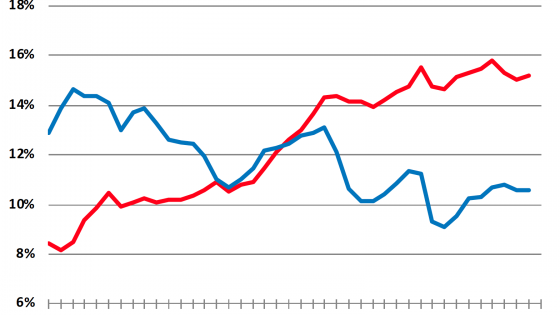

Technological progress changes the nature of corporate investment and capital. In a seminal paper, Corrado and Hulten (2010) illustrate that intangible investment in the US, which was under half the level of tangible investment in the 1970s, now exceeds tangible investment (see Figure 1, as well as Haskel and Westlake 2018). Andersson and Saiz (2018) confirm a similar trend in the euro area, albeit at lower levels of intangible investment.

Figure 1 Gross business fixed investment (% of NFB output adjusted to include intangibles) from Corrado and Hulten (2010)

The impact of interest rates on corporate investment is a key component of monetary policy transmission. The notion that the rise of intangible investment may affect monetary policy transmission was recognised, for example, in Crouzet and Eberly’s (2019) Jackson Hole address, and in Haskel’s (2020) Bank of England speech. Nevertheless, comprehensive empirical evidence on how monetary policy affects intangible investment is lacking.

Our recent research (Döttling and Ratnovski 2021) aims to fill this gap. We assess the effects of monetary policy on stock prices and investment on US data over 1990–2017, obtaining a set of mutually consistent results:

- Stock prices and investment of firms with more intangible assets respond less to monetary policy.

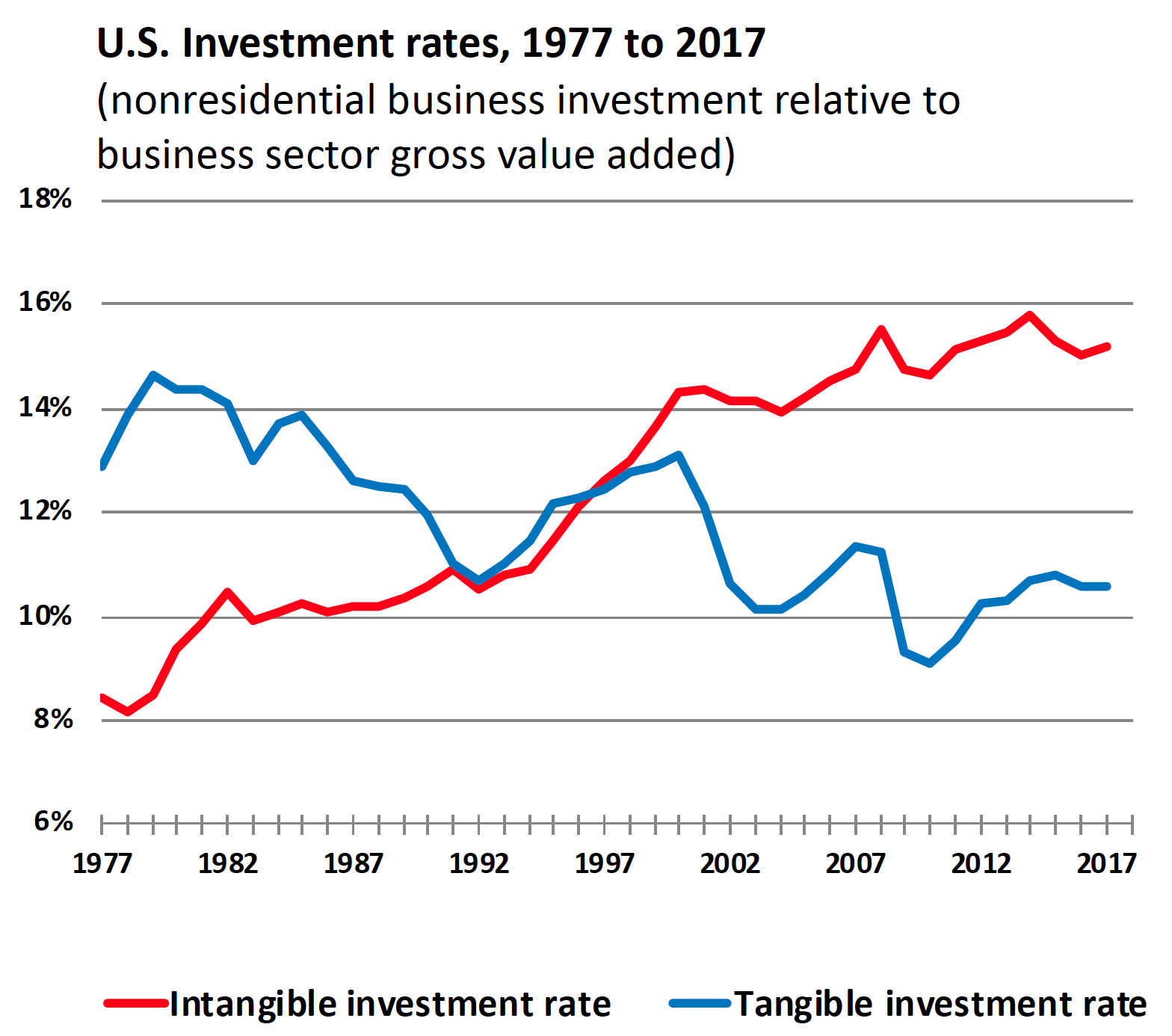

A one standard deviation higher intangible-to-total capital ratio is associated with an 11 basis point smaller stock price decline in response to a 25 basis point unexpected increase in the Federal Reserve’s Funds rate (approximately one-tenth of the average stock price decline of 1.09%). Similarly, a one standard deviation higher intangible-to-total capital ratio is associated with a 43 basis point smaller investment decline in response to a 25 basis point increase in the instrumented one-year Treasury rate after 12 quarters (approximately one-seventh of the average 3% investment decline). This result is illustrated in Figure 2, which plots the response of total investment to a 25 basis point monetary policy tightening among intangible firms (with above-median intangible-to-total capital) compared to tangible firms (below median).

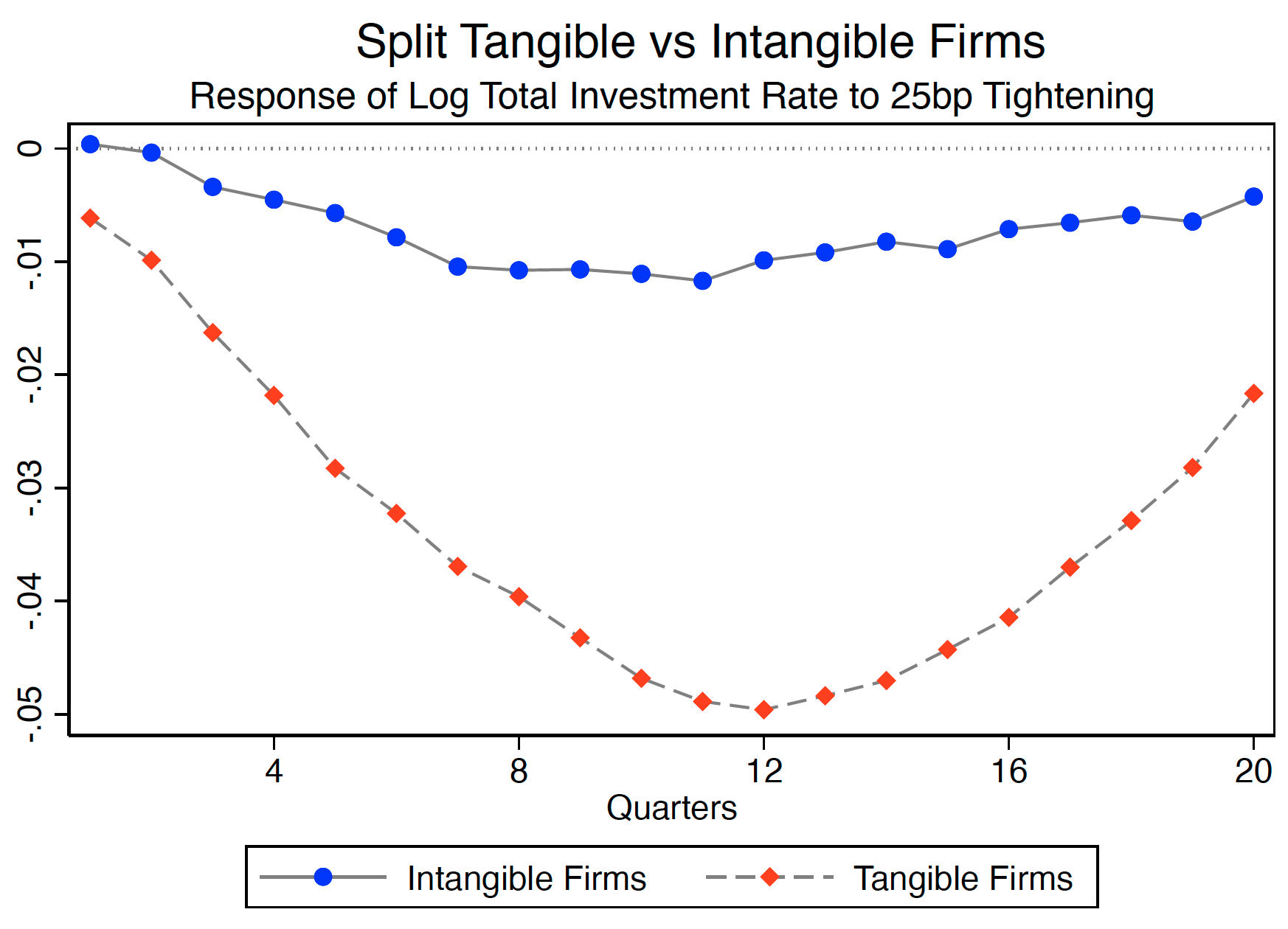

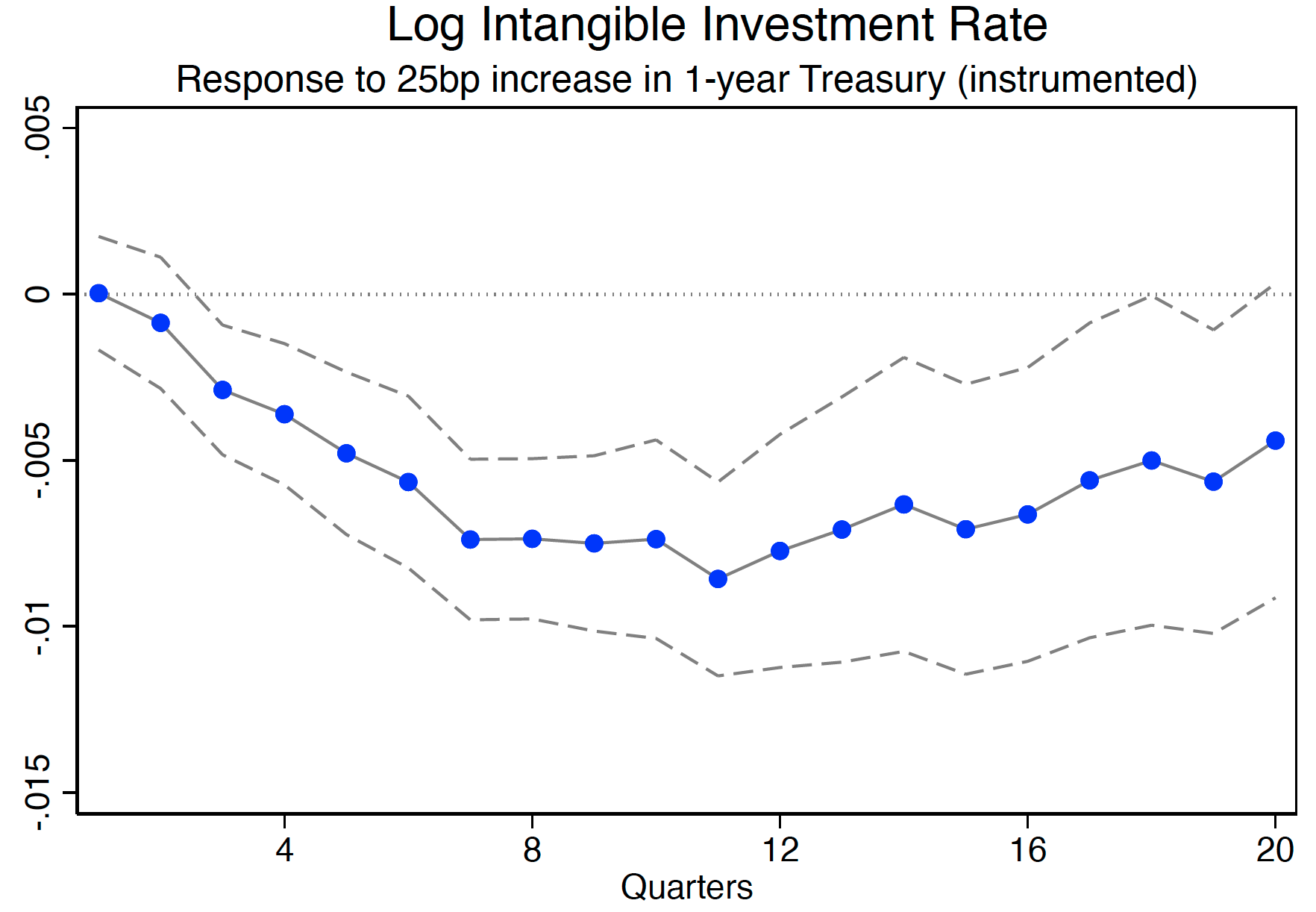

- Intangible investment responds less to monetary policy compared to tangible investment.

Whereas a 25 basis point increase in the instrumented one-year Treasury rate is associated with a tangible investment decline of approximately 6% after 12 quarters, intangible investment declines by less than 1% (see Figure 3). The weaker response of intangible investment is robust to different measures of intangible capital and is present in both aggregate and firm-level data.

Figure 2 Investment response to monetary policy in firms with more tangible and more intangible assets.

Figure 3 Tangible and intangible investment response to monetary policy

These results point to a significantly weaker transmission of monetary policy to intangible investment, and more broadly to a lower effectiveness of monetary policy in a world where more of corporate assets and investment are intangible.

Which forces can impede the transmission of monetary policy to intangible investment? We consider three candidate economic channels, and find evidence consistent with two of them.

- We find strong evidence that firms with intangible assets experience a weaker credit channel of monetary policy.

Firms with more intangible assets use less debt because intangible assets are not a good source of collateral (Brown et al. 2009, Cecchetti and Schoenholtz 2018, Falato et al. 2020). As a result, the effect of monetary policy on debt-financing conditions is less pertinent for firms with more intangible assets. We test this mechanism by comparing the relative weakness of intangible investment response to monetary policy between financially constrained firms (where external financing conditions matter for investment) and financially unconstrained firms. Data confirm that much of the weaker intangible investment response originates in financially constrained firms, confirming the weaker credit channel of monetary policy for firms with intangible assets.

Additionally, we find that the weaker investment response to monetary policy in financially constrained intangible firms is mirrored by a weaker response of debt growth in these firms, further confirming a muted credit channel of monetary policy. At the same time, we find monetary policy generally has little effect on the growth of firm equity financing, consistent with significant frictions and costs in raising external equity. Equity financing may be particularly important for firms with intangible assets, as documented in Brown et al. (2009) and Hall and Lerner (2010).

- We find evidence, albeit weaker, that higher depreciation rates of intangible assets also play a role.

Statistically, intangible asset depreciation rates are between 10% and 40% (Ewens et al. 2019), while tangible asset depreciation rates are under 10%. With higher depreciation rates, same changes in interest rates imply proportionately smaller changes in the user cost of capital, and thus in the investment ‘hurdle’ rate.

- We test whether higher adjustment costs of intangible investment can explain its subdued response to monetary policy. Existing data offer no evidence to support this hypothesis.

Our findings have important economic policy implications. The result that intangible capital makes corporate investment less responsive to monetary policy may help shed light on why investment has responded tepidly to substantial monetary easing during the last decade. Moreover, continued technological progress is likely to keep elevating the role of intangible assets in firms, further weakening the investment channel of monetary policy in the future.

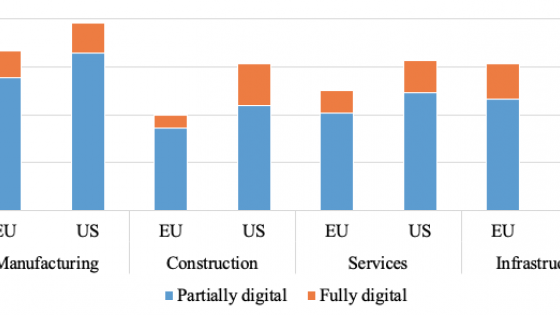

Given these frictions in the transmission of monetary policy, intangible investment may best be encouraged not by traditional monetary policy, but by other means. These can include fiscal policies (e.g. research and development tax credits), structural reforms that support innovation, deeper equity markets including for early-stage firms, and possibly by expanding unconventional monetary policy tools to support equity financing of firms (Brown et al. 2013, Chun et al. 2015, Beck et al. 2020). The adoption of these policies might be particularly useful for EU countries as part of their post-pandemic stimulus measures. EU countries historically lag the US in terms of intangible investment, innovation, and digitalisation. Better fiscal and structural measures to promote the ‘knowledge economy’ might hasten the catch-up (Revoltella 2019, Revoltella et al. 2020).

References

Andersson, M and L Saiz (2018), “Investment in intangible assets in the euro area”, ECB Economic Bulletin 7.

Bates, T W, K M Kahle and R M Stulz (2009), “Why do US firms hold so much more cash than they used to?”, Journal of Finance 64(5): 1985-2021

Beck, T, R Döttling, T Lambert and M van Dijk (2020), “How banks affect investment and growth: New evidence”, VoxEU.org, 2 July.

Brown, J R, S M Fazzari and B C Petersen (2009), “Financing innovation and growth: Cashflow, external equity, and the 1990s R&D boom”, Journal of Finance 64(1): 151–185.

Brown, J R, G Martinsson and B C Petersen (2013), “Law, stock markets, and innovation”, The Journal of Finance 68(4): 1517-1549.

Cecchetti, S and K Schoenholtz (2018), “Financing intangible capital”, VoxEU.org, 22 February.

Chun, H, T Miyagawa, H Pyo and K Tonogi (2015), “Intangibles and productivity growth: Evidence from Japan and Korea”, VoxEU.org, 9 October.

Corrado, C A and C R Hulten (2010), “How do you measure a “technological revolution”?”, American Economic Review 100(2): 99–104.

Crouzet, N and J C Eberly (2019), “Understanding weak capital investment: The role of market concentration and intangibles”, NBER Working Paper 25869.

Döttling, R and L Ratnovski (2021), “Monetary Policy and Intangible Investment”, SSRN.

Ewens, M, R Peters and S Wang (2019), “Measuring intangible capital with market prices”, NBER Working Paper 25960.

Falato, A, D Kadyrzhanova, J Sim and R Steri (2020), “Rising intangible capital, shrinking debt capacity, and the US corporate savings glut”, Journal of Finance, forthcoming.

Hall, B H and J Lerner (2010), “The financing of R&D and innovation”, Handbook of the Economics of Innovation 1(1): 609–639.

Haskel, J (2020), “Monetary policy in the intangible economy”, speech, Bank of England.

Haskel, J and S Westlake (2018), Capitalism without Capital: The Rise of the Intangible Economy, Princeton, NJ: Princeton University Press.

Revoltella, D (2019), “Retooling Europe’s economy”, VoxEU.org, 22 January. Available at:

Revoltella, D, D Rückert and C Weiss (2020), "Adoption of digital technologies by firms in Europe and the US: Evidence from the EIB Investment Survey", VoxEU.org, 18 March.