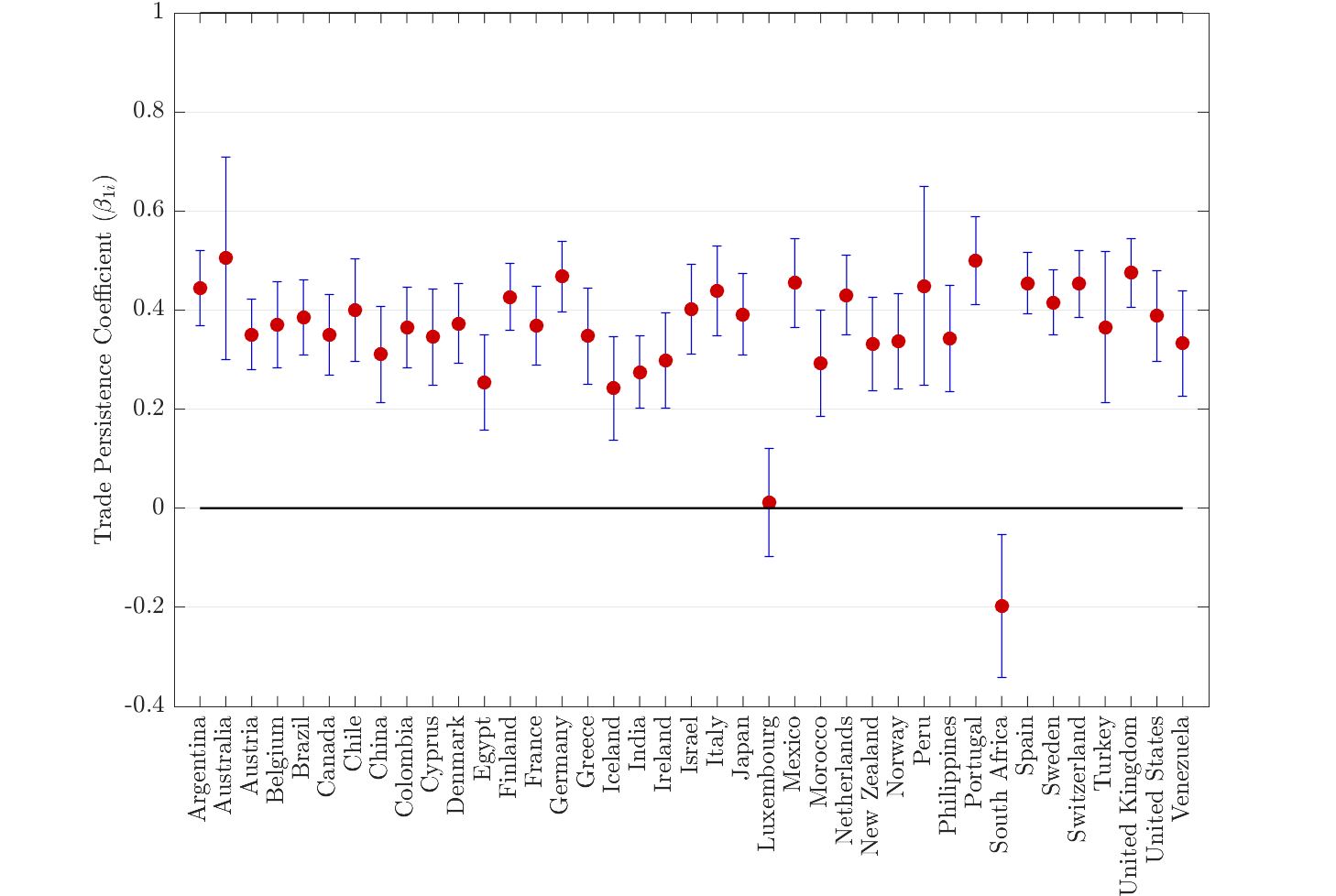

Figure 2 Cross-country heterogeneity of trade persistence

Our empirical bilateral trade model is consistent with the theory and accounts for the heterogeneous trade dynamics, differences in multilateral resistance terms proxied by dynamic unobserved factors with trade-pair-specific loadings, and aggregate trade imbalances. Figure 2 demonstrates the extent of the cross-country parameter heterogeneity. For clarity and space, the coefficient estimates specific to each country pair are averaged across all destinations for each source country.

Nearly all of the trade persistence coefficients turn out to be positive and statistically significant, with values clustered around the cross-sectional average of 0.35 (see Figure 2). This is substantially lower than a homogenous parameter model with no global shocks, which predicts excessively persistent trade flows (persistence reaches 0.9). And unlike the neo-classical gravity equation, whose trade persistence coefficient is strongly bounded by the magnitude of the capital depreciation rate, even the smallest bilateral habits are able to rationalise the magnitudes of our trade persistence estimates.

From a policy perspective, this finding illustrates that reshuffling the global trade network will take longer for economies that are heavily integrated in inputs trade.1 Moreover, trade flows appear to be more persistent if countries share colonial ties and/or a common language. In contrast, there is more volatility in trade dynamics for geographically distant countries. Importantly, the new empirical model outperforms existing dynamic gravity models in terms of prediction power, particularly during global recessions.

Conclusions

Sharp, synchronised, and unequal trade flow adjustments across countries are widely-observable in the face of global trade shocks, such as the Global Trade Collapse and the Covid-19 pandemic. We present a theory of habits in supply chains that provides a rationalisation as to why global trade flows are far less persistent than predicted by the neo-classical trade theory. We further demonstrate that it is important to distinguish between differences in country-specific habits and to control for innovations in global factors when predicting bilateral trade flow adjustments empirically. Our results emphasise an important distinction between the choice of trade partners, which is a sluggish and slowly adjusting process, and the actual value of trade flows which changes rapidly, especially in response to global trade shocks.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily represent those of the ECB, the Bank of Lithuania, or the ESCB.

References

Alessandria, G, J P Kaboski and V Midrigan (2010), “The Great Trade Collapse of 2008–09: An Inventory Adjustment?”, IMF Economic Review 58(2): 254–294.

Anderson, J E, M Larch and Y V Yotov (2020), “Transitional Growth and Trade with Frictions: A Structural Estimation Framework”, The Economic Journal 130(630): 1583–1607.

Anderson, J E and E van Wincoop (2003), “Gravity with Gravitas: A Solution to the Border Puzzle”, American Economic Review 93(1): 170–192.

Baldwin, R (ed.) (2009), The Great Trade Collapse: Causes, Consequences and Prospects, a VoxEU.org eBook, 27 November.

Baldwin, R (2020), “The Greater Trade Collapse of 2020: Learnings from the 2008-09 Great Trade Collapse”, VoxEU.org, 07 April.

Comunale, M, J Dainauskas and P Lastauskas (2021), “What Explains Excess Trade Persistence?: A Theory of Habits in the Supply Chains”, Bank of Lithuania Working Paper No 84 (also CAMA Working Paper No. 11/2021).

Delpeuch, S, E Fize and P Martin (2021), “Trade imbalances and the rise of protectionism”, VoxEU.org, 12 February.

Eichengreen, B and D Irwin (1998), “The Role of History in Bilateral Trade Flows”, In J Frankel (ed.), The Regionalization of the World Economy, pp. 33–62, NBER.

Espitia, A, A Mattoo, N Rocha, M Ruta and D Winkler (2021), “Trade and Covid-19: Lessons from the first wave”, VoxEU.org, 18 January.

Yotov, Y V and M Olivero (2012), “Dynamic Gravity: Endogenous Country Size and Asset Accumulation”, Canadian Journal of Economics 45(1): 64–92.

Endnotes

1 For instance, see Espitia et al. (2021) for an analysis of the role of global value chains (GVCs) during the first wave of Covid-19 pandemic.