The Global Crisis made clear that financial and real integration are deeply interlinked. Yet, we know little about the empirical impact of financial globalisation on international trade. This is all the more surprising as it has long been recognised that greater domestic financial development and access to finance facilitate trade (see Foley and Manova, 2015 for a survey) and that shocks to banks’ health can impede trade (e.g. Amiti and Weinstein 2011, Chor and Manova 2012). In a recent Bank of England Staff Working Paper we set out to fill this knowledge gap and explore the links between the local presence of foreign banks and trade flows (Claessens and Van Horen 2017).

Foreign banks and trade: Channels

One can think of several reasons why foreign banks might benefit exporting firms and therefore positively affect trade. First, foreign banks can increase the availability of external finance, which may especially benefit firms that (want to) export as they typically have a higher need for bank funding. They can do so directly by moving funds into the exporting country from their parent banks or international financial markets, or by raising (hitherto untapped) funds locally. Or they can do so indirectly by introducing new and better technologies and increasing competition in the local banking system, which can raise the quality and reduce the cost of financial intermediation (Claessens and Van Horen 2013).

Second, foreign banks might be especially well positioned to provide the type of financial products that exporters need, such as letters of credit to overcome credit risk and derivatives to hedge currency risk. Providing these products is a specialised business and thus mostly done by a limited set of globally active banks with the required size, global focus and reach. Foreign banks present in exporting countries, by utilising their parents’ expertise, likely have an advantage providing such specialised products, especially compared to domestic banks in financially less developed countries.

Third, foreign banks might, compared to domestic banks, be better able to overcome information and contracting risks specific to trade. If a bank has an affiliate locally present in the exporting county, this can facilitate the flow of information regarding risks on both the importer and exporter side of the transaction, especially when the parent bank is headquartered in the importing country. This reduces information asymmetries and therefore financing risk. Furthermore, international contracts and payments tend to be hard to enforce. By being present in multiple countries, foreign banks can likely better deal with these enforcement issues. And when present in both the importing and exporting country, they can more easily assure contracts on both sides of the transaction and thus enhance the credibility of payment guarantees.

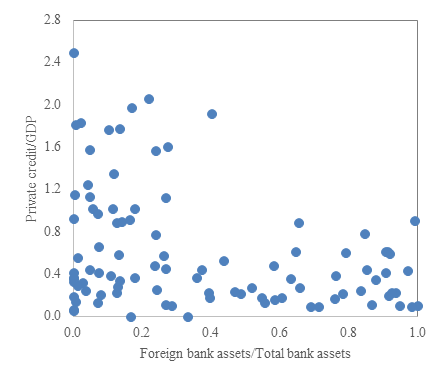

To investigate the role of foreign banks in trade, we exploit a unique dataset which combines time-varying, bilateral data on foreign bank ownership (Claessens and Van Horen 2015) with bilateral export data for 28 manufacturing sectors for 99 exporting countries trading with 117 importing countries for the period 1995-2007. Importantly, the exporting countries differ widely in their level of financial development; yet this development is not very correlated with foreign bank presence (Figure 1). This helps us to study the impact of foreign bank presence over and above that of general financial development, which, as shown by earlier studies, facilitates trade.

Figure 1 Financial development and foreign bank presence

Note: Figure plots private credit to GDP in the 99 exporting countries in our sample against the share of foreign bank assets in the exporting country in 2007.

Source: Global Financial Development, World Bank; Bank Ownership Database, Claessens and Van Horen (2015).

Key in our analysis is that we compare exports in sectors which vary in their likeliness to benefit from foreign bank presence. Using sectoral differences allows us to control for characteristics of the exporting country (such as institutional development), of the importing country (such as demand for certain products), and of the exporter–importer pair (such as common language or trade agreements) that might correlate with both the presence of foreign banks and trade patterns.

Foreign banks alleviate financing constraints for exporters

We first consider differences among sectors in their dependence on external finance (Rajan and Zingales 1998). In certain industries, the production process typically requires more up-front funds (e.g. to buy expensive machinery) that cannot be generated internally. These industries thus require more external finance. If foreign banks increase the availability of external finance in a country, then this should have a stronger impact on exporters in industries that depend more on external finance. And if foreign banks overcome information and contracting risks, then their presence should again disproportionally affect exporters in industries with high external finance needs. We can expect the latter effect to be especially strong when foreign banks from the importing country, as opposed to from other countries, are present.

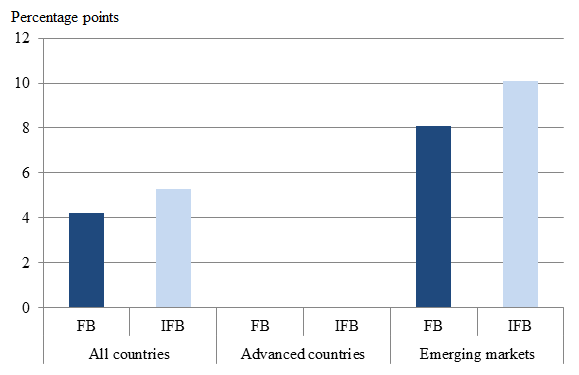

Figure 2 summarises the main results of our analysis. It shows what happens to exports when the share of foreign bank assets in total bank assets in a country increases by one standard deviation. The height of the column indicates the predicted increase in exports of a sector at the 75th percentile of the distribution of external finance dependency (textiles) relative to exports in a sector at the 25th percentile of distribution (non-metallic products). The dark columns show the impact of an increase in presence of foreign banks in general, and the lighter columns represent the impact of an increase in the presence of foreign banks from the importing country.

When studying all countries in our sample, we find that exports of textiles are 4.2 percentage points higher compared to non-metallic products for an increase in foreign bank presence of one standard deviation, and 5.3 percentage points for an increase in foreign bank presence from the importing country. Importantly, when splitting the countries into advanced countries and emerging markets, we find that in the first group foreign bank presence has no significant impact, but in emerging markets a strong impact: 8.1 and 10.1 percentage points respectively. The fact that exports in sectors that are more dependent on external finance react more strongly, indicates that the local presence of foreign banks reduces financing constraints for exporters in emerging markets.

Figure 2 Foreign banks and export

Notes: Figure plots the regression coefficients from Table 2, column 5 and Table 4 in the Working Paper. See the main text for further explanation.

Foreign banks also overcome information asymmetries

We also differentiate by how much sectors naturally suffer from information asymmetries, by measuring the share of products in the sector that has a reference price (i.e. are traded on organised exchanges or have a price listed in trade publications) (Rauch 1999). A high share implies that the sector is less differentiated and therefore less opaque. If foreign banks facilitate the flow of information and as such reduce information asymmetries, foreign bank presence should especially benefit exports in more opaque sectors. We find that while both general foreign bank presence and the presence of a bank from the importing country positively correlate with exports in external finance dependent industries, only the presence of foreign banks from the importing country matters for exports in opaque industries. This result supports the idea that foreign banks from the importing country primarily perform the role of information transmitter, whereas the role of provider of finance is performed by all foreign banks.

These findings are confirmed when studying the impact of the entry of a foreign bank. If a bank from the importing country enters for the first time the exporting country, bilateral exports grow significantly more in external finance dependent and more opaque sectors. This effect is also found for countries that become indirectly linked through foreign bank entry (i.e. countries that now have a foreign bank from the same country in common), with, as expected, the economic impact for opaque sectors being substantially smaller. Studying the type of entry, we find that the positive relationship between entry and exports is much more pronounced when the foreign bank enters through a merger or acquisition. By acquiring a bank instead of starting a new bank from scratch, a foreign bank benefits from the knowledge of the local environment embodied in the acquired entity and an existing customer base, which makes it easier for the bank to extend financing to exporters.

Our results show that foreign banks can facilitate trade in emerging markets. Given the importance of trade for economic development (Dollar and Kraay 2004), our findings indicate that foreign banks can have a positive impact on a country beyond their (already well-documented) impact on lowering the cost and increasing the quality of domestic financial intermediation, and improving risk-sharing internationally. Financial globalisation through the local presence of foreign banks can thus positively affect real integration, something to be taken into account when debating the benefits and risks of financial globalisation.

Editors’ note: This column is published jointly on VoxEU and Bank Underground.

References

Amiti, M and D E Weinstein (2011), “Exports and Financial Shocks”, Quarterly Journal of Economics 126(4): 1841-187.

Claessens, S and N Van Horen (2013), “Impact of Foreign Banks”, Journal of Financial Perspectives 1(1): 29-42.

Claessens, S and N Van Horen (2015), “The Impact of the Global Financial Crisis on Banking Globalization”, IMF Economic Review 63(4): 868–918.

Claessens, S and N Van Horen (2017), "The role of foreign banks in trade", Bank of England Working Paper.

Davin Chora, D and K Manova (2012), “Off the cliff and back? Credit conditions and international trade during the global financial crisis”, Journal of International Economics 87(1): 117–133

Dollar, D and A Kraay (2004), “Trade, Growth, and Poverty”, The Economic Journal 114(493): F22-F49.

Foley, F and K Manova (2015), “International Trade, Multinational Activity, and Corporate Finance”, Annual Review of Economics 7:119-146.

Rajan, R G and L Zingales (1998), “Financial Dependence and Growth”, The American Economic Review 88(3): 559-586.

Rauch, J E (1999), “Networks versus markets in international trade”, Journal of International Economics 48(1): 7–35.