The recent political crisis in the euro area has brought the design of fiscal policy to the forefront of public debate. Many argue that EU-level transfers are a sine qua non condition for the ‘completion’ of the Economic and Monetary Unification (EMU). In this regard, policymakers and academics have pushed for a sizeable expansion of the EU budget and transfer schemes. While the EU has historically evolved in an incremental manner, these proposals have renewed research interest in the role of regional transfers in large currency unions (Farhi and Werning 2016, Nakamura and Steinsson 2014).

For decades, macroeconomic research on the role of fiscal transfers employed aggregate time-series approaches that aimed to quantify the impact of fiscal shocks on aggregate employment, wages, productivity, and output (see Ramey 2016 for a review). Recently, empirical research has turned to disaggregated analyses, mostly US-based, uncovering a fiscal multiplier of around 2 (see Chodorow-Reich 2019 for an overview, and, among others, the US-centred studies of Nakamura and Steinsson 2014, Chodorow-Reich et al. 2012, Serrato and Wingender 2016, Auerbach et al. 2019, and Shoag 2012, and the Italy-based study of Acconia et al. 2011). These findings are hard to extrapolate to other countries, as economies vary significantly along multiple dimensions that are relevant to the effectiveness of fiscal policy, such as trade openness, liquidity constraints, competition in product markets, and institutional quality.

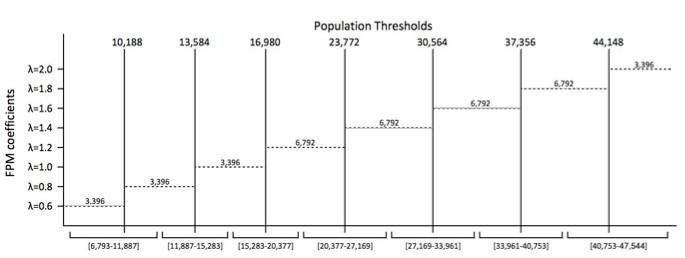

In recent work (Corbi et al. 2019), we explore the role of federal transfers in a large emerging market, Brazil, where municipal receipts from the federal government change abruptly at pre-determined population thresholds. The Fundo de Participação dos Municípios (FPM) is an automatic federal transfer scheme that accounts for almost 80% of all types of federal transfers and 31% of total municipal revenues. While municipalities belonging to the same population bracket receive the same amount of transfers in a given year and state from the federal government, municipalities with a few inhabitants above (below) a population threshold receive 20% more (less), on average. There are many discontinuities (see Figure 1), and we can thus examine the role of federal transfers across thousands of municipalities. Our analysis exploits variation in more than 3,000 municipalities over the period 1999-2014 using a high granularity administrative dataset covering wages, employment, and labour income in Brazil’s formal economy (sadly the data do not cover the informal economy, which although less productive, is non-negligible).

Figure 1 FPM coefficients and population brackets

Regional transfers and municipal public spending

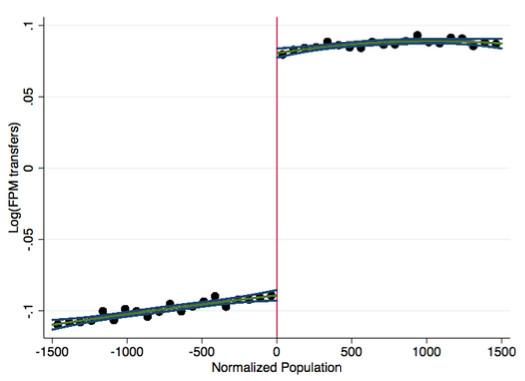

First, we document that while enforcement is imperfect, federal transfers increase (fall) abruptly when a municipality crosses one of the population cut-offs and moves to a higher (lower) threshold (see Figure 2).

Figure 2 FPM transfers around the cut-offs

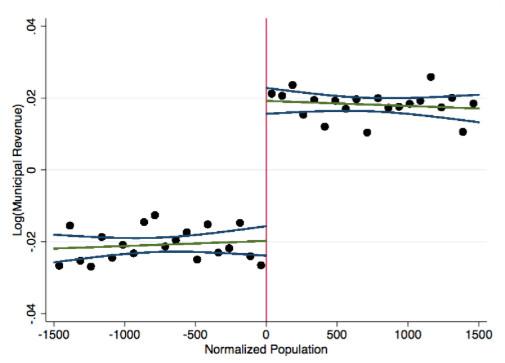

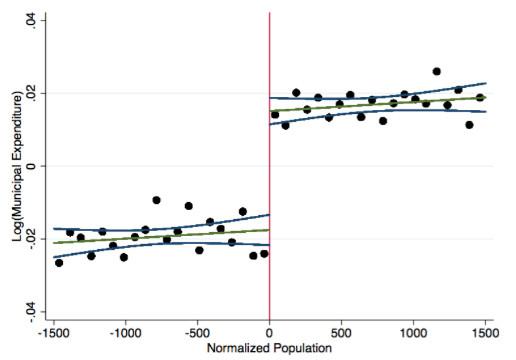

Second, municipal revenues and expenditure follow a similar pattern, changing abruptly at the FPM population cut-offs (Figure 3). By law, Brazilian municipalities run balanced budgets and tend to adjust their spending to federal receipts quickly.

Third, we find that neither local tax revenue, nor state transfers, nor receipts from Bolsa Familia – Brazil’s largest conditional transfer programme – change abruptly at the population thresholds.

Fourth, we show how municipalities recruit new workers with temporary contracts and raise the wages of their existing employees in response to higher transfers.

Figure 3 Municipal revenues (top panel) and municipal expenditure (bottom panel) across FPM population cut-offs

Federal transfer local multipliers

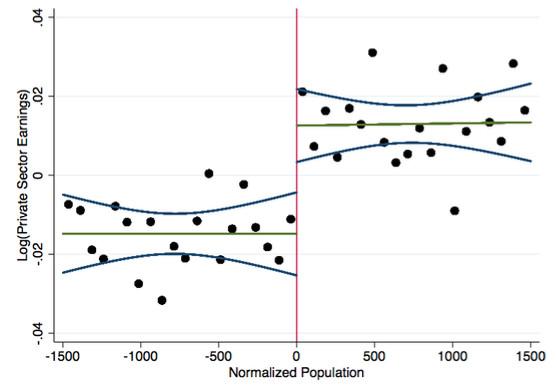

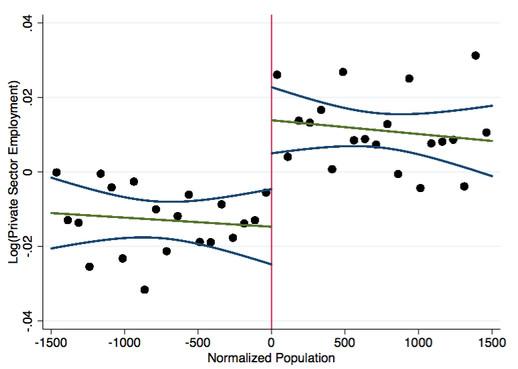

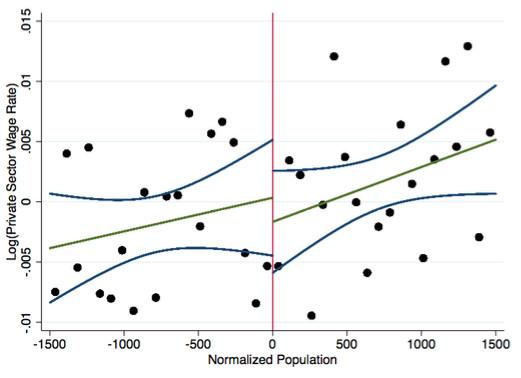

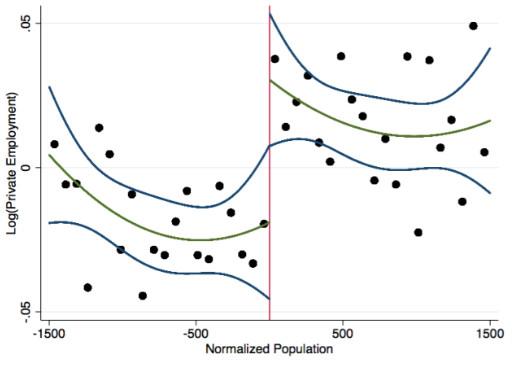

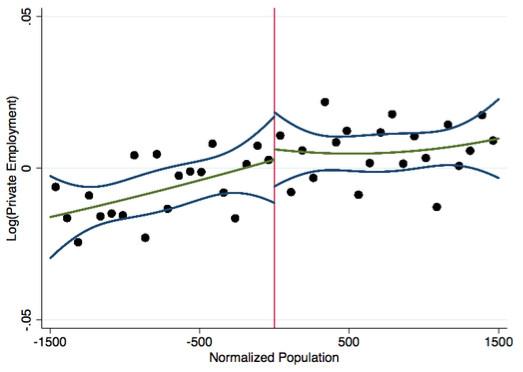

Our core analysis examines the response of private employment and average wages around the FPM discontinuities. As Figure 4a shows, total private sector average earnings jump when municipalities move to a higher FPM bracket. A 20% increase in federal transfers (roughly the step in the FPM allocation function) is associated with a 3-4% boost in private-sector labour income. This corresponds to roughly the mean of earnings growth in our sample. The bulk of this effect takes place via increased private sector hiring (employment) as opposed to average wages, a perhaps unsurprising result given the slack of labour in rural and suburban Brazil (Figures 4b and 4c).

Figure 4a Earnings in the private sector

Figure 4b Employment in the private sector

Figure 4c Average wages in the private sector

Our estimates suggest an average cost per job of around $6,000-13,000 at constant 2016 prices. This is roughly one quarter of the corresponding calculation of about $30,000 that Serrato and Wingender (2016) report across US counties employing an innovative identification scheme (which are comparable in size to Brazilian municipalities). This is in line with the real wage and productivity gaps between Brazil and the US of around 0.8-1. We also map these employment impact estimates into local multipliers, using a simple and intuitive mapping akin to Chodorow-Reich (2019). The local output multiplier is around 1.9 (a range of 1.1 to 2.6), quite similar to the US-based estimates.

Heterogeneity

We then exploit two important dimensions of heterogeneity – trade openness and financial constraints – that workhorse economic (Nee-Keynesian) models stress. This is useful as our sample covers hundreds of municipalities and sheds light on the transmission mechanisms of economic shocks.

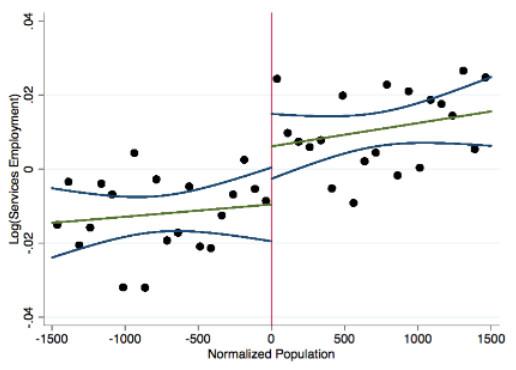

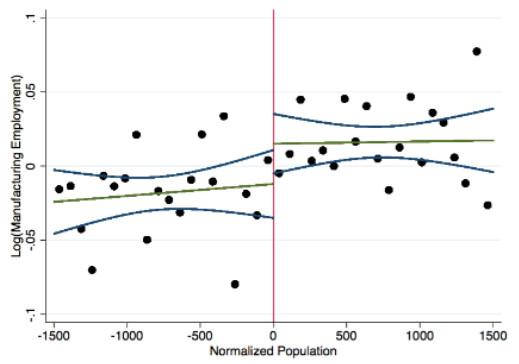

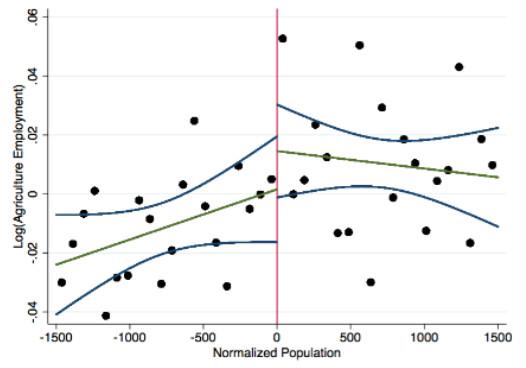

Regarding openness, we re-run our baseline specifications by sectors (agriculture, manufacturing, and services). We find that the link between FPM transfers and private employment is stronger and more precisely estimated for services/non-tradeables (Figure 5).

Figure 5 Employment in agriculture (top panel), manufacturing (middle panel) and services (bottom panel)

As for liquidity constraints, we find that the impact of federal transfers is larger in municipalities where credit access is more scarce – localities without bank branches, with low levels of private credit, and low municipal income (Figures 6).

Figure 6 Transfers and private sector employment by private credit

Implications for policy

Our research, alongside other empirical studies, provides an example of how federal transfers play an important stabilisation role in a currency union. The economically meaningful heterogeneity uncovered in our analysis, together with the similarity in magnitude of our estimates relative to other settings (e.g. Becker et al. 2010, Coelho 2018) assuages external validity concerns. Our evidence feeds the ongoing debate on the future of the EU and the merits and perils of establishing a ‘fiscal’ union among the members of the euro area – and possibly beyond.

References

Acconcia, A, G Corsetti, and S Simonelli (2014), “Mafia and Public Spending: Evidence on the Fiscal Multiplier from a Quasi-experiment”, American Economic Review, 104 (7), 2185-2209.

Auerbach, A, Y Gorodnichenko, and D Murphy (2019), “Local Fiscal Multipliers and Fiscal Spillovers in the United States”, NBER Working Paper no. 25457.

Becker, S, P Egger, and M von Ehrlich (2010), “Going NUTS: The Effect of EU Structural Funds on Regional Performance”, Journal of Public Economics, 94 (2), 578–590.

Chodorow-Reich, G, L Feiveson, Z Liscow, and W G Woolston (2012), “Does State Fiscal Relief during Recessions Increase Employment? Evidence from the American Recovery and Reinvestment Act”, American Economic Journal: Economic Policy, 4 (1),118-145.

Chodorow-Reich, G (2018), “Geographic Cross-Sectional Fiscal Multipliers: What Have We Learned?”, American Economic Journal: Economic Policy, forthcoming.

Coelho, M (2018), “Fiscal Stimulus in a Monetary Union: Evidence from Eurozone Regions”, University of California, Berkeley, mimeo.

Corbi, R, E Papaioannou, and P Surico (2014), “Regional Transfer Multipliers”, Review of Economic Studies, forthcoming.

Corbi, R, E Papaioannou, and P Surico (2018), “Regional Transfer Multipliers”, CEPR Discussion Paper no. 13304.

Farhi, E, and I Werning (2016), “Fiscal Multipliers: Liquidity Traps and Currency Unions,” in the Handbook of Macroeconomics, Volume 2, 2417-2492.

Feyrer, J, and B Sacerdote (2012), “Did the Stimulus Stimulate? The Effects of the American Recovery and Reinvestment Act”, mimeo., Dartmouth College.

Nakamura, E, and J Steinsson (2014), “Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regions”, American Economic Review, 104 (3), 753-792.

Ramey, V A (2016), “Macroeconomic Shocks and Their Propagation”, in John B Taylor and Harald Uhlig (eds.), Handbook of Macroeconomics, Amsterdam: Elsevier, Volume 2, 71-162.

Serrato, J C S, and P Wingender (2016), “Estimating Local Fiscal Multipliers”, mimeo., Duke University.

Shoag, D (2013), “The Impact of Government Spending Shocks: Evidence on the Multiplier from State Pension Plan Returns,” mimeo., Harvard University.