There has been a great deal of debate about whether inflation – or even high inflation – might return after the Covid-19 pandemic (Blanchard 2020, Blanchard and Pisani-Ferry 2020, Garicano et al. 2020, Miles and Scott 2020, Rehn 2021). While many economists do doubt this turn of events, the recent book by Goodhart and Pradhan (2020b) casts a very different picture and suggests a strong return of inflation.

Drawing on recent conceptual work, we suggest that the disinflationary force through bank equity regulation will no longer be at work once the economies return to normal times. Thus, inflation risks are higher than generally assumed.

In support of our argument, we start from the current monetary architecture, which is based on four pillars (see Faure and Gersbach 2019a):

- The creation of money is organised hierarchically. The central bank issues banknotes and coins (physical central bank money), which serve as legal tender.

- Commercial banks have the right to issue deposits when they grant loans or purchase assets. Deposits themselves are claims on banknotes.

- Commercial banks face a set of rules such as capital requirements or deposit insurance schemes. However, they are not (or only to a small extent) required to hold central bank money as reserves for their deposits.

- Interbank liabilities, such as those created through payments in the economy, are settled with reserves (electronic central bank money). Only commercial banks have access to it.

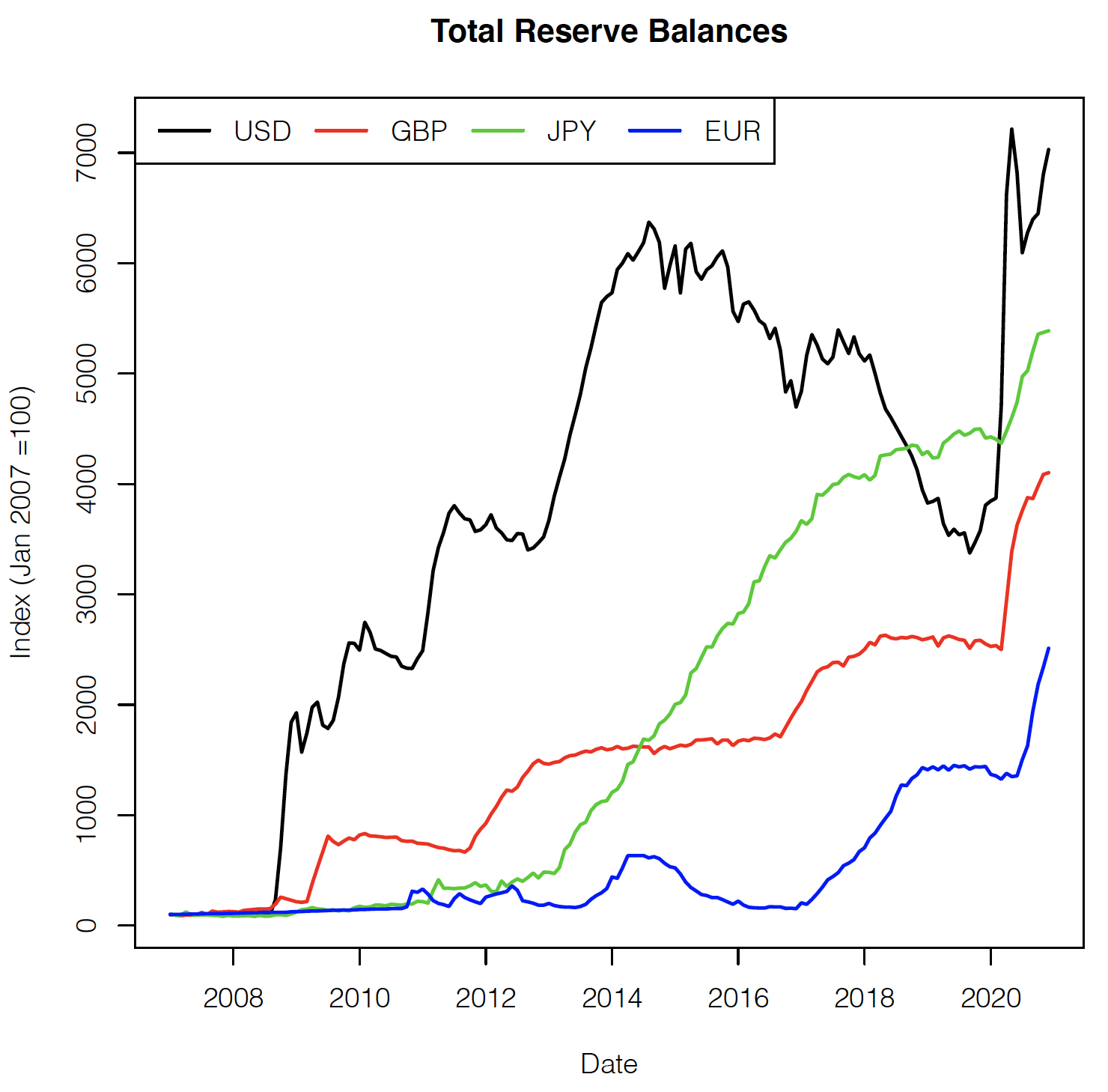

Since the financial crisis of 2007/08 central bank reserves of the banking systems in most countries and in the euro area have been strongly rising, albeit to different degrees and not always monotonically (Figure 1). The Covid-19 pandemic has pushed the level of central bank reserves to even higher levels.

Figure 1 Total reserve balances maintained by private banks

Notes: Total reserve balances maintained by private banks at the Federal Reserve Banks (USD), the Bank of England (GBP), the Bank of Japan (JPY), and the ECB (EUR), see https://www.federalreserve.gov/, https://www.boj.or.jp, https://www.bankofengland.co.uk/ and https://www.ecb.europa.eu

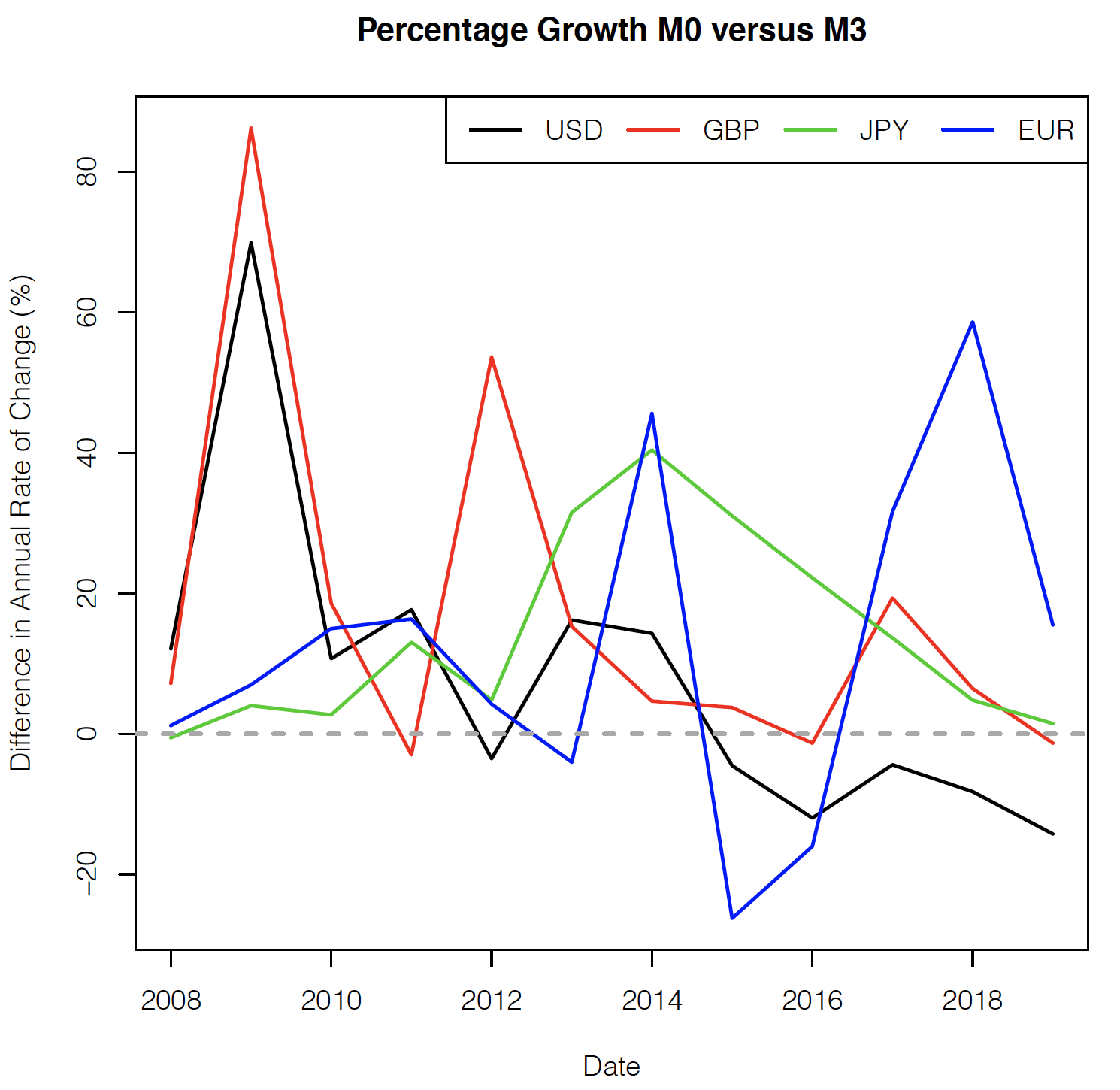

In principle, large central bank reserves allow banks to strongly increase lending and asset purchases, since they can settle ensuing interbank liabilities (e.g. following from deposit outflows) more easily. Since money (bank deposit) creation is the flip side of loan creation to and asset purchases from the private sector, money supply (in terms of M1, M2, M3) could, in principle, increase strongly, with large central bank reserves. As it did before, the monetary base multiplier relating the broad money stock to the monetary base, depending on the public’s currency/deposit ratio and the commercial banks’ desired reserve/deposit ratio, could have reactivated itself. However, it has not happened, and the monetary aggregates have been increasing at a much lower rate than central bank reserves (Figure 2).

Figure 2 Difference of percentage growth of the monetary base M0 and the money stock M3

Notes: See https://www.federalreserve.gov/, https://www.boj.or.jp, https://www.bankofengland.co.uk/ and https://www.ecb.europa.eu

The argument in a nutshell

Why did the broad money supply grow at a much lower rate than the monetary base? There are several reasons for it, as well as an identification problem. It is very hard to tell whether the weakness in bank loans and deposits was caused by a fall in demand or a fall in supply (for an assessment, see Mian and Sufi 2018). In addition, debt-overhang problems and structural changes might have lowered the profitability of loan and money creation. However, some reasons are more subtle.

Faure and Gersbach (2019a) and Böser and Gersbach (2020) show that capital requirements constrain money creation once bank equity is given or if it only changes slowly. That is, when banks’ possibilities for equity financing are constrained, a tightening of capital regulation will constrain the dual process of loan creation and deposit creation and thus will slow the increase of monetary aggregates such as M1, M2, and M3.

Of course, as the last decades showed, the link between the growth of bank money and inflation is unstable and depends on the macroeconomic environment. On the one extreme, in a liquidity trap and when market participants use bank deposits significantly as a saving instrument in a low-interest environment, or if the output is quite below potential output, higher bank money creation has little or no effect on inflation. The same happens if there are strong complementary disinflationary forces, as at the begining of the COVID-19 pandemic. On the other hand, when these circumstances are not present, or not present anymore, permanently stronger bank money creation will have inflationary consequences, in particular if it happens jointly with negative supply shocks.

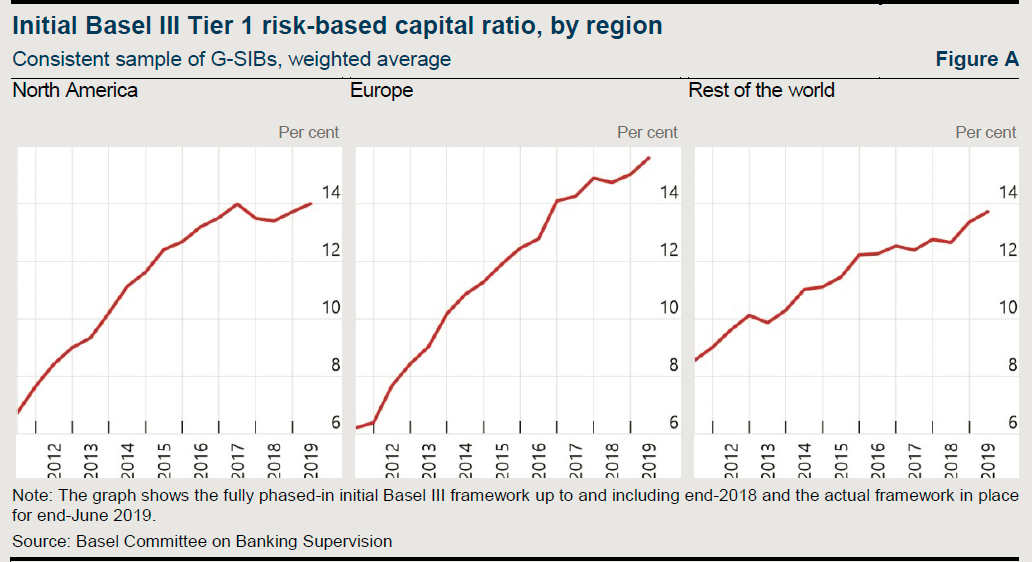

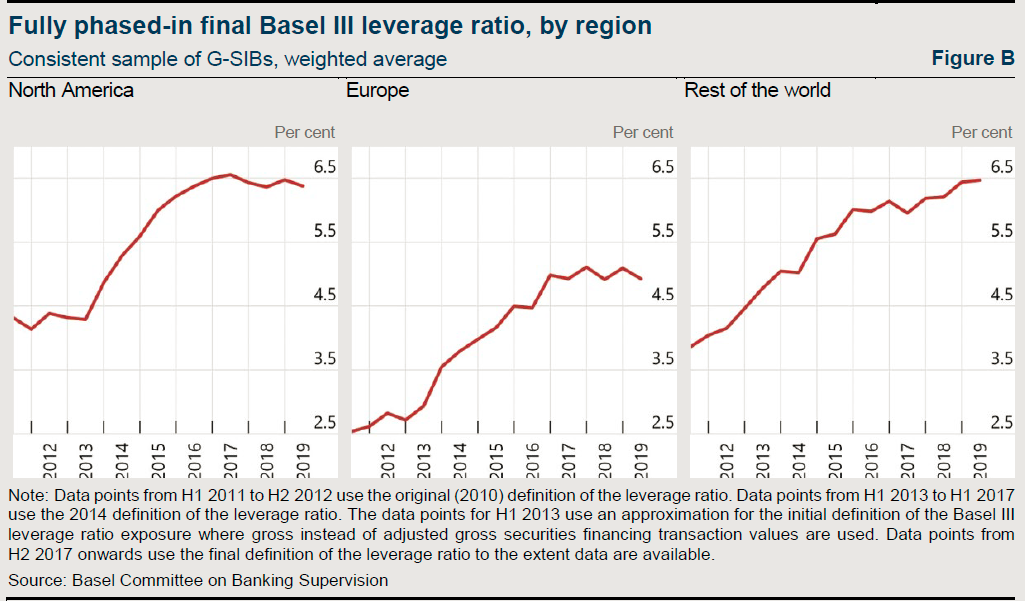

Based on the above reasoning, tightening capital requirements can be seen as an anti-inflationary force, as it limits the creation of bank deposits and thus reduces the growth of bank money. Both conditions – higher capital requirements and sticky bank equity – were typical for banking systems since the financial crisis of 2007/2008. First, banking regulation has been tightened—risk-sensitive capital requirements and leverage ratios, in particular (Figures 3 and 4).

Figure 3 Initial Basel III Tier 1 risk-based capital ratio (by region)

Notes: See Financial Stability Board (2020).

Figure 4 Fully phased-in final Basel III leverage ratio (by region)

Notes: See Financial Stability Board (2020).

Figure 5 Evolution of risk-weighted and unweighted capital ratios for banks

Notes: See Financial Stability Board (2020).

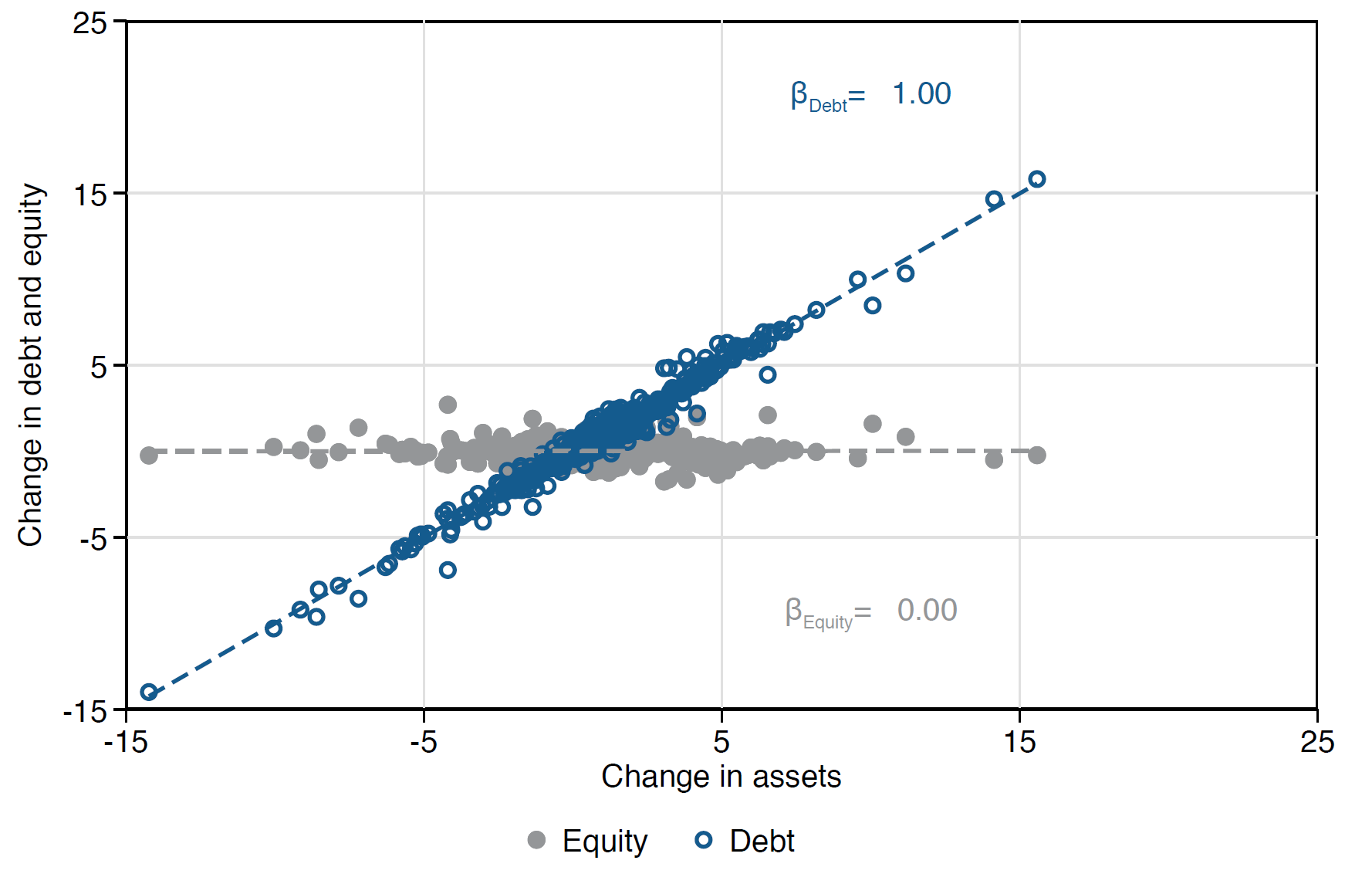

In addition, bank equity has been quite sticky (Figures 5 and 6). This was demonstrated in several papers such as Coimbra and Rey (2017) and Boyarchenko and Mueller (2019).

Figure 6 Relationship between year-over-year changes in total assets, total liabilities, and total financial equity for monetary financial institutions

Notes: This figure shows the relationship between year-over-year changes in total assets, total liabilities and total financial equity for monetary financial institutions (including the monetary authority and central banks) sector. See Boyarchenko and Mueller 2019.

Of course, there are reasons why bank equity is sticky – e.g. current shareholders want to avoid the dilution of their equity value because of new equity issuance – but this will not change significantly after the Covid-19 pandemic.

To sum up, as the tightening of bank equity regulation has come to an end, this disinflationary force will vanish, so that we cannot rely on it after the pandemic.

Remedies

The above arguments show that we may have to worry about banks that hold large reserves more than we used to. Central banks can, of course, reduce reserve holdings by selling some of the assets they acquired through quantitative easing. Moreover, if central banks pay interest on reserves, once these interest rate payments become significant again, they will encourage banks to keep large reserves and renounce strong money creation. However, paying interest on reserves will continuously increase these reserves, as well as the interest paid on them. Hence, this strategy leads to a trap, so that it will be difficult to control money creation by banks once the profitability of loan/asset purchases and money creation recovers sufficiently.

If central banks do not pay interest on reserves, depending on the precise interest rate setting regime, commercial banks will have even stronger and immediate incentives to use excess reserves to expand lending and monetary deposits, with the corresponding inflation risks. Nevertheless, this is a better outlook, as it allows the return to more normal times in which central bank reserves constrain bank behaviour tightly. To avoid additional inflation risks from a return to zero interest rates on reserves, imposing suitable reserve requirements should be used as a complementary measure in the transition.

Conclusion

The connection between bank equity regulation and inflation, particularly the disinflationary force of tighter capital requirements, is often overlooked. Even if bank equity regulation seems unconnected to inflation, tightening this regulation acts as a disinflationary force. This force might play no major role anymore, and thus the risk of inflation after the Covid-19 pandemic may be greater than commonly assumed. Of course, we cannot address in this short column the magnitude of this force and how much its disappearance will contribute to inflation in the future.

Author’s note: I am grateful to Florian Böser and Charles Goodhart for valuable comments.

References

Blanchard, O (2020), “Is there Deflation or Inflation in our Future?”, VoxEU.org, 24 April.

Blanchard, O and J Pisani-Ferry (2020), “Monetisation: Do not Panic”, VoxEU.org, 10 April.

Böser, F and H Gersbach (2020), “Monetary Policy with a Central Bank Digital Currency: The Short and the Long Term”, CEPR Discussion Paper No. 15322.

Boyarchenko, N and P Mueller (2019), “Corporate Credit Provision”, Federal Reserve Bank of New York Staff Report No. 895.

Coimbra, N and H Rey (2017), “Financial Cycles with Heterogeneous Intermediaries”, NBER Working Paper 23245.

Faure, S and H Gersbach (2019a), “On the Money Creation Approach to Banking”, CEPR Discussion Paper No. 11368.

Faure, S and H Gersbach (2019b), “Money Creation in Different Architectures”, CEPR Discussion Paper, No.13156.

Financial Stability Board (2020), “Evaluation of the effect of too-big-to-fail reforms: consultation report”, 28 June.

Garicano, L, J Saa-Requejo and T Santos (2020), “Tackling Inflation if It Reappears”, VoxEU.org, 6 October.

Gersbach, H (2021), “The fragile triangle: Price stability, bank regulation and central bank reserves”, CEPR Policy Insight No. 112.

Goodhart, C (2020), “Inflation after the Pandemic: Theory and Practice”, VoxEU.org, 13 June.

Goodhart, C and M Pradhan (2020a), “Future Imperfect after Coronavirus”, VoxEU.org, 27 March.

Goodhart, C and M Pradhan (2020b), The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival, Palgrave MacMillan.

Mian, A and A Sufi (2018), "Finance and Business Cycles: The Credit-Driven Household Demand Channel”, Journal of Economic Perspectives 32(3): 31-58.

Miles, D and A Scott (2020), “Will Inflation Make a Comeback after the Crisis Ends?”, VoxEU.org, 4 April.

Rehn, O (2021), “Will Inflation Make a Comeback as Populations Age?”, VoxEU.org, 13 January.