One of the many responses to the COVID-19 pandemic has been central bank cooperation on an unprecedented scale. This crisis has once again demonstrated the vulnerability of US dollar funding of banks and other firms outside the US (Avdjiev et al. 2020). On 19 March 2020, the Fed renewed its dollar liquidity swap lines to nine central banks at twice the 2008 limits, and the next day enhanced its existing unlimited swaps to Canada, Japan, Switzerland, and the ECB. By 3 April, ten of these central banks had just under $400b in outstanding drawings on Federal Reserve credit, with the ECB and Bank of Japan the largest takers of dollars (Figure 1).1 This hugely ambitious scheme was supplemented by new a repo facility for foreign official holders of US Treasury and agency securities to enable them to access dollar liquidity without outright sales of securities in still fragile markets. Since many more countries use the Federal Reserve Bank of New York to hold their US Treasury and agency securities than have swap lines, this was a very significant step.

Figure 1 Fed swaps outstanding $ billion 18 March - 3 April 2020

Note: Canada, New Zealand and Sweden have not drawn on these facilities.

Source: Federal Reserve Bank of New York.

These initiatives highlight the importance of global dollar funding liquidity and the role of innovations in central bank cooperation in managing it in times of crisis. Before the current crisis, Truman (2010) suggested joining the Fed's swap system to the IMF to broaden its participants, and Ocampo (2017, p. 225-6) proposed wider ranging changes to loosen up the IMF's resources,to broaden emerging market economies' access to Fed swaps and to de-link regional financial arrangements from IMF programmes. More recently, Setser (2020) suggested central bank repo facilities (on 17 March, a week before they were introduced) and Tooze (2020) proposed a widening of the swap system to reach major offshore borrowers and investors in dollars.

Policy innovation during crisis should be able to draw on what has been tried in the past. Yet evidently, in 2008, policymakers innovated to address the global dollar shortage (Sheets et al. 2018) without a command of the measures that their predecessors had taken to stabilise offshore dollar funding markets in the face of seasonal pressures. In particular, in the 1960s the Fed entered into swaps with the BIS and European central banks not only to manage exchange rate pressures, but also to manage eurodollar rates in the face of seasonal variation in the supply of dollar funding (McCauley and Schenk 2020).

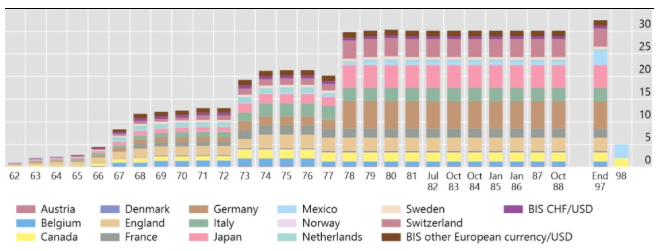

In the spring of 1962, Charles A. Coombs, head of the foreign exchange desk at the Federal Reserve Bank of New York (FRBNY), toured European central banks to conclude formal standing facilities that could be drawn on by either partner with little notice for a range of purposes. He met with an unenthusiastic response, but by the end of 1962, he convinced seven European banks, the Bank of Canada, the Bank of Japan and the BIS to open swap facilities of $50-$100 million each. These swap facilities proved useful to the Federal Reserve and it asked the partners to increase the limits during the years that followed. Figure 2 shows the nominal value of the Federal Reserve swap facilities and the central banks involved.

Swaps served principally to defend pegged exchange rates; however, the system did not disappear when the Bretton Woods system ended. Rather it was extended to a broader range of OECD countries. Swap lines expanded quickly after the pegged exchange rate regime collapsed in 1973 and again in 1978 in response to the dollar exchange rate crisis of that year. Indeed, the swaps in the early 1970s were large even by the standards of September 2008. At their peak value, the arrangements amounted to the equivalent of over $250 billion. This about matches the $247 billion of lines of credit available in the Fed swaps at the start of September 2008, before the Lehman Brothers collapse. This created an even more extreme need for funding liquidity and the Fed lifted the limits on the swaps for the ECB, SNB, Bank of England, and Bank of Japan.

Figure 2 Federal Reserve swap lines, 1962-1998

In billions of US dollars at end year

Source: Federal Reserve.

Notes: This was a time of inflation, so Figure 3 presents the value of the facilities relative to global reserves at the time and shown in dollars representing the same share of US GDP in 2017. In the late 1960s these facilities were equivalent to about 30% of global foreign exchange reserves or over 40% of the FX reserves of advanced economies. They were thus an important part of the global financial safety net.

Figure 3 Fed’s reciprocal swap lines in relation to US GDP and global reserves1

Note: Swaps data are from end year except: 1983, 1984 and 1988 October, 1985 and 1986 January, 1982 July. 2 Scaled to 2017 US GDP in billions of US dollars. 3 Reserves exclude gold and SDR.

Source: Federal Reserve; IMF, International Financial Statistics (December 2019); Bureau of Economic Analysis; UK Data Service; authors’ calculations.

It is also important to note that these Federal Reserve swap lines did not stand alone. They were embedded in a broader network of central bank cooperation that aimed to provide liquidity for FX intervention in times of crisis and to manage the decline of sterling as an international currency (Schenk 2010).

Swaps then

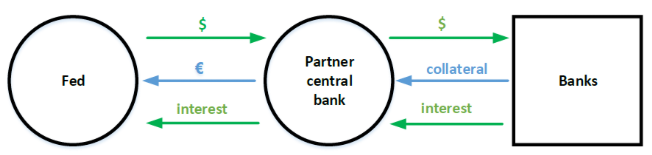

In the 1960s, as in the 2000s, strains in the growing eurodollar market threatened spillovers, not only to FX markets, but also to domestic US money markets. The FRBNY innovated by swapping dollars with the BIS, which in turn placed the funds with banks outside the US as shown in Figure 4. In doing so, the BIS took much greater credit risk than contemporary Fed purchase of two-name paper (i.e. bankers’ acceptances), and the Fed’s current swap partners, who generally advance dollars against domestic currency collateral. Taken as a whole, the eurodollar operations through the BIS not only extended the geographic and time zone reach of Fed operations, but also deepened them, bringing them to bear on what would become benchmark interbank rates.

Figure 4 Providing dollar funding offshore through swaps

Source: authors.

Specifically for this purpose, the Fed-BIS swap facility began in 1965 at $150 million and was rapidly increased so that by March 1968 it amounted to $1,000 million, which was the same size as the Fed swap with the Bundesbank or with the Bank of Japan. This swap was not a mere side-show of the Fed swap circus but in fact belonged to the main tent. The largest drawings on this swap occurred in the late 1960s and our analysis focuses on five episodes in this period when the BIS and Fed cooperated to use swaps to deposit over $1 billion in the eurodollar market to dampen the tightening of liquidity in this market.

End-year operations in 1966 and 1967 and the end-quarter operation in June 1968 came after US banks reached unprecedented levels of dependence on eurodollars for funding (Klopstock 1968, p 136). This fund-raising in the eurodollar market left US banks exposed to the seasonal window-dressing of non-US banks, particularly Swiss banks. The risk was that, as the rates on one-month Libid outstripped New York money market rates, US banks would seek to pass on the higher cost of eurodollar funding to the firms at home. Therefore, FRBNY cooperated with the BIS to dampen incipient higher rates in these episodes.

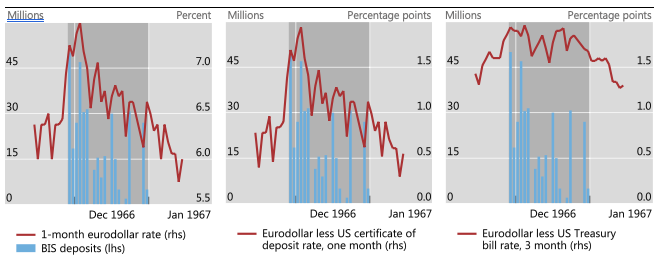

Figure 5 shows the timing and effect of the first episode in 1966. The left panel shows the one-month Libid; discussion between the Fed and BIS typically focussed on these yields. The centre panel shows the spread of one-month Libid over its nearest domestic equivalent, namely the one-month CD rate. And the right panel shows the spread of 3-month Libid over 3-month Treasury bills. This is chosen because a series for the one-month Treasury bill is not available. The so called Treasury-eurodollar spread, later dubbed the ‘TED spread’, is of interest because of the liquidity and lack of regulatory constraint on the bill rate, unlike the CD rate.2

Figure 5 Episode 1: Libid and BIS deposits: November – December 1966

Sources: Datastream; BISA 7.24(3) – Banking Daily Sheets, vol. 24, November - December 1966.

When G10 central banker FX managers gathered in Basel in January 1967, they deemed the operation a success. Coombs went so far as to suggest that “perhaps [the] BIS eurodollar operation in December is a breakthrough. BIS has operated more or less as a Central Bank in the international money market. Suggests that some agency should assume responsibility for market, especially if eurodollar market continues to grow”.3 Four more operations followed before the Fed’s monetary policy stance shifted to tightening and the incentive to depress the eurodollar market rates to ensure the transmission of Fed domestic policy receded.

The operations in the 1960s compared to those in 2008 and 2020 offer both points of contrast and comparison. Differences include the state of the market, the instrument used, amounts involved and the monetary transmission mechanism. Similarities include using central bank cooperation to stabilise dollar money markets, the relative scale of operations, premium pricing for offshore dollars and the main maturity of operations. Both operations reached a substantial fraction of the eurodollar market size. The sum of the BIS and SNB placements in December 1966 reached $675 million, out of a eurodollar market of $13 billion as estimated by the BIS (1967, p 142). The maximum reached by the 2008 swaps, just short of $600 billion, represented a smaller share of the eurodollar liabilities in 2008 of almost $13 trillion. Similarly sized injections had similar effects, notwithstanding the different market conditions. The December 1966 operation brought down eurodollar rates by about 1 percentage point. In 2008, the shift to swaps of unspecified size brought down eurodollar rates by about 2 percentage points.

In sum, it is important to recognize that central bank swaps had a long history in the last century, from 1962 to the late 1990s. While they were invented during a period of fixed exchange rates, the swaps survived the transition to floating exchange rates in the early 1970s and served a range of purposes. The BIS often played a pivotal role not only as a coordinating forum for participants, but also as a principal, employing its balance sheet in operations. Moreover, these facilities were part of a much wider system of bilateral swaps and swap-like facilities provided by G10 central banks to each other both in dollars and in their national currencies (Schenk 2010). They amounted to a global financial safety net stretched under the global monetary system that aimed at managing dollar liquidity as well as stabilising exchange rates directly. Swaps have recently served to provide funding liquidity and to manage yields in the offshore dollar market, but they also served the same purpose soon after the Fed swap system was established in the 1960s. Both in 2008 and in the late 1960s, the Fed conveyed dollars through swaps in order to alleviate funding liquidity shortages in the offshore dollar market.

References

Avdjiev, S, E Eren and P McGuire (2020), “Dollar funding costs during the Covid-19 crisis through the lens of the FX swap market”, BIS Bulletin, no 1, 1 April.

Bank for International Settlements (1967), 37th Annual Report, Basel, June.

Cetorelli, N and L Goldberg (2012), "Liquidity management of U.S. global banks: internal capital markets in the Great Recession", Journal of International Economics, vol 88, no 2 (November), pp 299-311.

Coombs, C (1967), “Treasury and Federal Reserve foreign exchange operations”, Federal Reserve Bank of New York Monthly Review, March, pp 43-51.

Klopstock, F (1968), “Euro-dollars in the liquidity and reserve management of United States banks”, FRBNY Monthly Review, July, pp 130-138.

McCauley, R and C R Schenk (2020), “Central bank swaps then and now: swaps and dollar liquidity in the 1960s”, BIS Working Papers no 851, 1 April.

Ocampo, J (2017), Resetting the international monetary (non)system, Oxford University Press.

Schenk, C (2010), The decline of sterling: managing the retreat of a global currency, Cambridge: Cambridge University Press.

Setser, B (2020), “Addressing the global dollar shortage: more swap lines? A new Fed repo facility for central banks? More IMF lending?” Council on Foreign Relations, 17 March.

Sheets, N, T Truman, and C Lowery (2018), The Fed’s swap lines during the crisis: lender of last resort on a global scale”, Hutchins Center, Brookings Institution, and Program on Financial Stability, Yale School of Management, 11-12 September.

Tooze, A (2020), “This is the one thing that might save the world from financial collapse”, New York Times, 20 March.

Truman, E (2010), “The G-20 and international financial institution governance”, PIIE Working Paper 10-13, September.

Endnotes

1 https://apps.newyorkfed.org/markets/autorates/fxswap

2 Both measures have their drawbacks. The Fed had capped CD rates at 5.5%, and while secondary market yields could and did rise above this level, outstanding amounts fell, leaving the yield less representative. Because the TED spread is for the longer, 3-month term, any effect of shorter term depositing by the BIS would have been attenuated.

3 Notes of Gold and Foreign Exchange Experts Meeting, handwritten by Dealtry, Basel 7 January 1967. BIS Archives 7.18(12) DEA20. Coombs (1967, p 43) drew the lesson that this “truly international money market…cannot rely, as can a national money market, on the support of any single central bank to relieve temporary stringencies or knots in the market”.