About 11.5 million Europeans of working age live in an EU member state other than their country of citizenship, representing about 4% of the total working age population.1 Compared to ten years ago, the share has increased by about 60%. Higher intra-EU labour mobility reflects an increasing degree of integration of labour markets, prosperity differentials between member states, as well as strong push and pull factors arising from the financial crisis and subsequent sovereign debt crisis.

Over the past ten years, the new member states have experienced the largest cumulative outflows, with more than 14% of the working age population in Lithuania, for example, leaving their country for another EU country for work, education, or other reasons. Mobility from Southern Europe over the same period was more limited in comparison, but South-North migration picked up during the financial crisis (Batsaikhan et al. 2018). Germany and the UK have been the main countries of destination for intra-EU movers from both Southern and Eastern Europe over the last decade.

Most intra-EU movers are well qualified, with 80% of people who moved to a different EU member state in the last ten years having a medium or high level of education. On average, recent movers are more highly educated than nationals in the countries of destination (European Commission 2019).

Figure 1 Net migration flow of EU citizens, 2007-2016 (% of working age population)

Note: Figures refer to cumulative net outflows of nationals to other EU countries between 2007 and 2016. Adjusted for returning population.

Source: Eurostat: Emigration by age group, sex and citizenship [migr_emi1ctz]. Population on 1 January by age and sex [demo_pjan]. Immigration (for EU28 countries except reporting country plus reporting country) by age group, sex and citizenship [migr_imm1ctz]. Population on 1 January by age and sex [demo_pjan]. Immigration data for EU28 countries is for years 2013-2016. Years 2009 and 2012 for this series are from the EC annual report on intra-EU labour mobility 2017. Missing years have been interpolated.

For the EU as a whole, labour mobility is beneficial

From an individual perspective, labour mobility is a good thing. It means the opportunity to find employment where labour market conditions are better, and thus to gain new experiences and enhance skill formation. Labour mobility is also beneficial to overall EU competitiveness; a dynamic labour market that allocates labour and skills efficiently is important to innovate, grow and invest (EIB 2018). Moreover, labour mobility is needed to deepen the Single Market for services, which can help boost productivity.

From an economic resilience perspective, labour mobility is also desirable. Low mobility (in the absence of wage flexibility) means long and painful adjustment processes to shocks in a currency union (Blanchard and Katz 1992). While there is evidence that cross-country mobility has become more important over time, overall labour movements in Europe still play less of a role in helping to absorb country-specific economic shocks than in the US (Beyer and Smets 2015).2

Concerns about crowding out of workers in receiving countries, on the other hand, appear mostly unjustified. Overall, the existing evidence suggests that the impact on wages due to incoming labour supply is small and immigrants often contribute to easing labour shortages rather than replacing the local workforce, moving to sectors and occupations where their labour is most needed (Kahanec and Zimmermann 2016, Kahanec and Guzi 2016, Kahanec and Pytlikova 2016).

The national view can differ, particularly for those countries who are persistent net exporters of labour

The benefits and opportunities that labour mobility brings about at the individual level and at the EU level notwithstanding, large and persistent outflows of people can be a substantial drag at the country level. Here, the literature on ‘brain drain’ links losses in the stock of human capital to negative effects on innovation, labour markets, and countries’ fiscal situation, which is generally only partly compensated for by remittances or easier access to foreign markets through diaspora networks.

For Central and Eastern Europe, where net outward migration has been most pronounced over the past decade (see Figure 1) and dominated by the emigration of educated and young people, large-scale emigration has exacerbated skill shortages and slowed growth as well as income convergence (IMF 2016 and EIB 2018); although there is evidence that in some instances migration from new member states may have also led to improved knowledge flows and thus strengthened innovation in the region (EBRD 2018).

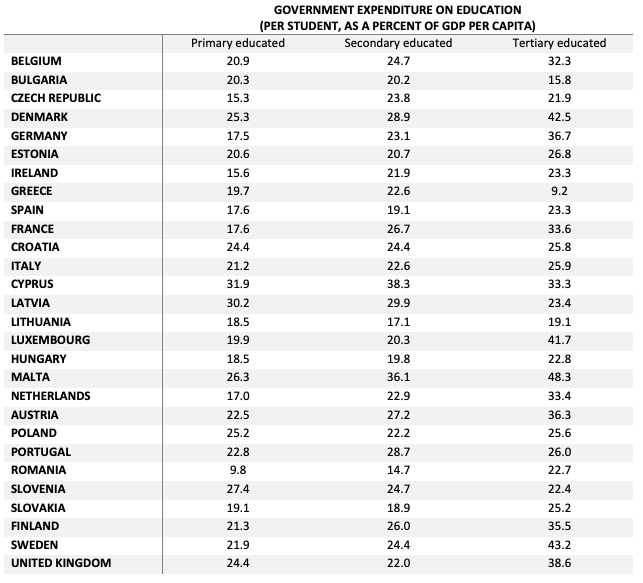

What is more, high and persistent outward migration also means a loss in government subsidies. Governments cover a major portion of the cost of education in the form of education subsidies, with public spending on the tertiary-educated population being particularly high (see Table 1).3 These subsidies are generally rationalised by the gap between private and social returns to education. As, in the case of the emigrating population, the latter accrue largely outside of the country where the education took place, the subsidy becomes a net cost.

Table 1 Government spending on education by country

Source: United Nations Education, Scientific, and Cultural Organization, (UNESCO). Initial government funding per student as a percentage of GDP per capita

Note: Figures refer to the average for the period 2012 to 2015. Where data was missing an average over adjacent years was taken.

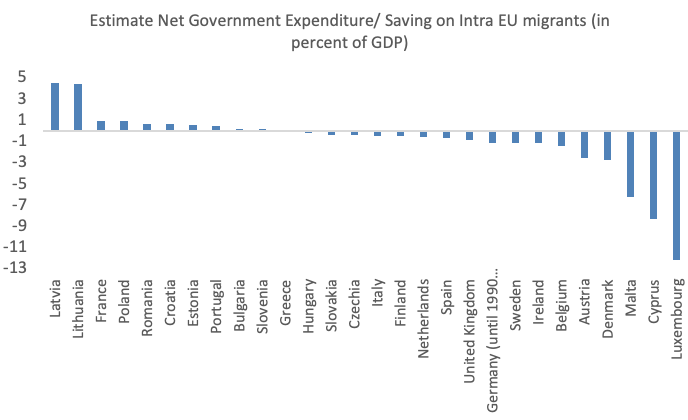

The mismatch between where investment activities take place and where the corresponding returns accrue raises questions of intra-EU fairness, with some countries ‘harnessing the benefits of investment activities paid for by others’ (see Figure 2). In addition, a mismatch between investment activities and returns risks to have a negative effect on overall investment levels in human capital formation – if the most educated leave the country, the incentive for governments to invest in their education may be dampened4 (even though from an EU-wide perspective, such investment would be desirable).

Similarly, if emigration rates are highest among those with ‘portable skills’, governments may be inclined to put more emphasis on educating professions that are more likely to stay, ‘producing’ too many lawyers and historians and too few ‘nurses and doctors’ from an EU-wide perspective.

The negative effect that outward migration can have on investment in human capital formation is often made worse by the negative consequences of high (net) outward migration on the fiscal stance in countries with ‘persistent net outward migration’. Foregone taxes from emigrants imply ceteris paribus tighter government finances, which need to be matched by lower government expenditures. Some of this is likely to fall upon education. The problem is accentuated by the fact that young workers aged 25-45 with a relatively high level of education, who typically constitute the main group of emigrants, tend to make up the biggest (net) contributors to public finances.

Figure 2 Estimated net spending on the education of emigrants by country

Note: Authors’ calculations. The figures are derived as follows: government expenditure on education of emigrants = Emigrants by level of education over total population multiplied by the cost per student for that level of education. Saved expenditure on education of immigrants = Immigrants by level of education over total population multiplied by the cost per student. The cost estimates are always those for the country under consideration.

Source: Eurostat: Emigration by age group, sex and citizenship [migr_emi1ctz]. Population on 1 January by age and sex [demo_pjan]. Immigration (for EU28 countries except reporting country plus reporting country) by age group, sex and citizenship [migr_imm1ctz]. Population on 1 January by age and sex [demo_pjan]. Immigration data for EU28 countries is for years 2013-2016. Years 2009 and 2012 for this series are from the EC annual report on intra-EU labour mobility 2017. Missing year have been interpolated. Eurostat: Population by educational attainment level, sex, age and country of birth (%) [edat_lfs_9912]. United Nations: Education, Scientific, and Cultural Organization, (UNESCO). Initial government funding per student as a percentage of GDP per capita. OECD: Education profile of migrants. DIOC 2010/11

Existing redistribution channels at the EU level address the issue at best partially

Existing EU schemes are insufficient to address the risk of under-investment in human capital formation.

- First, they account for a relatively low share of total public investment in education only (about 1%).

- Second, existing schemes – while clearly beneficial – only address the problem partially. Support via ERASMUS(+), for example, provides subsidies to facilitate pursuing studies or getting work experience abroad, aiming primarily at individuals that have already completed a large part of their education.5

Other existing EU funds, such as Cohesion and regional development funds, aim at correcting imbalances across countries and regions via compensation, which is not necessarily the same as compensating regions with high outward migration that invested a lot in their students. While correlated, being poorer does not necessarily mean high net outward migration nor high public investment in human capital.

To address the resulting risk of under-investment in human capital in times of rising intra-EU mobility but little willingness of member states to increase their contribution to existing redistributional schemes, we advocate learning from Japan’s experience.

Japan as an example for a European tax credit for investment in human capital

Japan, like many other countries, experiences large intra-country flows of skilled and younger people from poorer, often rural areas to cities. While the country’s overall population is shrinking, Tokyo’s population (like that of other big cities) keeps on increasing by about 100,000 people per year.

The way the Japanese address the resulting mismatch between where most educational investment takes place and where the returns to this investment accrue – as well as the associated tensions between cities and rural regions – is as follows. People can donate a share of their income tax, which is local, to a region of their choosing in return for a 1:1 tax credit on next year’s tax. The share can range from anywhere between 0% and 40%. The idea is that if taxpayers donate part of their income tax to their hometowns, Tokyo (and other large cities) no longer freeride on the substantial public expenditures required to raise and educate internal migrants.

The programme has become hugely successful in enticing donations since its launch 2008, with volumes surging in particular after the administration of Prime Minister Shinzo Abe, as part of its regional revitalisation initiative, doubled the upper limit on the tax-deductible donations. The annual amount of donations made to municipalities across the country reached ¥365.3 billion (€2.9 billion) in fiscal 2017 – 45 times the volume in its initial year in 2008.6

Could such a scheme help to better align investment in human capital formation and returns to such investment across EU countries? Probably yes. It would mean that foreign-born (or foreign-educated) workers can opt in to voluntarily donate a part of their income tax to their home country with a view to supporting human capital formation. Just like in Japan, the donation could then be used as a tax credit towards their tax bill in the following year.

Complement existing redistribution channels and support education as a European public good

This would be a novel and complementary way to foster investment in education. It would be targeted at supporting human capital, also at an early stage where local investment is key, thus helping in particular those countries/ regions that would otherwise be under-compensated for their investment efforts in this area.

As the donation is voluntary, countries/ regions would have an incentive to develop and highlight (for instance, through a common platform) good practice examples of investment in human capital formation. This, in turn, would make for a good complementary initiative to existing re-distributional schemes – in particular if EU funds co-invest in these projects – insofar as it would help to make visible where EU funds go and why the resulting investments are desirable.

For most net recipient countries in terms of migrant workers, the scheme would not entail a big loss in tax revenues overall – in particular if it is combined with a ceiling (relative and absolute).7 By design, it would be flexible, reflecting changes in individual mobility situations. From a wider perspective, it could be a step towards addressing that some parts of Europe feel being taken advantage of/ left behind within the EU and help to ensure equal access to quality education and excellence across the EU.

Authors’ note: The opinions expressed are the authors' only. The column should not be reported as representing the views of the European Investment Bank.

References

Arpaia, A, A Kiss, B Palvolgyi and A Turrini (2014), “Labour Mobility and Labour Market Adjustment in the EU”, Economic Papers 539, DG ECFIN.

Batsaikhan, U, Z Darvas and I Goncalves Raposo (2018), “People on the Move: migration and mobility in the European Union”, Bruegel, Brussels.

Blanchard, O J and L F Katz (1992), “Regional Evolutions”, Brookings Papers on Economic Activity 23(1): 1-76.

Beyer, R C M and F Smets (2015), “Labour Market Adjustments in Europe and the US: How Different?”, ECB Working Paper No.1767.

European Commission (2019), 2018 Annual Report on intra-EU Labour Mobility, DG Employment.

European Investment Bank (2018), Investment Report 2018: Retooling Europe’s Economy, Luxembourg.

EBRD (2018), Work in Transition, Transition Report 2018/19, London.

IMF (2016), “Emigration and its economic impact on Eastern Europe”, IMF staff discussion note 16/7.

Kahanec, M and M Pytliková (2016), “The economic impact of East-West migration on the European Union”, IZA Discussion Paper 10381.

Kahanec, M and M Guzi (2016), “How Immigrants Helped EU Labor Markets to Adjust During the Great Recession”, IZA Discussion Paper 10443.

Kahanec, M and K F Zimmermann (eds) (2016), Labor Migration, EU Enlargement, and the Great Recession, Springer, Berlin.

Endnotes

[1] Based on European Union Labour Force Survey estimates.

[2] For adjusting to region-specific shocks, the contribution of migration is rather similar but adjustment takes longer in the EU.

[3] The total public expenditure on education is defined as the sum of the expenditure on education and education administration made by local, regional, and central governments. It includes: i) current expenditure on education—expenditure for goods and services consumed within the current year, e.g., staff salaries, pensions and benefits; contracted or purchased services; other resources including books and teaching materials; welfare services and other current expenditure such as subsidies to students and households, furniture and minor equipment, minor repairs, fuel, telecommunication, travel, insurance, and rents; as well as ii) capital expenditure on education—expenditure for assets that last longer than one year. It includes expenditure for construction, renovation and major repairs of buildings and the purchase of heavy equipment or vehicles.

[4] This works via higher uncertainty of realising the gains and changes in the composition of the (local) electorate that can further reduce the incentives for investment in education, favouring for instance higher spending on social and retirement benefits for non-movers.

[5] Erasmus+ also provides some support for organisations to promote transnational learning, cooperation and organisational capacity building and networking activities.

[6] An important design aspect of the scheme in Japan is that it limits the gifts that municipalities can offer in return for a donation (to currently no more than 30% of the amount of donations). Municipalities that violate the rule are excluded from the program and the donations made to those municipalities no longer be tax deductible. Note that the furusato nozei system is currently undergoing reforms with a view to better balancing inflows and outflows, broadening the user base and improving the effective use of funds for regional revitalization for instance by strengthening contributions based on projects.

[7] To avoid a too strong drag on recipient government’s’ fiscal situation, the scheme could be complemented with both a relative ceiling on how much individuals can donate as well as a maximum share of the total tax income that any one country may have to forego due to the scheme. The latter would be to shield smaller open economies that heavily rely on labour from other EU countries from an undue burden.