After the international uproar had abated over the policy adopted by the Swiss National Bank (SNB) in the first half of 2012, a certain level of sympathy for the situation in Switzerland had remained, Yet, the SNB has yet again been confronted with another barrage of accusations; Standard & Poor’s led the charge, accusing the SNB of exacerbating the crisis in the Eurozone by pegging the franc to the euro. The SNB stands accused of currency manipulation as part of an ongoing ‘currency war’.

Benefits for Switzerland

There is no denying that the minimum exchange rate ‘medicine’ has had certain side effects. Besides putting a brake on deflationary tendencies caused by reduced import prices, its primary purpose is to relieve the pressure on the Swiss export industry. Adjusting to the exchange rate shock enables Switzerland to remain competitive abroad. According to figures from the Bank for International Settlements (BIS), the Swiss currency appreciated 35% against its trading partners in real terms since the financial crisis began in 2007 until August 2011. Almost 15 percentage points of this 35% were gained in the four months prior to the SNB’s introduction of the minimum exchange rate on 6 September 2011.

The announcement and introduction of the minimum exchange rate resulted in the euro remaining well above the ceiling of CHF 1.20, set by the SNB in Spring 2012. This helped to fox currency speculators. Furthermore, during this phase the SNB succeeded in reducing its foreign currency assets from an equivalent CHF 305 billion in September 2011 to nearly CHF 240 billion in February 2012.

The minimum exchange rate and price adjustments, particularly on the Swiss side, reduced the appreciation of the franc to approximately 15% in real terms since the onset of the financial crisis. Research has revealed that the real economic adjustment processes – which originate from such appreciations – are protracted. As such, they are likely to follow a J-curve (see Bahmani-Oskooee and Ratha, 2004). Switzerland still exports more than it imports; indeed, despite the corrections that have already been made to the Swiss trade balance (as a result of the appreciation) and reduced world demand, Switzerland will continue to be a net exporter at for at least the foreseeable future.

Effects on the Eurozone?

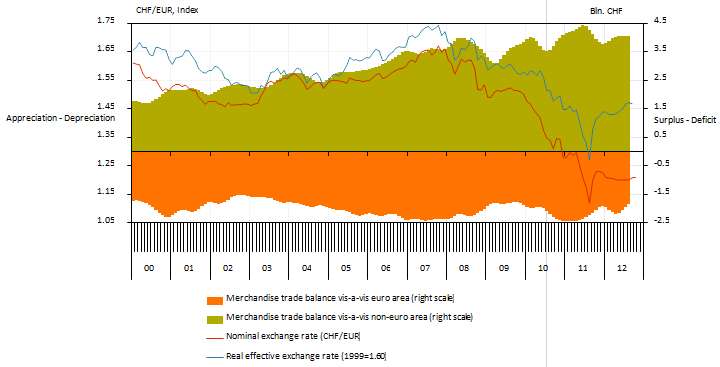

While Switzerland is an overall net exporter, this does not apply to all its trading partners. Indeed, as shown in Figure 1, Switzerland has had a negative merchandise trade balance with the Eurozone countries for many decades. The introduction of the minimum exchange rate has done little to change this1. The widespread argument that trade imbalances must be reduced implies that Switzerland should purchase fewer goods from the Eurozone. This is not, of course, in the interests of the Eurozone countries at present. As a net importer from the Eurozone, it would be equally feasible to argue that a further appreciation of the Swiss franc, particularly against the euro, would be a move in the wrong direction. A stronger Swiss franc would further increase its trade imbalance with the Eurozone2. Thus, it is difficult to use the existing trade deficit with the Eurozone to plead for a further appreciation of the Swiss franc against the euro.

Figure 1. Exchange rates and foreign trade balances figures for merchandise

Overestimating trade imbalances

The theory may sound convincing, yet there is virtually no empirical correlation between the balance of trade figures on the one hand and the exchange rate movements on the other hand. It is therefore important not to overestimate the effects on the flows of goods and services, at least in the short-term. Where the effects of the minimum exchange rate on the Eurozone are concerned, financial flows are probably more relevant.

If the goods and services that are exported are not offset by goods and services that are imported, Switzerland will receive foreign currencies or securities for the goods and services that it exports. Last Spring, when the crisis in the Eurozone reached a critical stage, the increased uncertainty again led to an unwillingness on the part of Swiss investors to continue taking inherent risks in accepting these foreign assets. In order to maintain its minimum exchange rate, the SNB was forced to assume the role of a private economy, at least temporarily. Between March and mid-September, the exchange rate was basically at CHF/€ 1.20 and in the second quarter of 2012, the currency reserves held at the SNB increased by around €80 billion. This increase sparked considerable debate.

The SNB’s investment strategy

It was speculated that this increase was due to the Swiss buying up Eurozone countries’ government bonds . However, the balance of foreign exchange payments by the SNB shows that the currency reserves invested in securities ‘only’ rose by around CHF 35 billion in the same period. The entire increase is, moreover, unlikely to be the result of acquisitions in only the Eurozone. It is quite likely that some of this amount has been allocated to accounts at other central banks, the International Monetary Fund (IMF) and the Bank of International Settlement (BIS), as was customary in the past.

Even if the amount that was invested in the Eurozone is far lower than the amount that was discussed in the media, it is still considerable. It is therefore all the more important to understand how it might have affected interest rates in the Eurozone. Every additional unit of demand for government bonds invariably lowers interest rates. A recently published BIS study (Gerlach-Kristen, McCauley and Ueda 2012) corroborates this overall impact. The paper argues that demand for government bonds leads to a relaxation of monetary conditions in the recipient country. This may be a welcome effect in times in which many member countries have budgetary problems and monetary policy is striving towards relaxation of monetary conditions.

From this capital market perspective, the only possible criticism is that the SNB – although we have no precise knowledge of its investment strategy – is mainly buying bonds from countries with a high credit rating. This would result in a widening of the interest-rate differential between countries with a high credit rating and countries with a lower credit rating. However, this would neither be detrimental to the Eurozone as a whole nor to its individual members. Countries with a high credit rating benefit from lower interest rates, whereas nothing changes for the countries at the other end of the spectrum. The acquisitions by the SNB reduce the interest charge for Europe as a whole and simultaneously boost the credit rating of the existing rescue packages.

Conclusions

The strong appreciation of the Swiss franc in recent years has been determined less by foreign trade imbalances than by its safe haven function. The introduction of the minimum exchange rate has ensured planning certainty and absorbed some of the negative impact of the sharp appreciation on exporting firms within Switzerland. The minimum exchange rate has also ensured that financial capital continues to flow from Switzerland. This is, in principal, tantamount to a relaxation of the monetary conditions in the Eurozone.

References

Bahmani-Oskooee, Mohsen and Artatrana Ratha (2004), “The J-Curve: a literature review”, Applied Economics, 36(13), 1377–1398.

Gerlach-Kristen, Petra, Robert N. McCauley, and Kazuo Ueda (2012), “Currency intervention and the global portfolio balance effect: Japanese lessons”, BIS Working Paper Series, 389.

1 We do not have the foreign trade figures for services that are broken down according to trading partners.

2 Since the euro area also has a (growing) foreign trade surplus with the rest of the world the logical outcome would be the appreciation of the euro and the Swiss franc against all the other currencies in the world.