Since the beginning of 2018, the US administration has implemented several measures limiting trade with its partners, in particular China (Bown and Kolb 2019). A new series of measures targeting $11 billion of EU exports was announced on 8 April 2019, but it has not been implemented as the WTO arbitration is still pending. This has fuelled retaliation and has resulted in high trade tensions at the global level. The 60% trade war optimal tariff obtained by Ossa (2014) has indeed not been reached yet, but the shared losses for all the countries entering into the current war are worth investigating.

Global value chains (GVCs) have an impact on the shape of trade policies and also trigger consequences on the effects of trade protection. First, GVC linkages modify countries’ incentives to impose import protection – tariffs should be decreasing in the domestic content of foreign-produced final goods and in the imported content of domestic production of final goods (Blanchard et al. 2018). Second, once imposed, additional tariffs have a direct impact on the targeted products and countries, but also an indirect one, on third sectors and countries, through GVCs. In this column, we argue that by imposing tariffs on imported inputs and by taxing domestic value added contained in the imports of final goods, a trade war hurts not only the targeted countries but also the country imposing the tariffs.

Both China and the US would lose as a result of imposing protectionist measures and retaliation (Balistreri et al. 2018, Freund et al. 2018, Felbermayr and Steininger 2019). US exports should also suffer a loss of competitiveness induced by the increase in the production cost of industries using taxed imported goods as an input (Charbonneau and Landry 2018). The additional tariffs under section 232 and the first wave of section 301 taxed around $900 million of US value added embodied in imports (Bellora et al. 2018). Early ex-post evidence confirms that the cost of these effects works through the impact of tariffs on prices as a consequence of the disruption of global value chains (Amiti et al. 2019).

In a recent contribution (Bellora and Fontagné 2019), we drill further into the consequences of the trade war by focusing on this disruption of value chains and by investigating systematically third-country effects. We rely on information at the tariff line level on sanctions and retaliations, and encapsulate this information in a general equilibrium framework featuring imperfect competition, recursive dynamics and global value chains (MIRAGE-e V2). Beyond separate trade effects for intermediate and final goods, we track price changes and compute value-added changes. We rely on a dynamic baseline of the world economy up to the 2030 horizon in order to obtain long-term effects. The two series of events we take on board are the so-called ‘Section 232’ (of the Trade Expansion Act of 1962) on aluminium and steel by the US (including exemptions, quotas and retaliation) and the ‘Section 301’ (of the Trade Act of 1974) applied to US imports from China in two waves (and Chinese retaliations as well). Where Tariff Rate Quotas have been imposed, we model them as Voluntary Export Restraints, assuming that quotas are fully used and that the quota rent is captured by the exporter.

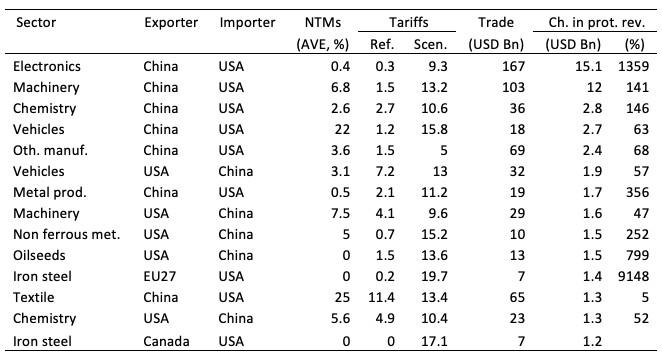

Table 1 identifies the sectors potentially most impacted by the trade war, at least when it comes to bilateral trade, using the simple criterion of the impacted tariff revenue (initial imports multiplied by tariff increase). Starting with Chinese exports, electronics is potentially the most impacted sector – $167 billion of exports will face an average tariff increasing from 0.3% to 9.3%. Machinery is the second impacted sector, with an increase in tariffs of 11.7 percentage points applied by the US on $103 billion of Chinese exports. Among all other sectors, tariff changes can be even larger, but trade is more limited. The best illustration of this is the automotive sector (actually mainly parts and components) where a 14.6 percentage point increase in protection will only affect $18 billion of Chinese exports. From the US point of view, the potentially most impacted sector is the car industry. The 5.8 percentage point increase in tariffs will curb $32 billion of US exports to China, with a huge toll on exports to China of German plants located in the US. Machinery, non-ferrous metals and oilseeds will be the other US sectors impacted by Chinese retaliation. Retaliation from countries other than China has much smaller impacts since it affects smaller flows. Indeed, the trade war is also impacting other exporters – $7 billion of iron and steel exported by the EU27 to the US are facing a 19.5 percentage point increase, while another $7billion of Canadian exports shift from free access to the US market to a 17.1 % tariff.

Table 1 Trade value and protection: Most impacted bilateral flows

Notes: Sectors are ranked by decreasing impacted tariff revenue.

Sources: BACI (2016), MAcMap-HS6 and Kee et al. (2008), authors’ calculations.

Taking on board all the input-ouput relationships along the GVCs and the third-country effects provides a different perspective, illustrating the negative impacts tariffs can have even on domestic sectors, beyond trade. Newly imposed tariffs dramatically increase US tariff revenues – they actually double. However, the improvement in US terms of trade is negligible (+0.06%) as opposed to the usual optimal-tariff argument.

As shown in Figure 1, the trade war translates into a -28% cut in US imports of goods for final consumption from China, but the cut amounts to -43% for intermediate goods. Exports of intermediate goods to China also record a -31% drop, partly because of retaliation but also due to the hit of US tariffs to the US value added contained in targeted Chinese goods. Ultimately, US exports to the world post a -6% decrease as a result of sanctions but also reduced competitiveness – the cost of imported intermediate inputs increases, resulting in an increase in producer prices. Overall Chinese exports record a modest -3.09% decrease, meaning that China manages to compensate reduced access to the US market by redirecting exports, although this is at the expense of reduced producer prices. Chinese terms of trade decrease as a consequence (-0.75%).

Figure 1 Impacts on US trade flows (variations with respect to the baseline, in 2030)

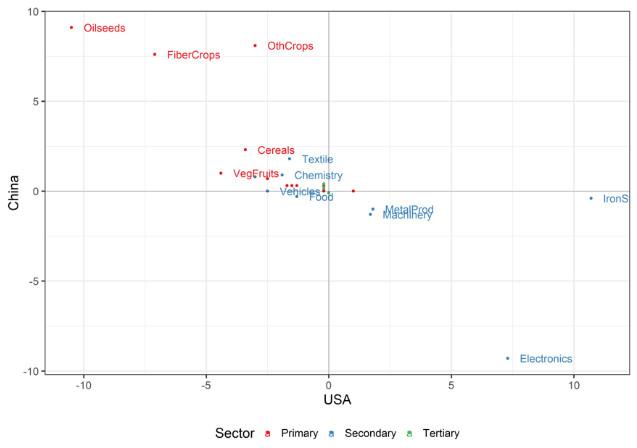

Now, the question is which sectors are winners and losers from this tariff battle. We are interested in the change in value added of the different sectors, which is the right metric of the impact, after having tracked changes along the global value chains. In Figure 2, we plot the percentage changes in the value added of US and Chinese sectors.

The upper-right quadrant corresponds to sectors winning in both countries. Not surprisingly, this quadrant is empty, meaning that the trade war fails to create value.

Turning clockwise, the bottom-right quadrant shows industries winning in the US at the expense of their competitors in China. Clearly, most of the action is in the electronics sector, where the Chinese value added records a 9% decrease, while the US gains 7%. In dollar terms, and in the long run, Chinese losses are even more impressive, with a $40 billion drop, while US gains reach only $4.2 billion. Accordingly, this industry will record a massive destruction of value. In the iron and steel sector US gains are also sizeable (almost 11% of value added, or a $8.5 billion increase) but the impact on China is negligible, even taking on board (as we did) European safeguards. China was already barred from the US market with anti-dumping before the trade war, and the new measures have little impact. Finally, machinery and metal products post modest gains for the US and modest losses for China.

In the quadrant where both countries lose only the food sector shows up, accounting for a small effect.

Lastly, the quadrant where the US loses and China gains is very populated. Firstly, the US is hit heavily in oilseeds by Chinese retaliations – US value added records a -10.5 % drop (or $6.5 billion), which is in the order of magnitude of US gains in the iron and steel sector. US producers of fibre crops, other crops, cereals, vegetables and fruits also pay their tribute. Among industrial sectors, chemistry is hit by a 1.9% drop in value added, representing more than $10 billion given the size of this sector. The same remark pertains to the US car industry, posting a 2.5% and $8.2 billion drop in value added. The latter sector suffers from reduced competitiveness due to increased prices of steel and aluminium, as well as other imported Chinese car components.

Figure 2 Relative changes in value added, by sector, in 2030 (%)

This exercise points to the deleterious impact of trade wars for economies deeply involved in global value chains. Beyond the usual effect of targeted retaliation (here the impact is on US agriculture), the price increases in intermediate inputs reduce the competitiveness of downstream industries. And reciprocally, hitting with tariffs imports of final goods is detrimental to domestic upstream industries providing the components assembled abroad. In a tariff battle, these are the indirect effects contributing to imposing countries doing themselves a disservice as the burden of the value-added loss will ultimately have to be shared in the affected industries among firms and employees.

References

Amiti, M, S Redding and D Weinstein (2019), “The impact of the 2018 trade war on US prices and welfare”, CEPR discussion paper 13564.

Balistreri, E J, C Böhringer and T F Rutherford (2018), “Quantifying disruptive trade policies”, CESifo working paper 7382.

Bellora, C, S Jean and G Santoni (2018), “Un chiffrage de l’impact des mesures de protection commerciale de Donald Trump”, La Lettre du CEPII 388, May 2018.

Bellora, C and L Fontagné (2019), “Shooting oneself in the foot? Trade war and global value chains”, mimeo, CEPII.

Blanchard, E J, C P Bown and R C Johnson (2016), “Global supply chains and trade policy”, NBER working paper 21883.

Bown, C P and M Kolb (2019), “Trump’s trade war timeline: An up-to-date guide”, Peterson Institute of International Economics, 24 February.

Charbonneau, K B and A Landry (2018), “The trade war in numbers”, Bank of Canada working paper 2018-57.

Felbermayr, G and M Steininger (2019), “Trump's trade attack on China – who laughs last?”, EconPol Policy Brief 13 (3).

Freund, C, M Ferrantino, M Maliszewska and M Ruta (2018), “Impacts on global trade and income of current trade disputes”, Macroeconomics, Trade and Investment Practice Notes 2, World Bank.

Kee, H L, A Nicita and M Olarreaga (2008), “Estimating trade restrictiveness indices”, Economic Journal 119(534): 172-199.

Ossa, R (2014), “Trade wars and trade talks with data”, American Economic Review 104: 4104-46.