Foreign direct investment (FDI) is traditionally viewed as a key driver of prosperity in policy circles. According to the OECD (2002), “FDI is an integral part of an open and effective international economic system and a major catalyst to development. [...] With most FDI flows originating from OECD countries, developed countries can contribute to advancing this agenda. They can facilitate developing countries' access to international markets and technology.” In addition, modern FDI has become a vehicle for transferring intangible assets. According to the World Bank (2015), “[t]oday, FDI is not only about capital, but also – and more important – about technology and know-how, [...] International patterns of production are leading to new forms of cross-border investment, in which foreign investors share their intangible assets such as know-how or brands in conjunction with local capital or tangible assets of domestic investors.” Academics share the hopes of policymakers for a positive economic impact of FDI, which plays central role in recent integration efforts. Slaughter (2013: 3) argues that “[i]f successfully negotiated, [TTIP and TPP] would deepen and strengthen ties with many of the most significant U.S. economic partners. A large majority of inward FDI in the United States already originates from TTIP and TPP countries, making these deals particularly important in the broader effort to recruit global business investment.”

Policymakers' enthusiasm is based on the obvious partial equilibrium evidence of FDI impacts on sectoral output, employment, and capital returns. In contrast, there is relatively little structural evidence for the economy-wide importance of FDI as a vehicle for knowledge transfer and the effects on trade, domestic investment, and welfare. The lack of a unified multi-country framework of the global economy impact of FDI is, at least in part, because the relationship between FDI and various economic outcomes is intrinsically dynamic. However, as noted by Desmet and Rossi-Hansberg (2014), introducing dynamics to static multi-country trade models is hard, typically making “spatial dynamic models intractable, both analytically and numerically.” (p. 1212).

To gain traction with spatial dynamics in the case of FDI, in a recent paper (Anderson et al. 2019b) we build a framework that characterises the impact of FDI through interactions with trade and domestic investment in physical capital. On the trade side, the model is a member of the wide structural gravity class of new quantitative general equilibrium trade models described in detail by Arkolakis et al. (2012). Domestic investment in physical capital is modelled following Anderson et al. (2019a). The main novelty is the introduction of FDI on the supply side, where, in the spirit of McGrattan and Prescott (2009) and Markusen (2002), production uses FDI in the form of non-rival (or joint) technology capital along with labour and physical capital stocks. Thus, countries can use their technology capital in potentially all countries while using at home the technology capital from potentially all countries.

FDI liberalisation increases FDI, with general equilibrium implications for trade, income, and expenditure. An increase in bilateral FDI directly leads to higher income and to higher expenditure in the liberalising countries. Since higher expenditure leads to more accumulation of technology capital, FDI liberalisation between two countries will also trigger positive spillover effects on output and expenditure in third countries. Through its impact on output and expenditure, increases in FDI will also translate into increases in trade flows. The changes in FDI in our counterfactual experiment also indirectly affect trade between countries with no change in bilateral FDI. The structural gravity class of models describes equilibrium trade as if each country trades with a world market facing an average friction called multilateral resistance – one on outward shipments (export) and another on inward shipments (imports). Changes in outputs and expenditures change the equilibrium multilateral resistances because they are general equilibrium indexes, i.e. they capture the effects of changes between any two countries on consumer and on producer prices in any other country in the model.

Motivated by one of the opening quotes, which depicts FDI as a key driver of development, we quantify the importance of the novel FDI channel with a counterfactual experiment that describes a hypothetical world without outward and inward FDI from and to low- and lower-middle-income countries. The calibration is based on a balanced data set for 89 countries, which account for more than 96% of world GDP and for more than 94% of FDI in 2011. Of the 89 countries, 21 are classified as low- or lower-middle-income countries according to The World Bank's Country and Lending Groups classification.

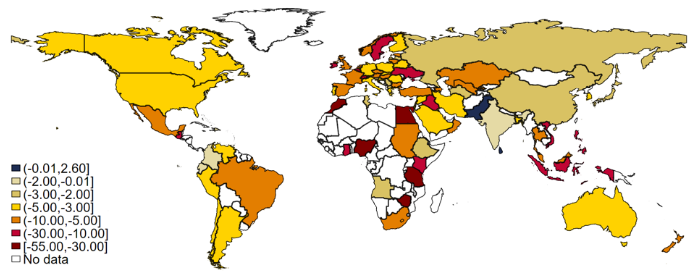

The impact from the elimination of FDI in the low- and lower-middle-income countries on trade and welfare in the world is depicted in Figures 1 and 2. Figure 1 reports the effects on trade, measured by the percentage change in total exports. Three main findings stand out. First, FDI is indeed an important driver of trade. On average, the gains from FDI in the poorer countries in the world amount to 7% of world's trade in 2011, the year of our counterfactual analysis. Second, all countries lose from the counterfactual elimination of FDI in the poorer countries. Third, the impact is heterogeneous. Poorer countries lose the most, but the impact varies widely even within this group – some lose over 50% and some very little. The impact on countries in the rest of the world is significant as well. Some countries lose a lot (e.g. Luxembourg, Singapore, and Ireland) while others (such as India, Ecuador, and Dominican Republic) lose less. Pakistan and Sri Lanka actually see an increase in their total exports due to the elimination of FDI.

Figure 1 Percentage change in total exports from eliminating outward and inward FDI to and from low- and lower-middle-income countries

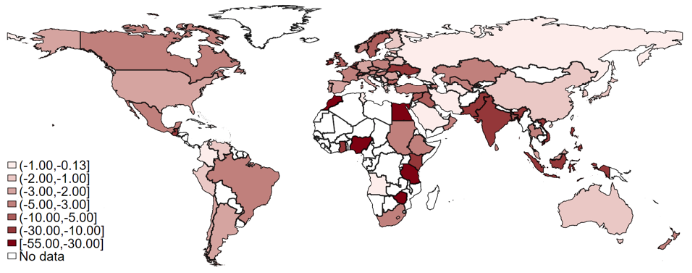

Figure 2 reports impact of the elimination of FDI in the poorer countries on welfare, measured by properly discounted consumption. Overall, in terms of direction, the welfare indexes in Figure 2 are consistent with the trade indexes that we present in Figure 1. On average, the gains from FDI amount to 6% of world's welfare in 2011. Further, all countries in the world have benefited from FDI, but the effects are very heterogeneous. The directly affected low- and lower-middle-income countries see welfare changes up to over 50% (Morocco and Nigeria), while some of the remaining 68 countries, such as Ecuador, Turkmenistan, and Dominican Republic are hardly affected. A higher country-specific production share of FDI leads to larger welfare losses, all else equal. Intuitively, a larger importance of FDI in production leads to larger welfare losses when restricting FDI. A larger net log FDI position leads to larger welfare losses. Intuitively, if a country has more inward than outward FDI, restricting FDI will lead to larger welfare losses, as FDI is complementary to other production factors and therefore overall income increases more than FDI payments.

The results suggest that FDI has acted to reduce cross-country income inequality. In particular, the results suggest that FDI has led to significant increases in the welfare of some of the poorer economies in the EU. Given the renewed interest in the determinants of inequality (European Commission 2010), our results have potentially important implications for regional policy.

Figure 2 Welfare effects of eliminating outward and inward FDI to and from low- and lower-middle-income countries (%)

Overall, the analysis reveals that FDI is indeed an important component of the modern world economic system. The results suggest positive payoffs to policies designed to facilitate FDI, particularly those concerning protection of intellectual property. In addition, our structural approach opens new opportunities for further empirical and policy research. For example, the model delivers a structural FDI gravity system that resembles the traditional gravity system of the trade literature and lends itself to estimation with the most recent econometric techniques from the gravity literature. Another structural implication of the model is on the relationship between FDI and income/growth, which can be tested in the spirit of Frankel and Romer (1999). Yet another structurally motivated relationship that can be tested is the one between FDI and domestic investment.

References

Anderson, J E, M Larch, and Y V Yotov (2019a), “Growth and Trade with Frictions: A Structural Estimation Framework”, Economic Journal, forthcoming.

Anderson, J E, M Larch, and Y V Yotov (2019b), “Trade and Investment in the Global Economy: A Multi-country Dynamic Analysis”, working paper.

Arkolakis, C, A Costinot, and A Rodríguez-Clare (2012), “New Trade Models, Same Old Gains?,” American Economic Review 102(1): 94–130.

Desmet, K and E Rossi-Hansberg (2014), “Spatial Development”, American Economic Review 104(4): 1211–1243.

European Commission (2010), Investing in Europe's Future.

Frankel, J A and D H Romer (1999), “Does Trade Cause Growth?”, American Economic Review 89(3): 379–399.

Markusen, J R and K E Maskus (2002), “Discriminating Among Alternative Theories of the Multinational Enterprise,” Review of International Economics 10(4): 694–707.

McGrattan, E R and E C Prescott (2009), “Openness, Technology Capital, and Development,” Journal of Economic Theory 144(6): 2454–2476.

OECD (2002), Foreign Direct Investment for Development: Maximising Benefits, Minimising Costs.

Slaughter, M J (2013), Attracting Foreign Direct Investment through an Ambitious Trade Agenda, Organization for International Investment Research Report.

Qiang, C, R Echandi and J Krajcovicova (2015), “Foreign Direct Investment and Development: Insights from Literature and Ideas for Research”, World Bank Private Sector Development Blog, 24 November.