Austerity plans in southern European countries (Greece, Portugal, Spain, and Italy) have so far yielded mixed results (Salto 2013). On the one hand, the primary budget balances of these countries have improved, and their risk premiums are now stabilised at a much lower level than during the crisis peak.

On the other hand, the consolidation effort has been particularly large and concentrated in a short time period. For instance, Greece adopted no less than five austerity programs between the end of 2009 and the end of 2012. As shown in Table 1, these efforts translated into a sharp reduction of the government deficit – seven points of GDP for Greece in cumulative terms for 2011 and 2012. Over the same period, however, the cumulative output drop in Greece amounted to an unprecedented 13% of GDP. Retrospectively, some policymakers consider that the efforts that were asked were too large. Indeed, the repeated and drastic austerity plans have deeply affected the functioning of those economies.

Table 1. Changes in primary structural balance of general government (% of potential GDP)

Source: In’t Veld (2013).

There are many theoretical channels through which recessionary economies may fall even deeper into recession when facing such adjustments. One such channel, often ignored, is the ‘transparency response’ of firms to increased tax pressure (see Pappadà and Zylberberg 2014 for further details). Simply put, when facing high taxes, firms do not only reduce their activity because of lower expected returns, but they also conceal more of it. Concealing production is costly for the government, because it implies that a part of the tax increase will not translate into additional tax revenues. In addition, the firms that become more informal are less able to attract external finance, and need to downsize their activity even further. This mechanism is to be expected in a country that is, like Greece, plagued by widespread tax evasion.

Is the transparency response to tax pressure an important channel in explaining the Greek crisis?

To reduce deficits, the Greek government implemented a mix of spending cuts and tax hikes. For instance, the government increased VAT to unprecedented levels (23% for the high rate instead of 18–19% in normal times). However, this tax increase generated a lower-than-expected increase in tax receipts. Between 2009 and 2010, the Bank of Greece anticipated an increase in tax revenues of 15%, while actual tax revenues only rose by 7.5%. Why?

In Pappadà and Zylberberg (2014), we argue that tax monitoring in Greece is such that small and medium businesses face a trade-off when choosing whether to declare their activity or not. On the one hand, being transparent gives firms access to external finance. On the other hand, it implies paying taxes. This trade-off only exists when tax monitoring alone is insufficient to deter businesses from concealing their activity. What happens then after a VAT increase? First, investment proves less profitable and firms reduce their activity. Second, they tilt resources toward non-declared activity. Doing so, they compromise their access to credit. In the end, the tax base shrinks more than in a fully transparent world. When we account for this mechanism in the context of the VAT increase of 2009 in Greece, we find that slightly more than half of the increase in tax rates did not translate into additional revenues. This response is essentially due to firms modifying the extent to which they declare their activity.

In which situation should we expect the transparency response to be quantitatively important? The answer depends on the elasticity of firms’ transparency to taxes, and how many firms there are at the ‘margin of formality’ (and how large they are).

Along those two dimensions, Greece was the worst candidate for a VAT reform. With low tax monitoring, the decision to hide/declare activity hinges a lot on the needs for external finance, which changed quite significantly after the tax hike. In addition, in Greece, firms at the margin of formality are numerous and quite large (turnover above €1 million) – they represent a large share of the Greek economy. Following the VAT reform, many of these businesses switched to informality, depriving the government of a large part of the expected gain in tax revenues.

Such a conclusion would also apply to Italy, Spain, or Portugal – countries with a large number of small and medium-size firms at the margin of formality. We would expect the behavioural response of firms to be smaller in countries like France or Germany (with better tax monitoring and much smaller firms at the margin).

The credit channel and the margin of formality

How could policymakers reduce the transparency response to a change in tax pressure (and make their austerity plans successful)? One could argue that Southern European countries, and Greece in particular, should simply reinforce tax monitoring. While an improvement in tax monitoring is widely considered as a key policy, this solution is fairly difficult to implement in the short run, and is likely to generate consistent results only in the medium to long run.

In our opinion, the credit market represents an additional and unexplored channel to monitor and curb firms’ transparency response to changes in tax pressure.

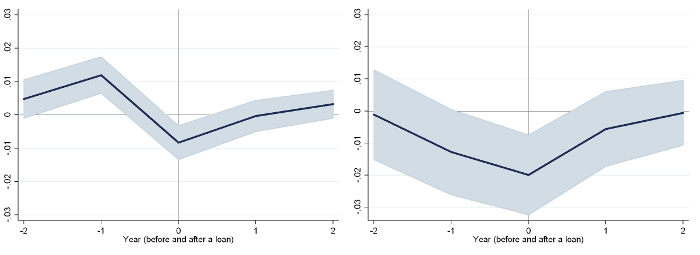

Using balance-sheet data on Greek firms over the period 2001–2011, we show that there is an excess profitability declared by firms just before gaining access to credit (see Figure 1). This anomaly can only be seen for firms that have, in normal times, incentives to hide their activity (firms in sectors with high taxes). Credit can give incentives to declare activity. It should be noted, however, that this response differs across firm sizes – some firms react, some others do not. The main challenge for a credit-oriented policy would be to know which firms to target.

Figure 1. Firm profitability around credit access – high (left) vs. low (right) VAT

As can be seen in Figure 2, between 2007 (pre-crisis) and 2011 (post-crisis), there has been a shift of credit from small firms to medium–large firms in Greece. How can we explain this shift? Typically, there are very small firms that are informal and do not have access to credit. There are also large firms that have high standards of transparency, and can access external finance either through credit or stock markets. In between, the small to medium-size firms are those for which credit access interacts more with firm transparency.

Figure 2. Bank loans over total assets and total assets

An improvement in the credit access of small to medium-size firms might counteract the negative effects of the higher tax pressure on firms’ transparency choice. Providing incentives for increased transparency for the firms at the margin of formality could therefore prevent the fall in investment by these firms. Such measures might be less costly and more effective in the short run than an institutional – though fundamental – improvement in tax enforcement.

References

In ’t Veld J (2013), “Fiscal consolidations and spillovers in the euro area periphery and core”, European Economy Economic Papers 506.

Pappadà, F and Y Zylberberg (2014), “Austerity plans and tax evasion: theory and evidence from Greece”, Cahiers de Recherches Economiques du Département d'Econométrie et d'Economie politique (DEEP) 14.01, Université de Lausanne, Faculté des HEC.

Salto, M, ed. (2013), "Report on Public finances in EMU 2013", European Economy 4, Brussels: European Commission.